Proceedings of the 8th International Conference on Intellectual ...

Proceedings of the 8th International Conference on Intellectual ...

Proceedings of the 8th International Conference on Intellectual ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

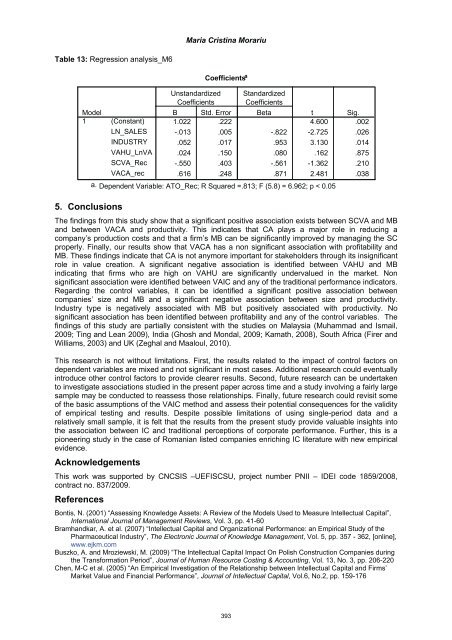

Table 13: Regressi<strong>on</strong> analysis_M6<br />

Model<br />

1<br />

5. C<strong>on</strong>clusi<strong>on</strong>s<br />

(C<strong>on</strong>stant)<br />

LN_SALES<br />

INDUSTRY<br />

VAHU_LnVA<br />

SCVA_Rec<br />

VACA_rec<br />

Maria Cristina Morariu<br />

Unstandardized<br />

Coefficients<br />

Coefficients a<br />

Standardized<br />

Coefficients<br />

B Std. Error Beta<br />

t Sig.<br />

1.022 .222 4.600 .002<br />

-.013 .005 -.822 -2.725 .026<br />

.052 .017 .953 3.130 .014<br />

.024 .150 .080 .162 .875<br />

-.550 .403 -.561 -1.362 .210<br />

.616 .248 .871 2.481 .038<br />

a. Dependent Variable: ATO_Rec; R Squared =.813; F (5.8) = 6.962; p < 0.05<br />

The findings from this study show that a significant positive associati<strong>on</strong> exists between SCVA and MB<br />

and between VACA and productivity. This indicates that CA plays a major role in reducing a<br />

company’s producti<strong>on</strong> costs and that a firm’s MB can be significantly improved by managing <str<strong>on</strong>g>the</str<strong>on</strong>g> SC<br />

properly. Finally, our results show that VACA has a n<strong>on</strong> significant associati<strong>on</strong> with pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itability and<br />

MB. These findings indicate that CA is not anymore important for stakeholders through its insignificant<br />

role in value creati<strong>on</strong>. A significant negative associati<strong>on</strong> is identified between VAHU and MB<br />

indicating that firms who are high <strong>on</strong> VAHU are significantly undervalued in <str<strong>on</strong>g>the</str<strong>on</strong>g> market. N<strong>on</strong><br />

significant associati<strong>on</strong> were identified between VAIC and any <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> traditi<strong>on</strong>al performance indicators.<br />

Regarding <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>trol variables, it can be identified a significant positive associati<strong>on</strong> between<br />

companies’ size and MB and a significant negative associati<strong>on</strong> between size and productivity.<br />

Industry type is negatively associated with MB but positively associated with productivity. No<br />

significant associati<strong>on</strong> has been identified between pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itability and any <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>trol variables. The<br />

findings <str<strong>on</strong>g>of</str<strong>on</strong>g> this study are partially c<strong>on</strong>sistent with <str<strong>on</strong>g>the</str<strong>on</strong>g> studies <strong>on</strong> Malaysia (Muhammad and Ismail,<br />

2009; Ting and Lean 2009), India (Ghosh and M<strong>on</strong>dal, 2009; Kamath, 2008), South Africa (Firer and<br />

Williams, 2003) and UK (Zeghal and Maaloul, 2010).<br />

This research is not without limitati<strong>on</strong>s. First, <str<strong>on</strong>g>the</str<strong>on</strong>g> results related to <str<strong>on</strong>g>the</str<strong>on</strong>g> impact <str<strong>on</strong>g>of</str<strong>on</strong>g> c<strong>on</strong>trol factors <strong>on</strong><br />

dependent variables are mixed and not significant in most cases. Additi<strong>on</strong>al research could eventually<br />

introduce o<str<strong>on</strong>g>the</str<strong>on</strong>g>r c<strong>on</strong>trol factors to provide clearer results. Sec<strong>on</strong>d, future research can be undertaken<br />

to investigate associati<strong>on</strong>s studied in <str<strong>on</strong>g>the</str<strong>on</strong>g> present paper across time and a study involving a fairly large<br />

sample may be c<strong>on</strong>ducted to reassess those relati<strong>on</strong>ships. Finally, future research could revisit some<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> basic assumpti<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> VAIC method and assess <str<strong>on</strong>g>the</str<strong>on</strong>g>ir potential c<strong>on</strong>sequences for <str<strong>on</strong>g>the</str<strong>on</strong>g> validity<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> empirical testing and results. Despite possible limitati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> using single-period data and a<br />

relatively small sample, it is felt that <str<strong>on</strong>g>the</str<strong>on</strong>g> results from <str<strong>on</strong>g>the</str<strong>on</strong>g> present study provide valuable insights into<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> associati<strong>on</strong> between IC and traditi<strong>on</strong>al percepti<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> corporate performance. Fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r, this is a<br />

pi<strong>on</strong>eering study in <str<strong>on</strong>g>the</str<strong>on</strong>g> case <str<strong>on</strong>g>of</str<strong>on</strong>g> Romanian listed companies enriching IC literature with new empirical<br />

evidence.<br />

Acknowledgements<br />

This work was supported by CNCSIS –UEFISCSU, project number PNII – IDEI code 1859/2008,<br />

c<strong>on</strong>tract no. 837/2009.<br />

References<br />

B<strong>on</strong>tis, N. (2001) “Assessing Knowledge Assets: A Review <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> Models Used to Measure <strong>Intellectual</strong> Capital”,<br />

<str<strong>on</strong>g>Internati<strong>on</strong>al</str<strong>on</strong>g> Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Management Reviews, Vol. 3, pp. 41-60<br />

Bramhandkar, A. et al. (2007) “<strong>Intellectual</strong> Capital and Organizati<strong>on</strong>al Performance: an Empirical Study <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Pharmaceutical Industry”, The Electr<strong>on</strong>ic Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Knowledge Management, Vol. 5, pp. 357 - 362, [<strong>on</strong>line],<br />

www.ejkm.com<br />

Buszko, A. and Mroziewski, M. (2009) “The <strong>Intellectual</strong> Capital Impact On Polish C<strong>on</strong>structi<strong>on</strong> Companies during<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Transformati<strong>on</strong> Period”, Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Human Resource Costing & Accounting, Vol. 13, No. 3, pp. 206-220<br />

Chen, M-C et al. (2005) “An Empirical Investigati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> Relati<strong>on</strong>ship between <strong>Intellectual</strong> Capital and Firms’<br />

Market Value and Financial Performance”, Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>Intellectual</strong> Capital, Vol.6, No.2, pp. 159-176<br />

393