- Page 1 and 2:

PROYECTOS DE INVERSIÓN Formulació

- Page 3 and 4:

Proyectos de inversión Formulació

- Page 5 and 6:

Proyectos de inversión Formulació

- Page 7 and 8:

A la memoria de mi hermano Manir y

- Page 9 and 10:

Índice de contenidos Acerca del au

- Page 11 and 12:

8.4 Flujo de caja para una desinver

- Page 13 and 14:

Acerca del autor NASSIR SAPAG CHAIN

- Page 15 and 16:

Prólogo La nueva edición de este

- Page 17 and 18:

•y El capítulo de costo de capit

- Page 19 and 20:

1Capítulo Conceptos introductorios

- Page 21 and 22:

Nassir Sapag Chain A diferencia de

- Page 23 and 24:

Nassir Sapag Chain Las inversiones

- Page 25 and 26:

Nassir Sapag Chain afectarán, por

- Page 27 and 28:

Nassir Sapag Chain Aunque la evalua

- Page 29 and 30:

Nassir Sapag Chain La viabilidad po

- Page 31 and 32:

Nassir Sapag Chain La viabilidad am

- Page 33 and 34:

Nassir Sapag Chain ejemplo, cuánto

- Page 35 and 36:

Nassir Sapag Chain frecuente que el

- Page 37 and 38:

Nassir Sapag Chain • y Estrategia

- Page 39 and 40:

Nassir Sapag Chain posible introduc

- Page 41 and 42:

Nassir Sapag Chain El flujo de caja

- Page 43 and 44:

Nassir Sapag Chain Cada etapa, en c

- Page 45 and 46:

Nassir Sapag Chaín 1.14 La evaluac

- Page 47 and 48:

2Capítulo Estudio del mercado La e

- Page 49 and 50:

Nassir Sapag Chain comprar. Al subi

- Page 51 and 52:

Nassir Sapag Chain Si, por ejemplo,

- Page 53 and 54:

Nassir Sapag Chain Si no hay restri

- Page 55 and 56:

Nassir Sapag Chain 2. Demanda inel

- Page 57 and 58:

Nassir Sapag Chain Cuando el result

- Page 59 and 60:

Nassir Sapag Chain Para dimensionar

- Page 61 and 62:

Nassir Sapag Chain y motivando, en

- Page 63 and 64:

Nassir Sapag Chain Un efecto direct

- Page 65 and 66:

Nassir Sapag Chain hacia la baja en

- Page 67 and 68:

Nassir Sapag Chain El éxito de muc

- Page 69 and 70:

Nassir Sapag Chain La discriminaci

- Page 71 and 72:

Nassir Sapag Chain De lo anterior e

- Page 73 and 74:

Nassir Sapag Chain El mercado compe

- Page 75 and 76:

Nassir Sapag Chain • y Tamaño y

- Page 77 and 78:

Nassir Sapag Chain • y Ubicación

- Page 79 and 80:

Nassir Sapag Chain No es trivial es

- Page 81 and 82:

Nassir Sapag Chain La proyección d

- Page 83 and 84:

Nassir Sapag Chain Finalmente, seg

- Page 85 and 86:

Nassir Sapag Chain 2.23 ¿Qué es e

- Page 87 and 88:

Nassir Sapag Chain 2.53 Una importa

- Page 89 and 90:

3Capítulo Técnicas de predicción

- Page 91 and 92:

Nassir Sapag Chain 3.1 Técnicas cu

- Page 93 and 94:

Nassir Sapag Chain En la Tabla 3.1

- Page 95 and 96:

Nassir Sapag Chain Ejemplo 3.2 Con

- Page 97 and 98:

Nassir Sapag Chain El valor relativ

- Page 99 and 100:

Nassir Sapag Chain Figura 3.3 Const

- Page 101 and 102:

Nassir Sapag Chain En cambio, si el

- Page 103 and 104:

Nassir Sapag Chain Especial relevan

- Page 105 and 106:

Nassir Sapag Chain 3.2.2 Investigac

- Page 107 and 108:

Nassir Sapag Chain En otras palabra

- Page 109 and 110:

Nassir Sapag Chain El diseño de la

- Page 111 and 112:

Nassir Sapag Chain clasifican, a su

- Page 113 and 114:

Nassir Sapag Chain Ejemplo 3.10 En

- Page 115 and 116:

Nassir Sapag Chain 4. Determinació

- Page 117 and 118:

Nassir Sapag Chain Los principales

- Page 119 and 120:

Nassir Sapag Chain 3.20 ¿Qué es u

- Page 121 and 122:

Nassir Sapag Chain 3.36 Explique lo

- Page 123 and 124:

Nassir Sapag Chain 3.39 Una prueba

- Page 125 and 126:

4Capítulo Estudio técnico del pro

- Page 127 and 128:

Nassir Sapag Chain 1. 2. La identif

- Page 129 and 130:

Nassir Sapag Chain verá afectada.

