Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

126 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

As of March 31, 20<strong>10</strong>, the newly formed company, OOO Parfümerie International Company<br />

based <strong>in</strong> Moscow/Russia was <strong>in</strong>cluded for the first time <strong>in</strong> the consolidated f<strong>in</strong>ancial<br />

statements. The Estonian subsidiary, OU <strong>Douglas</strong> Estonia, was liquidated <strong>in</strong> February 20<strong>10</strong><br />

and was removed from the scope of consolidation.<br />

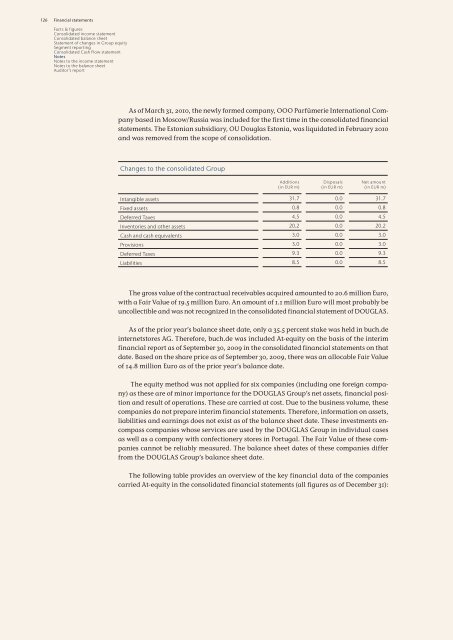

Changes to the consolidated Group<br />

Additions<br />

(<strong>in</strong> EUR m)<br />

Disposals<br />

(<strong>in</strong> EUR m)<br />

Net amount<br />

(<strong>in</strong> EUR m)<br />

Intangible assets 31.7 0.0 31.7<br />

Fixed assets 0.8 0.0 0.8<br />

Deferred Taxes 4.5 0.0 4.5<br />

Inventories and other assets 20.2 0.0 20.2<br />

Cash and cash equivalents 3.0 0.0 3.0<br />

Provisions 3.0 0.0 3.0<br />

Deferred Taxes 9.3 0.0 9.3<br />

Liabilities 8.5 0.0 8.5<br />

The gross value of the contractual receivables acquired amounted to 20.6 million Euro,<br />

with a Fair Value of 19.5 million Euro. An amount of 1.1 million Euro will most probably be<br />

uncollectible and was not recognized <strong>in</strong> the consolidated f<strong>in</strong>ancial statement of DOUGLAS.<br />

As of the prior year’s balance sheet date, only a 35.5 percent stake was held <strong>in</strong> buch.de<br />

<strong>in</strong>ternetstores AG. Therefore, buch.de was <strong>in</strong>cluded At-equity on the basis of the <strong>in</strong>terim<br />

f<strong>in</strong>ancial report as of September 30, <strong>2009</strong> <strong>in</strong> the consolidated f<strong>in</strong>ancial statements on that<br />

date. Based on the share price as of September 30, <strong>2009</strong>, there was an allocable Fair Value<br />

of 14.8 million Euro as of the prior year’s balance date.<br />

The equity method was not applied for six companies (<strong>in</strong>clud<strong>in</strong>g one foreign company)<br />

as these are of m<strong>in</strong>or importance for the DOUGLAS Group’s net assets, f<strong>in</strong>ancial position<br />

and result of operations. These are carried at cost. Due to the bus<strong>in</strong>ess volume, these<br />

companies do not prepare <strong>in</strong>terim f<strong>in</strong>ancial statements. Therefore, <strong>in</strong>formation on assets,<br />

liabilities and earn<strong>in</strong>gs does not exist as of the balance sheet date. These <strong>in</strong>vestments encompass<br />

companies whose services are used by the DOUGLAS Group <strong>in</strong> <strong>in</strong>dividual cases<br />

as well as a company with confectionery stores <strong>in</strong> Portugal. The Fair Value of these companies<br />

cannot be reliably measured. The balance sheet dates of these companies differ<br />

from the DOUGLAS Group’s balance sheet date.<br />

The follow<strong>in</strong>g table provides an overview of the key f<strong>in</strong>ancial data of the companies<br />

carried At-equity <strong>in</strong> the consolidated f<strong>in</strong>ancial statements (all figures as of December 31):