- Page 1: World Small Hydropower Development

- Page 5 and 6: Published in 2013 by United Nations

- Page 7 and 8: in the World Small Hydropower Devel

- Page 9 and 10: Acknowledgements The World Small Hy

- Page 11 and 12: JICA NEP NREAP OLADE PICTS PPA PPP

- Page 13 and 14: 86 1.3.3 Morocco 90 1.3.4 Sudan 92

- Page 15 and 16: 301 3.5.3 Georgia 304 3.5.4 Iraq 30

- Page 17 and 18: Executive Summary Comprehensive inf

- Page 19 and 20: electrification, building micro-hyd

- Page 21 and 22: potential is Chile (7,000 MW). Some

- Page 23 and 24: A range of barriers exist in Southe

- Page 25 and 26: The Renewable Energy Directive has

- Page 27 and 28: The WSHPDR 2013 proposes a more det

- Page 29 and 30: Introduction A world-first assessme

- Page 31 and 32: Small hydropower definition Countri

- Page 33 and 34: 12. United Nations Environment Prog

- Page 35 and 36: small- and micro-hydro plants in ru

- Page 37 and 38: 1.1.2 Ethiopia Lara Esser, Internat

- Page 39: potential developers, since their p

- Page 43 and 44: Financial institutions are not will

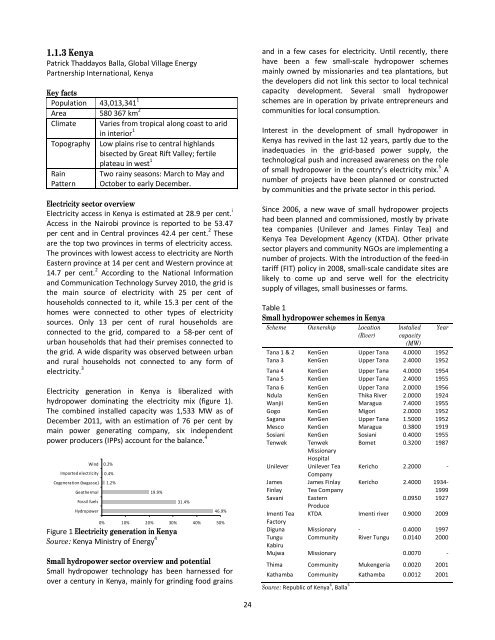

- Page 45 and 46: Table 1 Installed small hydropower

- Page 47 and 48: 10. Électricité de Madagascar (20

- Page 49 and 50: the district of Mulanje. The Agency

- Page 51 and 52: 1.1.6 Mauritius Lara Esser, Interna

- Page 53 and 54: 1.1.7 Mozambique Wim Jonker Klunne,

- Page 55 and 56: with local entrepreneurs to extend

- Page 57 and 58: 1.1.8 Réunion Lara Esser and Laxmi

- Page 59 and 60: 1.1.9 Rwanda Lara Esser and Laxmi A

- Page 61 and 62: Different donor agencies have assis

- Page 63 and 64: 1.1.10 South Sudan Ater Amogpai, Un

- Page 65 and 66: 5. Al Jazeera (2012). China offers

- Page 67 and 68: Table 1 Installed small hydropower

- Page 69 and 70: newsletter-issue-5/. 8. Tumwesigye,

- Page 71 and 72: 70% 60% 50% 40% 30% 20% 10% 0% 2% 1

- Page 73 and 74: Table 2 Potential small hydropower

- Page 75 and 76: 1.1.13 Zambia Malama Chileshe, Zamb

- Page 77 and 78: the challenge remains as to whether

- Page 79 and 80: Francis turbine. Project commission

- Page 81 and 82: 1.2 Middle Africa Matty Fombong, Ru

- Page 83 and 84: 1.2.1 Angola Lara Esser, Internatio

- Page 85 and 86: out according to social, economic a

- Page 87 and 88: avaged by vandals for parts and cop

- Page 89 and 90: 1.2.3 Central African Republic Lara

- Page 91 and 92:

1.2.4 Democratic Republic of the Co

- Page 93 and 94:

1.2.5 São Tomé and Príncipe Lara

- Page 95 and 96:

1.3 Northern Africa Hussein Elhag,

- Page 97 and 98:

1.3.1 Algeria Kai Whiting, Internat

- Page 99 and 100:

1.3.2 Egypt Kai Whiting and Pascal

- Page 101 and 102:

Barriers to small hydropower develo

- Page 103 and 104:

SHP installed capacity (up to 8 MW)

- Page 105 and 106:

16. Agence Nationale pour le Dével

- Page 107 and 108:

construction and the project will b

- Page 109 and 110:

Table 1 Small hydropower in Tunisia

- Page 111 and 112:

1.4 Southern Africa Wim Jonker Klun

- Page 113 and 114:

1.4.1 Lesotho Wim Jonker Klunne, Co

- Page 115 and 116:

and the penstock is a 150-metre lon

- Page 117 and 118:

oth present and future”. Should t

- Page 119 and 120:

1.4.3 South Africa Wim Jonker Klunn

- Page 121 and 122:

hydropower in South Africa and the

- Page 123 and 124:

Integrated resource plan for electr

- Page 125 and 126:

Figure 3 Map of potential hydropowe

- Page 127 and 128:

1.5 Western Africa A. A. Esan, UNID

- Page 129 and 130:

Trust funds for renewable energy te

- Page 131 and 132:

According to a 2010 analysis for in

- Page 133 and 134:

consumption, as well as cost deprec

- Page 135 and 136:

Sustainable energy through developi

- Page 137 and 138:

enewable energies. 4 The 2010 Energ

- Page 139 and 140:

Table 2 Micro hydropower sites in G

- Page 141 and 142:

1.5.6 Liberia Lara Esser, Internati

- Page 143 and 144:

1.5.7 Mali Oumar Sidibe, Direction

- Page 145 and 146:

1.5.8 Nigeria Basheer Adekunle Kade

- Page 147 and 148:

3. World Bank (2011). Economic over

- Page 149 and 150:

The only small hydropower station i

- Page 151 and 152:

1.5.10 Togo Lara Esser, Internation

- Page 153 and 154:

2 Americas 2.1 Caribbean Sven Homsc

- Page 155 and 156:

potential for small hydropower prov

- Page 157 and 158:

2.1.2 Dominica Sven Homscheidt, Car

- Page 159 and 160:

2.1.3 Dominican Republic Lara Esser

- Page 161 and 162:

2.1.4 Grenada Sven Homscheidt, Cari

- Page 163 and 164:

2.1.6 Haiti Lara Esser, Internation

- Page 165 and 166:

Immediate key initiatives for the f

- Page 167 and 168:

kW but less than 15 MW are consider

- Page 169 and 170:

Cibuco-Guajataca Culebrinas- Guanaj

- Page 171 and 172:

2.1.9 Saint Lucia Sven Homscheidt,

- Page 173 and 174:

Renewable energy policy In February

- Page 175 and 176:

Table 2 Classification of small hyd

- Page 177 and 178:

2. Bloomberg New Energy Finance and

- Page 179 and 180:

sector and rural communities will b

- Page 181 and 182:

1989 by the CEL and Universidad Cen

- Page 183 and 184:

years of commercial operation). In

- Page 185 and 186:

operate renewable energy projects a

- Page 187 and 188:

Since then, several values close to

- Page 189 and 190:

addition to long period of contract

- Page 191 and 192:

institutions portray a robust syste

- Page 193 and 194:

exemption from distribution and tra

- Page 195 and 196:

een lowered in this region. One of

- Page 197 and 198:

The upper limit of 15 MW is only a

- Page 199 and 200:

y Law 26190. It is not easy to meet

- Page 201 and 202:

provide not only labor, but local m

- Page 203 and 204:

2.3.3 Brazil Geraldo Lúcio Tiago F

- Page 205 and 206:

https://ben.epe.gov.br/downloads/Re

- Page 207 and 208:

Electrification with Renewable Ener

- Page 209 and 210:

2.3.5 Colombia Elena Quiroga Ferná

- Page 211 and 212:

grid/colombia/EnergyOverviewofColom

- Page 213 and 214:

The Constitution of Ecuador, approv

- Page 215 and 216:

2.3.7 French Guiana Laxmi Aggarwal

- Page 217 and 218:

2.3.8 Peru Lara Esser, Internationa

- Page 219 and 220:

In addition, Peru has a clean energ

- Page 221 and 222:

In accordance with the requirements

- Page 223 and 224:

Information on the total installed

- Page 225 and 226:

2.4.1 Canada Jinxing Huang, Canmet

- Page 227 and 228:

Table 4 Small hydropower potential

- Page 229 and 230:

2.4.2 United States of America Lara

- Page 231 and 232:

Table 2 Eligibility criteria for hy

- Page 233 and 234:

involving certain low-impact situat

- Page 235 and 236:

which hydropower plants under 30 MW

- Page 237 and 238:

share of total energy balance by 20

- Page 239 and 240:

2. World Meteorological Organizatio

- Page 241 and 242:

SHP installed capacity SHP potentia

- Page 243 and 244:

3.1.4 Turkmenistan Yingnan Zhang, I

- Page 245 and 246:

3.1.5 Republic of Uzbekistan Yingna

- Page 247 and 248:

Table 3 Small hydropower in Eastern

- Page 249 and 250:

In addition to the investment made

- Page 251 and 252:

3.2.2 Japan Motoyuki Inoue, Ritsume

- Page 253 and 254:

to release sediment from dams, it i

- Page 255 and 256:

infrastructure and of the transmiss

- Page 257 and 258:

3.2.5 Mongolia Dursan Basandorj, Mo

- Page 259 and 260:

3.3 Southern Asia Arun Kumar, India

- Page 261 and 262:

3.3.1 Afghanistan Lara Esser, Inter

- Page 263 and 264:

Livelihoods and Energy Department,

- Page 265 and 266:

3.3.2 Bangladesh Md. Abdul Wazed, C

- Page 267 and 268:

Hydropower projects, until recently

- Page 269 and 270:

Renewable energy policy The Renewab

- Page 271 and 272:

Table 2 Small hydropower in India P

- Page 273 and 274:

www.cia.gov/library/publications/th

- Page 275 and 276:

Procurement and Construction (EPC)

- Page 277 and 278:

3.3.6 Nepal Madhu Prasad Bhetuwal,

- Page 279 and 280:

Besides, EA and ER, there are Envir

- Page 281 and 282:

Table 2 Installed micro hydro plant

- Page 283 and 284:

3.3.8 Sri Lanka Nimashi Fernando, H

- Page 285 and 286:

presented at Sri Lanka Wind Power W

- Page 287 and 288:

Indonesia (99 MW). Viet Nam (2,205

- Page 289 and 290:

3.4.1 Cambodia Lara Esser, Internat

- Page 291 and 292:

3.4.2 Indonesia Lara Esser, Interna

- Page 293 and 294:

3.4.3 Lao People’s Democratic Rep

- Page 295 and 296:

The International Finance Corporati

- Page 297 and 298:

5. To enhance awareness on the role

- Page 299 and 300:

sustainability in policy is expecte

- Page 301 and 302:

ecent policy shift by the National

- Page 303 and 304:

2. Generate off-grid hydropower at

- Page 305 and 306:

3.4.8 Timor-Leste Lara Esser and Ka

- Page 307 and 308:

Sustainable Development On the Run

- Page 309 and 310:

comparison with other energy source

- Page 311 and 312:

Cyprus has an isolated energy syste

- Page 313 and 314:

3.2.1 Armenia Vahan Sargsyan, Levon

- Page 315 and 316:

3.5.2 Azerbaijan Ugranath Chakarvar

- Page 317 and 318:

3.5.3 Georgia Lara Esser and Kai Wh

- Page 319 and 320:

Regional Reports on Renewable Energ

- Page 321 and 322:

The Ministry of Water Resources is

- Page 323 and 324:

Table 1 Small hydropower potential

- Page 325 and 326:

3.5.6 Lebanon Joy Balta, Lebanese A

- Page 327 and 328:

13. Lebanon, Ministry of Power and

- Page 329 and 330:

Small hydropower potential in Turke

- Page 331 and 332:

4 Europe 4.1 Eastern Europe Lara Es

- Page 333 and 334:

2. The Russian Federation, Ministry

- Page 335 and 336:

Barriers to small hydropower develo

- Page 337 and 338:

Barriers to small hydropower develo

- Page 339 and 340:

parameters are taken into account.

