Biofuel co-products as livestock feed - Opportunities and challenges

Biofuel co-products as livestock feed - Opportunities and challenges

Biofuel co-products as livestock feed - Opportunities and challenges

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

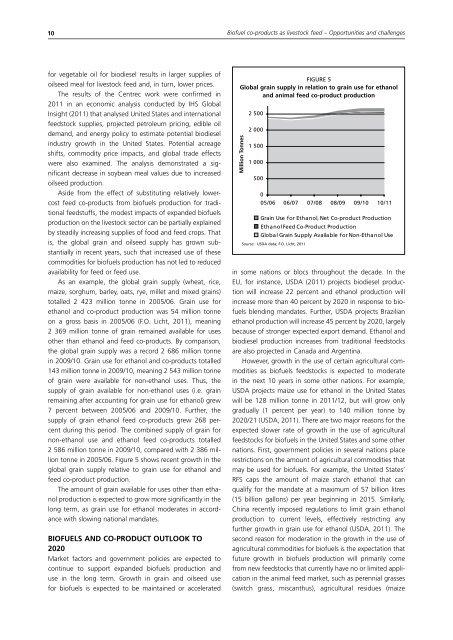

10<strong>Biofuel</strong> <strong>co</strong>-<strong>products</strong> <strong>as</strong> <strong>livestock</strong> <strong>feed</strong> – <strong>Opportunities</strong> <strong>and</strong> <strong>challenges</strong>for vegetable oil for biodiesel results in larger supplies ofoilseed meal for <strong>livestock</strong> <strong>feed</strong> <strong>and</strong>, in turn, lower prices.The results of the Centrec work were <strong>co</strong>nfirmed in2011 in an e<strong>co</strong>nomic analysis <strong>co</strong>nducted by IHS GlobalInsight (2011) that analysed United States <strong>and</strong> international<strong>feed</strong>stock supplies, projected petroleum pricing, edible oildem<strong>and</strong>, <strong>and</strong> energy policy to estimate potential biodieselindustry growth in the United States. Potential acreageshifts, <strong>co</strong>mmodity price impacts, <strong>and</strong> global trade effectswere also examined. The analysis demonstrated a significantdecre<strong>as</strong>e in soybean meal values due to incre<strong>as</strong>edoilseed production.Aside from the effect of substituting relatively lower<strong>co</strong>st<strong>feed</strong> <strong>co</strong>-<strong>products</strong> from biofuels production for traditional<strong>feed</strong>stuffs, the modest impacts of exp<strong>and</strong>ed biofuelsproduction on the <strong>livestock</strong> sector can be partially explainedby steadily incre<strong>as</strong>ing supplies of food <strong>and</strong> <strong>feed</strong> crops. Thatis, the global grain <strong>and</strong> oilseed supply h<strong>as</strong> grown substantiallyin recent years, such that incre<strong>as</strong>ed use of these<strong>co</strong>mmodities for biofuels production h<strong>as</strong> not led to reducedavailability for <strong>feed</strong> or <strong>feed</strong> use.As an example, the global grain supply (wheat, rice,maize, sorghum, barley, oats, rye, millet <strong>and</strong> mixed grains)totalled 2 423 million tonne in 2005/06. Grain use forethanol <strong>and</strong> <strong>co</strong>-product production w<strong>as</strong> 54 million tonneon a gross b<strong>as</strong>is in 2005/06 (F.O. Licht, 2011), meaning2 369 million tonne of grain remained available for usesother than ethanol <strong>and</strong> <strong>feed</strong> <strong>co</strong>-<strong>products</strong>. By <strong>co</strong>mparison,the global grain supply w<strong>as</strong> a re<strong>co</strong>rd 2 686 million tonnein 2009/10. Grain use for ethanol <strong>and</strong> <strong>co</strong>-<strong>products</strong> totalled143 million tonne in 2009/10, meaning 2 543 million tonneof grain were available for non-ethanol uses. Thus, thesupply of grain available for non-ethanol uses (i.e. grainremaining after ac<strong>co</strong>unting for grain use for ethanol) grew7 percent between 2005/06 <strong>and</strong> 2009/10. Further, thesupply of grain ethanol <strong>feed</strong> <strong>co</strong>-<strong>products</strong> grew 268 percentduring this period. The <strong>co</strong>mbined supply of grain fornon-ethanol use <strong>and</strong> ethanol <strong>feed</strong> <strong>co</strong>-<strong>products</strong> totalled2 586 