Current version - Indiana University South Bend

Current version - Indiana University South Bend

Current version - Indiana University South Bend

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

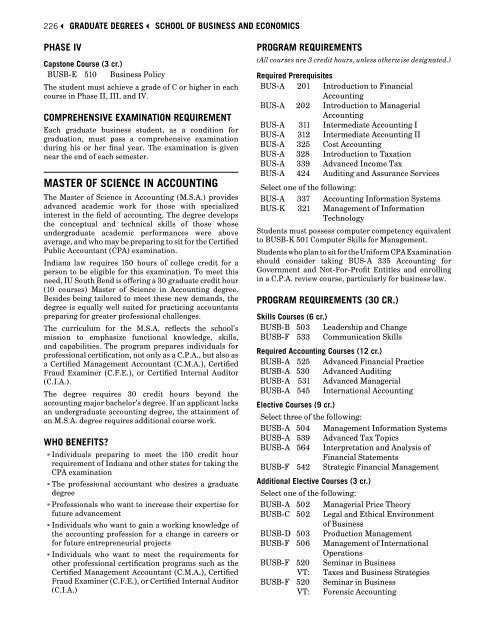

2263 GRADUATE DEGREES3 SCHOOL OF BUSINESS AND ECONOMICS<br />

Phase IV<br />

Capstone Course (3 cr.)<br />

BUSB-E 510 Business Policy<br />

The student must achieve a grade of C or higher in each<br />

course in Phase II, III, and IV.<br />

Comprehensive Examination Requirement<br />

Each graduate business student, as a condition for<br />

graduation, must pass a comprehensive examination<br />

during his or her final year. The examination is given<br />

near the end of each semester.<br />

Master of Science in Accounting<br />

The Master of Science in Accounting (M.S.A.) provides<br />

advanced academic work for those with specialized<br />

interest in the field of accounting. The degree develops<br />

the conceptual and technical skills of those whose<br />

undergraduate academic performances were above<br />

average, and who may be preparing to sit for the Certified<br />

Public Accountant (CPA) examination.<br />

<strong>Indiana</strong> law requires 150 hours of college credit for a<br />

person to be eligible for this examination. To meet this<br />

need, IU <strong>South</strong> <strong>Bend</strong> is offering a 30 graduate credit hour<br />

(10 courses) Master of Science in Accounting degree.<br />

Besides being tailored to meet these new demands, the<br />

degree is equally well suited for practicing accountants<br />

preparing for greater professional challenges.<br />

The curriculum for the M.S.A. reflects the school’s<br />

mission to emphasize functional knowledge, skills,<br />

and capabilities. The program prepares individuals for<br />

professional certification, not only as a C.P.A., but also as<br />

a Certified Management Accountant (C.M.A.), Certified<br />

Fraud Examiner (C.F.E.), or Certified Internal Auditor<br />

(C.I.A.).<br />

The degree requires 30 credit hours beyond the<br />

accounting major bachelor’s degree. If an applicant lacks<br />

an undergraduate accounting degree, the attainment of<br />

an M.S.A. degree requires additional course work.<br />

Who Benefits?<br />

• Individuals preparing to meet the 150 credit hour<br />

requirement of <strong>Indiana</strong> and other states for taking the<br />

CPA examination<br />

• The professional accountant who desires a graduate<br />

degree<br />

• Professionals who want to increase their expertise for<br />

future advancement<br />

• Individuals who want to gain a working knowledge of<br />

the accounting profession for a change in careers or<br />

for future entrepreneurial projects<br />

• Individuals who want to meet the requirements for<br />

other professional certification programs such as the<br />

Certified Management Accountant (C.M.A.), Certified<br />

Fraud Examiner (C.F.E.), or Certified Internal Auditor<br />

(C.I.A.)<br />

Program Requirements<br />

(All courses are 3 credit hours, unless otherwise designated.)<br />

Required Prerequisites<br />

BUS-A 201 Introduction to Financial<br />

Accounting<br />

BUS-A 202 Introduction to Managerial<br />

Accounting<br />

BUS-A 311 Intermediate Accounting I<br />

BUS-A 312 Intermediate Accounting II<br />

BUS-A 325 Cost Accounting<br />

BUS-A 328 Introduction to Taxation<br />

BUS-A 339 Advanced Income Tax<br />

BUS-A 424 Auditing and Assurance Services<br />

Select one of the following:<br />

BUS-A 337 Accounting Information Systems<br />

BUS-K 321 Management of Information<br />

Technology<br />

Students must possess computer competency equivalent<br />

to BUSB-K 501 Computer Skills for Management.<br />

Students who plan to sit for the Uniform CPA Examination<br />

should consider taking BUS-A 335 Accounting for<br />

Government and Not-For-Profit Entities and enrolling<br />

in a C.P.A. review course, particularly for business law.<br />

Program Requirements (30 cr.)<br />

Skills Courses (6 cr.)<br />

BUSB-B 503 Leadership and Change<br />

BUSB-F 533 Communication Skills<br />

Required Accounting Courses (12 cr.)<br />

BUSB-A 525 Advanced Financial Practice<br />

BUSB-A 530 Advanced Auditing<br />

BUSB-A 531 Advanced Managerial<br />

BUSB-A 545 International Accounting<br />

Elective Courses (9 cr.)<br />

Select three of the following:<br />

BUSB-A 504 Management Information Systems<br />

BUSB-A 539 Advanced Tax Topics<br />

BUSB-A 564 Interpretation and Analysis of<br />

Financial Statements<br />

BUSB-F 542 Strategic Financial Management<br />

Additional Elective Courses (3 cr.)<br />

Select one of the following:<br />

BUSB-A 502 Managerial Price Theory<br />

BUSB-C 502 Legal and Ethical Environment<br />

of Business<br />

BUSB-D 503 Production Management<br />

BUSB-F 506 Management of International<br />

Operations<br />

BUSB-F 520 Seminar in Business<br />

VT: Taxes and Business Strategies<br />

BUSB-F 520 Seminar in Business<br />

VT: Forensic Accounting