Chapter 11 - Sedibeng District Municipality

Chapter 11 - Sedibeng District Municipality

Chapter 11 - Sedibeng District Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

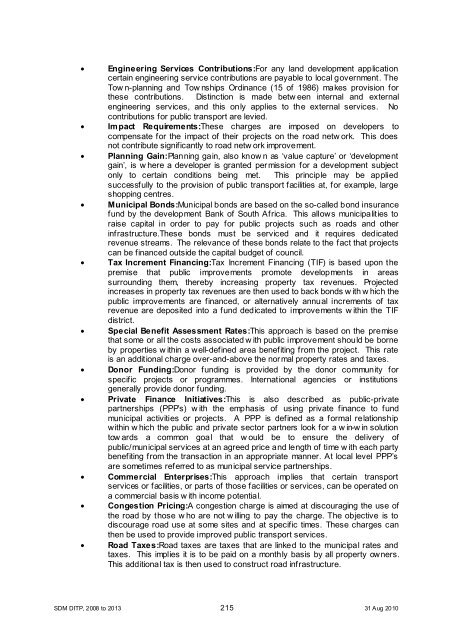

• Engineering Services Contributions:For any land development application<br />

certain engineering service contributions are payable to local government. The<br />

Tow n-planning and Tow nships Ordinance (15 of 1986) makes provision for<br />

these contributions. Distinction is made betw een internal and external<br />

engineering services, and this only applies to the external services. No<br />

contributions for public transport are levied.<br />

• Impact Requirements:These charges are imposed on developers to<br />

compensate for the impact of their projects on the road netw ork. This does<br />

not contribute significantly to road netw ork improvement.<br />

• Planning Gain:Planning gain, also know n as ‘value capture’ or ‘development<br />

gain’, is w here a developer is granted permission for a development subject<br />

only to certain conditions being met. This principle may be applied<br />

successfully to the provision of public transport facilities at, for example, large<br />

shopping centres.<br />

• Municipal Bonds:Municipal bonds are based on the so-called bond insurance<br />

fund by the development Bank of South Africa. This allows municipalities to<br />

raise capital in order to pay for public projects such as roads and other<br />

infrastructure.These bonds must be serviced and it requires dedicated<br />

revenue streams. The relevance of these bonds relate to the fact that projects<br />

can be financed outside the capital budget of council.<br />

• Tax Increment Financing:Tax Increment Financing (TIF) is based upon the<br />

premise that public improvements promote developments in areas<br />

surrounding them, thereby increasing property tax revenues. Projected<br />

increases in property tax revenues are then used to back bonds w ith w hich the<br />

public improvements are financed, or alternatively annual increments of tax<br />

revenue are deposited into a fund dedicated to improvements w ithin the TIF<br />

district.<br />

• Special Benefit Assessment Rates:This approach is based on the premise<br />

that some or all the costs associated w ith public improvement should be borne<br />

by properties w ithin a well-defined area benefiting from the project. This rate<br />

is an additional charge over-and-above the normal property rates and taxes.<br />

• Donor Funding:Donor funding is provided by the donor community for<br />

specific projects or programmes. International agencies or institutions<br />

generally provide donor funding.<br />

• Private Finance Initiatives:This is also described as public-private<br />

partnerships (PPP’s) w ith the emphasis of using private finance to fund<br />

municipal activities or projects. A PPP is defined as a formal relationship<br />

within w hich the public and private sector partners look for a w in-w in solution<br />

tow ards a common goal that w ould be to ensure the delivery of<br />

public/municipal services at an agreed price and length of time w ith each party<br />

benefiting from the transaction in an appropriate manner. At local level PPP’s<br />

are sometimes referred to as municipal service partnerships.<br />

• Commercial Enterprises:This approach implies that certain transport<br />

services or facilities, or parts of those facilities or services, can be operated on<br />

a commercial basis w ith income potential.<br />

• Congestion Pricing:A congestion charge is aimed at discouraging the use of<br />

the road by those w ho are not w illing to pay the charge. The objective is to<br />

discourage road use at some sites and at specific times. These charges can<br />

then be used to provide improved public transport services.<br />

• Road Taxes:Road taxes are taxes that are linked to the municipal rates and<br />

taxes. This implies it is to be paid on a monthly basis by all property owners.<br />

This additional tax is then used to construct road infrastructure.<br />

SDM DITP, 2008 to 2013 215 31 Aug 2010