Relazione semestrale

Relazione semestrale

Relazione semestrale

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

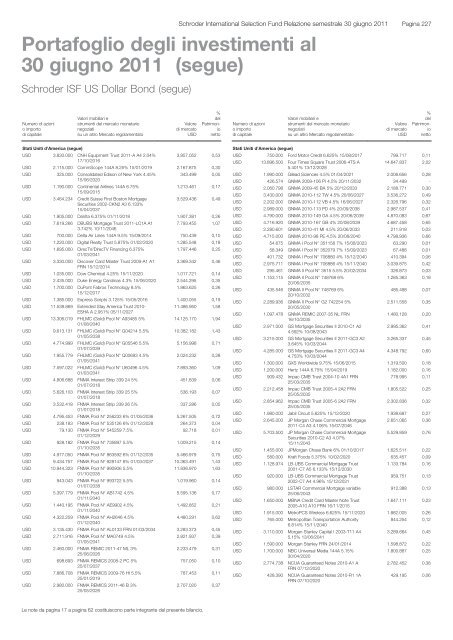

Schroder International Selection Fund <strong>Relazione</strong> <strong>semestrale</strong> 30 giugno 2011Portafoglio degli investimenti al30 giugno 2011 (segue)Pagina 227Schroder ISF US Dollar Bond (segue)Schroder ISF US Dollar Bond (segue)Numero di azionio importodi capitaleValori mobiliari estrumenti del mercato monetarionegoziatisu un altro Mercato regolamentatoValoredi mercatoUSD%delPatrimonionettoNumero di azionio importodi capitaleValori mobiliari estrumenti del mercato monetarionegoziatisu un altro Mercato regolamentatoValoredi mercatoUSD%delPatrimonionettoStati Uniti d'America (segue)USD 3.830.000 CNH Equipment Trust 2011-A A4 2.04% 3.857.052 0,5317/10/2016USD 2.115.000 CommScope 144A 8.25% 15/01/2019 2.167.875 0,30USD 325.000 Consolidated Edison of New York 4.45%343.499 0,0515/06/2020USD 1.190.000 Continental Airlines 144A 6.75%1.213.461 0,1715/09/2015USD 3.464.234 Credit Suisse First Boston MortgageSecurities 2002-CKN2 A3 6.133%15/04/20373.529.436 0,49USD 1.905.000 DaVita 6.375% 01/11/2018 1.907.381 0,26USD 7.619.266 DBUBS Mortgage Trust 2011-LC1A A17.793.455 1,073.742% 10/11/2046USD 700.000 Delta Air Lines 144A 9.5% 15/09/2014 750.439 0,10USD 1.220.000 Digital Realty Trust 5.875% 01/02/2020 1.285.548 0,18USD 1.695.000 DirecTV/DirecTV Financing 6.375%1.797.446 0,2501/03/2041USD 3.330.000 Discover Card Master Trust 2009-A1 A1 3.369.342 0,46FRN 15/12/2014USD 1.035.000 Dow Chemical 4.25% 15/11/2020 1.017.721 0,14USD 2.435.000 Duke Energy Carolinas 4.3% 15/06/2020 2.544.295 0,35USD 1.700.000 DuPont Fabros Technology 8.5%1.863.625 0,2615/12/2017USD 1.385.000 Express Scripts 3.125% 15/05/2016 1.400.055 0,19USD 11.538.869 Extended Stay America Trust 2010-11.486.950 1,58ESHA A 2.951% 05/11/2027USD 13.306.019 FHLMC (Gold) Pool N° A93485 5%14.125.170 1,9401/08/2040USD 9.613.131 FHLMC (Gold) Pool N° G04214 5.5%10.382.182 1,4301/05/2038USD 4.774.999 FHLMC (Gold) Pool N° G05546 5.5%5.156.998 0,7101/07/2039USD 1.955.779 FHLMC (Gold) Pool N° Q00693 4.5%2.024.232 0,2801/05/2041USD 7.597.022 FHLMC (Gold) Pool N° U60496 4.5%7.893.360 1,0901/03/2041USD 4.806.688 FNMA Interest Strip 339 24 5%451.839 0,0601/07/2018USD 5.626.103 FNMA Interest Strip 339 25 5%536.193 0,0701/07/2018USD 3.532.418 FNMA Interest Strip 339 26 5%337.286 0,0501/07/2018USD 4.795.453 FNMA Pool N° 256233 6% 01/05/2036 5.267.505 0,72USD 238.183 FNMA Pool N° 535126 6% 01/12/2028 264.373 0,04USD 79.130 FNMA Pool N° 545259 7.5%92.718 0,0101/12/2029USD 928.182 FNMA Pool N° 735897 5.5%1.009.215 0,1401/10/2035USD 4.977.050 FNMA Pool N° 863592 6% 01/12/2035 5.466.979 0,75USD 9.434.757 FNMA Pool N° 928147 6% 01/03/2037 10.363.491 1,43USD 10.944.323 FNMA Pool N° 990906 5.5%11.836.970 1,6301/10/2035USD 943.043 FNMA Pool N° 993722 5.5%1.019.960 0,1401/07/2038USD 5.397.779 FNMA Pool N° AB1742 4.5%5.595.136 0,7701/11/2040USD 1.440.195 FNMA Pool N° AE9902 4.5%1.492.852 0,2101/11/2040USD 4.322.259 FNMA Pool N° AH2646 4.5%4.480.291 0,6201/12/2040USD 3.135.430 FNMA Pool N° AL0133 