<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Revenue Overview<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Growth in <strong>City</strong> Revenues ~ FY 1992 - FY 2002199219931994199519961997199819992000$0 $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000General Fund Other Gov't'l Fds Enterprise Fds Internal Svc FdsAll % IncreaseFiscal Governmental Funds Proprietary Funds <strong>City</strong> overYear General Fund Other Gov't'l Enterprise** Internal Svc Funds Prior Year1992 $ 16,654,003 $ 3,515,490 $ 2,876,313 $ 983,619 $ 24,029,4251993 17,570,668 3,703,854 3,532,487 1,105,711 25,912,720 7.84%1994 18,407,584 3,729,683 4,415,013 1,058,115 27,610,395 6.55%1995 19,876,679 5,368,643 4,927,094 972,069 31,144,485 12.80%1996 22,565,856 4,396,361 5,235,624 945,038 33,142,879 6.42%1997 23,128,657 6,097,463 5,734,996 965,374 35,926,490 8.40%1998 24,412,533 5,738,150 7,145,435 973,436 38,269,554 6.52%1999 28,217,199 7,019,408 5,280,503 1,044,463 41,561,573 8.60%2000 29,348,728 7,058,252 5,816,414 1,201,990 43,425,384 4.48%2001 30,976,507 8,218,805 4,668,460 1,308,058 45,171,830 4.02%2002 * 32,498,932 8,502,372 5,340,702 1,340,412 47,682,418 5.56%Growth in total revenue from FY 92 to FY 02Average annual growth in total revenue98.43%8.95%* Unaudited** In fiscal year 1996, financial reporting for the <strong>City</strong>'s Industrial Development Board (IDB) was changed topresent the IDB as a discretely (separately) presented component unit <strong>of</strong> the <strong>City</strong>. The 1996-2002 amountsreported above for Enterprise Funds include the IDB's revenues for comparability. Like,wise in 1997, thefinancial reporting for the <strong>Auburn</strong> Center for Developing Industries (ACDI) was changed to present the ACDIas a discretely presented component unit <strong>of</strong> the <strong>City</strong>. The 1997 - 2002 amounts reported above for EnterpriseFunds includes the ACDI's revenues for comparability.59

