- Page 1 and 2:

October 5, 2012 Via Email Original

- Page 3 and 4:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 5 and 6:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 7 and 8:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 9 and 10:

Utility Name Milton Hydro Distribut

- Page 11 and 12:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 13 and 14:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 15 and 16:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 17 and 18:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 19 and 20:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 21 and 22:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 23 and 24:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 25 and 26:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 27 and 28:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 29 and 30:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 31 and 32:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 33 and 34:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 35 and 36:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 37 and 38:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 39 and 40:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 41 and 42:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 43 and 44:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 45 and 46:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 47 and 48:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 49 and 50:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 51 and 52:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 53 and 54:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 55 and 56:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 57 and 58:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 59 and 60:

1 2 3 4 5 6 7 8 Response: FortisBC

- Page 61 and 62:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 63 and 64:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 65 and 66:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 67 and 68:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 69 and 70:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 71 and 72:

ID Task Name Duration Start Finish

- Page 73 and 74:

ID Task Name Duration Start Finish

- Page 75 and 76:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 77 and 78:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 79 and 80:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 81 and 82:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 83 and 84:

1 2 3 4 5 6 7 8 9 10 2013 FortisBC

- Page 85 and 86:

1 FortisBC Inc. (FortisBC or the Co

- Page 87 and 88:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 89 and 90:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 91 and 92:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 93 and 94:

1 2 3 4 5 6 7 8 9 10 11 Response: F

- Page 95 and 96:

1 2 3 4 5 6 7 8 9 10 11 12 13 Respo

- Page 97 and 98:

FortisBC Inc. (FortisBC or the Comp

- Page 99 and 100:

FortisBC Inc. (FortisBC or the Comp

- Page 101 and 102:

1 2 3 FortisBC Inc. (FortisBC or th

- Page 103 and 104:

1 2 3 4 5 6 7 8 9 10 11 12 13 Respo

- Page 105 and 106:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 107 and 108:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 109 and 110:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 111 and 112:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 113 and 114:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 115 and 116:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 117 and 118:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 119 and 120:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 121 and 122:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 123 and 124:

1 2 3 4 5 6 7 8 9 10 11 12 FortisBC

- Page 125 and 126:

FortisBC Inc. (FortisBC or the Comp

- Page 127 and 128:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 129 and 130:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 131 and 132:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 133 and 134:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 135 and 136:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 137 and 138:

1 2 3 4 5 6 7 8 9 10 11 12 Results:

- Page 139 and 140:

Revenue Requirements Analysis Advan

- Page 141 and 142:

Revenue Requirements Analysis Advan

- Page 143 and 144:

Revenue Requirements Analysis Advan

- Page 145 and 146:

Revenue Requirements Analysis Advan

- Page 147 and 148:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 149 and 150:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 151 and 152:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 153 and 154:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 155 and 156:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 157 and 158:

Corporate Headquarters 2111 North M

- Page 159 and 160:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 161 and 162:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 163 and 164:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 165 and 166:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 167 and 168:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 169 and 170:

1 2 3 4 5 6 7 8 9 10 11 Response: F

- Page 171 and 172:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 173 and 174:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 175 and 176:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 177 and 178:

1 2 3 4 5 6 7 8 9 10 11 12 13 Respo

- Page 179 and 180:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 181 and 182: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 183 and 184: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 185 and 186: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 187 and 188: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 189 and 190: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 191 and 192: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 193 and 194: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 195 and 196: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 197 and 198: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 199 and 200: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 201 and 202: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 203 and 204: 1 2 3 FortisBC Inc. (FortisBC or th

- Page 205 and 206: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 207 and 208: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 209 and 210: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 211 and 212: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 213 and 214: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 215 and 216: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 217 and 218: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 219 and 220: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 221 and 222: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 223 and 224: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 225 and 226: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 227 and 228: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 229 and 230: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

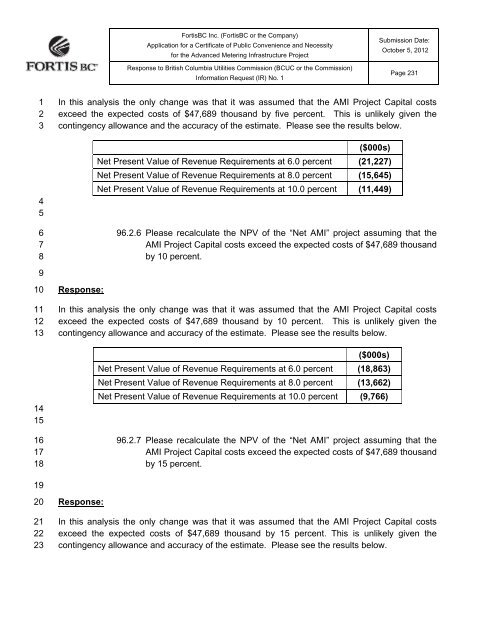

- Page 231: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 235 and 236: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 237 and 238: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 239 and 240: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 241 and 242: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 243 and 244: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 245 and 246: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 247 and 248: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 249 and 250: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 251 and 252: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 253 and 254: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 255 and 256: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 257 and 258: Year FortisBC Inc. (FortisBC or the

- Page 259 and 260: 1 2 3 4 5 6 7 8 9 10 FortisBC Inc.

