Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The operat<strong>in</strong>g earn<strong>in</strong>gs <strong>in</strong> the Books division climbed by 2.3 million EUR to 25.1 million<br />

EUR. The EBT marg<strong>in</strong> of 2.8 percent was <strong>in</strong> l<strong>in</strong>e with the prior year. Exclud<strong>in</strong>g the oneoff<br />

<strong>in</strong>come amount aris<strong>in</strong>g from the revaluation of the buch.de shares total<strong>in</strong>g 6.1 million<br />

EUR, the earn<strong>in</strong>gs decreased to 19.0 million EUR. Alongside the generally weak market<br />

development <strong>in</strong> the book retail<strong>in</strong>g sector, the report<strong>in</strong>g period was also impacted by special<br />

effects from the <strong>in</strong>troduction of a new merchandise management system.<br />

The Jewelry division posted a higher EBT from 15.1 million EUR <strong>in</strong> the preced<strong>in</strong>g year<br />

to 17.4 million EUR <strong>in</strong> the year under review. The EBT marg<strong>in</strong> improved to 5.6 percent after<br />

5.2 percent a year earlier. This positive development arose from the very solid sales performance<br />

<strong>in</strong> comparison to the sector and to the further expansion of the exclusive and<br />

private labels, which also further improved Christ’s gross profit marg<strong>in</strong>.<br />

The Fashion division’s earn<strong>in</strong>gs before clos<strong>in</strong>g costs for the Berl<strong>in</strong> store resulted <strong>in</strong> a<br />

balanced outcome just like <strong>in</strong> the previous year. Despite the slight sales decl<strong>in</strong>e, pre-tax<br />

earn<strong>in</strong>gs stabilized as a consequence of consistent cost management. In terms of costs,<br />

the restructur<strong>in</strong>g has been completed. Therefore, the focus is now on communicat<strong>in</strong>g the<br />

new direction with the aim of atta<strong>in</strong><strong>in</strong>g a susta<strong>in</strong>able sales <strong>in</strong>crease.<br />

The EBT of the Confectionery division of 2.8 million EUR just missed the prior year’s<br />

figure by 0.5 million EUR (before costs for the store network streaml<strong>in</strong><strong>in</strong>g). Correspond<strong>in</strong>gly,<br />

the EBT marg<strong>in</strong> dropped from 3.3 percent <strong>in</strong> the prior year to 2.8 percent <strong>in</strong> the report<strong>in</strong>g<br />

period.<br />

The marg<strong>in</strong>al earn<strong>in</strong>gs decrease <strong>in</strong> the Services division arose from a lower net <strong>in</strong>terest<br />

result. This was caused <strong>in</strong> particular by lower <strong>in</strong>terest <strong>in</strong>come from loans granted to<br />

subsidiaries.<br />

The DOUGLAS Group’s cost structure (exclud<strong>in</strong>g the prior year’s costs for the store network<br />

streaml<strong>in</strong><strong>in</strong>g) <strong>in</strong> the year under review did not materially change compared to the<br />

prior year. The personnel costs rose disproportionately to sales. Accord<strong>in</strong>gly, the personnel<br />

cost ratio slightly decreased to 21.7 percent. The rental and energy costs rose <strong>in</strong> proportion<br />

to sales. In addition to scheduled depreciation, which was <strong>in</strong> l<strong>in</strong>e with the prior year’s<br />

level, extraord<strong>in</strong>ary write-downs were higher by 6.2 million EUR.<br />

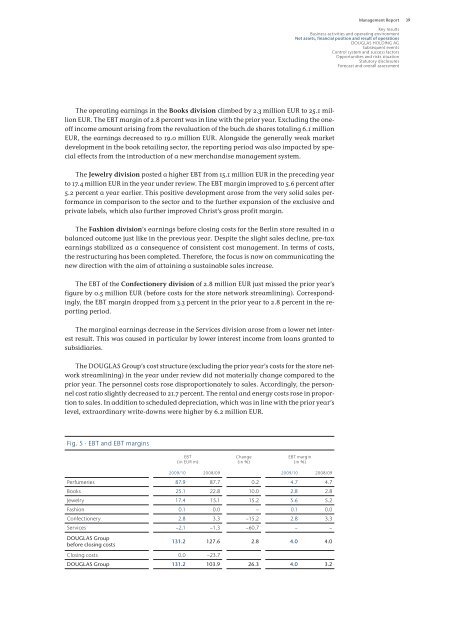

Fig. 5 · EBT and EBT marg<strong>in</strong>s<br />

EBT<br />

(<strong>in</strong> EUR m)<br />

Change<br />

(<strong>in</strong> %)<br />

EBT marg<strong>in</strong><br />

(<strong>in</strong> %)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09 <strong>2009</strong>/<strong>10</strong> 2008/09<br />

Perfumeries 87.9 87.7 0.2 4.7 4.7<br />

Books 25.1 22.8 <strong>10</strong>.0 2.8 2.8<br />

Jewelry 17.4 15.1 15.2 5.6 5.2<br />

Fashion 0.1 0.0 − 0.1 0.0<br />

Confectionery 2.8 3.3 −15.2 2.8 3.3<br />

Services −2.1 −1.3 −60.7 − −<br />

DOUGLAS Group<br />

before clos<strong>in</strong>g costs<br />

131.2 127.6 2.8 4.0 4.0<br />

Clos<strong>in</strong>g costs 0.0 −23.7<br />

DOUGLAS Group 131.2 <strong>10</strong>3.9 26.3 4.0 3.2<br />

Management <strong>Report</strong><br />

Key results<br />

Bus<strong>in</strong>ess activities and operat<strong>in</strong>g environment<br />

Net assets, f<strong>in</strong>ancial position and result of operations<br />

DOUGLAS HOLDING AG<br />

Subsequent events<br />

Control system and success factors<br />

Opportunities and risks situation<br />

Statutory disclosures<br />

Forecast and overall assessment<br />

39