Proceedings of the 8th International Conference on Intellectual ...

Proceedings of the 8th International Conference on Intellectual ...

Proceedings of the 8th International Conference on Intellectual ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Maria Cristina Morariu<br />

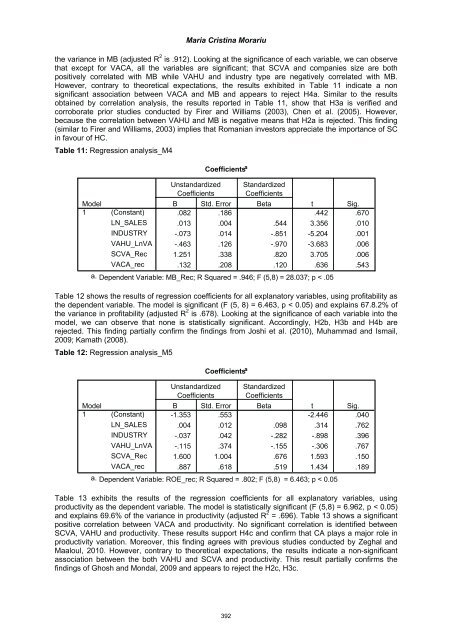

<str<strong>on</strong>g>the</str<strong>on</strong>g> variance in MB (adjusted R 2 is .912). Looking at <str<strong>on</strong>g>the</str<strong>on</strong>g> significance <str<strong>on</strong>g>of</str<strong>on</strong>g> each variable, we can observe<br />

that except for VACA, all <str<strong>on</strong>g>the</str<strong>on</strong>g> variables are significant; that SCVA and companies size are both<br />

positively correlated with MB while VAHU and industry type are negatively correlated with MB.<br />

However, c<strong>on</strong>trary to <str<strong>on</strong>g>the</str<strong>on</strong>g>oretical expectati<strong>on</strong>s, <str<strong>on</strong>g>the</str<strong>on</strong>g> results exhibited in Table 11 indicate a n<strong>on</strong><br />

significant associati<strong>on</strong> between VACA and MB and appears to reject H4a. Similar to <str<strong>on</strong>g>the</str<strong>on</strong>g> results<br />

obtained by correlati<strong>on</strong> analysis, <str<strong>on</strong>g>the</str<strong>on</strong>g> results reported in Table 11, show that H3a is verified and<br />

corroborate prior studies c<strong>on</strong>ducted by Firer and Williams (2003), Chen et al. (2005). However,<br />

because <str<strong>on</strong>g>the</str<strong>on</strong>g> correlati<strong>on</strong> between VAHU and MB is negative means that H2a is rejected. This finding<br />

(similar to Firer and Williams, 2003) implies that Romanian investors appreciate <str<strong>on</strong>g>the</str<strong>on</strong>g> importance <str<strong>on</strong>g>of</str<strong>on</strong>g> SC<br />

in favour <str<strong>on</strong>g>of</str<strong>on</strong>g> HC.<br />

Table 11: Regressi<strong>on</strong> analysis_M4<br />

Coefficients a<br />

Unstandardized Standardized<br />

Coefficients Coefficients<br />

Model<br />

B Std. Error Beta<br />

t Sig.<br />

1 (C<strong>on</strong>stant) .082 .186 .442 .670<br />

LN_SALES .013 .004 .544 3.356 .010<br />

INDUSTRY -.073 .014 -.851 -5.204 .001<br />

VAHU_LnVA -.463 .126 -.970 -3.683 .006<br />

SCVA_Rec 1.251 .338 .820 3.705 .006<br />

VACA_rec .132 .208 .120 .636 .543<br />

a. Dependent Variable: MB_Rec; R Squared = .946; F (5,8) = 28.037; p < .05<br />

Table 12 shows <str<strong>on</strong>g>the</str<strong>on</strong>g> results <str<strong>on</strong>g>of</str<strong>on</strong>g> regressi<strong>on</strong> coefficients for all explanatory variables, using pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itability as<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> dependent variable. The model is significant (F (5, 8) = 6.463, p < 0.05) and explains 67.8.2% <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> variance in pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itability (adjusted R 2 is .678). Looking at <str<strong>on</strong>g>the</str<strong>on</strong>g> significance <str<strong>on</strong>g>of</str<strong>on</strong>g> each variable into <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

model, we can observe that n<strong>on</strong>e is statistically significant. Accordingly, H2b, H3b and H4b are<br />

rejected. This finding partially c<strong>on</strong>firm <str<strong>on</strong>g>the</str<strong>on</strong>g> findings from Joshi et al. (2010), Muhammad and Ismail,<br />

2009; Kamath (2008).<br />

Table 12: Regressi<strong>on</strong> analysis_M5<br />

Coefficients a<br />

Unstandardized Standardized<br />

Coefficients Coefficients<br />

Model<br />

B Std. Error Beta<br />

t Sig.<br />

1 (C<strong>on</strong>stant) -1.353 .553 -2.446 .040<br />

LN_SALES .004 .012 .098 .314 .762<br />

INDUSTRY -.037 .042 -.282 -.898 .396<br />

VAHU_LnVA -.115 .374 -.155 -.306 .767<br />

SCVA_Rec 1.600 1.004 .676 1.593 .150<br />

VACA_rec .887 .618 .519 1.434 .189<br />

a. Dependent Variable: ROE_rec; R Squared = .802; F (5,8) = 6.463; p < 0.05<br />

Table 13 exhibits <str<strong>on</strong>g>the</str<strong>on</strong>g> results <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> regressi<strong>on</strong> coefficients for all explanatory variables, using<br />

productivity as <str<strong>on</strong>g>the</str<strong>on</strong>g> dependent variable. The model is statistically significant (F (5,8) = 6.962, p < 0.05)<br />

and explains 69.6% <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> variance in productivity (adjusted R 2 = .696). Table 13 shows a significant<br />

positive correlati<strong>on</strong> between VACA and productivity. No significant correlati<strong>on</strong> is identified between<br />

SCVA, VAHU and productivity. These results support H4c and c<strong>on</strong>firm that CA plays a major role in<br />

productivity variati<strong>on</strong>. Moreover, this finding agrees with previous studies c<strong>on</strong>ducted by Zeghal and<br />

Maaloul, 2010. However, c<strong>on</strong>trary to <str<strong>on</strong>g>the</str<strong>on</strong>g>oretical expectati<strong>on</strong>s, <str<strong>on</strong>g>the</str<strong>on</strong>g> results indicate a n<strong>on</strong>-significant<br />

associati<strong>on</strong> between <str<strong>on</strong>g>the</str<strong>on</strong>g> both VAHU and SCVA and productivity. This result partially c<strong>on</strong>firms <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

findings <str<strong>on</strong>g>of</str<strong>on</strong>g> Ghosh and M<strong>on</strong>dal, 2009 and appears to reject <str<strong>on</strong>g>the</str<strong>on</strong>g> H2c, H3c.<br />

392