- Page 341 and 342:

The development of hydropower plant

- Page 343 and 344:

2. European Small Hydropower Associ

- Page 345 and 346:

Renewable energy policy According t

- Page 347 and 348:

4.1.7 Romania European Small Hydrop

- Page 349 and 350:

4.1.8 Russian Federation Pascal Hau

- Page 351 and 352:

11. Russian Federation, Ministry of

- Page 353 and 354:

Renewable energy policy Slovakia ha

- Page 355 and 356:

References 1. Central Intelligence

- Page 357 and 358:

Regional overview and potential All

- Page 359 and 360:

4.2.1 Denmark European Small Hydrop

- Page 361 and 362:

4.2.2 Estonia European Small Hydrop

- Page 363 and 364:

4.2.3 Finland European Small Hydrop

- Page 365 and 366:

4.2.4 Iceland Lara Esser, Internati

- Page 367 and 368:

4.2.5 Ireland Lara Esser, Internati

- Page 369 and 370:

5.2.6 Latvia European Small Hydropo

- Page 371 and 372:

4.2.7 Lithuania European Small Hydr

- Page 373 and 374:

4.2.8 Norway Pascal Hauser, Interna

- Page 375 and 376:

4.2.9 Sweden European Small Hydropo

- Page 377 and 378:

4.2.10 United Kingdom of Great Brit

- Page 379 and 380:

Despite the issues which adversely

- Page 381 and 382:

characteristic has provided the Gov

- Page 383 and 384:

No. 9072 (last amended in November

- Page 385 and 386:

7. Energy Community (2008). Impleme

- Page 387 and 388:

Renewable energy policy Using renew

- Page 389 and 390:

development of small water currents

- Page 391 and 392:

changes should be scheduled and tim

- Page 393 and 394:

Legislation on small hydropower The

- Page 395 and 396:

development and construction of sma

- Page 397 and 398:

Licensing procedure suitable for sm

- Page 399 and 400:

Renewable energy policy Serbia has

- Page 401 and 402:

€93 (< 1,000 kW) €82 (< 10,000

- Page 403 and 404:

growing difficulty to obtain the ne

- Page 405 and 406:

Table 3 Small hydropower up to 10 M

- Page 407 and 408:

Barriers to small hydropower develo

- Page 409 and 410:

The Stream Map Project recommends t

- Page 411 and 412:

action. It will be also a good tool

- Page 413 and 414:

4.4.4 Germany European Small Hydrop

- Page 415 and 416:

4.4.5 Luxembourg European Small Hyd

- Page 417 and 418:

4.4.6 The Netherlands European Smal

- Page 419 and 420:

4.4.7 Switzerland Martin Bölli, Sk

- Page 421 and 422:

Available from www.meteoswiss.admin

- Page 423 and 424:

For New Zealand, the remaining pote

- Page 425 and 426:

Table 1 Small-scale hydropower deve

- Page 427 and 428:

5.2.2 New Zealand Niels Nielsen, In

- Page 429 and 430:

5.2 Pacific Island Countries and Te

- Page 431 and 432:

The Government of Fiji developed a

- Page 433 and 434:

Melanesia 5.2.1 Fiji Lara Esser, In

- Page 435 and 436:

5.2.2 New Caledonia Lara Esser, Int

- Page 437 and 438:

5.2.3 Papua New Guinea Lara Esser,

- Page 439 and 440:

5.2.3 Solomon Islands i Peter D. Ly

- Page 441 and 442:

organizations and foreign governmen

- Page 443 and 444:

Vanuatu Government anticipated fina

- Page 445 and 446:

In 1988, the Nanpil river hydropowe

- Page 447 and 448:

Polynesia 5.2.7 French Polynesia La

- Page 449 and 450:

5.2.8 Samoa Rapa Young, Electric Po

- Page 451 and 452:

List of tables Eastern Africa 14 1

- Page 453 and 454:

South America 178 1 Overview of cou

- Page 455 and 456:

Lebanon 310 1 Installed small hydro

- Page 457 and 458:

67 2 Small hydropower capacities in

- Page 459 and 460:

155 2 Small hydropower capacities i

- Page 461 and 462:

254 1 Electricity generation in Ind

- Page 463 and 464:

347 2 Small hydropower capacities i

- Page 465 and 466:

431 1 Electricity generation in Fre