- Page 1:

TheCity of AuburnAlabamaBiennial Bu

- Page 4 and 5:

City of Auburn General Fund (contin

- Page 6 and 7:

City of AuburnFY 03 & FY 04Biennial

- Page 8 and 9:

City of Auburn, AlabamaApproximatel

- Page 10 and 11:

City of Auburn, Alabamaachievements

- Page 14 and 15:

City of Auburn, Alabama• The annu

- Page 16 and 17:

Miscellaneous Statistical DataAubur

- Page 18 and 19:

City of AuburnPersonnel Summary by

- Page 20 and 21:

City of AuburnFY03 & FY04Biennial B

- Page 22 and 23:

City of AuburnFY03 & FY04Biennial B

- Page 24 and 25:

City of AuburnFY03 & FY04Biennial B

- Page 26 and 27:

The Government Finance Officers Ass

- Page 28 and 29:

Budget Message (continued) May 28,

- Page 30 and 31:

Budget Message (continued) May 28,

- Page 32 and 33:

Budget Message (continued) May 28,

- Page 34 and 35:

Budget Message (continued) May 28,

- Page 36 and 37:

Budget Message (continued) May 28,

- Page 38 and 39:

Budget Message (continued) May 28,

- Page 40 and 41:

Budget Message (continued) May 28,

- Page 42 and 43:

City of Auburn Key Decisions of the

- Page 44 and 45:

City of AuburnFinancial OverviewThe

- Page 46 and 47:

City of AuburnFinancial Overview$40

- Page 48 and 49:

41City of Auburn ~ General Fund ~ S

- Page 50 and 51:

The City of AuburnDescription of th

- Page 52 and 53:

City of Auburnexpenditures by fund

- Page 54 and 55:

City of AuburnBiennial Budget Calen

- Page 56 and 57:

City of AuburnAnnual Citizen Survey

- Page 58 and 59:

City of AuburnAmong the following s

- Page 60 and 61:

Auburn 202022 Goals for 2020The Aub

- Page 62 and 63:

City of AuburnRevenue Overview• a

- Page 64 and 65:

City of AuburnRevenue Overviewincre

- Page 66 and 67:

City of AuburnRevenue OverviewCity

- Page 68 and 69:

City of AuburnOverview of Debt Poli

- Page 70 and 71:

City of AuburnOverview of Debt Poli

- Page 72 and 73:

City of AuburnOverview of Debt Poli

- Page 74 and 75:

City of AuburnOverview of Debt Poli

- Page 76 and 77:

City of AuburnOverview of Projected

- Page 78 and 79:

City of AuburnDetails of Financing

- Page 80 and 81:

PublicTotal-AllSpecial Safety Budge

- Page 82 and 83:

City of AuburnOverview of Other Fun

- Page 84 and 85:

City of AuburnSummary of Capital Ou

- Page 86 and 87:

City of AuburnSummary of Capital Ou

- Page 88 and 89:

City of AuburnSummary of Capital Ou

- Page 90 and 91:

City of AuburnSummary of Capital Ou

- Page 92 and 93:

City of AuburnSummary of Capital Ou

- Page 94 and 95:

City of AuburnCapital Improvements

- Page 96 and 97:

City of AuburnCapital Improvements

- Page 98 and 99:

City of AuburnFY 03 & FY 04Biennial

- Page 100 and 101:

City of AuburnTrends in Total Reven

- Page 102 and 103:

The City of AuburnGeneral Fund - Su

- Page 104 and 105:

City of AuburnGeneral Fund - Detail

- Page 106 and 107:

City of AuburnGeneral Fund - Detail

- Page 108 and 109:

City of AuburnOverview of Expenditu

- Page 110 and 111:

City of AuburnDetail of Expenditure

- Page 112 and 113:

City of AuburnDetails of Expenditur

- Page 114 and 115:

City of AuburnSummary of Expenditur

- Page 116 and 117:

City of AuburnGeneral Fund - Summar

- Page 118 and 119:

City of AuburnComparative Budgeted

- Page 120 and 121:

City of AuburnBiennial BudgetTable

- Page 122 and 123:

City of AuburnOverview of Expenditu

- Page 124 and 125:

City CouncilBudget SummaryBiennial

- Page 126 and 127:

Office of the City ManagerDouglas J

- Page 128 and 129:

Office of the City ManagerBudget Su

- Page 130 and 131:

GENERAL FUNDExpendituresCity Manage

- Page 132 and 133:

Judicial DepartmentJoe Bailey, Muni

- Page 134 and 135:

GENERAL FUNDExpendituresJudicialCla

- Page 136 and 137:

Information Technology DepartmentJa

- Page 138 and 139:

Information TechnologyBudget Summar

- Page 140 and 141:

GENERAL FUNDExpendituresInformation

- Page 142 and 143:

GENERAL FUNDExpendituresInformation

- Page 144 and 145:

Finance DepartmentAndrea E. Jackson

- Page 146 and 147:

Finance DepartmentAndrea Jackson, D

- Page 148 and 149:

GENERAL FUNDExpendituresFinanceClas

- Page 150 and 151:

Economic DevelopmentDepartmentPhill

- Page 152 and 153:

Economic Development DepartmentPhil

- Page 154 and 155:

GENERAL FUNDExpendituresEconomic De

- Page 156 and 157:

Human Resources DepartmentSteven A.

