- Page 1 and 2:

“La gestión de recursos: Sustent

- Page 3 and 4:

3 Autoridades XI CONGRESO INTERNACI

- Page 5 and 6:

5 INDICE Capítulo 2. COMUNICACIONE

- Page 7 and 8:

7 -Avaliando sistemas de contabilid

- Page 9 and 10:

9 Capítulo 2 COMUNICACIONES DE EXP

- Page 11 and 12:

XI CONGRESO INTERNACIONAL DE COSTOS

- Page 13 and 14:

Algumas empresas estão usando as p

- Page 15 and 16:

(uma vez que a empresa funcionaria

- Page 17 and 18:

Com iniciativas de ordem social e a

- Page 19 and 20:

(2006), pertencentes aos mesmos set

- Page 21 and 22:

21 Demonstra o percentual de Lucro

- Page 23 and 24:

As variáveis TIE (total de investi

- Page 25 and 26:

Tabela 7 - Evolução da Imobiliza

- Page 27 and 28:

Como os recursos ambientais têm um

- Page 29 and 30:

CTP Tabela 12 - Evolução do Custo

- Page 31 and 32:

possível, se esforça para reduzir

- Page 33 and 34:

REFERÊNCIAS ANDREASEN A. Marketing

- Page 35 and 36:

RAO, Purba; HOLT, Diane. Do green s

- Page 37 and 38:

37 Gestión del conocimiento y la i

- Page 39 and 40:

1 INTRODUÇÃO O contexto social at

- Page 41 and 42:

todas as áreas ou um conjunto dela

- Page 43 and 44:

VALORES DESCRIÇÃO-SIGNIFICADO Abe

- Page 45 and 46:

a universidade é o espaço privile

- Page 47 and 48:

originária da teoria das restriç

- Page 49 and 50:

49 PROBLEMAS ESPECIAIS DE PRODUÇÃ

- Page 51 and 52:

51 2. As habilidades: “capacidade

- Page 53 and 54:

REFERÊNCIAS ARGYRIS, Chris. Aprend

- Page 55 and 56:

55 Costos y Gestión sectoriales XI

- Page 57 and 58:

1.Introducción Para diversos autor

- Page 59 and 60:

mejor que otra, ya que todas tienen

- Page 61 and 62:

de los consumos que cada una de las

- Page 63 and 64:

Línea 2 63 Tramos Puerto Origen Pu

- Page 65 and 66:

que en el corto plazo, las Autorida

- Page 67 and 68:

5. Reflexiones finales El sistema q

- Page 69 and 70:

69 XI CONGRESO INTERNACIONAL DE COS

- Page 71 and 72:

1 Introdução Este trabalho visa u

- Page 73 and 74:

milhões para adquirir 20% do capit

- Page 75 and 76:

eduzida para apuração dos imposto

- Page 77 and 78:

77 Investimento = Ativo Total - Pas

- Page 79 and 80:

79 • Serviço da Mulher; e • Ci

- Page 81 and 82:

Demonstração do Resultado do Exer

- Page 83 and 84:

Demonstração do Resultado do Exer

- Page 85 and 86:

O valor de mercado da empresa é fo

- Page 87 and 88:

pretende afirmar que é a melhor, m

- Page 89 and 90:

89 XI CONGRESO INTERNACIONAL DE COS

- Page 91 and 92:

INTRODUÇÃO O objetivo do presente

- Page 93 and 94:

Na direção em que os autores dest

- Page 95 and 96:

O autor faz referência ao caso da

- Page 97 and 98:

Por meio de dois boletins, SMA 4X (

- Page 99 and 100:

99 CÉLULAS MAPEAMENTO FÍSICO-CONT

- Page 101 and 102:

Uma segunda conclusão a que se che

- Page 103 and 104:

103 XI CONGRESO INTERNACIONAL DE CO

- Page 105 and 106:

1. Introdução As premissas que or

- Page 107 and 108:

SEJA, FAZER COM QUE OS OBJETIVOS DA

- Page 109 and 110:

ESTRATÉGICA, ATKINSON (1998) ASSEV

- Page 111 and 112:

NO QUE SE REFERE À CLASSIFICAÇÃO

- Page 113 and 114:

ATRAVÉS DE REPRESENTANTES, DEPOIS

- Page 115 and 116:

UM PAÍS PARA OUTRO, UTILIZANDO PAR

- Page 117 and 118:

Suas massas recheadas, todas de fab

- Page 119 and 120:

que o mercado estava muito vulnerá

- Page 121 and 122:

Referências Bibliográficas ANTHON

- Page 123 and 124:

123 XI CONGRESO INTERNACIONAL DE CO

- Page 125 and 126:

para evitar custos com acompanhamen

- Page 127 and 128:

Objetivo e metodologia O objetivo g

- Page 129 and 130:

A premissa dessa concepção é a d

- Page 131 and 132:

para definição da prioridade nas

- Page 133 and 134:

133 Σ [Z(A,B,C,D)] O somatório qu

- Page 135 and 136:

expressos pelos gestores, é o Mét

- Page 137 and 138:

137 XI CONGRESO INTERNACIONAL DE CO

- Page 139 and 140:

1.- Introducción. En los últimos

- Page 141 and 142:

2.- Estrategias. Apreciaciones Conc

- Page 143 and 144:

económica general, la situación p

- Page 145 and 146:

La estrategia financiera se define

- Page 147 and 148:

empresa, siendo los generadores de

- Page 149 and 150:

Cargos diferidos Estos a juicio de

- Page 151 and 152:

acciones con los nuevos recursos pr

- Page 153 and 154:

Las organizaciones económicas como

- Page 155 and 156:

Grafico N° 1. Necesidades Financie

- Page 157 and 158:

al rubro de Maquinarias, en un segu

- Page 159 and 160:

igual modo el uso de prestamos de l

- Page 161 and 162:

Koontz, H. y Weihrich, H (2004). El

- Page 163 and 164:

163 XI CONGRESO INTERNACIONAL DE CO

- Page 165 and 166:

165 dados cedidos pela empresa. O m

- Page 167 and 168:

167 clientes, provocam efeitos noci

- Page 169 and 170:

169 A dimensão de pedido do client

- Page 171 and 172:

171 Gráfico 1 - Media anual do mix

- Page 173 and 174:

173 Ano Número de veículos Ano 20

- Page 175 and 176:

(=) Resultado direto do produto 175

- Page 177 and 178:

177 4.4 Análise da Rentabilidade p

- Page 179 and 180:

Considerações finais 179 Por meio

- Page 181 and 182:

181 XI CONGRESO INTERNACIONAL DE CO

- Page 183 and 184:

INTRODUÇÃO No setor de serviços,

- Page 185 and 186:

um controle estatístico. Isso pode

- Page 187 and 188:

epresenta estatisticamente 3,4 poss

- Page 189 and 190:

importância na análise de process

- Page 191 and 192:

A partir disto foi aplicada a metod

- Page 193 and 194:

Como solução, adotou-se a premiss

- Page 195 and 196:

Custo Figura 6. Demonstração da e

- Page 197 and 198:

REFERÊNCIAS ABRAHAM, Márcio. Mode

- Page 199 and 200:

199 XI CONGRESO INTERNACIONAL DE CO

- Page 201 and 202:

INTRODUCTION The article identifies

- Page 203 and 204:

available in various way as in cost

- Page 205 and 206:

205 ‐ Combined transport: transpo

- Page 207 and 208:

efficient way leads us to a broader

- Page 209 and 210:

quo of the unimodal solution, suppo

- Page 211 and 212:

RESEARCH METHODOLOGY The present re

- Page 213 and 214:

ail. In the analysis of the case of

- Page 215 and 216:

Picture 6: Syntatic Analysis behavi

- Page 217 and 218:

REFERENCES ALENCAR, E. Introdução

- Page 219 and 220:

219 XI CONGRESO INTERNACIONAL DE CO

- Page 221 and 222:

1 .Introdução Dentre as variávei

- Page 223 and 224:

Em agricultura, de acordo com Castr

- Page 225 and 226:

Scramim e Batalha (1999) desenvolve

- Page 227 and 228:

5 - Aparato Metodológico Sob inspi

- Page 229 and 230:

qual opera, mas deve monitorar o de

- Page 231 and 232:

Figura 2 - A cadeia de custos por a

- Page 233 and 234:

233 Foi levantada a hipótese de qu

- Page 235 and 236:

Referências ALMEIDA, A. R. C de. G

- Page 237 and 238:

SWENSON, D.; ANSARI, S.; BELL, J.;

- Page 239 and 240:

239 XI CONGRESSO INTERNACIONAL DE C

- Page 241 and 242:

em Santa Catarina. A pesquisa quant

- Page 243 and 244:

serie de fatores, entretanto Las Ca

- Page 245 and 246:

Segundo Callado et al. (2008, p. 01

- Page 247 and 248:

Os seis passos de Kotler (2000) par

- Page 249 and 250:

Conforme verificados no Quadro 3 o

- Page 251 and 252:

possui uma preocupação direta com

- Page 253 and 254:

Pergunta do Entrevistador 253 Como

- Page 255 and 256:

REFERÊNCIAS BRUNI, Adriano Leal; F

- Page 257 and 258:

257 XI CONGRESO INTERNACIONAL DE CO

- Page 259 and 260:

1. INTRODUÇÃO A decisão de inves

- Page 261 and 262:

2.1 Custos políticos À medida que

- Page 263 and 264:

Salbador e Vendrzyk (2006) relatam

- Page 265 and 266:

A renúncia fiscal foi estimada da

- Page 267 and 268:

267 renunpl: renúncia fiscal escal

- Page 269 and 270:

Obseva-se que a inclinação dos co

- Page 271 and 272:

Considerando as diferenças obtidas

- Page 273 and 274:

SALBADOR, Debra A., VENDRZYK, Valar

- Page 275 and 276:

275 XI CONGRESO INTERNACIONAL DE CO

- Page 277 and 278:

apresentadas por estes estabelecime

- Page 279 and 280: 2.11 Sistema de Acumulação de Cus

- Page 281 and 282: de São Paulo, pela AHESP. Existem

- Page 283 and 284: Na terceira pergunta foi possível

- Page 285 and 286: Os custos são acumulados por Centr

- Page 287 and 288: Diante desta carência, os hospitai

- Page 289 and 290: devido à dificuldade de obtenção

- Page 291 and 292: XI CONGRESO INTERNACIONAL DE COSTOS

- Page 293 and 294: 1. Introdução Com o aumento da co

- Page 295 and 296: 2.2 Direcionadores de Custos para o

- Page 297 and 298: sistema real, pode-se não alcança

- Page 299 and 300: Figura 1: Ciclo Operacional do Proc

- Page 301 and 302: Neste estudo de caso múltiplo, Alf

- Page 303 and 304: Nos três hospitais, a entrada do p

- Page 305 and 306: Referências Bibliográficas ABBAS,

- Page 307 and 308: RAIMUNDINI S. L.; SOUZA A. A.; STRU

- Page 309 and 310: 309 XI CONGRESO INTERNACIONAL DE CO

- Page 311 and 312: 311 • Con producción de caña de

- Page 313 and 314: 313 • Una laguna de homogenizaci

- Page 315 and 316: 315 • Generado por las Industrias

- Page 317 and 318: 317 • Esta iniciativa se realiza

- Page 319 and 320: transformarse en “carbono neutral

- Page 321 and 322: 7 Conducción de biogás hasta la P

- Page 323 and 324: empresa (Campo - Empaque - Industri

- Page 325 and 326: La inversión en este proyecto ambi

- Page 327 and 328: XI CONGRESO INTERNACIONAL DE COSTOS

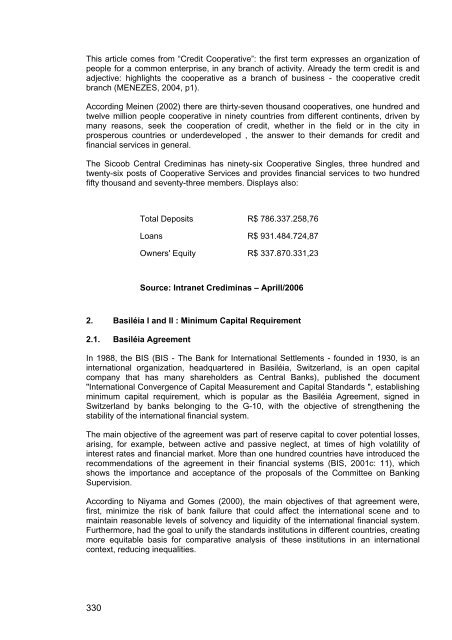

- Page 329: Introduction The historical process

- Page 333 and 334: implementation of the Basiléia Agr

- Page 335 and 336: characteristics of these institutio

- Page 337 and 338: The table below shows the correlati

- Page 339 and 340: 5.3. Regression of Degree of financ

- Page 341 and 342: Final Considerations According to s

- Page 343 and 344: BRASIL. Lei 5764, de 16 de dezembro

- Page 345 and 346: 345 XI CONGRESO INTERNACIONAL DE CO

- Page 347 and 348: 347 2 - CUSTOS AMBIENTAIS Os custos

- Page 349 and 350: Ao escolher um sistema de custeio,

- Page 351 and 352: como pressuposto que são os produt

- Page 353 and 354: questionamentos à fim de quantific

- Page 355 and 356: Fonte: TOMIYA (1994, pág.17), adap

- Page 357 and 358: Homem Hora 11.712 29.280 17.568 333

- Page 359 and 360: 359 É possível então, a partir d

- Page 361 and 362: REFERÊNCIAS BIBLIOGRÁFICAS ABNT -

- Page 363 and 364: 363 Gestión de costos en las organ

- Page 365 and 366: Objetivo del trabajo: El objetivo d

- Page 367 and 368: 367 1000 60 = 6% (costo efectivo) P

- Page 369 and 370: Se observa que 8.5% sería el costo

- Page 371 and 372: Bibliografía: El trabajo fue confe

- Page 373 and 374: RESUMO 373 XI CONGRESO INTERNACIONA

- Page 375 and 376: que se refere aos efeitos decorrent

- Page 377 and 378: analisar os efeitos da aplicação

- Page 379 and 380: seja utilizado pelos calçadistas,

- Page 381 and 382:

381 Ganho = Venda - Material Direto

- Page 383 and 384:

383 Ganho por Unidade Restrita = Ga

- Page 385 and 386:

7.3. Segunda Etapa: Aplicação da

- Page 387 and 388:

decidiu negociar com o cliente um c

- Page 389 and 390:

23,23 e emaximiza o uso deste insum

- Page 391 and 392:

9. Referências Bibliográficas BEU

- Page 393 and 394:

393 XI CONGRESO INTERNACIONAL DE CO

- Page 395 and 396:

1 CONSIDERAÇÕES INICIAIS A reduç

- Page 397 and 398:

objetivo deve ser quantificado, dif

- Page 399 and 400:

No Brasil, na prática, as empresas

- Page 401 and 402:

E para expressar as principais prá

- Page 403 and 404:

vendas pela internet, por interméd

- Page 405 and 406:

que, tradicionalmente, o saldo posi

- Page 407 and 408:

REFERÊNCIAS Associação Nacional

- Page 409 and 410:

409 XI CONGRESO INTERNACIONAL DE CO

- Page 411 and 412:

Womack e Jones (1998) afirmam que o

- Page 413 and 414:

2.3 Sistema de custeio Forma-se a p

- Page 415 and 416:

atividades da cadeia de valor da em

- Page 417 and 418:

3.2 Etapas do estudo de caso O estu

- Page 419 and 420:

Grupo 419 Custos Diretos Custos Ind

- Page 421 and 422:

Identificação dos direcionadores

- Page 423 and 424:

perdas. Corrigindo algumas falhas n

- Page 425 and 426:

Tabela 7 - Margem de lucro dos prod

- Page 427 and 428:

427 XI CONGRESO INTERNACIONAL DE CO

- Page 429 and 430:

1 Introdução As empresas do setor

- Page 431 and 432:

análise examina o comporatamento d

- Page 433 and 434:

É também denominado de ponto de r

- Page 435 and 436:

Além disso, o teste da equação c

- Page 437 and 438:

Vale destacar que a equação da re

- Page 439 and 440:

quando este índice é menor que 5%

- Page 441 and 442:

Quadro 5 - Ponto de Equilíbrio a p

- Page 443 and 444:

6. Conclusão O objetivo principal

- Page 445 and 446:

XI CONGRESO INTERNACIONAL DE COSTOS

- Page 447 and 448:

1. INTRODUÇÃO Ao longo das pesqui

- Page 449 and 450:

O referido método de custeio basei

- Page 451 and 452:

Nesta primeira etapa, a organizaç

- Page 453 and 454:

FASE III - Determinação dos equiv

- Page 455 and 456:

Nesta etapa, tem-se a transformaç

- Page 457 and 458:

A amostra utilizada para o desenvol

- Page 459 and 460:

Tempo Freqüência % Freqüência T

- Page 461 and 462:

Total 19 100,00 19 Tabela 13 - Util

- Page 463 and 464:

5. Conclusão e Recomendações O r

- Page 465 and 466:

NETO, Renata Valeska do Nascimento.

- Page 467 and 468:

RESUMEN XI CONGRESO INTERNACIONAL D

- Page 469 and 470:

En el segmento de diálisis se dio

- Page 471 and 472:

RECUROS Financieros Falta de capita

- Page 473 and 474:

AMENAZAS OPORTUNIDADES SUBCONTEXTO

- Page 475 and 476:

Considerando las deducciones del di

- Page 477 and 478:

que el paciente está dispuesto a p

- Page 479 and 480:

A través de la alianza se puede ac

- Page 481 and 482:

la realización de mantenimientos p

- Page 483 and 484:

información. Los sistemas de redes

- Page 485 and 486:

Q s = Costos Estrutura Incrementale

- Page 487 and 488:

8. Bibliografía • BEIER W.. ¨ P

- Page 489 and 490:

XI CONGRESO INTERNACIONAL DE COSTOS

- Page 491 and 492:

eduzidas sistemática e continuamen

- Page 493 and 494:

493 493 recursos exigidos pelas ati

- Page 495 and 496:

495 495 2.3 Time Driven Activity Ba

- Page 497 and 498:

Tabela 3 - Alocação de recursos p

- Page 499 and 500:

REFERÊNCIA BLIBLIOGRÁFICA BACIC,

- Page 501 and 502:

501 XI CONGRESO INTERNACIONAL DE CO

- Page 503 and 504:

503 503 2. Contabilidade Gerencial

- Page 505 and 506:

505 505 Dar aos funcionários a aut

- Page 507 and 508:

507 507 Um centro de responsabilida

- Page 509 and 510:

509 509 Na tabela 1 é demonstrada

- Page 511 and 512:

511 511 Tabela 51 - Movimentação

- Page 513 and 514:

513 Gestión de costos en entes pú

- Page 515 and 516:

1. Introdução 515 515 Desde a Lei

- Page 517 and 518:

517 517 Em 1990, como resultado da

- Page 519 and 520:

519 519 atua nas áreas inter-relac

- Page 521 and 522:

521 521 No período de 01 de maio a

- Page 523 and 524:

Bibliografia ALMEIDA, Marcelo Caval

- Page 525 and 526:

525 XI CONGRESO INTERNACIONAL DE CO

- Page 527 and 528:

1. Introdução O saneamento básic

- Page 529 and 530:

(e a sociedade) refém da inflaçã

- Page 531 and 532:

531 531 Com a devida adequação ao

- Page 533 and 534:

533 Fig. 2 - Estrutura Organizacion

- Page 535 and 536:

535 535 integração no sistema de

- Page 537 and 538:

537 Tabela 1: O Custeio Variável n

- Page 539 and 540:

539 539 específicos de abastecimen

- Page 541 and 542:

conferência e identificação a qu

- Page 543 and 544:

elatórios, propondo como uma das s

- Page 545 and 546:

Bibliografia: 545 545 AFONSO, R.A.E

- Page 547 and 548:

547 XI CONGRESO INTERNACIONAL DE CO

- Page 549 and 550:

1. INTRODUÇÃO Os governos, seja q

- Page 551 and 552:

Há muito que se percebe a necessid

- Page 553 and 554:

553 De acordo com §4º do artigo 2

- Page 555 and 556:

555 555 Meirelles (1999) destacou d

- Page 557 and 558:

O leilão holandês ocorre de manei

- Page 559 and 560:

As premissas principais desse méto

- Page 561 and 562:

dada a variação nos preços que o

- Page 563 and 564:

563 563 Gráfico 4. Analisando-se o

- Page 565 and 566:

565 Gráfico 6: Redução do Gasto

- Page 567 and 568:

6. CONCLUSÃO A adoção da utiliza

- Page 569 and 570:

569 569 SOUZA, Wellington de. Um es

- Page 571 and 572:

571 XI CONGRESO INTERNACIONAL DE CO

- Page 573 and 574:

573 573 de custos no setor público

- Page 575 and 576:

575 575 Desde então, vários siste

- Page 577 and 578:

da contabilidade de custos é forne

- Page 579 and 580:

579 579 O gráfico 3 ilustra a regi

- Page 581 and 582:

581 581 analisando visualmente o gr

- Page 583 and 584:

Tabela 9 - Teste Mann-Whitney para

- Page 585 and 586:

Na pergunta 7 - O custo possibilita

- Page 587 and 588:

Com relação à pergunta 04 - A ge

- Page 589 and 590:

589 p06 ,705 p07 ,696 p03 ,656 p05

- Page 591 and 592:

REFERÊNCIAS BRASIL. Lei 4320/64, d

- Page 593 and 594:

593 Auditoria de Gestión XI CONGRE

- Page 595 and 596:

1. Introdução Desde a Lei Elói C

- Page 597 and 598:

O governo, visando melhorar a admin

- Page 599 and 600:

Figura 01 - Auditoria Administrativ

- Page 601 and 602:

Através das constantes mutações

- Page 603 and 604:

A equipe de Auditoria Interna do Ri

- Page 605 and 606:

HENDRIKSEN, Eldon S.; BREDA, Michae

- Page 607 and 608:

607 XI CONGRESO INTERNACIONAL DE CO

- Page 609 and 610:

Como definición de cada uno de ell

- Page 611 and 612:

GPAC = Gsac + Gmac + Geac 611 n ∑

- Page 613 and 614:

Gmnrd: Gastos de materiales durante

- Page 615 and 616:

GFIGD: Gastos de Fallos Internos pr

- Page 617 and 618:

617 13. ISO 9001:2000 Sistemas de G

- Page 619 and 620:

619 XI CONGRESO INTERNACIONAL DE CO

- Page 621 and 622:

divulgação financeira decorrentes

- Page 623 and 624:

estimar‐se tendo por base a melho

- Page 625 and 626:

Por seu lado, as fontes internas de

- Page 627 and 628:

identificável de activos que gera

- Page 629 and 630:

Se os valores das perdas por impari

- Page 631 and 632:

No documento intitulado ‘Modelos

- Page 633 and 634:

5. Bibliografia ° AAA Financial Ac

- Page 635 and 636:

° Kieso, D. & Weygandt, J. (1998):

- Page 637 and 638:

° Wyatt, Anne (2005). Accounting R

- Page 639 and 640:

639 XI CONGRESO INTERNACIONAL DE CO

- Page 641 and 642:

A metodologia escolhida é a pesqui

- Page 643 and 644:

Para os autores Kaplan e Norton, O

- Page 645 and 646:

colaboradores, sistemas de Informa

- Page 647 and 648:

colaboradores. A partir daí, inici

- Page 649 and 650:

Etapa 0.6. Análise e revisão de m

- Page 651 and 652:

M A P A E S T R A T É G I C O 651

- Page 653 and 654:

Quadro 3 − BSC da Nova Rent a Car

- Page 655 and 656:

REFERÊNCIAS BIBLIOGRÁFICAS ALMEID

- Page 657 and 658:

657 XI CONGRESO INTERNACIONAL DE CO

- Page 659 and 660:

1. Advertencia. Este trabajo no est

- Page 661 and 662:

empresaria?¿No deben ser igualment

- Page 663 and 664:

CUADRO 3 Y, finalmente, la determin

- Page 665 and 666:

CUADRO 7 De donde, el coeficiente d

- Page 667 and 668:

Aunque frecuentemente se tratará d

- Page 669 and 670:

ANEXO: VALUACIÓN DE LA PRODUCCIÓN

- Page 671 and 672:

CUADRO 17 De modo que, en lo concer

- Page 673 and 674:

Lo que nos permite calcular el coef