Relazione semestrale

Relazione semestrale

Relazione semestrale

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

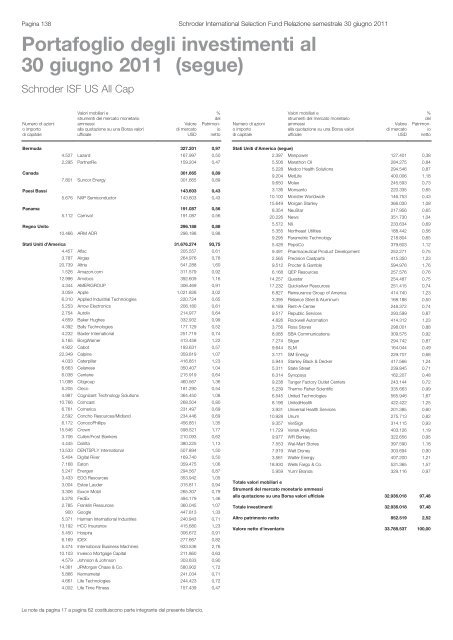

Pagina 138 Schroder International Selection Fund <strong>Relazione</strong> <strong>semestrale</strong> 30 giugno 2011Portafoglio degli investimenti al30 giugno 2011 (segue)Schroder ISF US All CapSchroder ISF US All Cap (segue)Numero di azionio importodi capitaleValori mobiliari estrumenti del mercato monetarioammessialla quotazione su una Borsa valoriufficialeValoredi mercatoUSD%delPatrimonionettoNumero di azionio importodi capitaleValori mobiliari estrumenti del mercato monetarioammessialla quotazione su una Borsa valoriufficialeValoredi mercatoUSD%delPatrimonionettoBermuda 327.201 0,974.527 Lazard 167.997 0,502.295 PartnerRe 159.204 0,47Canada 301.665 0,897.801 Suncor Energy 301.665 0,89Paesi Bassi 143.603 0,435.676 NXP Semiconductor 143.603 0,43Panama 191.087 0,565.112 Carnival 191.087 0,56Regno Unito 296.188 0,8810.466 ARM ADR 296.188 0,88Stati Uniti d'America 31.676.274 93,754.457 Aflac 205.557 0,613.787 Airgas 264.976 0,7820.739 Altria 541.288 1,601.526 Amazon.com 311.579 0,9212.996 Amdocs 392.609 1,164.344 AMERIGROUP 306.469 0,913.059 Apple 1.021.828 3,026.310 Applied Industrial Technologies 220.724 0,655.253 Arrow Electronics 206.180 0,612.754 Autoliv 214.977 0,644.659 Baker Hughes 332.932 0,994.392 Bally Technologies 177.129 0,524.232 Baxter International 251.719 0,745.165 BorgWarner 413.458 1,224.922 Cabot 193.631 0,5722.349 Calpine 359.819 1,074.033 Caterpillar 416.851 1,236.663 Celanese 350.407 1,046.038 Centene 215.919 0,6411.098 Citigroup 460.567 1,365.205 Cleco 181.290 0,544.987 Cognizant Technology Solutions 364.450 1,0810.766 Comcast 268.504 0,806.761 Comerica 231.497 0,692.592 Concho Resources/Midland 234.446 0,696.172 ConocoPhillips 456.851 1,3515.546 Crown 598.521 1,773.706 Cullen/Frost Bankers 210.093 0,624.445 DaVita 380.225 1,1313.533 DENTSPLY International 507.894 1,505.404 Digital River 169.740 0,507.168 Eaton 359.475 1,065.247 Energen 294.567 0,873.433 EOG Resources 353.942 1,053.004 Estee Lauder 315.811 0,943.306 Exxon Mobil 265.307 0,795.278 FedEx 494.179 1,462.785 Franklin Resources 360.045 1,07900 Google 447.813 1,335.371 Harman International Industries 240.943 0,7113.192 HCC Insurance 415.680 1,235.450 Hospira 306.672 0,916.169 IDEX 277.667 0,825.474 International Business Machines 933.536 2,7610.103 Invesco Mortgage Capital 211.860 0,634.579 Johnson & Johnson 303.633 0,9014.361 JPMorgan Chase & Co. 580.902 1,725.866 Kennametal 241.034 0,714.661 Life Technologies 244.423 0,724.002 Life Time Fitness 157.439 0,47Stati Uniti d'America (segue)2.397 Manpower 127.401 0,385.506 Marathon Oil 284.275 0,845.228 Medco Health Solutions 294.546 0,879.204 MetLife 400.006 1,189.650 Molex 245.593 0,733.136 Monsanto 220.335 0,6510.100 Monster Worldwide 146.753 0,4315.649 Morgan Stanley 366.030 1,088.354 NeuStar 217.956 0,6520.226 News 351.730 1,045.572 NII 233.634 0,695.355 Northeast Utilities 188.442 0,569.295 Parametric Technology 218.804 0,655.426 PepsiCo 379.603 1,129.491 Pharmaceutical Product Development 252.271 0,752.565 Precision Castparts 415.350 1,239.512 Procter & Gamble 594.976 1,766.168 QEP Resources 257.576 0,7614.257 Questar 254.487 0,7517.232 Quicksilver Resources 251.415 0,746.827 Reinsurance Group of America 414.740 1,233.395 Reliance Steel & Aluminum 168.188 0,508.189 Rent-A-Center 248.372 0,749.517 Republic Services 293.599 0,874.826 Rockwell Automation 414.312 1,233.756 Ross Stores 298.001 0,888.085 SBA Communications 309.575 0,927.274 Silgan 294.742 0,879.644 SLM 164.044 0,493.171 SM Energy 229.707 0,685.944 Stanley Black & Decker 417.566 1,245.311 State Street 239.845 0,716.314 Synopsys 162.207 0,489.238 Tanger Factory Outlet Centers 243.144 0,725.239 Thermo Fisher Scientific 335.663 0,996.545 United Technologies 565.946 1,678.196 UnitedHealth 422.422 1,253.931 Universal Health Services 201.385 0,6010.928 Unum 275.713 0,829.357 VeriSign 314.115 0,9311.729 Verisk Analytics 403.126 1,199.977 WR Berkley 322.656 0,957.553 Wal-Mart Stores 397.590 1,187.919 Walt Disney 303.694 0,903.561 Walter Energy 407.200 1,2118.930 Wells Fargo & Co. 531.365 1,575.959 Yum! Brands 329.116 0,97Totale valori mobiliari eStrumenti del mercato monetario ammessialla quotazione su una Borsa valori ufficiale 32.936.018 97,48Totale investimenti 32.936.018 97,48Altro patrimonio netto 852.519 2,52Valore netto d'inventario 33.788.537 100,00Le note da pagina 17 a pagina 62 costituiscono parte integrante del presente bilancio.