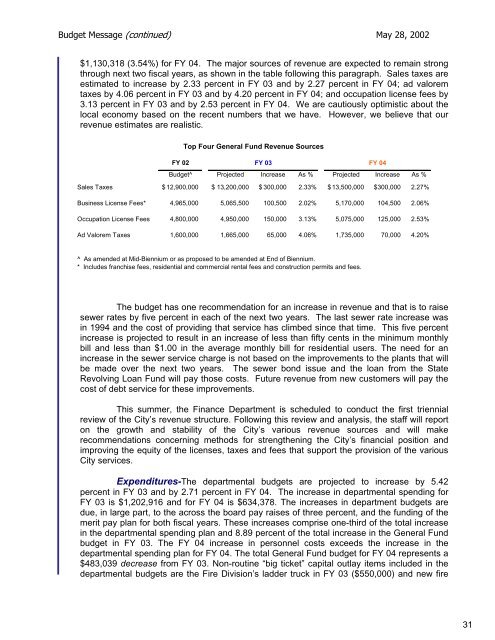

Budget Message (continued) May 28, 2002$1,130,318 (3.54%) for FY 04. The major sources <strong>of</strong> revenue are expected to remain strongthrough next two fiscal years, as shown in the table following this paragraph. Sales taxes areestimated to increase by 2.33 percent in FY 03 and by 2.27 percent in FY 04; ad valoremtaxes by 4.06 percent in FY 03 and by 4.20 percent in FY 04; and occupation license fees by3.13 percent in FY 03 and by 2.53 percent in FY 04. We are cautiously optimistic about thelocal economy based on the recent numbers that we have. However, we believe that ourrevenue estimates are realistic.Top Four General Fund Revenue SourcesFY 02FY 03 FY 04Budget^ Projected Increase As % Projected Increase As %Sales Taxes $ 12,900,000 $ 13,200,000 $ 300,000 2.33% $ 13,500,000 $ 300,000 2.27%Business License Fees* 4,965,000 5,065,500 100,500 2.02% 5,170,000 104,500 2.06%Occupation License Fees 4,800,000 4,950,000 150,000 3.13% 5,075,000 125,000 2.53%Ad Valorem Taxes 1,600,000 1,665,000 65,000 4.06% 1,735,000 70,000 4.20%^ As amended at Mid-Biennium or as proposed to be amended at End <strong>of</strong> Biennium.* Includes franchise fees, residential and commercial rental fees and construction permits and fees.The budget has one recommendation for an increase in revenue and that is to raisesewer rates by five percent in each <strong>of</strong> the next two years. The last sewer rate increase wasin 1994 and the cost <strong>of</strong> providing that service has climbed since that time. This five percentincrease is projected to result in an increase <strong>of</strong> less than fifty cents in the minimum monthlybill and less than $1.00 in the average monthly bill for residential users. The need for anincrease in the sewer service charge is not based on the improvements to the plants that willbe made over the next two years. The sewer bond issue and the loan from the StateRevolving Loan Fund will pay those costs. Future revenue from new customers will pay thecost <strong>of</strong> debt service for these improvements.This summer, the Finance Department is scheduled to conduct the first triennialreview <strong>of</strong> the <strong>City</strong>’s revenue structure. Following this review and analysis, the staff will reporton the growth and stability <strong>of</strong> the <strong>City</strong>’s various revenue sources and will makerecommendations concerning methods for strengthening the <strong>City</strong>’s financial position andimproving the equity <strong>of</strong> the licenses, taxes and fees that support the provision <strong>of</strong> the various<strong>City</strong> services.Expenditures-The departmental budgets are projected to increase by 5.42percent in FY 03 and by 2.71 percent in FY 04. The increase in departmental spending forFY 03 is $1,202,916 and for FY 04 is $634,378. The increases in department budgets aredue, in large part, to the across the board pay raises <strong>of</strong> three percent, and the funding <strong>of</strong> themerit pay plan for both fiscal years. These increases comprise one-third <strong>of</strong> the total increasein the departmental spending plan and 8.89 percent <strong>of</strong> the total increase in the General Fundbudget in FY 03. The FY 04 increase in personnel costs exceeds the increase in thedepartmental spending plan for FY 04. The total General Fund budget for FY 04 represents a$483,039 decrease from FY 03. Non-routine “big ticket” capital outlay items included in thedepartmental budgets are the Fire Division’s ladder truck in FY 03 ($550,000) and new fire31

