(VERSION-IV) - DVC :: Consumer Login

(VERSION-IV) - DVC :: Consumer Login

(VERSION-IV) - DVC :: Consumer Login

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

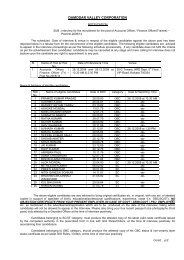

Advance should not be paid in less than two installments except in special circumstances for that<br />

reasons to be recorded.<br />

A clause in the tender enquiry to be incorporated that the interest free advance would be<br />

deemed as interest bearing advance at a Bsae rate of SBI plus 3.5% if the contract is terminated<br />

due to default of the contractor. However rate of interest should be applied for calculation of<br />

interest on the advance amount in reset basis (i.e. not fixed rate of interest, it may go on changing<br />

during the period of advance remain unadjusted) based on the change of base rate time to time.<br />

Advance should be recovered within the original completion<br />

time.<br />

II) Other advance: provision for 100% advance (interest free) without submission of BG may<br />

also be allowed in dealing with procurement on single tender basis from CPSU/Govt. controlled<br />

autonomous Organisation / Universities / Laboratories/ Reputed Private Manufacturer as OEM<br />

etc.<br />

Specific examples are:<br />

—<br />

a) Procurement of LDO/FO/HSD/Motor Spirit/Lubricants & Greases from CPSUs<br />

like<br />

IOC/HPCL/BPCL<br />

.<br />

b) Procurement of Steel from CPSUs like SAIL, IISCO, RINL<br />

etc.<br />

c) Procurement of Vehicles from Tata Motors, Hindusthan Motors, Maruti Udyog, Hero<br />

Hondo, Bajaj, Enfield etc.<br />

d) Testing/consultancy & other services from CPSUs like CMERI, CMRI, CPRI CFRI,<br />

NTPC, IIT’s, IIM’s, NPC,BSNL etc. and<br />

e) OEM’s who do not sell their product without<br />

advance.<br />

Where a claim of Sales Tax/VAT is preferred and admitted, the supplier must satisfy that he is a<br />

registered dealer under the Sales Tax Act and possesses a Certificate of Registration in the firms<br />

name in which the supply is made and shall in proof thereof, while submitting bills for payment,<br />

furnish the, number, date and other particulars of such certificate.<br />

For materials which are ordered on weights/ volume, the payment should be as per<br />

measurement at <strong>DVC</strong>’s stores / sites irrespective of the quantity mentioned in the challans /<br />

documents, unless there is explicit provision in the Purchase Order/contracts. If there is 3 rd party<br />

inspection, in the above cases, 3 rd party inspection charges would be as per Weight/ Volume<br />

received at <strong>DVC</strong> end. The statutory charges and duties, however, have to be paid on actuals as per<br />

documents received from the vendor.<br />

The contractor/vendor shall furnish the following certificate to the Paying Authority along<br />

with each invoice/bill against payment for supplies made against any supply order/RC with<br />

W& P Manual – 2012 Page 85