- Page 158 and 159:

Human Resources DepartmentHuman Res

- Page 160 and 161:

GENERAL FUNDExpendituresHuman Resou

- Page 162 and 163:

GENERAL FUNDExpendituresHuman Resou

- Page 164 and 165:

City of Auburn Public Safety Depart

- Page 166 and 167:

Public Safety Department Mission an

- Page 168 and 169:

GENERAL FUNDExpendituresPublic Safe

- Page 170 and 171:

Public Safety DepartmentPolice Divi

- Page 172 and 173:

GENERAL FUNDExpendituresPublic Safe

- Page 174 and 175:

GENERAL FUNDExpendituresPublic Safe

- Page 176 and 177:

Public Safety DepartmentCommunicati

- Page 178 and 179:

Public Safety DepartmentCodes Enfor

- Page 180 and 181:

Public Works DepartmentJeff Ramsey,

- Page 182 and 183:

Public Works DepartmentAdministrati

- Page 184 and 185:

GENERAL FUNDExpendituresPublic Work

- Page 186 and 187:

GENERAL FUNDExpendituresPublic Work

- Page 188 and 189:

Public Works DepartmentEngineering

- Page 190 and 191:

Public Works DepartmentInspection D

- Page 192 and 193:

GENERAL FUNDExpendituresPublic Work

- Page 194 and 195:

GENERAL FUNDExpendituresPublic Work

- Page 196 and 197:

Environmental Services DepartmentAl

- Page 198 and 199:

GENERAL FUNDExpendituresEnvironment

- Page 200 and 201:

Environmental Services DepartmentRe

- Page 202 and 203:

GENERAL FUNDExpendituresEnvironment

- Page 204 and 205:

GENERAL FUNDExpendituresEnvironment

- Page 206 and 207: Environmental Services DepartmentAn

- Page 208 and 209: Environmental Services DepartmentRi

- Page 210 and 211: GENERAL FUNDExpendituresEnvironment

- Page 212 and 213: GENERAL FUNDExpendituresEnvironment

- Page 214 and 215: Auburn City LibraryMargie B. Huffma

- Page 216 and 217: LibraryBudget SummaryBiennial Budge

- Page 218 and 219: GENERAL FUNDExpendituresLibrary (co

- Page 220 and 221: Parks and Recreation DepartmentRebe

- Page 222 and 223: GENERAL FUNDExpendituresParks and R

- Page 224 and 225: Parks and Recreation DepartmentLeis

- Page 226 and 227: Parks and Recreation DepartmentPark

- Page 228 and 229: GENERAL FUNDExpendituresParks and R

- Page 230 and 231: Planning DepartmentRobert J. Juster

- Page 232 and 233: GENERAL FUNDExpendituresPlanningCla

- Page 234 and 235: Non-DepartmentalBudget SummaryBienn

- Page 236 and 237: GENERAL FUNDExpendituresNon Departm

- Page 238 and 239: GENERAL FUNDExpendituresNon Departm

- Page 240 and 241: GENERAL FUNDExpendituresNon Departm

- Page 242 and 243: Water and Sewer DepartmentRex Griff

- Page 244 and 245: City of AuburnOverview of Sewer Fun

- Page 246 and 247: SEWER FUNDExpendituresSewer Mainten

- Page 248 and 249: Sewer FundSewer General Operations

- Page 250 and 251: SEWER CAPITALPROJECTS FUNDExpenditu

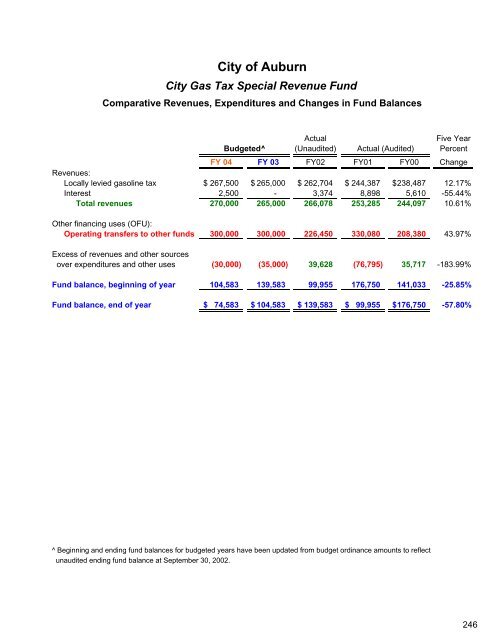

- Page 252 and 253: City of AuburnDescription of and Tr

- Page 254 and 255: City of AuburnTotal Special Revenue

- Page 258 and 259: City of AuburnState Nine Cent Gas T

- Page 260 and 261: City of AuburnSpecial Additional Sc

- Page 262 and 263: City of AuburnCommunity Development

- Page 264 and 265: City of AuburnDescription of and Tr

- Page 266 and 267: City of AuburnTotal Debt Service Fu

- Page 268 and 269: City of AuburnSpecial Five Mill Tax

- Page 270 and 271: City of AuburnFY 03 & FY 04Biennial

- Page 272 and 273: City of AuburnOverview of Total Ent

- Page 274 and 275: City of AuburnDetail of Enterprise

- Page 276 and 277: City of AuburnSewer Equipment Repla

- Page 278 and 279: City of AuburnIndustrial Park FundC

- Page 280 and 281: City of AuburnDescription of and Tr

- Page 282 and 283: City of AuburnTotal Internal Servic

- Page 284 and 285: City of AuburnLiability Risk Retent