2011 General CataloG & announCement of Courses - Ventura College

2011 General CataloG & announCement of Courses - Ventura College

2011 General CataloG & announCement of Courses - Ventura College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

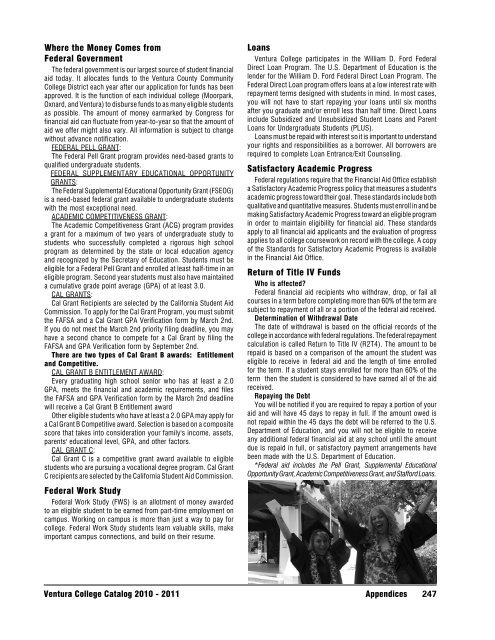

Where the Money Comes from<br />

Federal Government<br />

The federal government is our largest source <strong>of</strong> student financial<br />

aid today. It allocates funds to the <strong>Ventura</strong> County Community<br />

<strong>College</strong> District each year after our application for funds has been<br />

approved. It is the function <strong>of</strong> each individual college (Moorpark,<br />

Oxnard, and <strong>Ventura</strong>) to disburse funds to as many eligible students<br />

as possible. The amount <strong>of</strong> money earmarked by Congress for<br />

financial aid can fluctuate from year-to-year so that the amount <strong>of</strong><br />

aid we <strong>of</strong>fer might also vary. All information is subject to change<br />

without advance notification.<br />

FEDERAL PELL GRANT:<br />

The Federal Pell Grant program provides need-based grants to<br />

qualified undergraduate students.<br />

FEDERAL SUPPLEMENTARY EDUCATIONAL OPPORTUNITY<br />

GRANTS:<br />

The Federal Supplemental Educational Opportunity Grant (FSEOG)<br />

is a need-based federal grant available to undergraduate students<br />

with the most exceptional need.<br />

ACADEMIC COMPETITIVENESS GRANT:<br />

The Academic Competitiveness Grant (ACG) program provides<br />

a grant for a maximum <strong>of</strong> two years <strong>of</strong> undergraduate study to<br />

students who successfully completed a rigorous high school<br />

program as determined by the state or local education agency<br />

and recognized by the Secretary <strong>of</strong> Education. Students must be<br />

eligible for a Federal Pell Grant and enrolled at least half-time in an<br />

eligible program. Second year students must also have maintained<br />

a cumulative grade point average (GPA) <strong>of</strong> at least 3.0.<br />

CAL GRANTS:<br />

Cal Grant Recipients are selected by the California Student Aid<br />

Commission. To apply for the Cal Grant Program, you must submit<br />

the FAFSA and a Cal Grant GPA Verification form by March 2nd.<br />

If you do not meet the March 2nd priority filing deadline, you may<br />

have a second chance to compete for a Cal Grant by filing the<br />

FAFSA and GPA Verification form by September 2nd.<br />

There are two types <strong>of</strong> Cal Grant B awards: Entitlement<br />

and Competitive.<br />

CAL GRANT B ENTITLEMENT AWARD:<br />

Every graduating high school senior who has at least a 2.0<br />

GPA, meets the financial and academic requirements, and files<br />

the FAFSA and GPA Verification form by the March 2nd deadline<br />

will receive a Cal Grant B Entitlement award<br />

Other eligible students who have at least a 2.0 GPA may apply for<br />

a Cal Grant B Competitive award. Selection is based on a composite<br />

score that takes into consideration your family's income, assets,<br />

parents' educational level, GPA, and other factors.<br />

CAL GRANT C:<br />

Cal Grant C is a competitive grant award available to eligible<br />

students who are pursuing a vocational degree program. Cal Grant<br />

C recipients are selected by the California Student Aid Commission.<br />

Federal Work Study<br />

Federal Work Study (FWS) is an allotment <strong>of</strong> money awarded<br />

to an eligible student to be earned from part-time employment on<br />

campus. Working on campus is more than just a way to pay for<br />

college. Federal Work Study students learn valuable skills, make<br />

important campus connections, and build on their resume.<br />

Loans<br />

<strong>Ventura</strong> <strong>College</strong> participates in the William D. Ford Federal<br />

Direct Loan Program. The U.S. Department <strong>of</strong> Education is the<br />

lender for the William D. Ford Federal Direct Loan Program. The<br />

Federal Direct Loan program <strong>of</strong>fers loans at a low interest rate with<br />

repayment terms designed with students in mind. In most cases,<br />

you will not have to start repaying your loans until six months<br />

after you graduate and/or enroll less than half time. Direct Loans<br />

include Subsidized and Unsubsidized Student Loans and Parent<br />

Loans for Undergraduate Students (PLUS).<br />

Loans must be repaid with interest so it is important to understand<br />

your rights and responsibilities as a borrower. All borrowers are<br />

required to complete Loan Entrance/Exit Counseling.<br />

Satisfactory Academic Progress<br />

Federal regulations require that the Financial Aid Office establish<br />

a Satisfactory Academic Progress policy that measures a student's<br />

academic progress toward their goal. These standards include both<br />

qualitative and quantitative measures. Students must enroll in and be<br />

making Satisfactory Academic Progress toward an eligible program<br />

in order to maintain eligibility for financial aid. These standards<br />

apply to all financial aid applicants and the evaluation <strong>of</strong> progress<br />

applies to all college coursework on record with the college. A copy<br />

<strong>of</strong> the Standards for Satisfactory Academic Progress is available<br />

in the Financial Aid Office.<br />

Return <strong>of</strong> Title IV Funds<br />

Who is affected?<br />

Federal financial aid recipients who withdraw, drop, or fail all<br />

courses in a term before completing more than 60% <strong>of</strong> the term are<br />

subject to repayment <strong>of</strong> all or a portion <strong>of</strong> the federal aid received.<br />

Determination <strong>of</strong> Withdrawal Date<br />

The date <strong>of</strong> withdrawal is based on the <strong>of</strong>ficial records <strong>of</strong> the<br />

college in accordance with federal regulations. The federal repayment<br />

calculation is called Return to Title IV (R2T4). The amount to be<br />

repaid is based on a comparison <strong>of</strong> the amount the student was<br />

eligible to receive in federal aid and the length <strong>of</strong> time enrolled<br />

for the term. If a student stays enrolled for more than 60% <strong>of</strong> the<br />

term then the student is considered to have earned all <strong>of</strong> the aid<br />

received.<br />

Repaying the Debt<br />

You will be notified if you are required to repay a portion <strong>of</strong> your<br />

aid and will have 45 days to repay in full. If the amount owed is<br />

not repaid within the 45 days the debt will be referred to the U.S.<br />

Department <strong>of</strong> Education, and you will not be eligible to receive<br />

any additional federal financial aid at any school until the amount<br />

due is repaid in full, or satisfactory payment arrangements have<br />

been made with the U.S. Department <strong>of</strong> Education.<br />

*Federal aid includes the Pell Grant, Supplemental Educational<br />

Opportunity Grant, Academic Competitiveness Grant, and Stafford Loans.<br />

<strong>Ventura</strong> <strong>College</strong> Catalog 2010 - <strong>2011</strong> Appendices 247