Budget Message (continued) May 28, 2002station in FY 04 ($400,000). There are some decreases in contractual services, commodities,and capital outlay for the departments. By cutting the departmental budgets in these areas,we have been able to afford the pay raises and capital items that are included in the budget.Also, several capital leases will pay out in FY 03 and FY 04, decreasing the amount that isneeded for debt service in the departmental portion <strong>of</strong> the General Fund budget. The result isthat we have fairly tight departmental budgets.General Fund - Comparative Expenditures by CategoryFY 02Proposed Budget - FY 03Increase (Decrease)Proposed Budget - FY 04Increase (Decrease)Mid-Bi Budget Budgeted Amount As % Budgeted Amount As %DepartmentsPersonal services $ 16,370,591 $ 16,772,140 $ 401,549 2.45% $ 17,637,703 865,563 5.16%Contractual services 2,965,231 3,225,623 260,392 8.78% 3,375,537 149,914 4.65%Commodities 1,760,051 1,698,157 (61,894) -3.52% 1,727,043 28,886 1.70%Capital outlay 649,252 1,307,154 657,902 101.33% 997,110 (310,044) -23.72%Debt service 449,121 394,088 (55,033) -12.25% 294,151 (99,937) -25.36%Total Departmental 22,194,246 23,397,162 1,202,916 5.42% 24,031,544 634,382 2.71%Non-DepartmentalGeneral operations 936,823 1,233,401 296,578 31.66% 1,062,493 (170,908) -13.86%Project operations 1,743,574 3,936,000 2,192,426 125.74% 2,458,500 (1,477,500) -37.54%Agency funding 4,781,536 4,861,312 79,776 1.67% 5,107,938 246,626 5.07%Transfers to other funds 1,521,048 1,927,985 406,937 26.75% 1,954,682 26,697 1.38%Debt service 1,812,616 2,152,039 339,423 18.73% 2,409,703 257,664 11.97%Total Non-Departmental 10,795,597 14,110,737 3,315,140 30.71% 12,993,316 (1,117,421) -7.92%General Fund Totals $ 32,989,843 $ 37,507,899 $ 4,518,056 13.70% $ 37,024,860 $ (483,039) -1.29%Growth in School funding for the biennium is substantial, as explained earlier, andcomprises a significant portion <strong>of</strong> the expenditure growth in the non-departmental budget forFY04. Total funding from the General Fund to the Schools for FY 03 increased only $48,519because there is no supplemental funding in addition to the fifteen mill equivalent. It isunderstood that school funding is the Council’s top priority and that it is important to fund theSchools at a level sufficient to provide high quality education for <strong>Auburn</strong>’s school children. Inorder for the Schools to be adequately funded in the face <strong>of</strong> unreliable funding from the Stateand for the <strong>City</strong> to address the issues that will face us in the future, the Council may need toconsider increasing revenue specifically for the Schools that will relieve some <strong>of</strong> the pressureon the General Fund.Nearly half <strong>of</strong> the increase in total General Fund budgeted expenditures for FY 03 isrepresented by the increase in the non-departmental Project Operations. This increase isaccounted for by the planned expenditure <strong>of</strong> $1 million for the Tennis Complex, which will befunded by borrowing and the borrowing repaid by memberships and other Complexrevenues, and another $1M for improvements to the Duck Samford Stadium. The amountincluded for the Stadium renovations is a worst-case scenario. The actual amount required tomake needed improvements will be based on the structural engineer’s inspection report. InFY 04, non-departmental expenditures are expected to decrease by $1.1 million.The sections <strong>of</strong> the budget following this Budget Message will provide detailedanalyses <strong>of</strong> the <strong>City</strong>’s revenues and expenditures.32

