FMS - GAIL

FMS - GAIL

FMS - GAIL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In addition to the deduction above due to overall quarterly, the contractor<br />

shall be liable for deduction for non-performance, if any equipment,<br />

module, network or part of network remains down due to non availoabiltiy<br />

of satisfactory <strong>FMS</strong> services at respective location. The calculations to this<br />

effect shall be submitted by the Contractor along with the bill.<br />

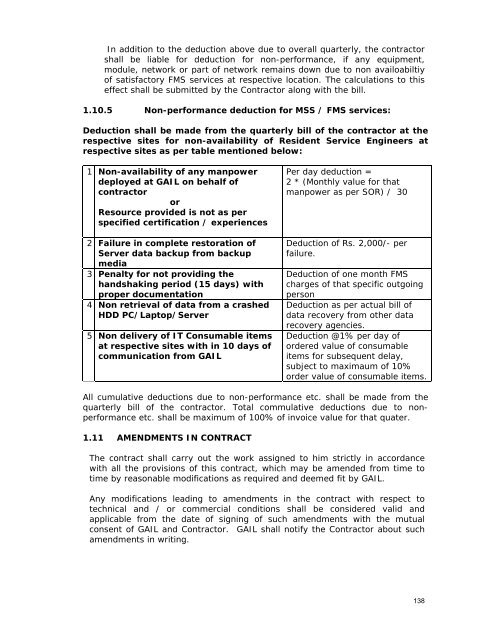

1.10.5 Non-performance deduction for MSS / <strong>FMS</strong> services:<br />

Deduction shall be made from the quarterly bill of the contractor at the<br />

respective sites for non-availability of Resident Service Engineers at<br />

respective sites as per table mentioned below:<br />

1 Non-availability of any manpower<br />

deployed at <strong>GAIL</strong> on behalf of<br />

contractor<br />

or<br />

Resource provided is not as per<br />

specified certification / experiences<br />

2 Failure in complete restoration of<br />

Server data backup from backup<br />

media<br />

3 Penalty for not providing the<br />

handshaking period (15 days) with<br />

proper documentation<br />

4 Non retrieval of data from a crashed<br />

HDD PC/Laptop/Server<br />

5 Non delivery of IT Consumable items<br />

at respective sites with in 10 days of<br />

communication from <strong>GAIL</strong><br />

Per day deduction =<br />

2 * (Monthly value for that<br />

manpower as per SOR) / 30<br />

Deduction of Rs. 2,000/- per<br />

failure.<br />

Deduction of one month <strong>FMS</strong><br />

charges of that specific outgoing<br />

person<br />

Deduction as per actual bill of<br />

data recovery from other data<br />

recovery agencies.<br />

Deduction @1% per day of<br />

ordered value of consumable<br />

items for subsequent delay,<br />

subject to maximaum of 10%<br />

order value of consumable items.<br />

All cumulative deductions due to non-performance etc. shall be made from the<br />

quarterly bill of the contractor. Total commulative deductions due to nonperformance<br />

etc. shall be maximum of 100% of invoice value for that quater.<br />

1.11 AMENDMENTS IN CONTRACT<br />

The contract shall carry out the work assigned to him strictly in accordance<br />

with all the provisions of this contract, which may be amended from time to<br />

time by reasonable modifications as required and deemed fit by <strong>GAIL</strong>.<br />

Any modifications leading to amendments in the contract with respect to<br />

technical and / or commercial conditions shall be considered valid and<br />

applicable from the date of signing of such amendments with the mutual<br />

consent of <strong>GAIL</strong> and Contractor. <strong>GAIL</strong> shall notify the Contractor about such<br />

amendments in writing.<br />

138