<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Overview <strong>of</strong> Debt Policy and Outstanding Debt• Capital leasing may be used for the acquisition <strong>of</strong> equipment items with an expected useful life <strong>of</strong>three years or longer with the approval <strong>of</strong> the <strong>City</strong> Manager upon the request <strong>of</strong> the departmenthead for whose department the equipment purchase is proposed. Debt service expenditures forcapital leases will be budgeted in the department for which the equipment was purchased.• When borrowing principal amounts that the local market can fund, general obligation notes orwarrants will be issued to the financing source submitting the lowest responsible bid in a publicopening <strong>of</strong> sealed bids. All invitations to bid on <strong>City</strong> borrowings that are issued to local institutionswill be reviewed by and must receive the approval <strong>of</strong> the <strong>City</strong>’s bond attorneys prior to theirissuance.• Debt will be issued on behalf <strong>of</strong> the <strong>City</strong> Board <strong>of</strong> Education as provided under the Code <strong>of</strong>Alabama upon the <strong>of</strong>ficial request <strong>of</strong> the Board. Principal amounts and amortization schedules <strong>of</strong>proposed education debt issues will be structured in a manner to maintain a positive fund balancein the <strong>City</strong>’s Schools’ property tax funds (the Special School Tax and Special Additional SchoolTax special revenue funds) that are held by the <strong>City</strong>.Debt Repayment ResourcesThe Five Mill Tax Fund’s revenues, expenditures and ending fund balances for the past eight fiscalyears demonstrate the stability and conservative use <strong>of</strong> this source for debt repayment:<strong>City</strong> <strong>of</strong> <strong>Auburn</strong> Five Mill Tax Fund History FY 1995-2002Fiscal Year 1995 1996 1997 1998** 1999 2000 2001 2002*Revenues $ 982,276 $ 1,042,300 $1,134,766 $1,222,107 $1,302,251 $1,535,557 $1,551,649 $1,593,478ExpendituresDebt Service-Principal 280,000 280,000 250,000 705,000 765,000 830,000 905,000 1,275,000-Interest 228,695 215,251 203,861 528,815 497,585 647,987 623,584 627,355Tax Collection Fees 42,719 23,065 37,405 45,639 44,834 53,843 65,266 66,075Refunding issue costs - - - 99,537 - - - -Other Sources (Uses)^ - - - (408,132) - (759,781) - -Ending Fund Balance $ 2,061,854 $2,585,838 $3,229,338 $2,664,322 $2,659,154 $1,903,100 $1,860,899 $1,485,947* Unaudited**FY98 transactions include the results <strong>of</strong> an advance refunding <strong>of</strong> certain 1988 Street Improvement Bonds.^By law, any or all <strong>of</strong> the cumulative interest revenue <strong>of</strong> the Five Mill Tax Fund may be transferred to the General Fund to be used forcapital expenditures.General Obligation DebtGeneral obligation debt is supported by the full faith and credit <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Auburn</strong>. This debt form isused to finance various types <strong>of</strong> capital projects <strong>of</strong> the <strong>City</strong> and the <strong>City</strong>'s Board <strong>of</strong> Education. The<strong>City</strong> issues debt on behalf <strong>of</strong> the School Board to finance the Board's capital projects. School Boarddebt is repaid from property taxes received by the <strong>City</strong>, which are earmarked for education purposes.61