- Page 261 and 262: 1 2 3 4 5 6 7 8 9 10 11 12 13 Forti

- Page 263 and 264: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 265 and 266: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 267 and 268: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 269 and 270: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 271 and 272: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 273 and 274: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 275 and 276: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 277 and 278: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 279 and 280: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 281 and 282: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 283 and 284:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 285 and 286:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 287 and 288:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 289 and 290:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 291 and 292:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 293 and 294:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 295 and 296:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 297 and 298:

ASK E SOURCE | UCC-ASKES-53 | PUBLI

- Page 299 and 300:

FIGURE 1: Interest in billing optio

- Page 301 and 302:

FortisBC, Inc. KELOWNA, BRITISH COL

- Page 303 and 304:

TABLE OF CONTENTS PART I. INTRODUCT

- Page 305 and 306:

PART I. INTRODUCTION Appendix BCUC

- Page 307 and 308:

BASIS OF THE STUDY Depreciation. Th

- Page 309 and 310:

PART II. METHODS USED IN THE ESTIMA

- Page 311 and 312:

ESTIMATION OF SURVIVOR CURVES Survi

- Page 313 and 314:

Iowa Type Curves The range of survi

- Page 315 and 316:

Appendix BCUC IR1 69.4

- Page 317 and 318:

Appendix BCUC IR1 69.4

- Page 319 and 320:

aged property transactions, a sched

- Page 321 and 322:

TABLE 2. OTHER TRANSACTIONS FOR EAC

- Page 323 and 324:

For the entire experience band 2001

- Page 325 and 326:

The original survivor curve is plot

- Page 327 and 328:

Appendix BCUC IR1 69.4

- Page 329 and 330:

Appendix BCUC IR1 69.4

- Page 331 and 332:

In Figure 9, the three fittings, 12

- Page 333 and 334:

Account 368.00 - Distribution Line

- Page 335 and 336:

etirement activity will likely be s

- Page 337 and 338:

of removal exceed the salvage proce

- Page 339 and 340:

CALCULATION OF ANNUAL AND ACCRUED A

- Page 341 and 342:

PART III. RESULTS OF STUDY Appendix

- Page 343 and 344:

percent surviving. The titles of th

- Page 345 and 346:

FORTISBC, INC. SCHEDULE 2. ESTIMATE

- Page 347 and 348:

FORRTISBC, INC. ACCOUNT 3330.10 - L

- Page 349 and 350:

FORTISBC, INC. ACCOUNT 330.10 - LAN

- Page 351 and 352:

FORTISBC, INC. ACCOUNT 331.00 - STR

- Page 353 and 354:

FORRTISBC, INC. ACCOUNT 332.00 - RE

- Page 355 and 356:

FORTISBC, INC. ACCOUNT 332.00 - RES

- Page 357 and 358:

FORTISBC, INC. ACCOUNT 333.00 - WAT

- Page 359 and 360:

FORRTISBC, INC. ACCOUNTT 334.00 - A

- Page 361 and 362:

FORTISBC, INC. ACCOUNT 334.00 - ACC

- Page 363 and 364:

FORTISBC, INC. ACCOUNT 335.00 - OTH

- Page 365 and 366:

FORRTISBC, INC. ACCOUNNT 336.00 - R

- Page 367 and 368:

FORTISBC, INC. ACCOUNT 336.00 - ROA

- Page 369 and 370:

FORTISBC, INC. ACCOUNT 350.10 - LAN

- Page 371 and 372:

FORRTISBC, INC. ACCCOUNT 353.00 - S

- Page 373 and 374:

FORTISBC, INC. ACCOUNT 353.00 - SUB

- Page 375 and 376:

FORTISBC, INC. ACCOUNT 355.00 - POL

- Page 377 and 378:

FORRTISBC, INC. ACCCOUNT 356.00 - C

- Page 379 and 380:

FORTISBC, INC. ACCOUNT 356.00 - CON

- Page 381 and 382:

FORTISBC, INC. ACCOUNT 359.00 - ROA

- Page 383 and 384:

FORTISBC, INC. ACCOUNT 360.10 - LAN

- Page 385 and 386:

FORRTISBC, INC. ACCCOUNT 362.00 - S

- Page 387 and 388:

FORTISBC, INC. ACCOUNT 362.00 - SUB

- Page 389 and 390:

FORTISBC, INC. ACCOUNT 364.00 - POL

- Page 391 and 392:

FORRTISBC, INC. ACCCOUNT 365.00 - C

- Page 393 and 394:

FORTISBC, INC. ACCOUNT 365.00 - CON

- Page 395 and 396:

FORTISBC, INC. ACCOUNT 368.00 - LIN

- Page 397 and 398:

FORRTISBC, INC. ACCOUNT 3369.00 - S

- Page 399 and 400:

FORRTISBC, INC. ACCOUNT 370.00 - ME

- Page 401 and 402:

FORTISBC, INC. ACCOUNT 370.00 - MET

- Page 403 and 404:

FORTISBC, INC. ACCOUNT 371.00 - INS

- Page 405 and 406:

FORTISBC, INC. ACCOUNT 373.00 - STR

- Page 407 and 408:

FORRTISBC, INC. ACCOUNNT 390.00 - S

- Page 409 and 410:

FORRTISBC, INC. ACCCOUNT 390.10 - S

- Page 411 and 412:

FORRTISBC, INC. ACCCOUNT 390.20 - O

- Page 413 and 414:

FORRTISBC, INC. ACCCOUNT 392.100 -

- Page 415 and 416:

FORRTISBC, INC. ACCCOUNT 392.200 -

- Page 417 and 418:

PART V. NET SALVAGE STATISTICS Appe

- Page 419 and 420:

FORTISBC, INC. ACCOUNT 332.00 - RES

- Page 421 and 422:

FORTISBC, INC. ACCOUNT 334.00 - ACC

- Page 423 and 424:

FORTISBC, INC. ACCOUNT 350.10 - LAN

- Page 425 and 426:

FORTISBC, INC. ACCOUNT 355.00 - POL

- Page 427 and 428:

FORTISBC, INC. ACCOUNT 362.00 - SUB

- Page 429 and 430:

FORTISBC, INC. ACCOUNT 365.00 - CON

- Page 431 and 432:

FORTISBC, INC. ACCOUNT 370.00 - MET

- Page 433 and 434:

FORTISBC, INC. ACCOUNT 390.10 - STR

- Page 435 and 436:

PART VI. DETAILED DEPRECIATION CALC

- Page 437 and 438:

FORTISBC, INC. ACCOUNT 331.00 - STR

- Page 439 and 440:

FORTISBC, INC. ACCOUNT 333.00 - WAT

- Page 441 and 442:

FORTISBC, INC. ACCOUNT 335.00 - OTH

- Page 443 and 444:

FORTISBC, INC. ACCOUNT 350.10 - LAN

- Page 445 and 446:

FORTISBC, INC. ACCOUNT 355.00 - POL

- Page 447 and 448:

FORTISBC, INC. ACCOUNT 359.00 - ROA

- Page 449 and 450:

FORTISBC, INC. ACCOUNT 362.00 - SUB

- Page 451 and 452:

FORTISBC, INC. ACCOUNT 364.00 - POL

- Page 453 and 454:

FORTISBC, INC. ACCOUNT 368.00 - LIN

- Page 455 and 456:

FORTISBC, INC. ACCOUNT 370.00 - MET

- Page 457 and 458:

FORTISBC, INC. ACCOUNT 373.00 - STR

- Page 459 and 460:

FORTISBC, INC. ACCOUNT 390.10 - STR

- Page 461 and 462:

FORTISBC, INC. ACCOUNT 391.00 - OFF

- Page 463 and 464:

FORTISBC, INC. ACCOUNT 391.20 - PC

- Page 465 and 466:

FORTISBC, INC. ACCOUNT 392.20 - HEA

- Page 467 and 468:

FORTISBC, INC. ACCOUNT 397.00 - COM

- Page 469 and 470:

Public Policy Sources is published

- Page 471 and 472:

Current public policy proposals emp

- Page 473 and 474:

Although there are a host of import

- Page 475 and 476:

Producing Marijuana in British Colu

- Page 477 and 478:

this amounts to about $10,000. 18 T

- Page 479 and 480:

ness that are not about business. I

- Page 481 and 482:

marijuana growing business is not t

- Page 483 and 484:

One point needs reinforcing. These

- Page 485 and 486:

PUBLIC POLICY SOURCES, NUMBER 74 Ta

- Page 487 and 488:

depend upon the prices in the US an

- Page 489 and 490:

Why Does it Happen in British Colum

- Page 491 and 492:

er of days of the sentence. The sec

- Page 493 and 494:

Number of convictions Figure 2: Day

- Page 495 and 496:

have not changed anything else. We

- Page 497 and 498:

References Australian Institute for

- Page 499 and 500:

Appendices Appendix Table 1A Table

- Page 501 and 502:

While this formula is undoubtedly c

- Page 503 and 504:

Appendix B: Risk and the Alternativ

- Page 505 and 506:

Appendix D: Delay Times and the Num

- Page 507 and 508:

Appendix F: The Demand for Marijuan

- Page 509 and 510:

LEDs in spotlight - Greenhouse Cana

- Page 511 and 512:

LEDs in spotlight - Greenhouse Cana

- Page 513 and 514:

I have also canvassed relevant acad

- Page 515 and 516:

some degree of regulation of the in

- Page 517 and 518:

More specifically, it seems likely

- Page 519:

adopt the provisions of the Act of