- Page 131 and 132:

Nassir Sapag Chain 4.2 Balance de o

- Page 133 and 134:

Nassir Sapag Chain Dependiendo de l

- Page 135 and 136:

Nassir Sapag Chain prestación, ya

- Page 137 and 138:

Nassir Sapag Chain 2. Que la cantid

- Page 139 and 140:

Nassir Sapag Chain Los principales

- Page 141 and 142:

Nassir Sapag Chain terrenos, insumo

- Page 143 and 144:

Nassir Sapag Chain Como para cada f

- Page 145 and 146:

Nassir Sapag Chain Donde C es el co

- Page 147 and 148:

Nassir Sapag Chain Gráfico 4.1 Var

- Page 149 and 150:

Nassir Sapag Chain Preguntas y prob

- Page 151 and 152:

Nassir Sapag Chain Componente Cable

- Page 153 and 154:

Nassir Sapag Chain 4.44 4.45 4.46 C

- Page 155 and 156:

5Capítulo Aspectos tributarios y a

- Page 157 and 158:

Nassir Sapag Chain el activo se ven

- Page 159 and 160:

Nassir Sapag Chain Que es lo mismo

- Page 161 and 162:

Nassir Sapag Chain En la Tabla 5.3,

- Page 163 and 164:

Nassir Sapag Chain El análisis es

- Page 165 and 166:

Nassir Sapag Chain Tabla 5.5 Cálcu

- Page 167 and 168:

Nassir Sapag Chain El efecto tribut

- Page 169 and 170:

Nassir Sapag Chain Ejemplo 5.8 (sit

- Page 171 and 172:

Nassir Sapag Chain 2. Cuando la emp

- Page 173 and 174:

Nassir Sapag Chain La teoría admin

- Page 175 and 176:

Nassir Sapag Chain •y Indemnizaci

- Page 177 and 178:

Nassir Sapag Chain 5.17 Una empresa

- Page 179 and 180:

Nassir Sapag Chain 5.27 Determine e

- Page 181 and 182:

6Capítulo Costos e inversiones El

- Page 183 and 184:

Nassir Sapag Chain Ejemplo 6.1 Cons

- Page 185 and 186:

Nassir Sapag Chain 6.2 Cómo determ

- Page 187 and 188:

Nassir Sapag Chain Sin embargo, 10%

- Page 189 and 190:

Nassir Sapag Chain La clínica demo

- Page 191 and 192:

Nassir Sapag Chain Para calcular lo

- Page 193 and 194:

Nassir Sapag Chain la adquisición

- Page 195 and 196:

Nassir Sapag Chain tendría inverti

- Page 197 and 198:

Nassir Sapag Chain En el proceso pr

- Page 199 and 200:

Nassir Sapag Chain Aunque los costo

- Page 201 and 202:

Nassir Sapag Chain horario de traba

- Page 203 and 204:

Nassir Sapag Chain A nivel de facti

- Page 205 and 206:

Nassir Sapag Chain 6.5 Costos de fa

- Page 207 and 208:

Nassir Sapag Chain Todo lo anterior

- Page 209 and 210:

Nassir Sapag Chain Tabla 6.3 Cálcu

- Page 211 and 212:

Nassir Sapag Chain 6.8 Tasa de crec

- Page 213 and 214:

Nassir Sapag Chain 6.9 Costos de un

- Page 215 and 216:

Nassir Sapag Chain Preguntas y prob

- Page 217 and 218:

Nassir Sapag Chain Las conclusiones

- Page 219 and 220:

7Capítulo Cálculo de beneficios d

- Page 221 and 222:

Nassir Sapag Chain Figura 7.1 Benef

- Page 223 and 224:

Nassir Sapag Chain Como se puede ob

- Page 225 and 226:

Nassir Sapag Chain Si el ingreso pe

- Page 227 and 228:

Nassir Sapag Chain tributario. Si e

- Page 229 and 230:

Nassir Sapag Chain Para ser consecu

- Page 231 and 232:

Nassir Sapag Chain En consecuencia,

- Page 233 and 234:

Nassir Sapag Chain Por esta razón,

- Page 235 and 236:

Nassir Sapag Chain respuesta no con

- Page 237 and 238:

Nassir Sapag Chain contable del act

- Page 239 and 240:

Nassir Sapag Chain activo, a sumarl

- Page 241 and 242:

Nassir Sapag Chain 7.6 Aplicación

- Page 243 and 244:

Nassir Sapag Chain Ventas $134.000.

