WSHPDR_2013_Final_Report-updated_version

WSHPDR_2013_Final_Report-updated_version

WSHPDR_2013_Final_Report-updated_version

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4.3.11 Spain<br />

European Small Hydropower Association, Stream Map<br />

Key facts<br />

Population 47,042,984<br />

Area 505,370 km 2 . 1<br />

Climate Temperate; clear, hot summers in<br />

interior, more moderate and cloudy<br />

along coast; cloudy, cold winters in<br />

interior, partly cloudy and cool along<br />

coast<br />

Topography Large, flat to dissected plateau<br />

surrounded by rugged hills; Pyrenees<br />

Rain<br />

pattern<br />

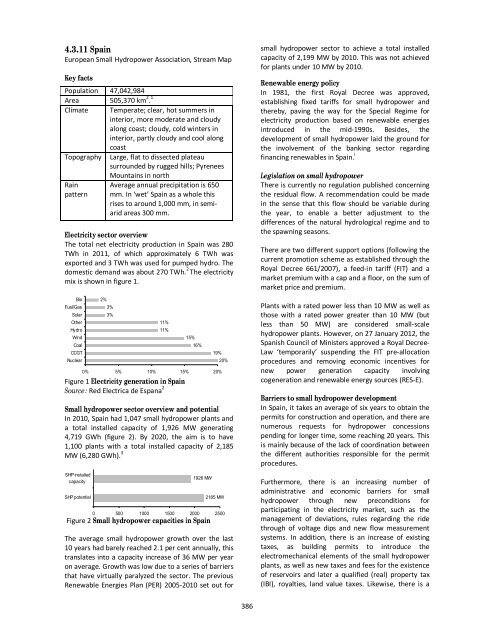

Electricity sector overview<br />

The total net electricity production in Spain was 280<br />

TWh in 2011, of which approximately 6 TWh was<br />

exported and 3 TWh was used for pumped hydro. The<br />

domestic demand was about 270 TWh. 2 The electricity<br />

mix is shown in figure 1.<br />

Bio<br />

Fuel/Gas<br />

Solar<br />

Other<br />

Hydro<br />

Wind<br />

Coal<br />

CCGT<br />

Nuclear<br />

2%<br />

3%<br />

3%<br />

11%<br />

11%<br />

15%<br />

16%<br />

19%<br />

0% 5% 10% 15% 20%<br />

Figure 1 Electricity generation in Spain<br />

Source: Red Electrica de Espana 2<br />

20%<br />

Small hydropower sector overview and potential<br />

In 2010, Spain had 1,047 small hydropower plants and<br />

a total installed capacity of 1,926 MW generating<br />

4,719 GWh (figure 2). By 2020, the aim is to have<br />

1,100 plants with a total installed capacity of 2,185<br />

MW (6,280 GWh). 3<br />

SHP installed<br />

capacity<br />

SHP potential<br />

Mountains in north<br />

Average annual precipitation is 650<br />

mm. In ‘wet’ Spain as a whole this<br />

rises to around 1,000 mm, in semiarid<br />

areas 300 mm.<br />

1926 MW<br />

2185 MW<br />

0 500 1000 1500 2000 2500<br />

Figure 2 Small hydropower capacities in Spain<br />

The average small hydropower growth over the last<br />

10 years had barely reached 2.1 per cent annually, this<br />

translates into a capacity increase of 36 MW per year<br />

on average. Growth was low due to a series of barriers<br />

that have virtually paralyzed the sector. The previous<br />

Renewable Energies Plan (PER) 2005-2010 set out for<br />

small hydropower sector to achieve a total installed<br />

capacity of 2,199 MW by 2010. This was not achieved<br />

for plants under 10 MW by 2010.<br />

Renewable energy policy<br />

In 1981, the first Royal Decree was approved,<br />

establishing fixed tariffs for small hydropower and<br />

thereby, paving the way for the Special Regime for<br />

electricity production based on renewable energies<br />

introduced in the mid-1990s. Besides, the<br />

development of small hydropower laid the ground for<br />

the involvement of the banking sector regarding<br />

financing renewables in Spain. i<br />

Legislation on small hydropower<br />

There is currently no regulation published concerning<br />

the residual flow. A recommendation could be made<br />

in the sense that this flow should be variable during<br />

the year, to enable a better adjustment to the<br />

differences of the natural hydrological regime and to<br />

the spawning seasons.<br />

There are two different support options (following the<br />

current promotion scheme as established through the<br />

Royal Decree 661/2007), a feed-in tariff (FIT) and a<br />

market premium with a cap and a floor, on the sum of<br />

market price and premium.<br />

Plants with a rated power less than 10 MW as well as<br />

those with a rated power greater than 10 MW (but<br />

less than 50 MW) are considered small-scale<br />

hydropower plants. However, on 27 January 2012, the<br />

Spanish Council of Ministers approved a Royal Decree-<br />

Law ‘temporarily’ suspending the FIT pre-allocation<br />

procedures and removing economic incentives for<br />

new power generation capacity involving<br />

cogeneration and renewable energy sources (RES-E).<br />

Barriers to small hydropower development<br />

In Spain, it takes an average of six years to obtain the<br />

permits for construction and operation, and there are<br />

numerous requests for hydropower concessions<br />

pending for longer time, some reaching 20 years. This<br />

is mainly because of the lack of coordination between<br />

the different authorities responsible for the permit<br />

procedures.<br />

Furthermore, there is an increasing number of<br />

administrative and economic barriers for small<br />

hydropower through new preconditions for<br />

participating in the electricity market, such as the<br />

management of deviations, rules regarding the ride<br />

through of voltage dips and new flow measurement<br />

systems. In addition, there is an increase of existing<br />

taxes, as building permits to introduce the<br />

electromechanical elements of the small hydropower<br />

plants, as well as new taxes and fees for the existence<br />

of reservoirs and later a qualified (real) property tax<br />

(IBI), royalties, land value taxes. Likewise, there is a<br />

386