Social ulighed og tilslutning til velfærdsstaten Private Equity Funds ...

Social ulighed og tilslutning til velfærdsstaten Private Equity Funds ...

Social ulighed og tilslutning til velfærdsstaten Private Equity Funds ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

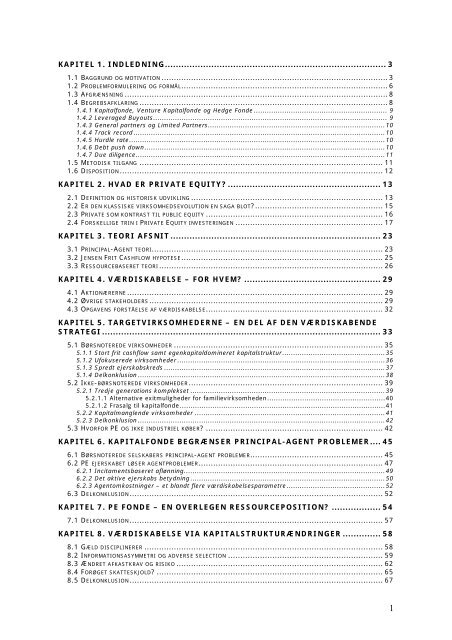

KAPITEL 1. INDLEDNING................................................................................. 3<br />

1.1 BAGGRUND OG MOTIVATION ............................................................................................ 3<br />

1.2 PROBLEMFORMULERING OG FORMÅL.................................................................................... 6<br />

1.3 AFGRÆNSNING ........................................................................................................... 8<br />

1.4 BEGREBSAFKLARING ..................................................................................................... 8<br />

1.4.1 Kapitalfonde, Venture Kapitalfonde <strong>og</strong> Hedge Fonde ............................................................. 9<br />

1.4.2 Leveraged Buyouts........................................................................................................... 9<br />

1.4.3 General partners <strong>og</strong> Limited Partners.................................................................................10<br />

1.4.4 Track record ...................................................................................................................10<br />

1.4.5 Hurdle rate.....................................................................................................................10<br />

1.4.6 Debt push down..............................................................................................................10<br />

1.4.7 Due diligence..................................................................................................................11<br />

1.5 METODISK TILGANG ................................................................................................... 11<br />

1.6 DISPOSITION ........................................................................................................... 12<br />

KAPITEL 2. HVAD ER PRIVATE EQUITY? ........................................................ 13<br />

2.1 DEFINITION OG HISTORISK UDVIKLING .............................................................................. 13<br />

2.2 ER DEN KLASSISKE VIRKSOMHEDSEVOLUTION EN SAGA BLOT?.................................................... 15<br />

2.3 PRIVATE SOM KONTRAST TIL PUBLIC EQUITY ........................................................................ 16<br />

2.4 FORSKELLIGE TRIN I PRIVATE EQUITY INVESTERINGEN ............................................................ 17<br />

KAPITEL 3. TEORI AFSNIT ............................................................................. 23<br />

3.1 PRINCIPAL-AGENT TEORI.............................................................................................. 23<br />

3.2 JENSEN FRIT CASHFLOW HYPOTESE.................................................................................. 25<br />

3.3 RESSOURCEBASERET TEORI ........................................................................................... 26<br />

KAPITEL 4. VÆRDISKABELSE – FOR HVEM? .................................................. 29<br />

4.1 AKTIONÆRERNE ........................................................................................................ 29<br />

4.2 ØVRIGE STAKEHOLDERS............................................................................................... 29<br />

4.3 OPGAVENS FORSTÅELSE AF VÆRDISKABELSE........................................................................ 32<br />

KAPITEL 5. TARGETVIRKSOMHEDERNE – EN DEL AF DEN VÆRDISKABENDE<br />

STRATEGI...................................................................................................... 33<br />

5.1 BØRSNOTEREDE VIRKSOMHEDER ..................................................................................... 35<br />

5.1.1 Stort frit cashflow samt egenkapitaldomineret kapitalstruktur ...............................................35<br />

5.1.2 Ufokuserede virksomheder ...............................................................................................36<br />

5.1.3 Spredt ejerskabskreds .....................................................................................................37<br />

5.1.4 Delkonklusion .................................................................................................................38<br />

5.2 IKKE-BØRSNOTEREDE VIRKSOMHEDER............................................................................... 39<br />

5.2.1 Tredje generations komplekset .........................................................................................39<br />

5.2.1.1 Alternative exitm<strong>ulighed</strong>er for familievirksomheden......................................................40<br />

5.2.1.2 Frasalg <strong>til</strong> kapitalfonde..............................................................................................41<br />

5.2.2 Kapitalmanglende virksomheder .......................................................................................41<br />

5.2.3 Delkonklusion .................................................................................................................42<br />

5.3 HVORFOR PE OG IKKE INDUSTRIEL KØBER? ........................................................................ 42<br />

KAPITEL 6. KAPITALFONDE BEGRÆNSER PRINCIPAL-AGENT PROBLEMER.... 45<br />

6.1 BØRSNOTEREDE SELSKABERS PRINCIPAL-AGENT PROBLEMER...................................................... 45<br />

6.2 PE EJERSKABET LØSER AGENTPROBLEMER........................................................................... 47<br />

6.2.1 Incitamentsbaseret aflønning............................................................................................49<br />

6.2.2 Det aktive ejerskabs betydning .........................................................................................50<br />

6.2.3 Agentomkostninger – et blandt flere værdiskabelsesparametre .............................................52<br />

6.3 DELKONKLUSION ....................................................................................................... 52<br />

KAPITEL 7. PE FONDE – EN OVERLEGEN RESSOURCEPOSITION? .................. 54<br />

7.1 DELKONKLUSION ....................................................................................................... 57<br />

KAPITEL 8. VÆRDISKABELSE VIA KAPITALSTRUKTURÆNDRINGER .............. 58<br />

8.1 GÆLD DISCIPLINERER ................................................................................................. 58<br />

8.2 INFORMATIONSASYMMETRI OG ADVERSE SELECTION ............................................................... 59<br />

8.3 ÆNDRET AFKASTKRAV OG RISIKO .................................................................................... 62<br />

8.4 FORØGET SKATTESKJOLD? ............................................................................................ 65<br />

8.5 DELKONKLUSION ....................................................................................................... 67<br />

1