- Page 1: TheCity of AuburnAlabamaBiennial Bu

- Page 4 and 5: City of Auburn General Fund (contin

- Page 6 and 7: City of AuburnFY 03 & FY 04Biennial

- Page 8 and 9: City of Auburn, AlabamaApproximatel

- Page 10 and 11: City of Auburn, Alabamaachievements

- Page 14 and 15: City of Auburn, Alabama• The annu

- Page 16 and 17: Miscellaneous Statistical DataAubur

- Page 18 and 19: City of AuburnPersonnel Summary by

- Page 20 and 21: City of AuburnFY03 & FY04Biennial B

- Page 22 and 23: City of AuburnFY03 & FY04Biennial B

- Page 24 and 25: City of AuburnFY03 & FY04Biennial B

- Page 26 and 27: The Government Finance Officers Ass

- Page 28 and 29: Budget Message (continued) May 28,

- Page 30 and 31: Budget Message (continued) May 28,

- Page 32 and 33: Budget Message (continued) May 28,

- Page 34 and 35: Budget Message (continued) May 28,

- Page 36 and 37: Budget Message (continued) May 28,

- Page 40 and 41: Budget Message (continued) May 28,

- Page 42 and 43: City of Auburn Key Decisions of the

- Page 44 and 45: City of AuburnFinancial OverviewThe

- Page 46 and 47: City of AuburnFinancial Overview$40

- Page 48 and 49: 41City of Auburn ~ General Fund ~ S

- Page 50 and 51: The City of AuburnDescription of th

- Page 52 and 53: City of Auburnexpenditures by fund

- Page 54 and 55: City of AuburnBiennial Budget Calen

- Page 56 and 57: City of AuburnAnnual Citizen Survey

- Page 58 and 59: City of AuburnAmong the following s

- Page 60 and 61: Auburn 202022 Goals for 2020The Aub

- Page 62 and 63: City of AuburnRevenue Overview• a

- Page 64 and 65: City of AuburnRevenue Overviewincre

- Page 66 and 67: City of AuburnRevenue OverviewCity

- Page 68 and 69: City of AuburnOverview of Debt Poli

- Page 70 and 71: City of AuburnOverview of Debt Poli

- Page 72 and 73: City of AuburnOverview of Debt Poli

- Page 74 and 75: City of AuburnOverview of Debt Poli

- Page 76 and 77: City of AuburnOverview of Projected

- Page 78 and 79: City of AuburnDetails of Financing

- Page 80 and 81: PublicTotal-AllSpecial Safety Budge

- Page 82 and 83: City of AuburnOverview of Other Fun

- Page 84 and 85: City of AuburnSummary of Capital Ou

- Page 86 and 87: City of AuburnSummary of Capital Ou

- Page 88 and 89:

City of AuburnSummary of Capital Ou

- Page 90 and 91:

City of AuburnSummary of Capital Ou

- Page 92 and 93:

City of AuburnSummary of Capital Ou

- Page 94 and 95:

City of AuburnCapital Improvements

- Page 96 and 97:

City of AuburnCapital Improvements

- Page 98 and 99:

City of AuburnFY 03 & FY 04Biennial

- Page 100 and 101:

City of AuburnTrends in Total Reven

- Page 102 and 103:

The City of AuburnGeneral Fund - Su

- Page 104 and 105:

City of AuburnGeneral Fund - Detail

- Page 106 and 107:

City of AuburnGeneral Fund - Detail

- Page 108 and 109:

City of AuburnOverview of Expenditu

- Page 110 and 111:

City of AuburnDetail of Expenditure

- Page 112 and 113:

City of AuburnDetails of Expenditur

- Page 114 and 115:

City of AuburnSummary of Expenditur

- Page 116 and 117:

City of AuburnGeneral Fund - Summar

- Page 118 and 119:

City of AuburnComparative Budgeted

- Page 120 and 121:

City of AuburnBiennial BudgetTable

- Page 122 and 123:

City of AuburnOverview of Expenditu

- Page 124 and 125:

City CouncilBudget SummaryBiennial

- Page 126 and 127:

Office of the City ManagerDouglas J

- Page 128 and 129:

Office of the City ManagerBudget Su

- Page 130 and 131:

GENERAL FUNDExpendituresCity Manage

- Page 132 and 133:

Judicial DepartmentJoe Bailey, Muni

- Page 134 and 135:

GENERAL FUNDExpendituresJudicialCla

- Page 136 and 137:

Information Technology DepartmentJa

- Page 138 and 139:

Information TechnologyBudget Summar

- Page 140 and 141:

GENERAL FUNDExpendituresInformation

- Page 142 and 143:

GENERAL FUNDExpendituresInformation

- Page 144 and 145:

Finance DepartmentAndrea E. Jackson

- Page 146 and 147:

Finance DepartmentAndrea Jackson, D

- Page 148 and 149:

GENERAL FUNDExpendituresFinanceClas

- Page 150 and 151:

Economic DevelopmentDepartmentPhill

- Page 152 and 153:

Economic Development DepartmentPhil

- Page 154 and 155:

GENERAL FUNDExpendituresEconomic De

- Page 156 and 157:

Human Resources DepartmentSteven A.