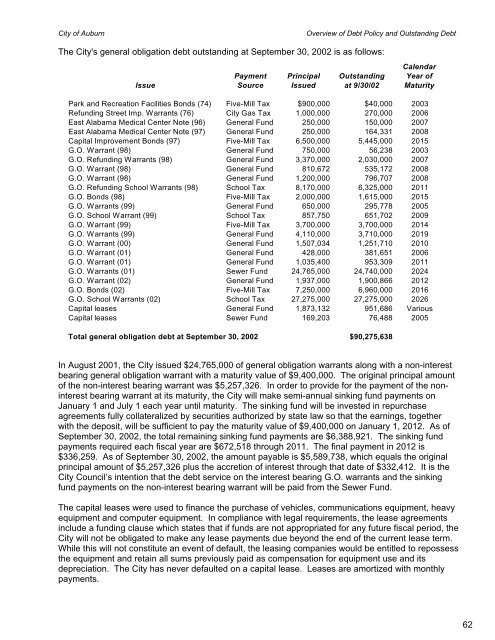

<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Overview <strong>of</strong> Debt Policy and Outstanding DebtThe <strong>City</strong>'s general obligation debt outstanding at September 30, 2002 is as follows:CalendarPayment Principal Outstanding Year <strong>of</strong>Issue Source Issued at 9/30/02 MaturityPark and Recreation Facilities Bonds (74) Five-Mill Tax $900,000 $40,000 2003Refunding Street Imp. Warrants (76) <strong>City</strong> Gas Tax 1,000,000 270,000 2006East Alabama Medical Center Note (96) General Fund 250,000 150,000 2007East Alabama Medical Center Note (97) General Fund 250,000 164,331 2008Capital Improvement Bonds (97) Five-Mill Tax 6,500,000 5,445,000 2015G.O. Warrant (98) General Fund 750,000 56,238 2003G.O. Refunding Warrants (98) General Fund 3,370,000 2,030,000 2007G.O. Warrant (98) General Fund 810,672 535,172 2008G.O. Warrant (98) General Fund 1,200,000 796,707 2008G.O. Refunding School Warrants (98) School Tax 8,170,000 6,325,000 2011G.O. Bonds (98) Five-Mill Tax 2,000,000 1,615,000 2015G.O. Warrants (99) General Fund 650,000 295,778 2005G.O. School Warrant (99) School Tax 857,750 651,702 2009G.O. Warrant (99) Five-Mill Tax 3,700,000 3,700,000 2014G.O. Warrants (99) General Fund 4,110,000 3,710,000 2019G.O. Warrant (00) General Fund 1,507,034 1,251,710 2010G.O. Warrant (01) General Fund 428,000 381,651 2006G.O. Warrant (01) General Fund 1,035,400 953,309 2011G.O. Warrants (01) Sewer Fund 24,765,000 24,740,000 2024G.O. Warrant (02) General Fund 1,937,000 1,900,866 2012G.O. Bonds (02) Five-Mill Tax 7,250,000 6,960,000 2016G.O. School Warrants (02) School Tax 27,275,000 27,275,000 2026Capital leases General Fund 1,873,132 951,686 VariousCapital leases Sewer Fund 169,203 76,488 2005Total general obligation debt at September 30, 2002$90,275,638In August 2001, the <strong>City</strong> issued $24,765,000 <strong>of</strong> general obligation warrants along with a non-interestbearing general obligation warrant with a maturity value <strong>of</strong> $9,400,000. The original principal amount<strong>of</strong> the non-interest bearing warrant was $5,257,326. In order to provide for the payment <strong>of</strong> the noninterestbearing warrant at its maturity, the <strong>City</strong> will make semi-annual sinking fund payments onJanuary 1 and July 1 each year until maturity. The sinking fund will be invested in repurchaseagreements fully collateralized by securities authorized by state law so that the earnings, togetherwith the deposit, will be sufficient to pay the maturity value <strong>of</strong> $9,400,000 on January 1, 2012. As <strong>of</strong>September 30, 2002, the total remaining sinking fund payments are $6,388,921. The sinking fundpayments required each fiscal year are $672,518 through 2011. The final payment in 2012 is$336,259. As <strong>of</strong> September 30, 2002, the amount payable is $5,589,738, which equals the originalprincipal amount <strong>of</strong> $5,257,326 plus the accretion <strong>of</strong> interest through that date <strong>of</strong> $332,412. It is the<strong>City</strong> Council’s intention that the debt service on the interest bearing G.O. warrants and the sinkingfund payments on the non-interest bearing warrant will be paid from the Sewer Fund.The capital leases were used to finance the purchase <strong>of</strong> vehicles, communications equipment, heavyequipment and computer equipment. In compliance with legal requirements, the lease agreementsinclude a funding clause which states that if funds are not appropriated for any future fiscal period, the<strong>City</strong> will not be obligated to make any lease payments due beyond the end <strong>of</strong> the current lease term.While this will not constitute an event <strong>of</strong> default, the leasing companies would be entitled to repossessthe equipment and retain all sums previously paid as compensation for equipment use and itsdepreciation. The <strong>City</strong> has never defaulted on a capital lease. Leases are amortized with monthlypayments.62

- Page 1:

TheCity of AuburnAlabamaBiennial Bu

- Page 4 and 5:

City of Auburn General Fund (contin

- Page 6 and 7:

City of AuburnFY 03 & FY 04Biennial

- Page 8 and 9:

City of Auburn, AlabamaApproximatel

- Page 10 and 11:

City of Auburn, Alabamaachievements

- Page 14 and 15:

City of Auburn, Alabama• The annu

- Page 16 and 17:

Miscellaneous Statistical DataAubur

- Page 18 and 19: City of AuburnPersonnel Summary by

- Page 20 and 21: City of AuburnFY03 & FY04Biennial B

- Page 22 and 23: City of AuburnFY03 & FY04Biennial B

- Page 24 and 25: City of AuburnFY03 & FY04Biennial B

- Page 26 and 27: The Government Finance Officers Ass

- Page 28 and 29: Budget Message (continued) May 28,

- Page 30 and 31: Budget Message (continued) May 28,

- Page 32 and 33: Budget Message (continued) May 28,

- Page 34 and 35: Budget Message (continued) May 28,

- Page 36 and 37: Budget Message (continued) May 28,

- Page 38 and 39: Budget Message (continued) May 28,

- Page 40 and 41: Budget Message (continued) May 28,

- Page 42 and 43: City of Auburn Key Decisions of the

- Page 44 and 45: City of AuburnFinancial OverviewThe

- Page 46 and 47: City of AuburnFinancial Overview$40

- Page 48 and 49: 41City of Auburn ~ General Fund ~ S

- Page 50 and 51: The City of AuburnDescription of th

- Page 52 and 53: City of Auburnexpenditures by fund

- Page 54 and 55: City of AuburnBiennial Budget Calen

- Page 56 and 57: City of AuburnAnnual Citizen Survey

- Page 58 and 59: City of AuburnAmong the following s

- Page 60 and 61: Auburn 202022 Goals for 2020The Aub

- Page 62 and 63: City of AuburnRevenue Overview• a

- Page 64 and 65: City of AuburnRevenue Overviewincre

- Page 66 and 67: City of AuburnRevenue OverviewCity

- Page 70 and 71: City of AuburnOverview of Debt Poli

- Page 72 and 73: City of AuburnOverview of Debt Poli

- Page 74 and 75: City of AuburnOverview of Debt Poli

- Page 76 and 77: City of AuburnOverview of Projected

- Page 78 and 79: City of AuburnDetails of Financing

- Page 80 and 81: PublicTotal-AllSpecial Safety Budge

- Page 82 and 83: City of AuburnOverview of Other Fun

- Page 84 and 85: City of AuburnSummary of Capital Ou

- Page 86 and 87: City of AuburnSummary of Capital Ou

- Page 88 and 89: City of AuburnSummary of Capital Ou

- Page 90 and 91: City of AuburnSummary of Capital Ou

- Page 92 and 93: City of AuburnSummary of Capital Ou

- Page 94 and 95: City of AuburnCapital Improvements

- Page 96 and 97: City of AuburnCapital Improvements

- Page 98 and 99: City of AuburnFY 03 & FY 04Biennial

- Page 100 and 101: City of AuburnTrends in Total Reven

- Page 102 and 103: The City of AuburnGeneral Fund - Su

- Page 104 and 105: City of AuburnGeneral Fund - Detail

- Page 106 and 107: City of AuburnGeneral Fund - Detail

- Page 108 and 109: City of AuburnOverview of Expenditu

- Page 110 and 111: City of AuburnDetail of Expenditure

- Page 112 and 113: City of AuburnDetails of Expenditur

- Page 114 and 115: City of AuburnSummary of Expenditur

- Page 116 and 117: City of AuburnGeneral Fund - Summar

- Page 118 and 119:

City of AuburnComparative Budgeted

- Page 120 and 121:

City of AuburnBiennial BudgetTable

- Page 122 and 123:

City of AuburnOverview of Expenditu

- Page 124 and 125:

City CouncilBudget SummaryBiennial

- Page 126 and 127:

Office of the City ManagerDouglas J

- Page 128 and 129:

Office of the City ManagerBudget Su

- Page 130 and 131:

GENERAL FUNDExpendituresCity Manage

- Page 132 and 133:

Judicial DepartmentJoe Bailey, Muni

- Page 134 and 135:

GENERAL FUNDExpendituresJudicialCla

- Page 136 and 137:

Information Technology DepartmentJa

- Page 138 and 139:

Information TechnologyBudget Summar

- Page 140 and 141:

GENERAL FUNDExpendituresInformation

- Page 142 and 143:

GENERAL FUNDExpendituresInformation

- Page 144 and 145:

Finance DepartmentAndrea E. Jackson

- Page 146 and 147:

Finance DepartmentAndrea Jackson, D

- Page 148 and 149:

GENERAL FUNDExpendituresFinanceClas

- Page 150 and 151:

Economic DevelopmentDepartmentPhill

- Page 152 and 153:

Economic Development DepartmentPhil

- Page 154 and 155:

GENERAL FUNDExpendituresEconomic De

- Page 156 and 157:

Human Resources DepartmentSteven A.

