RIVISTA DI DIRITTO TRIBUTARIO INTERNAZIONALE - Rdti.it

RIVISTA DI DIRITTO TRIBUTARIO INTERNAZIONALE - Rdti.it

RIVISTA DI DIRITTO TRIBUTARIO INTERNAZIONALE - Rdti.it

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

D. Gwmalll1: Tax lrealmerlt ofpellsiol1s. A comparative analysis<br />

tions for the employer does not prevent them from being treated as taxable<br />

in come for the employee: this is the case in Denmark, Finland and<br />

Portugal (12).<br />

The s<strong>it</strong>uation gets more complex \vhen <strong>it</strong> comes to the employee's<br />

contribution to a foreign scheme.<br />

B - Cmllributiol1S made bv the empIoyee<br />

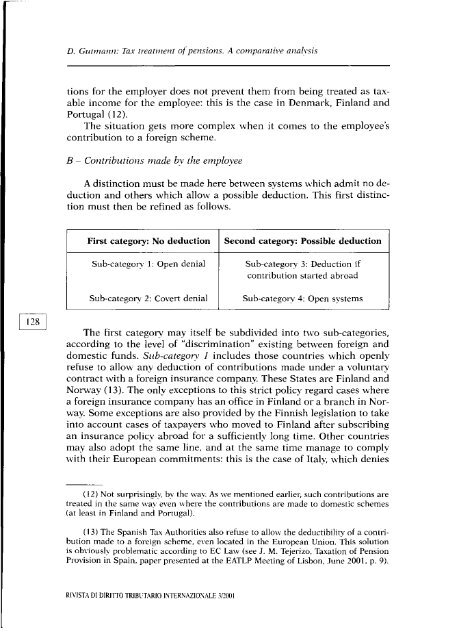

A distinction must be made here between systems which adm<strong>it</strong> no deduction<br />

and others which allow a possible deduction. This first distinction<br />

must then be refined as follows.<br />

First category: No deduction Second category: Possible deduction<br />

Sub-category l: Open denial Sub-categoT}' 3: Deduction if<br />

contribution started abroad<br />

Sub-category 2: Covert denial Sub-categoT}' 4: Open systerns<br />

The first categorv may <strong>it</strong>self be subdi,ided into two sub-categories,<br />

according to the level of "discrimination" existing between foreign and<br />

domestic funds. Sub-categon' l includes those countries which openly<br />

refuse to allo\\' any deduction of contributions made under a voluntary<br />

contract w<strong>it</strong>h a foreign insurance company. These States are Finlanci anci<br />

Norway (13). The only exceptions to this strict policy regard cases where<br />

a foreign insurance company has an office in Finlanci or a branch in Norway.<br />

Some exceptions are also provided by the Finnish legislation to take<br />

into account cases of taxpayers who moved to Finland after subscribing<br />

an insurance policy abroad for a sufficiently long time. Other countries<br />

may also adopt the same line, and at the same time manage to comply<br />

w<strong>it</strong>h their European comm<strong>it</strong>ments: this is the case of Haly, which denies<br />

(12) Not surprisingl ... " by the \vay. As \ve mentioned earlier, such contributions are<br />

treated in the same way e\'en where the eontributions are made to domestic schemes<br />

(at least in Finland and Portugal).<br />

(13) The Spanish Tax Author<strong>it</strong>ics also refuse to allo\\' the deductibil<strong>it</strong>y of a conlnbution<br />

made to a foreign scheme, e\'en Ioeated in the European Union. This solution<br />

is obviously problematic according to EC La\\' (see J. M. Tejerizo, Taxation of Pension<br />

Provision in Spain, paper presented at the EATLP Meeting of Lisbon, lune 2001, p. 9).<br />

<strong>RIVISTA</strong> <strong>DI</strong> DlRITIQ TRIBL:TARIO INTER\'AZIO\ALE 3nOOi