- Page 158 and 159:

Human Resources DepartmentHuman Res

- Page 160 and 161:

GENERAL FUNDExpendituresHuman Resou

- Page 162 and 163:

GENERAL FUNDExpendituresHuman Resou

- Page 164 and 165:

City of Auburn Public Safety Depart

- Page 166 and 167:

Public Safety Department Mission an

- Page 168 and 169:

GENERAL FUNDExpendituresPublic Safe

- Page 170 and 171:

Public Safety DepartmentPolice Divi

- Page 172 and 173:

GENERAL FUNDExpendituresPublic Safe

- Page 174 and 175:

GENERAL FUNDExpendituresPublic Safe

- Page 176 and 177:

Public Safety DepartmentCommunicati

- Page 178 and 179:

Public Safety DepartmentCodes Enfor

- Page 180 and 181:

Public Works DepartmentJeff Ramsey,

- Page 182 and 183:

Public Works DepartmentAdministrati

- Page 184 and 185:

GENERAL FUNDExpendituresPublic Work

- Page 186 and 187:

GENERAL FUNDExpendituresPublic Work

- Page 188 and 189:

Public Works DepartmentEngineering

- Page 190 and 191:

Public Works DepartmentInspection D

- Page 192 and 193:

GENERAL FUNDExpendituresPublic Work

- Page 194 and 195:

GENERAL FUNDExpendituresPublic Work

- Page 196 and 197:

Environmental Services DepartmentAl

- Page 198 and 199:

GENERAL FUNDExpendituresEnvironment

- Page 200 and 201:

Environmental Services DepartmentRe

- Page 202 and 203:

GENERAL FUNDExpendituresEnvironment

- Page 204 and 205:

GENERAL FUNDExpendituresEnvironment

- Page 206 and 207:

Environmental Services DepartmentAn

- Page 208 and 209:

Environmental Services DepartmentRi

- Page 210 and 211:

GENERAL FUNDExpendituresEnvironment

- Page 212 and 213:

GENERAL FUNDExpendituresEnvironment

- Page 214 and 215:

Auburn City LibraryMargie B. Huffma

- Page 216 and 217:

LibraryBudget SummaryBiennial Budge

- Page 218 and 219:

GENERAL FUNDExpendituresLibrary (co

- Page 220 and 221:

Parks and Recreation DepartmentRebe

- Page 222 and 223:

GENERAL FUNDExpendituresParks and R

- Page 224 and 225:

Parks and Recreation DepartmentLeis

- Page 226 and 227:

Parks and Recreation DepartmentPark

- Page 228 and 229:

GENERAL FUNDExpendituresParks and R

- Page 230 and 231:

Planning DepartmentRobert J. Juster

- Page 232 and 233:

GENERAL FUNDExpendituresPlanningCla

- Page 234 and 235:

Non-DepartmentalBudget SummaryBienn

- Page 236 and 237:

GENERAL FUNDExpendituresNon Departm

- Page 238 and 239:

GENERAL FUNDExpendituresNon Departm

- Page 240 and 241:

GENERAL FUNDExpendituresNon Departm

- Page 242 and 243:

Water and Sewer DepartmentRex Griff

- Page 244 and 245:

City of AuburnOverview of Sewer Fun

- Page 246 and 247:

SEWER FUNDExpendituresSewer Mainten

- Page 248 and 249:

Sewer FundSewer General Operations

- Page 250 and 251:

SEWER CAPITALPROJECTS FUNDExpenditu

- Page 252 and 253:

City of AuburnDescription of and Tr

- Page 254 and 255:

City of AuburnTotal Special Revenue

- Page 256 and 257:

City of AuburnCity Gas Tax Special

- Page 258 and 259:

City of AuburnState Nine Cent Gas T

- Page 260 and 261:

City of AuburnSpecial Additional Sc

- Page 262 and 263:

City of AuburnCommunity Development

- Page 264 and 265:

City of AuburnDescription of and Tr

- Page 266 and 267:

City of AuburnTotal Debt Service Fu

- Page 268 and 269:

City of AuburnSpecial Five Mill Tax

- Page 270 and 271:

City of AuburnFY 03 & FY 04Biennial

- Page 272 and 273:

City of AuburnOverview of Total Ent

- Page 274 and 275:

City of AuburnDetail of Enterprise

- Page 276 and 277:

City of AuburnSewer Equipment Repla

- Page 278 and 279:

City of AuburnIndustrial Park FundC

- Page 280 and 281:

City of AuburnDescription of and Tr

- Page 282 and 283:

City of AuburnTotal Internal Servic

- Page 284 and 285:

City of AuburnLiability Risk Retent