million tonne in 2009/10, <strong>co</strong>mpared with 2 386 milliontonne in 2005/06. Figure 5 shows recent growth in theglobal grain supply relative to grain use for ethanol <strong>and</strong><strong>feed</strong> <strong>co</strong>-product production.The amount of grain available for uses other than ethanolproduction is expected to grow more significantly in thelong term, <strong>as</strong> grain use for ethanol moderates in ac<strong>co</strong>rdancewith slowing national m<strong>and</strong>ates.BIOFUELS AND CO-PRODUCT OUTLOOK TO2020Market factors <strong>and</strong> government policies are expected to<strong>co</strong>ntinue to support exp<strong>and</strong>ed biofuels production <strong>and</strong>use in the long term. Growth in grain <strong>and</strong> oilseed usefor biofuels is expected to be maintained or acceleratedFIGURE 5Global grain supply in relation to grain use for ethanol<strong>and</strong> animal <strong>feed</strong> <strong>co</strong>-product productionMillion Tonnes2 5002 0001 5001 000500005/06 06/07 07/08 08/09 09/10 10/11Grain Use for Ethanol, Net Co-product ProductionEthanol Feed Co-Product ProductionGlobal Grain Supply Available for Non-Ethanol UseSource: USDA data; F.O. Licht, 2011in some nations or blocs throughout the decade. In theEU, for instance, USDA (2011) projects biodiesel productionwill incre<strong>as</strong>e 22 percent <strong>and</strong> ethanol production willincre<strong>as</strong>e more than 40 percent by 2020 in response to biofuelsblending m<strong>and</strong>ates. Further, USDA projects Brazilianethanol production will incre<strong>as</strong>e 45 percent by 2020, largelybecause of stronger expected export dem<strong>and</strong>. Ethanol <strong>and</strong>biodiesel production incre<strong>as</strong>es from traditional <strong>feed</strong>stocksare also projected in Canada <strong>and</strong> Argentina.However, growth in the use of certain agricultural <strong>co</strong>mmodities<strong>as</strong> biofuels <strong>feed</strong>stocks is expected to moderatein the next 10 years in some other nations. For example,USDA projects maize use for ethanol in the United Stateswill be 128 million tonne in 2011/12, but will grow onlygradually (1 percent per year) to 140 million tonne by2020/21 (USDA, 2011). There are two major re<strong>as</strong>ons for theexpected slower rate of growth in the use of agricultural<strong>feed</strong>stocks for biofuels in the United States <strong>and</strong> some othernations. First, government policies in several nations placerestrictions on the amount of agricultural <strong>co</strong>mmodities thatmay be used for biofuels. For example, the United States’RFS caps the amount of maize starch ethanol that canqualify for the m<strong>and</strong>ate at a maximum of 57 billion litres(15 billion gallons) per year beginning in 2015. Similarly,China recently imposed regulations to limit grain ethanolproduction to current levels, effectively restricting anyfurther growth in grain use for ethanol (USDA, 2011). These<strong>co</strong>nd re<strong>as</strong>on for moderation in the growth in the use ofagricultural <strong>co</strong>mmodities for biofuels is the expectation thatfuture growth in biofuels production will primarily <strong>co</strong>mefrom new <strong>feed</strong>stocks that currently have no or limited applicationin the animal <strong>feed</strong> market, such <strong>as</strong> perennial gr<strong>as</strong>ses(switch gr<strong>as</strong>s, miscanthus), agricultural residues (maize