Complete Document - City of Auburn

Complete Document - City of Auburn

Complete Document - City of Auburn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

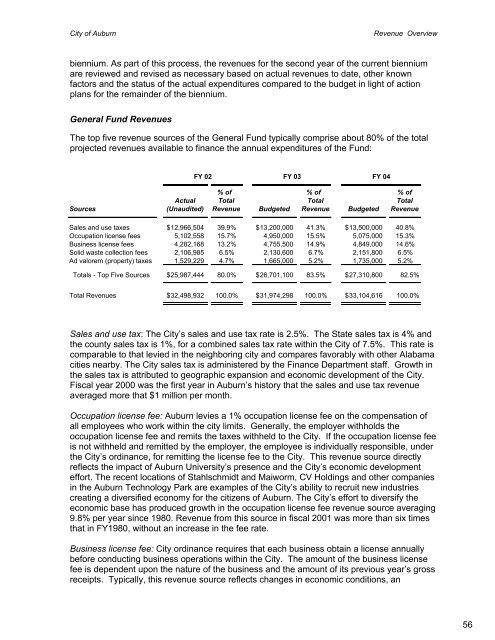

<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Revenue Overviewbiennium. As part <strong>of</strong> this process, the revenues for the second year <strong>of</strong> the current bienniumare reviewed and revised as necessary based on actual revenues to date, other knownfactors and the status <strong>of</strong> the actual expenditures compared to the budget in light <strong>of</strong> actionplans for the remainder <strong>of</strong> the biennium.General Fund RevenuesThe top five revenue sources <strong>of</strong> the General Fund typically comprise about 80% <strong>of</strong> the totalprojected revenues available to finance the annual expenditures <strong>of</strong> the Fund:FY 02FY 03 FY 04% <strong>of</strong> % <strong>of</strong> % <strong>of</strong>Actual Total Total TotalSources (Unaudited) Revenue Budgeted Revenue Budgeted RevenueSales and use taxes $ 12,966,504 39.9% $ 13,200,000 41.3% $ 13,500,000 40.8%Occupation license fees 5,102,558 15.7% 4,950,000 15.5% 5,075,000 15.3%Business license fees 4,282,168 13.2% 4,755,500 14.9% 4,849,000 14.6%Solid waste collection fees 2,106,985 6.5% 2,130,600 6.7% 2,151,800 6.5%Ad valorem (property) taxes 1,529,229 4.7% 1,665,000 5.2% 1,735,000 5.2%Totals - Top Five Sources $ 25,987,444 80.0% $ 26,701,100 83.5% $ 27,310,800 82.5%Total Revenues $ 32,498,932 100.0% $ 31,974,298 100.0% $ 33,104,616 100.0%Sales and use tax: The <strong>City</strong>’s sales and use tax rate is 2.5%. The State sales tax is 4% andthe county sales tax is 1%, for a combined sales tax rate within the <strong>City</strong> <strong>of</strong> 7.5%. This rate iscomparable to that levied in the neighboring city and compares favorably with other Alabamacities nearby. The <strong>City</strong> sales tax is administered by the Finance Department staff. Growth inthe sales tax is attributed to geographic expansion and economic development <strong>of</strong> the <strong>City</strong>.Fiscal year 2000 was the first year in <strong>Auburn</strong>’s history that the sales and use tax revenueaveraged more that $1 million per month.Occupation license fee: <strong>Auburn</strong> levies a 1% occupation license fee on the compensation <strong>of</strong>all employees who work within the city limits. Generally, the employer withholds theoccupation license fee and remits the taxes withheld to the <strong>City</strong>. If the occupation license feeis not withheld and remitted by the employer, the employee is individually responsible, underthe <strong>City</strong>’s ordinance, for remitting the license fee to the <strong>City</strong>. This revenue source directlyreflects the impact <strong>of</strong> <strong>Auburn</strong> University’s presence and the <strong>City</strong>’s economic developmenteffort. The recent locations <strong>of</strong> Stahlschmidt and Maiworm, CV Holdings and other companiesin the <strong>Auburn</strong> Technology Park are examples <strong>of</strong> the <strong>City</strong>’s ability to recruit new industriescreating a diversified economy for the citizens <strong>of</strong> <strong>Auburn</strong>. The <strong>City</strong>’s effort to diversify theeconomic base has produced growth in the occupation license fee revenue source averaging9.8% per year since 1980. Revenue from this source in fiscal 2001 was more than six timesthat in FY1980, without an increase in the fee rate.Business license fee: <strong>City</strong> ordinance requires that each business obtain a license annuallybefore conducting business operations within the <strong>City</strong>. The amount <strong>of</strong> the business licensefee is dependent upon the nature <strong>of</strong> the business and the amount <strong>of</strong> its previous year’s grossreceipts. Typically, this revenue source reflects changes in economic conditions, an56