- Page 1 and 2:

Proceedings <stron

- Page 3 and 4:

Contents Paper Title Author(s) Page

- Page 5 and 6:

Paper Title Author(s) Page No. Main

- Page 7 and 8:

Paper Title Author(s) Page No. Know

- Page 9 and 10:

Preface These proceedings represent

- Page 11 and 12:

TU Dortmund, Germany, ); Wing Bun L

- Page 13 and 14:

William Halal is Prof</stro

- Page 15 and 16:

Evgeny Blagov has obtained a specia

- Page 17 and 18:

science and mathem

- Page 19 and 20:

George Majdalany is a PhD candidate

- Page 21 and 22:

Joyce Nesamani Simson is a PhD cand

- Page 23 and 24:

Manpower Discipline Based on Knowle

- Page 25 and 26:

Peyman Akhavan et al. brains, knowl

- Page 27 and 28:

Peyman Akhavan et al. showed that o

- Page 29 and 30:

Peyman Akhavan et al. appropriate l

- Page 31 and 32:

Peyman Akhavan et al. sources for c

- Page 33 and 34:

Attitudes Towards Changes and Organ

- Page 35 and 36:

Ruth Alas et al. During the

- Page 37 and 38:

Professional inter

- Page 39 and 40:

Ruth Alas et al. Table 4: Correlati

- Page 41 and 42:

Research was supported by ETF Grant

- Page 43 and 44:

Rivadávia Correa Drummond de Alvar

- Page 45 and 46:

Rivadávia Correa Drummond de Alvar

- Page 47 and 48:

Rivadávia Correa Drummond de Alvar

- Page 49 and 50:

Rivadávia Correa Drummond de Alvar

- Page 51 and 52:

5. Conclusions Rivadávia Correa Dr

- Page 53 and 54:

Rivadávia Correa Drummond de Alvar

- Page 55 and 56:

Toward a Meta-Synthe</stron

- Page 57 and 58:

Xiaomi An et al 2.3 Reasons for dev

- Page 59 and 60:

Xiaomi An et al PTC works closely w

- Page 61 and 62:

Xiaomi An et al The first is an adm

- Page 63 and 64:

Xiaomi An et al policy reflections

- Page 65 and 66:

Figure 1: Transmission gear Marko A

- Page 67 and 68:

Marko Anzelak et al. knowledge basi

- Page 69 and 70:

Marko Anzelak et al. 72% recognise

- Page 71 and 72:

Marko Anzelak et al. virtually all

- Page 73 and 74:

Gabriel Prananingrum Aryanindita an

- Page 75 and 76:

Gabriel Prananingrum Aryanindita an

- Page 77 and 78:

Gabriel Prananingrum Aryanindita an

- Page 79 and 80:

Rita Babiliūtė and Kęstutis Kri

- Page 81 and 82:

Rita Babiliūtė and Kęstutis Kri

- Page 83 and 84:

Rita Babiliūtė and Kęstutis Kri

- Page 85 and 86:

Rita Babiliūtė and Kęstutis Kri

- Page 87 and 88:

Knowledge Management, Cultural Know

- Page 89 and 90:

Leonard Barnett and Edward Carter 2

- Page 91 and 92:

Leonard Barnett and Edward Carter p

- Page 93 and 94:

Leonard Barnett and Edward Carter p

- Page 95 and 96:

Leonard Barnett and Edward Carter d

- Page 97 and 98:

Impact of Knowledg

- Page 99 and 100:

Bob Barrett shorter product life-cy

- Page 101 and 102:

Bob Barrett 6. Concept of</

- Page 103 and 104:

Bob Barrett Brown, J.S. and Duguid

- Page 105 and 106:

Aurilla Aurelie Bechina and Eli Hus

- Page 107 and 108:

Aurilla Aurelie Bechina and Eli Hus

- Page 109 and 110:

Aurilla Aurelie Bechina and Eli Hus

- Page 111 and 112:

Aurilla Aurelie Bechina and Eli Hus

- Page 113 and 114:

Lorne Booker et al. Knowledge is us

- Page 115 and 116:

Figure 1: Business Valuation Knowle

- Page 117 and 118:

3.4 Practitioner knowledge market L

- Page 119 and 120:

4. Implications Lorne Booker et al.

- Page 121 and 122:

Strategic Thinking Dimensions in Em

- Page 123 and 124:

Constantin Bratianu et al. shows <s

- Page 125 and 126:

Constantin Bratianu et al. Academy

- Page 127 and 128:

Constantin Bratianu et al. cases wi

- Page 129 and 130:

Constantin Bratianu et al. Pinker,

- Page 131 and 132:

Delio Ignacio Castañeda and Sandra

- Page 133 and 134:

Delio Ignacio Castañeda and Sandra

- Page 135 and 136:

Delio Ignacio Castañeda and Sandra

- Page 137 and 138:

Quality in Teacher Education: A Sys

- Page 139 and 140:

Rajendra Chetty The mechanism <stro

- Page 141 and 142:

Academic leadership Rajendra Chetty

- Page 143 and 144:

Rajendra Chetty There must be a re-

- Page 145 and 146:

Developing Personal Knowledge Manag

- Page 147 and 148:

Thirathep Chonmait

- Page 149 and 150:

Thirathep Chonmait

- Page 151 and 152:

The Relationship Between Knowledge

- Page 153 and 154:

Samuel Kai Wah Chu et al. A knowled

- Page 155 and 156:

Samuel Kai Wah Chu et al. negative

- Page 157 and 158:

Samuel Kai Wah Chu et al. Questionn

- Page 159 and 160:

Samuel Kai Wah Chu et al. few done

- Page 161 and 162:

Value Creation Through Collaborativ

- Page 163 and 164:

Ridha Derrouiche et al. level for e

- Page 165 and 166:

Ridha Derrouiche et al. best, <stro

- Page 167 and 168:

Ridha Derrouiche et al. experience

- Page 169 and 170:

Ridha Derrouiche et al. Of course,

- Page 171 and 172:

Organizational Learning and Transfo

- Page 173 and 174:

Irra Chrisyanti Dewi was carried ou

- Page 175 and 176:

Irra Chrisyanti Dewi Table 2: Valid

- Page 177 and 178:

Irra Chrisyanti Dewi Library is exp

- Page 179 and 180:

Knowledge Acquisition and Sharing:

- Page 181 and 182:

Ikechukwu Diugwu articulated and st

- Page 183 and 184:

Ikechukwu Diugwu establishing setti

- Page 185 and 186:

Ikechukwu Diugwu Mentzer, J. T., Mi

- Page 187 and 188:

Eva Eckenhofer cou

- Page 189 and 190:

Eva Eckenhofer The

- Page 191 and 192:

Eva Eckenhofer The

- Page 193 and 194:

Eva Eckenhofer Bur

- Page 195 and 196:

1.2 Intellectual capital and innova

- Page 197 and 198:

3.2.2 Reliability Irene Y.H. Fan an

- Page 199 and 200:

Figure 4: latent variable coefficie

- Page 201 and 202:

Irene Y.H. Fan and Rongbin W.B. Lee

- Page 203 and 204:

Irene Y.H. Fan and Rongbin W.B. Lee

- Page 205 and 206:

2.1 Appropriation Ronny Gey From a

- Page 207 and 208:

Ronny Gey Table 1: Characterization

- Page 209 and 210:

Ronny Gey The developers feel that

- Page 211 and 212:

Ronny Gey A first limitation we wer

- Page 213 and 214:

Kenneth Grant part of</stro

- Page 215 and 216:

Kenneth Grant The diffusion was stu

- Page 217 and 218:

Kenneth Grant A detailed computer-s

- Page 219 and 220:

Kenneth Grant did not come to <stro

- Page 221 and 222:

Kenneth Grant of m

- Page 223 and 224:

Michel Grundstein although hundred

- Page 225 and 226:

Michel Grundstein Figure 1: DITEK p

- Page 227 and 228:

Michel Grundstein 4.1.1 Knowledge i

- Page 229 and 230:

Michel Grundstein share. However <s

- Page 231 and 232:

6. Conclusions and perspectives Mic

- Page 233 and 234:

Intellectual Property Valuation Dec

- Page 235 and 236:

Hezlin Harris et al. (Burrone and S

- Page 237 and 238:

Hezlin Harris et al. The need for s

- Page 239 and 240:

Acknowledgements Hezlin Harris et a

- Page 241 and 242:

Managing an Assessment Process <str

- Page 243 and 244:

Table 1: List of N

- Page 245 and 246:

Shaheed Hartley Table 3: OEQ respon

- Page 247 and 248:

Shaheed Hartley It is very difficul

- Page 249 and 250:

A Community Framework for Knowledge

- Page 251 and 252:

Igor Hawryszkiewycz between communi

- Page 253 and 254:

Figure 4: Modeling knowledge subsys

- Page 255 and 256:

Igor Hawryszkiewycz Prahalad, C.K.,

- Page 257 and 258:

Eli Hustad and Aurilla Aurelie Bech

- Page 259 and 260:

Eli Hustad and Aurilla Aurelie Bech

- Page 261 and 262:

Eli Hustad and Aurilla Aurelie Bech

- Page 263 and 264:

Eli Hustad and Aurilla Aurelie Bech

- Page 265 and 266:

Does Knowledge Stickiness Affect a

- Page 267 and 268:

Nurul Indarti knowledge (Nelson and

- Page 269 and 270:

3. Research methods 3.1 Research in

- Page 271 and 272:

Coded knowledge Nurul Indarti The f

- Page 273 and 274:

Nurul Indarti Arrow, K. J. (1969).

- Page 275 and 276:

Organizational Learning in Pr<stron

- Page 277 and 278:

Brigita Janiunaite et al. learn and

- Page 279 and 280:

Brigita Janiunaite et al. given dif

- Page 281 and 282:

Brigita Janiunaite et al. empowered

- Page 283 and 284:

Brigita Janiunaite et al. A statist

- Page 285 and 286:

Brigita Janiunaite et al. learning

- Page 287 and 288:

Balancing the Ince

- Page 289 and 290:

Giedrius Jucevičius safeguard and

- Page 291 and 292:

Giedrius Jucevičius nature <strong

- Page 293 and 294:

Giedrius Jucevičius motivating fac

- Page 295 and 296:

Giedrius Jucevičius Ghosh, T. (200

- Page 297 and 298:

Palmira Juceviciene and Vyda Mozuri

- Page 299 and 300:

Palmira Juceviciene and Vyda Mozuri

- Page 301 and 302:

Palmira Juceviciene and Vyda Mozuri

- Page 303 and 304:

Palmira Juceviciene and Vyda Mozuri

- Page 305 and 306:

Palmira Juceviciene and Vyda Mozuri

- Page 307 and 308:

Robertas Jucevicius relations shoul

- Page 309 and 310:

Robertas Jucevicius do not know whe

- Page 311 and 312:

Robertas Jucevicius and innovation

- Page 313 and 314:

Robertas Jucevicius Lawton Smith, H

- Page 315 and 316:

Annukka Jyrämä et al. knowledge c

- Page 317 and 318:

Annukka Jyrämä et al. Respondents

- Page 319 and 320:

Annukka Jyrämä et al. various cit

- Page 321 and 322:

Annukka Jyrämä et al. example hea

- Page 323 and 324:

Managing Information Overload - Tea

- Page 325 and 326:

Harri Ketamo conceptual structure a

- Page 327 and 328:

Harri Ketamo limited to YouTube, Fl

- Page 329 and 330:

Harri Ketamo Figure 8: Visualizatio

- Page 331 and 332:

Farmers’ Knowledge Management in

- Page 333 and 334:

2.1 Farmer knowledge Le Nguyen Doan

- Page 335 and 336:

Le Nguyen Doan Khoi days needed for

- Page 337 and 338:

Le Nguyen Doan Khoi dosage. Moreove

- Page 339 and 340:

Le Nguyen Doan Khoi use homemade in

- Page 341 and 342:

Developing Human Capital through Ne

- Page 343 and 344:

Eric Kong organisation as individua

- Page 345 and 346:

Eric Kong As described by Tosey and

- Page 347 and 348:

Eric Kong Craft, A. (2001) "Neuro-l

- Page 349 and 350:

Sophie Le Bellu and Benoit Le Blanc

- Page 351 and 352:

Sophie Le Bellu and Benoit Le Blanc

- Page 353 and 354:

Results Sophie Le Bellu and Benoit

- Page 355 and 356:

Sophie Le Bellu and Benoit Le Blanc

- Page 357 and 358: Sophie Le Bellu and Benoit Le Blanc

- Page 359 and 360: Pornpen Lertthasanawong and Nopasit

- Page 361 and 362: Pornpen Lertthasanawong and Nopasit

- Page 363 and 364: Pornpen Lertthasanawong and Nopasit

- Page 365 and 366: Pornpen Lertthasanawong and Nopasit

- Page 367 and 368: 2. Literature review Ya-Hui Ling 2.

- Page 369 and 370: Ya-Hui Ling action of</stro

- Page 371 and 372: Intellectual Capital Intellectual C

- Page 373 and 374: Ya-Hui Ling Hitt, M.A., Hoskisson,

- Page 375 and 376: Maksim Maksimovic et al paper prese

- Page 377 and 378: Maksim Maksimovic et al 4. Lean kno

- Page 379 and 380: Maksim Maksimovic et al of<

- Page 381 and 382: Maurizio Massaro and Andrea Moro <s

- Page 383 and 384: Maurizio Massaro and Andrea Moro Pr

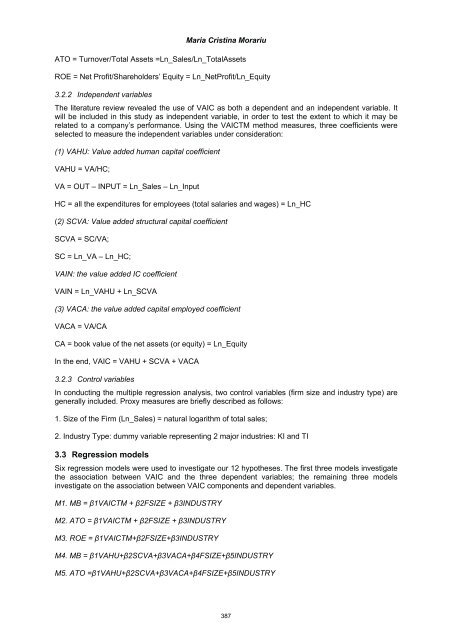

- Page 385 and 386: Maurizio Massaro and Andrea Moro hi

- Page 387 and 388: Maurizio Massaro and Andrea Moro Si

- Page 389 and 390: Helen Mitchell and Dennis Viehland

- Page 391 and 392: Helen Mitchell and Dennis Viehland

- Page 393 and 394: Helen Mitchell and Dennis Viehland

- Page 395 and 396: Helen Mitchell and Dennis Viehland

- Page 397 and 398: Figure 1: KMS Framework for collabo

- Page 399 and 400: Mohd Zali Mohd Nor et al. Ano<stron

- Page 401 and 402: Mohd Zali Mohd Nor et al. Table 4:

- Page 403 and 404: Mohd Zali Mohd Nor et al. KQ8 provi

- Page 405 and 406: Maria Cristina Morariu economy and

- Page 407: Table 1: Literature review summary

- Page 411 and 412: 4.2 Correlation analysis Maria Cris

- Page 413 and 414: 4.3 Regression analysis Maria Crist

- Page 415 and 416: Table 13: Regression analysis_M6 Mo

- Page 417 and 418: The Arrival of <st

- Page 419 and 420: Bertrand Pauget and Ahmed Dammak Mo

- Page 421 and 422: Bertrand Pauget and Ahmed Dammak no

- Page 423 and 424: Bertrand Pauget and Ahmed Dammak th

- Page 425 and 426: Bertrand Pauget and Ahmed Dammak Sa

- Page 427 and 428: Wannapa Pipattanawong et al. cannot

- Page 429 and 430: Wannapa Pipattanawong et al. 3.2 Do

- Page 431 and 432: Wannapa Pipattanawong et al. Moreov

- Page 433 and 434: The Dark Side of S

- Page 435 and 436: Siwarit Pongsakornrungsilp vans, ro

- Page 437 and 438: Siwarit Pongsakornrungsilp Kreng Ja

- Page 439: Siwarit Pongsakornrungsilp Lave, J.