Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

150 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

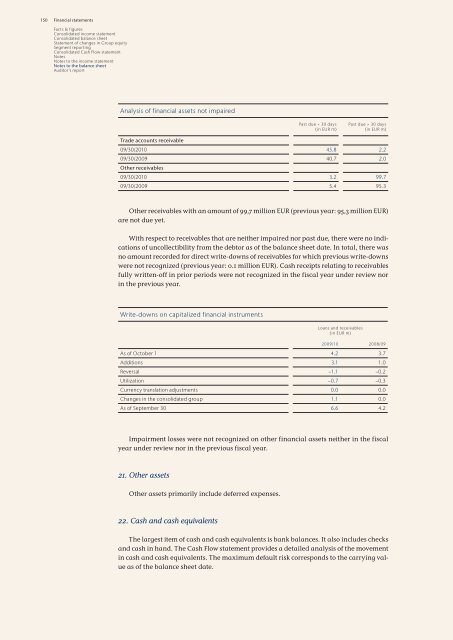

Analysis of f<strong>in</strong>ancial assets not impaired<br />

Past due < 30 days<br />

(<strong>in</strong> EUR m)<br />

Past due > 30 days<br />

(<strong>in</strong> EUR m)<br />

Trade accounts receivable<br />

09/30/20<strong>10</strong> 45.8 2.2<br />

09/30/<strong>2009</strong><br />

Other receivables<br />

40.7 2.0<br />

09/30/20<strong>10</strong> 3.2 99.7<br />

09/30/<strong>2009</strong> 5.4 95.3<br />

Other receivables with an amount of 99,7 million EUR (previous year: 95,3 million EUR)<br />

are not due yet.<br />

With respect to receivables that are neither impaired nor past due, there were no <strong>in</strong>dications<br />

of uncollectibility from the debtor as of the balance sheet date. In total, there was<br />

no amount recorded for direct write-downs of receivables for which previous write-downs<br />

were not recognized (previous year: 0.1 million EUR). Cash receipts relat<strong>in</strong>g to receivables<br />

fully written-off <strong>in</strong> prior periods were not recognized <strong>in</strong> the fiscal year under review nor<br />

<strong>in</strong> the previous year.<br />

Write-downs on capitalized f<strong>in</strong>ancial <strong>in</strong>struments<br />

Loans and receivables<br />

(<strong>in</strong> EUR m)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09<br />

As of October 1 4.2 3.7<br />

Additions 3.1 1.0<br />

Reversal −1.1 −0.2<br />

Utilization −0.7 −0.3<br />

Currency translation adjustments 0.0 0.0<br />

Changes <strong>in</strong> the consolidated group 1.1 0.0<br />

As of September 30 6.6 4.2<br />

Impairment losses were not recognized on other f<strong>in</strong>ancial assets neither <strong>in</strong> the fiscal<br />

year under review nor <strong>in</strong> the previous fiscal year.<br />

21. Other assets<br />

Other assets primarily <strong>in</strong>clude deferred expenses.<br />

22. Cash and cash equivalents<br />

The largest item of cash and cash equivalents is bank balances. It also <strong>in</strong>cludes checks<br />

and cash <strong>in</strong> hand. The Cash Flow statement provides a detailed analysis of the movement<br />

<strong>in</strong> cash and cash equivalents. The maximum default risk corresponds to the carry<strong>in</strong>g value<br />

as of the balance sheet date.