(VERSION-IV) - DVC :: Consumer Login

(VERSION-IV) - DVC :: Consumer Login

(VERSION-IV) - DVC :: Consumer Login

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

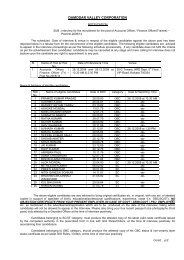

as per our QAP with applicable taxes and duties, if any *<br />

+ Loss capitalization charges, if any* –<br />

+ Any Other taxes and duties, such as TOT, Entry Tax, Municipal Tax<br />

etc. as applicable **<br />

= Total Evaluated Price<br />

In case of independent items, evaluation is to be made item-wise and to be clearly spelt out in<br />

NIT under the evaluation process.<br />

The liability of <strong>DVC</strong> shall be as per actual ED and E-Cess as applicable at the time of despatch,<br />

subject to production of documentary evidence by the manufacturer (bidder). Further the rate of<br />

ED shall be restricted to as applicable within the contractual delivery period only. Increase in ED<br />

rate, if any due to delay in supply beyond the contractual delivery period shall not be payable by<br />

<strong>DVC</strong> if the reasons for delay is attributable to the vendor only. However, the benefit of any<br />

decreases in ED shall be passed on to <strong>DVC</strong>.<br />

For tenders with lot of components/items, if any bidder fails to quote against a particular<br />

component/item or when the quoted item description is not as per NIT, the respective bid will be<br />

evaluated by loading the highest quoted price of that particular component/item of other eligible<br />

bidders. However order to be placed on rate negotiation of the subject item with L-1 bidder.<br />

If any bidder offers lesser quantity than the BOQ as stipulated in NIT against a particular<br />

component / item, the respective bid will be evaluated by loading on pro-rata basis.<br />

The lines with * mark may be deleted wherever not applicable.<br />

** = { Rate as on date of bid opening to be taken. }<br />

If a tenderer is exempted from payment of excise duty ED upto any value of supplies, or is<br />

entitled to concessional rate/quantum of ED, and has not stated that no ED will be charged by him<br />

upto the limit of exemption and has not indicated the concessional rate/quantum of ED leviable in<br />

respect of the tendered supplies but has made stipulation like, excise duty presently not<br />

applicable, but the same will be charged, if it becomes leviable latter on, the quoted price should<br />

be loaded with the quantum of excise duty with education cess which is applicable on the item as<br />

on the date of bid opening for the purpose of bid ranking.<br />

In respect of imported stores, when foreign bids are received in different currencies, conversion<br />

of foreign currency into rupees is to be done taking into account T.T selling rate of State Bank of<br />

India on the date of opening of price bid.<br />

In respect of Works/services contract, applicable service Tax with Education Cess to be loaded<br />

for evaluation of bids, if not specifically mentioned the same in the off<br />

16. INSPECTION / CHECKING / TESTING :<br />

All materials/equipments manufactured/supplied by the vendor against the Purchase<br />

Order/contract shall be subject to inspection, check and/or test by the Purchaser or his authorised<br />

W& P Manual – 2012 Page 156