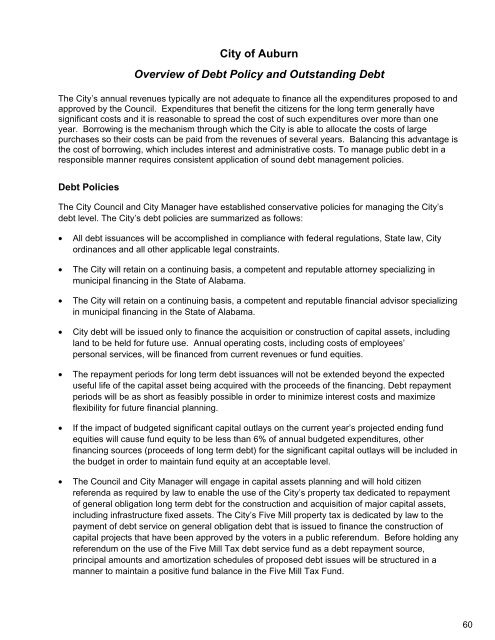

<strong>City</strong> <strong>of</strong> <strong>Auburn</strong>Overview <strong>of</strong> Debt Policy and Outstanding DebtThe <strong>City</strong>’s annual revenues typically are not adequate to finance all the expenditures proposed to andapproved by the Council. Expenditures that benefit the citizens for the long term generally havesignificant costs and it is reasonable to spread the cost <strong>of</strong> such expenditures over more than oneyear. Borrowing is the mechanism through which the <strong>City</strong> is able to allocate the costs <strong>of</strong> largepurchases so their costs can be paid from the revenues <strong>of</strong> several years. Balancing this advantage isthe cost <strong>of</strong> borrowing, which includes interest and administrative costs. To manage public debt in aresponsible manner requires consistent application <strong>of</strong> sound debt management policies.Debt PoliciesThe <strong>City</strong> Council and <strong>City</strong> Manager have established conservative policies for managing the <strong>City</strong>’sdebt level. The <strong>City</strong>’s debt policies are summarized as follows:• All debt issuances will be accomplished in compliance with federal regulations, State law, <strong>City</strong>ordinances and all other applicable legal constraints.• The <strong>City</strong> will retain on a continuing basis, a competent and reputable attorney specializing inmunicipal financing in the State <strong>of</strong> Alabama.• The <strong>City</strong> will retain on a continuing basis, a competent and reputable financial advisor specializingin municipal financing in the State <strong>of</strong> Alabama.• <strong>City</strong> debt will be issued only to finance the acquisition or construction <strong>of</strong> capital assets, includingland to be held for future use. Annual operating costs, including costs <strong>of</strong> employees’personal services, will be financed from current revenues or fund equities.• The repayment periods for long term debt issuances will not be extended beyond the expecteduseful life <strong>of</strong> the capital asset being acquired with the proceeds <strong>of</strong> the financing. Debt repaymentperiods will be as short as feasibly possible in order to minimize interest costs and maximizeflexibility for future financial planning.• If the impact <strong>of</strong> budgeted significant capital outlays on the current year’s projected ending fundequities will cause fund equity to be less than 6% <strong>of</strong> annual budgeted expenditures, otherfinancing sources (proceeds <strong>of</strong> long term debt) for the significant capital outlays will be included inthe budget in order to maintain fund equity at an acceptable level.• The Council and <strong>City</strong> Manager will engage in capital assets planning and will hold citizenreferenda as required by law to enable the use <strong>of</strong> the <strong>City</strong>’s property tax dedicated to repayment<strong>of</strong> general obligation long term debt for the construction and acquisition <strong>of</strong> major capital assets,including infrastructure fixed assets. The <strong>City</strong>’s Five Mill property tax is dedicated by law to thepayment <strong>of</strong> debt service on general obligation debt that is issued to finance the construction <strong>of</strong>capital projects that have been approved by the voters in a public referendum. Before holding anyreferendum on the use <strong>of</strong> the Five Mill Tax debt service fund as a debt repayment source,principal amounts and amortization schedules <strong>of</strong> proposed debt issues will be structured in amanner to maintain a positive fund balance in the Five Mill Tax Fund.60

- Page 1:

TheCity of AuburnAlabamaBiennial Bu

- Page 4 and 5:

City of Auburn General Fund (contin

- Page 6 and 7:

City of AuburnFY 03 & FY 04Biennial

- Page 8 and 9:

City of Auburn, AlabamaApproximatel

- Page 10 and 11:

City of Auburn, Alabamaachievements

- Page 14 and 15:

City of Auburn, Alabama• The annu

- Page 16 and 17: Miscellaneous Statistical DataAubur

- Page 18 and 19: City of AuburnPersonnel Summary by

- Page 20 and 21: City of AuburnFY03 & FY04Biennial B

- Page 22 and 23: City of AuburnFY03 & FY04Biennial B

- Page 24 and 25: City of AuburnFY03 & FY04Biennial B

- Page 26 and 27: The Government Finance Officers Ass

- Page 28 and 29: Budget Message (continued) May 28,

- Page 30 and 31: Budget Message (continued) May 28,

- Page 32 and 33: Budget Message (continued) May 28,

- Page 34 and 35: Budget Message (continued) May 28,

- Page 36 and 37: Budget Message (continued) May 28,

- Page 38 and 39: Budget Message (continued) May 28,

- Page 40 and 41: Budget Message (continued) May 28,

- Page 42 and 43: City of Auburn Key Decisions of the

- Page 44 and 45: City of AuburnFinancial OverviewThe

- Page 46 and 47: City of AuburnFinancial Overview$40

- Page 48 and 49: 41City of Auburn ~ General Fund ~ S

- Page 50 and 51: The City of AuburnDescription of th

- Page 52 and 53: City of Auburnexpenditures by fund

- Page 54 and 55: City of AuburnBiennial Budget Calen

- Page 56 and 57: City of AuburnAnnual Citizen Survey

- Page 58 and 59: City of AuburnAmong the following s

- Page 60 and 61: Auburn 202022 Goals for 2020The Aub

- Page 62 and 63: City of AuburnRevenue Overview• a

- Page 64 and 65: City of AuburnRevenue Overviewincre

- Page 68 and 69: City of AuburnOverview of Debt Poli

- Page 70 and 71: City of AuburnOverview of Debt Poli

- Page 72 and 73: City of AuburnOverview of Debt Poli

- Page 74 and 75: City of AuburnOverview of Debt Poli

- Page 76 and 77: City of AuburnOverview of Projected

- Page 78 and 79: City of AuburnDetails of Financing

- Page 80 and 81: PublicTotal-AllSpecial Safety Budge

- Page 82 and 83: City of AuburnOverview of Other Fun

- Page 84 and 85: City of AuburnSummary of Capital Ou

- Page 86 and 87: City of AuburnSummary of Capital Ou

- Page 88 and 89: City of AuburnSummary of Capital Ou

- Page 90 and 91: City of AuburnSummary of Capital Ou

- Page 92 and 93: City of AuburnSummary of Capital Ou

- Page 94 and 95: City of AuburnCapital Improvements

- Page 96 and 97: City of AuburnCapital Improvements

- Page 98 and 99: City of AuburnFY 03 & FY 04Biennial

- Page 100 and 101: City of AuburnTrends in Total Reven

- Page 102 and 103: The City of AuburnGeneral Fund - Su

- Page 104 and 105: City of AuburnGeneral Fund - Detail

- Page 106 and 107: City of AuburnGeneral Fund - Detail

- Page 108 and 109: City of AuburnOverview of Expenditu

- Page 110 and 111: City of AuburnDetail of Expenditure

- Page 112 and 113: City of AuburnDetails of Expenditur

- Page 114 and 115: City of AuburnSummary of Expenditur

- Page 116 and 117:

City of AuburnGeneral Fund - Summar

- Page 118 and 119:

City of AuburnComparative Budgeted

- Page 120 and 121:

City of AuburnBiennial BudgetTable

- Page 122 and 123:

City of AuburnOverview of Expenditu

- Page 124 and 125:

City CouncilBudget SummaryBiennial

- Page 126 and 127:

Office of the City ManagerDouglas J

- Page 128 and 129:

Office of the City ManagerBudget Su

- Page 130 and 131:

GENERAL FUNDExpendituresCity Manage

- Page 132 and 133:

Judicial DepartmentJoe Bailey, Muni

- Page 134 and 135:

GENERAL FUNDExpendituresJudicialCla

- Page 136 and 137:

Information Technology DepartmentJa

- Page 138 and 139:

Information TechnologyBudget Summar

- Page 140 and 141:

GENERAL FUNDExpendituresInformation

- Page 142 and 143:

GENERAL FUNDExpendituresInformation

- Page 144 and 145:

Finance DepartmentAndrea E. Jackson

- Page 146 and 147:

Finance DepartmentAndrea Jackson, D

- Page 148 and 149:

GENERAL FUNDExpendituresFinanceClas

- Page 150 and 151:

Economic DevelopmentDepartmentPhill

- Page 152 and 153:

Economic Development DepartmentPhil

- Page 154 and 155:

GENERAL FUNDExpendituresEconomic De

- Page 156 and 157:

Human Resources DepartmentSteven A.

