FUND 1. General Fund 2. Special Revenue Funds 3. Debt Service Funds Available 4. Less: Amounts for Future Debt Retirement 5. Total Debt Service Funds 6. Capital Projects Funds 7. Fiduciary Fund 8. Enterprise Funds Available 9. Less: Amounts for Future Debt Retirement 10. Total Enterprise Funds 11. Internal Service Funds 12. TOTAL ALL FUNDS 7,220,500 7,220,500 22,255,400 100,900 29,807,900 29,807,900 13,942,000 7,220,500 7,220,500 11,081,600 18,000 28,162,600 28,162,600 10,425,400 CITY OF SURPRISE Summary Schedule <strong>of</strong> Estimated Revenues and Expenditures/Expenses Fiscal Year 2014 ADOPTED FUND ESTIMATED REVENUES TOTAL BUDGETED ACTUAL BALANCE/ OTHER THAN FINANCIAL BUDGETED EXPENDITURES/ EXPENDITURES/ NET PROPERTY TAX PROPERTY OTHER FINANCING INTERFUND TRANSFERS RESOURCES EXPENDITURES/ EXPENSES* EXPENSES** POSITION*** REVENUES TAXES 2014 2014 AVAILABLE EXPENSES 2013 2013 July 1, 2013** 2014 Primary: 2014 SOURCES IN 2014 2014 $ 74,722,100 $ 73,998,600 $ $ 6,407,100 Secondary: $ 75,992,800 $ $ $ 5,772,300 $ 1,533,400 $ 86,638,800 $ 78,550,500 22,596,900 9,512,200 2,312,700 14,721,900 17,034,600 18,260,900 143,900 143,900 10,791,700 33,092,000 33,092,000 11,604,000 11,965,600 11,965,600 73,700 73,700 1,828,000 14,302,800 14,302,800 12,035,800 12,035,800 8,963,700 18,789,200 18,789,200 11,604,000 11,898,100 11,898,100 52,858,800 25,600 28,022,500 28,022,500 15,349,600 $ 170 170,645,700 645 700 $ 140 140,418,900 418 900 $ $ 88,719,800 719 800 $ 146 146,346,300 346 300 $ $ $ 17 17,737,900 737 900 $ 17 17,737,900 737 900 $ 155 155,066,100 066 100 $ 204 204,966,000 966 000 EXPENDITURE LIMITATION COMPARISON 2013 2014 1. <strong>Budget</strong>ed expenditures/expenses $ 170,645,700 $ 204,966,000 2. Add/subtract: estimated net reconciling items (7,190,000) (7,190,000) 3. <strong>Budget</strong>ed expenditures/expenses adjusted for reconciling items 163,455,700 197,776,000 4. Less: estimated exclusions 12,100,000 12,100,000 5. Amount subject to the expenditure limitation $ 151,355,700 $ 185,676,000 6. EEC or voter-approved alternative expenditure limitation $ 888,445,600 $ 912,481,200 The city/town does not levy property taxes and does not have special assessment districts for which property taxes are levied. Therefore, Schedule B has been omitted. * Includes Expenditure/Expense Adjustments Approved in current year from Schedule E. ** Includes actual amounts as <strong>of</strong> the date the proposed budget was prepared, adjusted for estimated activity for the remainder <strong>of</strong> the fiscal year. *** Amounts in this column represent Fund Balance/Net Position amounts except for amounts not in spendable form (e.g., prepaids and inventories) or legally or contractually required to be maintained intact (e.g., principal <strong>of</strong> a permanent fund). 248 SCHEDULE A

