[8] 2002 e-business-strategies-for-virtual-organizations

[8] 2002 e-business-strategies-for-virtual-organizations

[8] 2002 e-business-strategies-for-virtual-organizations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

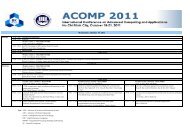

Four stages<br />

of market<br />

evolution<br />

Market structure<br />

Regulations Minimal regulatory<br />

freedom<br />

� Strict controls on<br />

ownership/capital<br />

repatriation<br />

� Strict regulatory<br />

oversight<br />

Transparency Unfamiliar to outsiders<br />

� Outpost mentality<br />

Alliance focus<br />

Global players Market skimming<br />

� Limited involvement<br />

� Technology licensing<br />

distribution<br />

agreements<br />

Local players Local game, local<br />

players<br />

Characteristics<br />

of alliance<br />

environment<br />

Low profile, nonequity-based<br />

collaborations<br />

Figure 11.2<br />

Evolution of market alliance<br />

Creating <strong>virtual</strong> cultures <strong>for</strong> global online communities<br />

burgeoning global economy. Alliances can seem the obvious<br />

solution <strong>for</strong> both sides. Yet alliances between global and<br />

emerging market players are hard to get right, and often highly<br />

unstable. Many have failed to meet expectations, required<br />

extensive restructuring, or been bought out by one of the<br />

partners. Differences of size, ownership structure, objectives,<br />

culture, and management style can all prove stumbling blocks.<br />

Alliances also need to recognize that there are four stages of<br />

market evolution and each stage of this will be driven by each<br />

partner’s shared strengths and weaknesses and by the relative<br />

importance of each contribution in shifting the balance of power<br />

(Figure 11.2).<br />

Regulations relaxed<br />

� Near majority or<br />

majority <strong>for</strong>eign<br />

stake allowed<br />

� Operating<br />

restrictions still exist<br />

(e.g. bureaucratic<br />

approvals<br />

Many global players<br />

present<br />

Few can replicate local<br />

market knowledge and<br />

government<br />

relationships<br />

Market access<br />

� Build options<br />

� Understand local<br />

market<br />

� Influence<br />

government<br />

Upgrade capabilities<br />

� Products<br />

� Technology<br />

� Capital<br />

Provide ‘escort’ service<br />

Rapid <strong>for</strong>mation of<br />

many joint ventures<br />

Regulations liberalized<br />

� Fully owned<br />

subsidiaries<br />

� Operating controls<br />

eased<br />

� Market <strong>for</strong> corporate<br />

control emerges<br />

Many global players<br />

present<br />

Many global players<br />

have ‘insider’<br />

knowledge<br />

Market growth<br />

� Prune options<br />

� Invest in winners<br />

Survival of fittest<br />

� Restructuring<br />

� Players without longterm<br />

advantage<br />

Dissolution of joint<br />

ventures, emergence<br />

of cross-border M & A,<br />

fully owned<br />

subsidiaries<br />

Examples Brazil (Telecom) China India UK<br />

Market deregulated<br />

� Free equity and<br />

capital flows<br />

� Operating freedom<br />

corporate control<br />

� Shareholder<br />

orientation<br />

Market integrated with<br />

global markets<br />

Market integration<br />

� Optimize global<br />

<strong>business</strong> system<br />

(e.g. by outsourcing)<br />

� Improve<br />

per<strong>for</strong>mance<br />

� New opportunities<br />

Genuine alliances<br />

� New markets<br />

� New products<br />

Full set of vehicles<br />

exist<br />

243

![[8] 2002 e-business-strategies-for-virtual-organizations](https://img.yumpu.com/8167654/262/500x640/8-2002-e-business-strategies-for-virtual-organizations.jpg)