- Page 158 and 159:

Human Resources DepartmentHuman Res

- Page 160 and 161:

GENERAL FUNDExpendituresHuman Resou

- Page 162 and 163:

GENERAL FUNDExpendituresHuman Resou

- Page 164 and 165:

City of Auburn Public Safety Depart

- Page 166 and 167:

Public Safety Department Mission an

- Page 168 and 169:

GENERAL FUNDExpendituresPublic Safe

- Page 170 and 171:

Public Safety DepartmentPolice Divi

- Page 172 and 173:

GENERAL FUNDExpendituresPublic Safe

- Page 174 and 175:

GENERAL FUNDExpendituresPublic Safe

- Page 176 and 177:

Public Safety DepartmentCommunicati

- Page 178 and 179:

Public Safety DepartmentCodes Enfor

- Page 180 and 181:

Public Works DepartmentJeff Ramsey,

- Page 182 and 183:

Public Works DepartmentAdministrati

- Page 184 and 185:

GENERAL FUNDExpendituresPublic Work

- Page 186 and 187:

GENERAL FUNDExpendituresPublic Work

- Page 188 and 189:

Public Works DepartmentEngineering

- Page 190 and 191:

Public Works DepartmentInspection D

- Page 192 and 193:

GENERAL FUNDExpendituresPublic Work

- Page 194 and 195:

GENERAL FUNDExpendituresPublic Work

- Page 196 and 197:

Environmental Services DepartmentAl

- Page 198 and 199:

GENERAL FUNDExpendituresEnvironment

- Page 200 and 201:

Environmental Services DepartmentRe

- Page 202 and 203:

GENERAL FUNDExpendituresEnvironment

- Page 204 and 205:

GENERAL FUNDExpendituresEnvironment

- Page 206 and 207:

Environmental Services DepartmentAn

- Page 208 and 209:

Environmental Services DepartmentRi

- Page 210 and 211:

GENERAL FUNDExpendituresEnvironment

- Page 212 and 213:

GENERAL FUNDExpendituresEnvironment

- Page 214 and 215:

Auburn City LibraryMargie B. Huffma

- Page 216 and 217:

LibraryBudget SummaryBiennial Budge

- Page 218 and 219:

GENERAL FUNDExpendituresLibrary (co

- Page 220 and 221:

Parks and Recreation DepartmentRebe

- Page 222 and 223:

GENERAL FUNDExpendituresParks and R

- Page 224 and 225:

Parks and Recreation DepartmentLeis

- Page 226 and 227:

Parks and Recreation DepartmentPark

- Page 228 and 229:

GENERAL FUNDExpendituresParks and R

- Page 230 and 231:

Planning DepartmentRobert J. Juster

- Page 232 and 233:

GENERAL FUNDExpendituresPlanningCla

- Page 234 and 235:

Non-DepartmentalBudget SummaryBienn

- Page 236 and 237:

GENERAL FUNDExpendituresNon Departm

- Page 238 and 239:

GENERAL FUNDExpendituresNon Departm

- Page 240 and 241:

GENERAL FUNDExpendituresNon Departm

- Page 242 and 243:

Water and Sewer DepartmentRex Griff

- Page 244 and 245:

City of AuburnOverview of Sewer Fun

- Page 246 and 247:

SEWER FUNDExpendituresSewer Mainten

- Page 248 and 249:

Sewer FundSewer General Operations

- Page 250 and 251:

SEWER CAPITALPROJECTS FUNDExpenditu

- Page 252 and 253:

City of AuburnDescription of and Tr

- Page 254 and 255:

City of AuburnTotal Special Revenue

- Page 256 and 257:

City of AuburnCity Gas Tax Special

- Page 258 and 259:

City of AuburnState Nine Cent Gas T

- Page 260 and 261:

City of AuburnSpecial Additional Sc

- Page 262 and 263:

City of AuburnCommunity Development

- Page 264 and 265:

City of AuburnDescription of and Tr

- Page 266 and 267:

City of AuburnTotal Debt Service Fu

- Page 268 and 269:

City of AuburnSpecial Five Mill Tax

- Page 270 and 271:

City of AuburnFY 03 & FY 04Biennial

- Page 272 and 273:

City of AuburnOverview of Total Ent

- Page 274 and 275:

City of AuburnDetail of Enterprise

- Page 276 and 277:

City of AuburnSewer Equipment Repla

- Page 278 and 279:

City of AuburnIndustrial Park FundC

- Page 280 and 281:

City of AuburnDescription of and Tr

- Page 282 and 283:

City of AuburnTotal Internal Servic

- Page 284 and 285:

City of AuburnLiability Risk Retent