January 2012 - Sandwell & West Birmingham Hospitals

January 2012 - Sandwell & West Birmingham Hospitals

January 2012 - Sandwell & West Birmingham Hospitals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

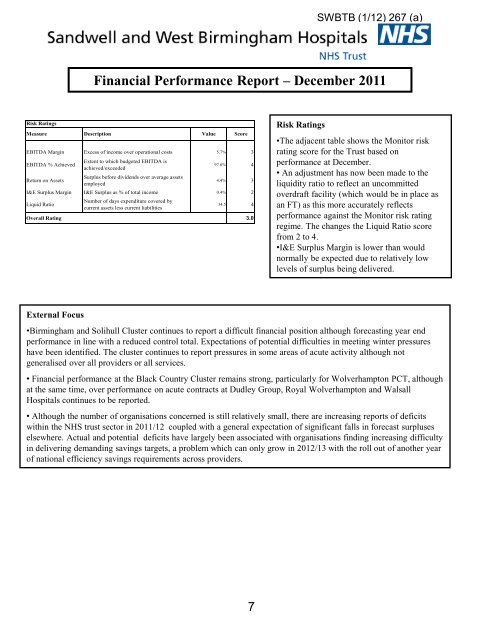

SWBTB (1/12) 267 (a)<br />

Financial Performance Report – December 2011<br />

Risk Ratings<br />

Measure Description Value Score<br />

EBITDA Margin Excess of income over operational costs 5.7% 3<br />

EBITDA % Achieved<br />

Return on Assets<br />

Extent to which budgeted EBITDA is<br />

achieved/exceeded<br />

Surplus before dividends over average assets<br />

employed<br />

97.6% 4<br />

4.4% 3<br />

I&E Surplus Margin I&E Surplus as % of total income 0.4% 2<br />

Liquid Ratio<br />

Number of days expenditure covered by<br />

current assets less current liabilities<br />

34.5 4<br />

Overall Rating 3.0<br />

Risk Ratings<br />

•The adjacent table shows the Monitor risk<br />

rating score for the Trust based on<br />

performance at December.<br />

• An adjustment has now been made to the<br />

liquidity ratio to reflect an uncommitted<br />

overdraft facility (which would be in place as<br />

an FT) as this more accurately reflects<br />

performance against the Monitor risk rating<br />

regime. The changes the Liquid Ratio score<br />

from 2 to 4.<br />

•I&E Surplus Margin is lower than would<br />

normally be expected due to relatively low<br />

levels of surplus being delivered.<br />

External Focus<br />

•<strong>Birmingham</strong> and Solihull Cluster continues to report a difficult financial position although forecasting year end<br />

performance in line with a reduced control total. Expectations of potential difficulties in meeting winter pressures<br />

have been identified. The cluster continues to report pressures in some areas of acute activity although not<br />

generalised over all providers or all services.<br />

• Financial performance at the Black Country Cluster remains strong, particularly for Wolverhampton PCT, although<br />

at the same time, over performance on acute contracts at Dudley Group, Royal Wolverhampton and Walsall<br />

<strong>Hospitals</strong> continues to be reported.<br />

• Although the number of organisations concerned is still relatively small, there are increasing reports of deficits<br />

within the NHS trust sector in 2011/12 coupled with a general expectation of significant falls in forecast surpluses<br />

elsewhere. Actual and potential deficits have largely been associated with organisations finding increasing difficulty<br />

in delivering demanding savings targets, a problem which can only grow in <strong>2012</strong>/13 with the roll out of another year<br />

of national efficiency savings requirements across providers.<br />

7