Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

38 Management <strong>Report</strong><br />

Key results<br />

Bus<strong>in</strong>ess activities and operat<strong>in</strong>g environment<br />

Net assets, f<strong>in</strong>ancial position and result of operations<br />

DOUGLAS HOLDING AG<br />

Subsequent events<br />

Control system and success factors<br />

Opportunities and risks situation<br />

Statutory disclosures<br />

Forecast and overall assessment<br />

Fig. 5<br />

Adjusted for the costs <strong>in</strong>curred for the store network streaml<strong>in</strong><strong>in</strong>g, the prior year’s figure<br />

stood at 127.6 million EUR. Hence, despite the weak sales <strong>in</strong>crease, like-for-like earn<strong>in</strong>gs<br />

slightly improved. Similar to the preced<strong>in</strong>g year, the return on sales – the ratio of EBT to<br />

sales – came <strong>in</strong> at 4.0 percent.<br />

Follow<strong>in</strong>g the majority acquisition of buch.de, a revaluation of shares already held<br />

was performed <strong>in</strong> conformity with IFRS 3. The one-off <strong>in</strong>come amount of 6.1 million EUR<br />

positively impacted the earn<strong>in</strong>gs for the year under review. This one-off effect however<br />

was offset by additional costs <strong>in</strong>curred, because goodwill impairments for the report<strong>in</strong>g<br />

period were <strong>10</strong>,8 million EUR more than <strong>in</strong> the preced<strong>in</strong>g year.<br />

Consequent implementation of the store network streaml<strong>in</strong><strong>in</strong>g<br />

In the preced<strong>in</strong>g year, the DOUGLAS Group resolved a store network streaml<strong>in</strong><strong>in</strong>g program,<br />

<strong>in</strong> which all stores generat<strong>in</strong>g a negative cash flow with no expectation of a susta<strong>in</strong>able<br />

improvement <strong>in</strong> earn<strong>in</strong>gs on the medium term were to be closed. A decisive factor<br />

was the cash-effect of costs associated with a store closure. As far as the cash costs of a<br />

store closure were estimated to be lower <strong>in</strong> the next one to two years than the anticipated<br />

negative cash flows from cont<strong>in</strong>u<strong>in</strong>g operations, it was decided to close the store. In total,<br />

clos<strong>in</strong>g costs amount<strong>in</strong>g to 23.7 million EUR were recognized <strong>in</strong> the previous year. These<br />

costs related to the divisions Perfumeries (19.2 million EUR), Fashion (3.8 million EUR)<br />

and Confectionery (0.7 million EUR). As of September 30, 20<strong>10</strong> the planned store network<br />

streaml<strong>in</strong><strong>in</strong>g program was largely completed.<br />

Operat<strong>in</strong>g earn<strong>in</strong>gs contribution by the divisions<br />

The Perfumeries’ earn<strong>in</strong>gs before taxes (EBT) reached 87.9 million EUR follow<strong>in</strong>g 87.7<br />

million EUR before clos<strong>in</strong>g costs <strong>in</strong> the same period last year. Correspond<strong>in</strong>gly, the return<br />

on sales (EBT marg<strong>in</strong>) rema<strong>in</strong>ed unchanged at 4.7 percent. While the earn<strong>in</strong>gs contribution<br />

of the domestic perfumeries significantly exceeded the prior year’s level due to the<br />

respectable sales performance, the EBT of the perfumeries outside of Germany decl<strong>in</strong>ed<br />

further. This was caused by the ongo<strong>in</strong>g challeng<strong>in</strong>g macroeconomic conditions <strong>in</strong> several<br />

countries, which led to lower sales and higher goodwill write-downs <strong>in</strong> some foreign<br />

subsidiaries.<br />

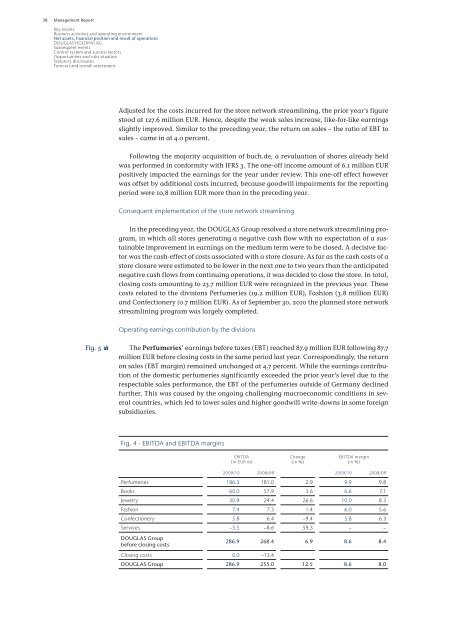

Fig. 4 · EBITDA and EBITDA marg<strong>in</strong>s<br />

EBITDA<br />

(<strong>in</strong> EUR m)<br />

Change<br />

(<strong>in</strong> %)<br />

EBITDA marg<strong>in</strong><br />

(<strong>in</strong> %)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09 <strong>2009</strong>/<strong>10</strong> 2008/09<br />

Perfumeries 186.3 181.0 2.9 9.9 9.8<br />

Books 60.0 57.9 3.6 6.6 7.1<br />

Jewelry 30.9 24.4 26.6 <strong>10</strong>.0 8.3<br />

Fashion 7.4 7.3 1.4 6.0 5.6<br />

Confectionery 5.8 6.4 −9.4 5.8 6.3<br />

Services −3.5 −8.6 59.3 − −<br />

DOUGLAS Group<br />

before clos<strong>in</strong>g costs<br />

286.9 268.4 6.9 8.6 8.4<br />

Clos<strong>in</strong>g costs 0.0 −13.4<br />

DOUGLAS Group 286.9 255.0 12.5 8.6 8.0