- Page 158 and 159:

Human Resources DepartmentHuman Res

- Page 160 and 161:

GENERAL FUNDExpendituresHuman Resou

- Page 162 and 163:

GENERAL FUNDExpendituresHuman Resou

- Page 164 and 165:

City of Auburn Public Safety Depart

- Page 166 and 167:

Public Safety Department Mission an

- Page 168 and 169:

GENERAL FUNDExpendituresPublic Safe

- Page 170 and 171:

Public Safety DepartmentPolice Divi

- Page 172 and 173:

GENERAL FUNDExpendituresPublic Safe

- Page 174 and 175:

GENERAL FUNDExpendituresPublic Safe

- Page 176 and 177:

Public Safety DepartmentCommunicati

- Page 178 and 179:

Public Safety DepartmentCodes Enfor

- Page 180 and 181:

Public Works DepartmentJeff Ramsey,

- Page 182 and 183:

Public Works DepartmentAdministrati

- Page 184 and 185:

GENERAL FUNDExpendituresPublic Work

- Page 186 and 187:

GENERAL FUNDExpendituresPublic Work

- Page 188 and 189:

Public Works DepartmentEngineering

- Page 190 and 191:

Public Works DepartmentInspection D

- Page 192 and 193:

GENERAL FUNDExpendituresPublic Work

- Page 194 and 195:

GENERAL FUNDExpendituresPublic Work

- Page 196 and 197:

Environmental Services DepartmentAl

- Page 198 and 199:

GENERAL FUNDExpendituresEnvironment

- Page 200 and 201:

Environmental Services DepartmentRe

- Page 202 and 203:

GENERAL FUNDExpendituresEnvironment

- Page 204 and 205:

GENERAL FUNDExpendituresEnvironment

- Page 206 and 207:

Environmental Services DepartmentAn

- Page 208 and 209:

Environmental Services DepartmentRi

- Page 210 and 211:

GENERAL FUNDExpendituresEnvironment

- Page 212 and 213:

GENERAL FUNDExpendituresEnvironment

- Page 214 and 215:

Auburn City LibraryMargie B. Huffma

- Page 216 and 217:

LibraryBudget SummaryBiennial Budge

- Page 218 and 219:

GENERAL FUNDExpendituresLibrary (co

- Page 220 and 221:

Parks and Recreation DepartmentRebe

- Page 222 and 223:

GENERAL FUNDExpendituresParks and R

- Page 224 and 225:

Parks and Recreation DepartmentLeis

- Page 226 and 227:

Parks and Recreation DepartmentPark

- Page 228 and 229:

GENERAL FUNDExpendituresParks and R

- Page 230 and 231:

Planning DepartmentRobert J. Juster

- Page 232 and 233:

GENERAL FUNDExpendituresPlanningCla

- Page 234 and 235:

Non-DepartmentalBudget SummaryBienn

- Page 236 and 237:

GENERAL FUNDExpendituresNon Departm

- Page 238 and 239:

GENERAL FUNDExpendituresNon Departm

- Page 240 and 241:

GENERAL FUNDExpendituresNon Departm

- Page 242 and 243:

Water and Sewer DepartmentRex Griff

- Page 244 and 245:

City of AuburnOverview of Sewer Fun

- Page 246 and 247:

SEWER FUNDExpendituresSewer Mainten

- Page 248 and 249:

Sewer FundSewer General Operations

- Page 250 and 251:

SEWER CAPITALPROJECTS FUNDExpenditu

- Page 252 and 253:

City of AuburnDescription of and Tr

- Page 254 and 255:

City of AuburnTotal Special Revenue

- Page 256 and 257:

City of AuburnCity Gas Tax Special

- Page 258 and 259:

City of AuburnState Nine Cent Gas T

- Page 260 and 261:

City of AuburnSpecial Additional Sc

- Page 262 and 263:

City of AuburnCommunity Development

- Page 264 and 265:

City of AuburnDescription of and Tr

- Page 266 and 267:

City of AuburnTotal Debt Service Fu

- Page 268 and 269:

City of AuburnSpecial Five Mill Tax

- Page 270 and 271:

City of AuburnFY 03 & FY 04Biennial

- Page 272 and 273:

City of AuburnOverview of Total Ent

- Page 274 and 275:

City of AuburnDetail of Enterprise

- Page 276 and 277:

City of AuburnSewer Equipment Repla

- Page 278 and 279:

City of AuburnIndustrial Park FundC

- Page 280 and 281:

City of AuburnDescription of and Tr

- Page 282 and 283:

City of AuburnTotal Internal Servic

- Page 284 and 285:

City of AuburnLiability Risk Retent