- Page 245 and 246:

Nassir Sapag Chain 7.20 7.21 ¿Qué

- Page 247 and 248:

Nassir Sapag Chain El capital de tr

- Page 249 and 250:

Nassir Sapag Chain Se estima que lo

- Page 251 and 252:

8Capítulo Cómo construir los fluj

- Page 253 and 254:

Nassir Sapag Chain Los ingresos y e

- Page 255 and 256:

Nassir Sapag Chain corresponde al m

- Page 257 and 258:

Nassir Sapag Chain Otra opción se

- Page 259 and 260:

Nassir Sapag Chain La forma de abor

- Page 261 and 262:

Nassir Sapag Chain El flujo de caja

- Page 263 and 264:

Nassir Sapag Chain una cuota anual

- Page 265 and 266:

Nassir Sapag Chain 8.3 Situación b

- Page 267 and 268:

Nassir Sapag Chain El vehículo act

- Page 269 and 270:

Nassir Sapag Chain Venta de activos

- Page 271 and 272:

Nassir Sapag Chain El resultado del

- Page 273 and 274:

Nassir Sapag Chain gasto en seguros

- Page 275 and 276:

Nassir Sapag Chain Otras situacione

- Page 277 and 278:

Nassir Sapag Chain 8.6 Alquilar o c

- Page 279 and 280:

Nassir Sapag Chain Tabla 8.10 Flujo

- Page 281 and 282:

Nassir Sapag Chain Cuando se constr

- Page 283 and 284:

Nassir Sapag Chain 8.19 Explique c

- Page 285 and 286:

Nassir Sapag Chain $16.000. El cost

- Page 287 and 288:

Nassir Sapag Chain El mantenimiento

- Page 289 and 290:

9Capítulo Cálculo y análisis de

- Page 291 and 292:

Nassir Sapag Chain Nper Tasa VA VF

- Page 293 and 294:

Nassir Sapag Chain Si lo que se bus

- Page 295 and 296:

Nassir Sapag Chain Figura 9.4 Cuadr

- Page 297 and 298:

Nassir Sapag Chain Figura 9.6 Cuadr

- Page 299 and 300:

Nassir Sapag Chain Ejemplo 9.6 Si l

- Page 301 and 302:

Nassir Sapag Chain Ejemplo 9.8 Si s

- Page 303 and 304:

Nassir Sapag Chain Tabla 9.7 Supues

- Page 305 and 306:

Nassir Sapag Chain Esto indica que

- Page 307 and 308:

Nassir Sapag Chain Si el flujo tuvi

- Page 309 and 310:

Nassir Sapag Chain 9.2.3 Periodo de

- Page 311 and 312:

Nassir Sapag Chain Se considera que

- Page 313 and 314:

Nassir Sapag Chain Gráfico 9.4 Pun

- Page 315 and 316:

Nassir Sapag Chain Para incorporar

- Page 317 and 318:

Nassir Sapag Chain El carácter bá

- Page 319 and 320:

Nassir Sapag Chain Gráfico 9.7 Pun

- Page 321 and 322:

Nassir Sapag Chain En el caso de un

- Page 323 and 324:

Nassir Sapag Chain La aplicación d

- Page 325 and 326:

Nassir Sapag Chain En un entorno mu

- Page 327 and 328:

Nassir Sapag Chain Donde f es la va

- Page 329 and 330:

Nassir Sapag Chaín Chain Preguntas

- Page 331 and 332:

Nassir Sapag Chaín Chain 9.38 9.39

- Page 333 and 334:

10 Capítulo Riesgo e incertidumbre

- Page 335 and 336:

Nassir Sapag Chain Ejemplo 6.4 del

- Page 337 and 338:

Nassir Sapag Chain n ∑ j=1 ( A j

- Page 339 and 340:

Nassir Sapag Chain Para calcular la

- Page 341 and 342:

Nassir Sapag Chain Ejemplo 10.3 Una

- Page 343 and 344:

Nassir Sapag Chain Tabla 10.7 Cálc

- Page 345 and 346:

Nassir Sapag Chain Tabla 10.8 Cálc

- Page 347 and 348:

Nassir Sapag Chain Por ejemplo, si

- Page 349 and 350:

Nassir Sapag Chain cantidad de equi

- Page 351 and 352:

Nassir Sapag Chain Gráfico 10.4 VA

- Page 353 and 354:

Nassir Sapag Chain Los supuestos de

- Page 355 and 356:

Nassir Sapag Chain barra Herramient

- Page 357 and 358:

Nassir Sapag Chain Con esta informa

- Page 359 and 360:

Nassir Sapag Chain Aunque el Risk S

- Page 361 and 362:

Nassir Sapag Chain En el cuadro de

- Page 363 and 364:

Nassir Sapag Chain La pestaña Esta

- Page 365 and 366:

Nassir Sapag Chain 4. Curtosis de l

- Page 367 and 368:

Nassir Sapag Chain Preguntas y prob

- Page 369 and 370:

Nassir Sapag Chain 10.25 Una empres

- Page 371 and 372:

Nassir Sapag Chain La inversión en

- Page 373 and 374:

11 Capítulo Cómo calcular el cost

- Page 375 and 376:

Nassir Sapag Chain El objetivo, ent

- Page 377 and 378:

Nassir Sapag Chain Tabla 11.1 Flujo

- Page 379 and 380:

Nassir Sapag Chain 11.3.1 Flujo de

- Page 381 and 382:

Nassir Sapag Chain Como los interes

- Page 383 and 384:

Nassir Sapag Chain costo de capital

- Page 385 and 386:

Nassir Sapag Chain Al agregar el ah

- Page 387 and 388:

Nassir Sapag Chain En resumen, se p

- Page 389 and 390:

Nassir Sapag Chain Preguntas y prob

- Page 391 and 392:

Nassir Sapag Chain 11.26 Construya,

- Page 393 and 394:

12 Capítulo Análisis para la opti

- Page 395 and 396:

Nassir Sapag Chain Tabla 12.1 Efect

- Page 397 and 398:

Nassir Sapag Chain 2. En la celda B

- Page 399 and 400:

Nassir Sapag Chain Tabla 12.3 Flujo

- Page 401 and 402:

Nassir Sapag Chain El cálculo del

- Page 403 and 404:

Nassir Sapag Chain En ambos casos e

- Page 405 and 406:

Nassir Sapag Chain Si el proyecto f

- Page 407 and 408:

Nassir Sapag Chain De acuerdo con e

- Page 409 and 410:

Nassir Sapag Chain Gráfico 12.4 Re

- Page 411 and 412:

Nassir Sapag Chain Como se observa

- Page 413 and 414:

Nassir Sapag Chain real de 10 años

- Page 415 and 416:

Nassir Sapag Chain Tabla 12.11 Proy

- Page 417 and 418:

Nassir Sapag Chain embargo, brinda

- Page 419 and 420:

Nassir Sapag Chain A la misma decis

- Page 421 and 422:

Nassir Sapag Chain posibilita, fren

- Page 423 and 424:

Nassir Sapag Chain Una solución f

- Page 425 and 426:

Nassir Sapag Chain En este ejemplo

- Page 427 and 428:

Nassir Sapag Chain Preguntas y prob

- Page 429 and 430:

Nassir Sapag Chain Tecnología Inve

- Page 431 and 432:

13 Capítulo Proyectos en empresas

- Page 433 and 434:

Nassir Sapag Chain •y La mitigaci

- Page 435 and 436:

Nassir Sapag Chain Como no hay inve

- Page 437 and 438:

Nassir Sapag Chain Los proyectos de

- Page 439 and 440:

Nassir Sapag Chain Menos importante

- Page 441 and 442:

Nassir Sapag Chain ahorrarse la tot

- Page 443 and 444:

Nassir Sapag Chain 13.2 Proyectos d

- Page 445 and 446:

Nassir Sapag Chain En los dos prime

- Page 447 and 448:

Nassir Sapag Chain La información

- Page 449 and 450:

Nassir Sapag Chain 13.3 Proyectos d

- Page 451 and 452:

Nassir Sapag Chain El costo fabril

- Page 453 and 454:

Nassir Sapag Chain Los gastos vincu

- Page 455 and 456:

Nassir Sapag Chain Para el cálculo

- Page 457 and 458:

Nassir Sapag Chain Cuando la empres

- Page 459 and 460:

Nassir Sapag Chain Dados los cambio

- Page 461 and 462: Nassir Sapag Chain 13.14 Explique l

- Page 463 and 464: Nassir Sapag Chain 13.29 Una empres

- Page 465 and 466: Nassir Sapag Chain El estudio técn

- Page 467 and 468: 14 Capítulo Estudio de casos El ob

- Page 469 and 470: Nassir Sapag Chain De acuerdo con l

- Page 471 and 472: Nassir Sapag Chain La empresa sigue

- Page 473 and 474: Nassir Sapag Chain Tabla 14.3 Costo

- Page 475 and 476: Nassir Sapag Chain Considerando el

- Page 477 and 478: Nassir Sapag Chain El costo variabl

- Page 479 and 480: Nassir Sapag Chain 14.2 Caso 2: Out

- Page 481 and 482: Nassir Sapag Chain a. Situación ba

- Page 483 and 484: Nassir Sapag Chain Tabla 14.11 Fluj

- Page 485 and 486: Nassir Sapag Chain La Tabla 14.12 m

- Page 487 and 488: Nassir Sapag Chain Tabla 14.13 Fluj

- Page 489 and 490: Nassir Sapag Chain Los costos de ma

- Page 491 and 492: Nassir Sapag Chain Por lo tanto, al

- Page 493 and 494: Nassir Sapag Chain 2. Reemplazar el

- Page 495 and 496: Nassir Sapag Chain El flujo de caja

- Page 497 and 498: Nassir Sapag Chain La inversión co

- Page 499 and 500: Nassir Sapag Chain mantendrán su c

- Page 501 and 502: Nassir Sapag Chain En la proyecció

- Page 503 and 504: Nassir Sapag Chain El valor actual

- Page 505 and 506: Nassir Sapag Chain El valor actual

- Page 507 and 508: Nassir Sapag Chain La Tabla 14.24 m

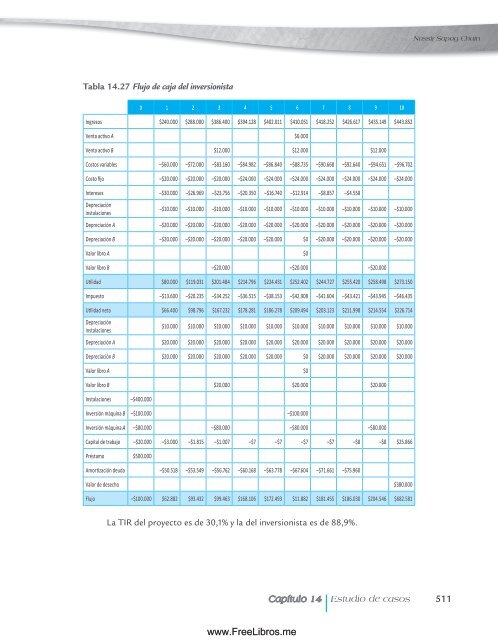

- Page 509 and 510: Nassir Sapag Chain 60% * 12% * (1 -

- Page 511: Nassir Sapag Chain tipo B, que cues

- Page 515 and 516: Nassir Sapag Chain Al calcular el V

- Page 517 and 518: Nassir Sapag Chain inversión crece

- Page 519 and 520: Nassir Sapag Chain Tabla 14.32 Fluj

- Page 521 and 522: Nassir Sapag Chain Opción A 0 1 2

- Page 523 and 524: Nassir Sapag Chain Tabla 14.34 Info

- Page 525 and 526: Nassir Sapag Chain Con la informaci

- Page 527 and 528: Nassir Sapag Chain Marcando Resolve

- Page 529 and 530: Nassir Sapag Chain Figura 14.7 Cuad

- Page 531 and 532: Nassir Sapag Chain ANEXO 1 Optimiza

- Page 533 and 534: Nassir Sapag Chain Los principales

- Page 535 and 536: Nassir Sapag Chain Específicamente

- Page 537 and 538: Índice temático A abandono 21, 22

- Page 539 and 540: evaluación 17-21, 25, 28, 33, 35,

- Page 541 and 542: promoción 72, 73, 102 proyecto(s)

- Page 543 and 544: Bibliografía ALIBER, R., La presup

- Page 545 and 546: HORNGREN, C.; G. FOSTER y otros, Co

- Page 547 and 548: www.FreeLibros.me