ACS Assessor Guide - Security Industry Authority

ACS Assessor Guide - Security Industry Authority

ACS Assessor Guide - Security Industry Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

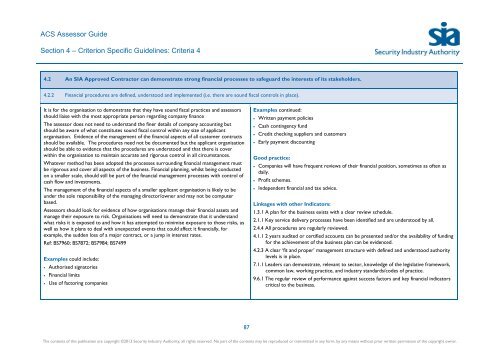

<strong>ACS</strong> <strong>Assessor</strong> <strong>Guide</strong>Section 4 – Criterion Specific <strong>Guide</strong>lines: Criteria 44.2 An SIA Approved Contractor can demonstrate strong financial processes to safeguard the interests of its stakeholders.4.2.2 Financial procedures are defined, understood and implemented (i.e. there are sound fiscal controls in place).It is for the organisation to demonstrate that they have sound fiscal practices and assessorsshould liaise with the most appropriate person regarding company financeThe assessor does not need to understand the finer details of company accounting butshould be aware of what constitutes sound fiscal control within any size of applicantorganisation. Evidence of the management of the financial aspects of all customer contractsshould be available. The procedures need not be documented but the applicant organisationshould be able to evidence that the procedures are understood and that there is coverwithin the organisation to maintain accurate and rigorous control in all circumstances.Whatever method has been adopted the processes surrounding financial management mustbe rigorous and cover all aspects of the business. Financial planning, whilst being conductedon a smaller scale, should still be part of the financial management processes with control ofcash flow and investments.The management of the financial aspects of a smaller applicant organisation is likely to beunder the sole responsibility of the managing director/owner and may not be computerbased.<strong>Assessor</strong>s should look for evidence of how organisations manage their financial assets andmanage their exposure to risk. Organisations will need to demonstrate that it understandwhat risks it is exposed to and how it has attempted to minimise exposure to those risks, aswell as how it plans to deal with unexpected events that could affect it financially, forexample, the sudden loss of a major contract, or a jump in interest rates.Ref: BS7960; BS7872; BS7984; BS7499Examples could include: Authorised signatories Financial limits Use of factoring companiesExamples continued: Written payment policies Cash contingency fund Credit checking suppliers and customers Early payment discountingGood practice: Companies will have frequent reviews of their financial position, sometimes as often asdaily. Profit schemes. Independent financial and tax advice.Linkages with other Indicators:1.3.1 A plan for the business exists with a clear review schedule.2.1.1 Key service delivery processes have been identified and are understood by all.2.4.4 All procedures are regularly reviewed.4.1.1 2 years audited or certified accounts can be presented and/or the availability of fundingfor the achievement of the business plan can be evidenced.4.2.3 A clear ‘fit and proper’ management structure with defined and understood authoritylevels is in place.7.1.1 Leaders can demonstrate, relevant to sector, knowledge of the legislative framework,common law, working practice, and industry standards/codes of practice.9.6.1 The regular review of performance against success factors and key financial indicatorscritical to the business.87The contents of this publication are copyright ©2013 <strong>Security</strong> <strong>Industry</strong> <strong>Authority</strong>, all rights reserved. No part of the contents may be reproduced or transmitted in any form, by any means without prior written permission of the copyright owner.