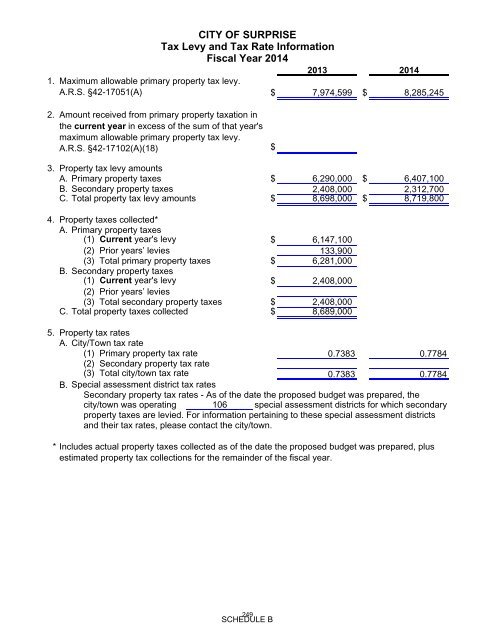

1. 2. 2013 2014 $ 7,974,599 $ 8,285,245 3. Property tax levy amounts A. Primary property taxes $ 6,290,000 $ 6,407,100 B. Secondary property taxes 2,408,000 2,312,700 C. Total property tax levy amounts $ 8,698,000 $ 8,719,800 4. Property taxes collected* A. Primary property taxes (1) Current year's levy $ 6,147,100 (2) Prior years’ levies 133,900 (3) Total primary property taxes $ 6,281,000 B. Secondary property taxes (1) Current year's levy $ 2,408,000 (2) Prior years’ levies (3) Total secondary property taxes $ 2,408,000 C. Total property taxes collected $ 8,689,000 5. Property tax rates A. <strong>City</strong>/Town tax rate (1) Primary property tax rate (2) Secondary property tax rate 0.7383 0.7784 (3) Total city/town tax rate B. Special assessment district tax rates 0.7383 0.7784 Secondary property tax rates - As <strong>of</strong> the date the proposed budget was prepared, the * Maximum allowable primary property tax levy. A.R.S. §42-17051(A) city/town was operating CITY OF SURPRISE Tax Levy and Tax Rate Information Fiscal Year 2014 Amount received from primary property taxation in the current year in excess <strong>of</strong> the sum <strong>of</strong> that year's maximum allowable primary property tax levy. A.R.S. §42-17102(A)(18) $ 106 special assessment districts for which secondary property taxes are levied. For information pertaining to these special assessment districts and their tax rates, please contact the city/town. Includes actual property taxes collected as <strong>of</strong> the date the proposed budget was prepared, plus estimated property tax collections for the remainder <strong>of</strong> the fiscal year. 249 SCHEDULE B

- Page 2 and 3:

City of Surprise, Arizona FY2014 Ci

- Page 4:

Transmittal Letter

- Page 9 and 10:

Introduction to the City y Manager

- Page 11 and 12:

Financial Review • FY2010 audit f

- Page 13 and 14:

Financial Review (Continued) ( )

- Page 15 and 16:

Approach pp oac to FY2014 0 Budget

- Page 17 and 18:

Approach to FY2014 Budget (Continue

- Page 19 and 20:

Citywide y FTE 860 840 820 800 780

- Page 21 and 22:

FY2014 City Manager Manager’s s R

- Page 23 and 24:

The Budget g Document Contains. . .

- Page 25 and 26:

Outcomes (continued) ( ) 4. Do not

- Page 27 and 28:

FY2014 General Fund Budget 19

- Page 29 and 30:

Millionss General Fund Revenue Summ

- Page 31 and 32:

FY2014 Forecast: $88.2M ($3.7M, 4%)

- Page 33 and 34:

Expenses 25

- Page 35 and 36:

Personnel Summary Summaryy In Milli

- Page 37 and 38:

Personnel Details (continued) ( ) I

- Page 39 and 40:

Services Details In Millions $ Chan

- Page 41 and 42:

Services Details (continued) ( ) In

- Page 43 and 44:

Supplies pp Details In Millions $ C

- Page 45 and 46:

Capital p Summaryy In Millions $ Ch

- Page 47 and 48:

Operating p gReserve In Millions FY

- Page 49 and 50:

Operating p gReserve: Estimated vs.

- Page 51 and 52:

City Council Discussion Issues (Con

- Page 53 and 54:

General Capital p Fund Outcomes •

- Page 55 and 56:

Project Name FY2014 BBell ll RRoad

- Page 57 and 58:

Transportation Improvement Fund Ado

- Page 59 and 60:

Impact p Fee Fund Outcomes • All

- Page 61 and 62:

Solid Waste Summaryy • FY2014: No

- Page 63 and 64:

Water Summaryy • FY2014: Rate inc

- Page 65 and 66:

Policy y Discussions May 2013 05/07

- Page 67 and 68:

Document Publication August 2013 08

- Page 69 and 70:

General Information Mayor and City

- Page 71 and 72:

RICHARD ALTON - Richard.Alton@surpr

- Page 73 and 74:

SKIP HALL - Skip.Hall@surpriseaz.go

- Page 75 and 76:

DOVE VALLEY RD LONE MOUNTAIN RD DIX

- Page 77 and 78:

Tourism Infuse tourism dollars into

- Page 79 and 80:

283rd Av 28300W 283rd Ave 28300W 27

- Page 81 and 82:

Statistical Information Population

- Page 83 and 84:

Revenue Revenue Summary Revenue D

- Page 85 and 86:

Overview The operating revenue fore

- Page 87 and 88:

General Fund Major Revenue Accounts

- Page 89 and 90:

Description Local Bed Tax FY2013 FY

- Page 91 and 92:

Vehicle License Tax FY2013 FY2014 $

- Page 93 and 94:

Court Revenue FY2013 FY2014 $ % Est

- Page 95 and 96:

All Other Operating Revenue FY2013

- Page 97 and 98:

Facilities Fees FY2013 FY2014 $ % E

- Page 99 and 100:

Cox Communications Cable Franchise

- Page 101 and 102:

City of Surprise Wastewater Franchi

- Page 103 and 104:

Water Service Fee FY2013 FY2014 $ %

- Page 105 and 106:

Wastewater Development Fee FY2013 F

- Page 107 and 108:

Parks and Recreation Development Fe

- Page 109 and 110:

Police Development Fee FY2013 FY201

- Page 111 and 112:

Expense Summary All Funds Total Ex

- Page 113 and 114:

City of Surprise All Funds - Detail

- Page 115 and 116:

Object Object Description FY2012 Ac

- Page 117 and 118:

Object Object Description FY2012 Ac

- Page 119 and 120:

City of Surprise All Funds - Detail

- Page 121 and 122:

Object Category FY2012 Actual FY201

- Page 123 and 124:

City of Surprise All Funds - Detail

- Page 125 and 126:

Object Object Description PW-Vehicl

- Page 127 and 128:

Object Object Description Mayor & C

- Page 129 and 130:

Object Object Description Community

- Page 131 and 132:

Object Object Description Legal Man

- Page 133 and 134:

Object Object Description PW-Replen

- Page 135 and 136:

Object Object Description Governmen

- Page 137 and 138:

Object Object Description 37111 OFF

- Page 139 and 140:

Object Object Description Finance G

- Page 141 and 142:

Object Object Description PW-Street

- Page 143 and 144:

Object Object Description CLAIM/SET

- Page 145 and 146:

Object Object Description Community

- Page 147 and 148:

Object Object Description Fire-Emer

- Page 149 and 150:

Object Object Description Community

- Page 151 and 152:

Object Object Description Mayor & C

- Page 153 and 154:

Object Object Description General O

- Page 155 and 156:

Object Object Description General O

- Page 157 and 158:

Object Object Description Fire-Emer

- Page 159 and 160:

Object Object Description Community

- Page 161 and 162:

Object Object Description RADIO EQU

- Page 163 and 164:

Object Object Description PW-Facili

- Page 165 and 166:

Object Object Description General O

- Page 167 and 168:

Object Object Description Mayor & C

- Page 169 and 170:

Object Object Description Community

- Page 171 and 172:

Object Object Description 39112 IMP

- Page 173 and 174:

Object Object Description PW-Sewer

- Page 175 and 176:

Object Object Description IMP'S OTH

- Page 177 and 178:

Object Object Description FY2012 Ac

- Page 179 and 180:

Police Department Department Overvi

- Page 181 and 182:

Divisions Office of the Chief - Thi

- Page 183 and 184:

Police Department General Fund Summ

- Page 185 and 186:

Police Department DEA Fund Summary

- Page 187 and 188:

Police Department Tow Fund Summary

- Page 189 and 190:

Fire Department Department Overview

- Page 191 and 192:

Support Services - Provides oversig

- Page 193 and 194:

Fire Department General Fund Summar

- Page 195 and 196:

Fire Department Firefighter’s Pen

- Page 197 and 198:

Fire Department Wildland Fire Fund

- Page 199 and 200:

Community and Economic Development

- Page 201 and 202:

Neighborhood Services - Neighborhoo

- Page 203 and 204:

Community and Economic Development

- Page 205 and 206:

Community and Economic Development

- Page 207 and 208:

Organizational Chart Primary Functi

- Page 209 and 210:

City Court General Fund Summary Maj

- Page 211 and 212:

City Court FARE Fund Fund Descripti

- Page 213 and 214:

City Court MFTG Fund Fund Descripti

- Page 215 and 216:

Organizational Chart The chart belo

- Page 217 and 218:

Department Goal: Comply with Arizon

- Page 219 and 220:

Human Resources Risk Management Fun

- Page 221 and 222:

Department Goal: Continue interacti

- Page 223 and 224:

Accomplishments, Enhancements, and

- Page 225 and 226:

Employee Dependent Scholarship Fund

- Page 227 and 228:

Major Budget Changes The FY2014 bud

- Page 229 and 230:

Organizational Chart Primary Functi

- Page 231 and 232:

Accomplishments, Enhancements, and

- Page 233 and 234:

Community and Recreation Services G

- Page 235 and 236:

Community and Recreation Services T

- Page 237 and 238:

Community and Recreation Services S

- Page 239 and 240:

Organizational Chart Due to the int

- Page 241 and 242:

• Engineering Goal: Improve the p

- Page 243 and 244:

FY2011 Final FY2012 Adopted FY2013

- Page 245 and 246:

Major Initiatives and Policy Issues

- Page 247 and 248:

Public Works Local Transportation A

- Page 249 and 250:

Public Works Water Operations Fund

- Page 251 and 252:

FY2011 Final FY2012 Adopted FY2013

- Page 253 and 254:

Water Department Goal: Provide high

- Page 255 and 256:

thickening centrifuge #1 to dewater

- Page 257 and 258:

Goals, Objectives, and Performance

- Page 259 and 260:

Public Works Sanitation Operations

- Page 261 and 262:

Accomplishments, Enhancements, and

- Page 263 and 264:

Information Technology Department D

- Page 265 and 266:

Major Initiatives and Policy Issues

- Page 267 and 268:

Major Budget Changes The FY2014 bud

- Page 269 and 270:

Donations Fund Fund Description The

- Page 271 and 272: City Manager’s Office Department

- Page 273 and 274: FY2011 FY2012 FY2013 FY2014 Amended

- Page 275 and 276: Accomplishments, Enhancements and E

- Page 277 and 278: Mayor and City Council Department D

- Page 279 and 280: Capital Improvement Plan Capital I

- Page 281 and 282: The majority of approved capital pr

- Page 283 and 284: Improvement districts: This financi

- Page 285 and 286: Update Process Updating the CIP tak

- Page 287 and 288: General Capital Fund Description Th

- Page 289 and 290: FY2011 Final FY2012 Adopted FY2013

- Page 291 and 292: Vehicle Replacement Description Veh

- Page 293 and 294: Police Development Fee Fund Descrip

- Page 295 and 296: Library Development Fee Fund Descri

- Page 297 and 298: Public Works Development Fee Fund D

- Page 299 and 300: MPC Proprietary Debt Service 2007 F

- Page 301 and 302: Wastewater System Development Fee F

- Page 303 and 304: Budget Transfer Policies and Proced

- Page 305 and 306: Introduction City of Surprise, Ariz

- Page 307 and 308: Capital Management Policies 20. The

- Page 309 and 310: Financial Reporting Policies 39. Th

- Page 311 and 312: Base Budget The ongoing expense for

- Page 313 and 314: CRS Community and Recreation Servic

- Page 315 and 316: Fund A fiscal and accounting entity

- Page 317 and 318: ITS Intelligent Transportation Syst

- Page 319 and 320: Primary Property Tax A limited tax

- Page 321: Turn key Supplied, installed, or pu

- Page 325 and 326: SOURCE OF REVENUES SPECIAL REVENUE

- Page 327 and 328: DEBT SERVICE FUNDS SOURCE OF REVENU

- Page 329 and 330: ENTERPRISE FUNDS SOURCE OF REVENUES

- Page 331 and 332: FUND/DEPARTMENT CITY OF SURPRISE Ex

- Page 333 and 334: FUND/DEPARTMENT CITY OF SURPRISE Ex

- Page 335 and 336: Fir Fire Fir General Fund $ 14,526,

- Page 337: FUND CITY OF SURPRISE Full-Time Emp