FRN 01/03/2034 3.283.373 0,45USD 2.711.916 FNMA Pool N° MA0749 4.5%2.821.937 0,3901/05/2041USD 2.460.000 FNMA REMIC 2011-47 ML 3%2.233.479 0,3125/06/2026USD 698.693 FNMA REMICS 2008-2 PC 5%757.050 0,1025/07/2037USD 7.886.708 FNMA REMICS 2009-76 HI 5.5%787.453 0,1125/01/2019USD 2.980.000 FNMA REMICS 2011-46 B 3%25/05/20262.707.020 0,37Stati Uniti d'America (segue)USD 750.000 Ford Motor Credit 6.625% 15/08/2017 799.717 0,11USD 13.896.500 Four Times Square Trust 2006-4TS A14.647.837 2,025.401% 13/12/2028USD 1.990.000 Gilead Sciences 4.5% 01/04/2021 2.006.656 0,28USD 426.574 GNMA 2009-106 PI 4.5% 20/11/2032 34.499 -USD 2.060.798 GNMA 2009-45 BA 5% 20/12/2033 2.188.771 0,30USD 3.430.000 GNMA 2010-112 TW 4.5% 20/06/2027 3.536.272 0,49USD 2.202.000 GNMA 2010-112 VB 4.5% 16/06/2027 2.326.796 0,32USD 2.989.000 GNMA 2010-113 PD 4% 20/09/2038 2.987.537 0,41USD 4.790.000 GNMA 2010-149 GA 4.5% 20/06/2039 4.870.083 0,67USD 4.716.920 GNMA 2010-167 GB 4% 20/08/2039 4.687.458 0,65USD 2.280.601 GNMA 2010-41 MI 4.5% 20/06/2033 211.918 0,03USD 4.715.000 GNMA 2010-98 PE 4.5% 20/08/2040 4.798.936 0,66USD 54.675 GNMA I Pool N° 351158 7% 15/08/2023 63.290 0,01USD 58.349 GNMA I Pool N° 352079 7% 15/09/2023 67.488 0,01USD 401.732 GNMA I Pool N° 706880 4% 15/12/2040 410.394 0,06USD 2.975.711 GNMA I Pool N° 706886 4% 15/11/2040 3.039.875 0,42USD 295.461 GNMA II Pool N° 3515 5.5% 20/02/2034 326.873 0,03USD 1.153.115 GNMA II Pool N° 748768 6%1.285.363 0,1820/06/2035USD 435.546 GNMA II Pool N° 748769 6%485.498 0,0720/10/2032USD 2.289.936 GNMA II Pool N° G2 742254 5%2.511.558 0,3520/05/2030USD 1.097.478 GNMA REMIC 2007-35 NL FRN1.480.128 0,2016/10/2035USD 2.971.000 GS Mortgage Securities II 2010-C1 A22.995.362 0,414.592% 10/08/2043USD 3.215.000 GS Mortgage Securities II 2011-GC3 A23.265.337 0,453.645% 10/03/2044USD 4.285.000 GS Mortgage Securities II 2011-GC3 A44.348.792 0,604.753% 10/03/2044USD 1.300.000 GXS Worldwide 9.75% 15/06/2015 1.319.500 0,18USD 1.200.000 Hertz 144A 6.75% 15/04/2019 1.182.000 0,16USD 909.432 Impac CMB Trust 2004-10 4A1 FRN778.995 0,1125/03/2035USD 2.212.458 Impac CMB Trust 2005-4 2A2 FRN1.805.522 0,2525/05/2035USD 2.854.962 Impac CMB Trust 2005-6 2A2 FRN2.302.836 0,3225/05/2035USD 1.980.000 Jabil Circuit 5.625% 15/12/2020 1.938.687 0,27USD 2.645.000 JP Morgan Chase Commercial Mortgage 2.651.065 0,362011-C4 A3 4.106% 15/07/2046USD 5.703.500 JP Morgan Chase Commercial MortgageSecurities 2010-C2 A3 4.07%15/11/20435.529.859 0,76USD 1.455.000 JPMorgan Chase Bank 6% 01/10/2017 1.625.511 0,22USD 580.000 Kraft Foods 5.375% 10/02/2020 635.457 0,09USD 1.128.974 LB-UBS Commercial Mortgage Trust1.133.784 0,162001-C7 A5 6.133% 15/12/2030USD 920.000 LB-UBS Commercial Mortgage Trust959.751 0,132002-C7 A4 4.96% 15/12/2031USD 980.000 LSTAR Commercial Mortgage variable912.388 0,1325/06/2043USD 1.650.000 MBNA Credit Card Master Note Trust1.647.111 0,232005-A10 A10 FRN 16/11/2015USD 1.915.000 MetroPCS Wireless 6.625% 15/11/2020 1.882.005 0,26USD 765.000 Metropolitan Transportation Authority844.254 0,126.814% 15/11/2040USD 3.110.000 Morgan Stanley Capital I 2003-T11 A43.289.664 0,455.15% 13/06/2041USD 1.590.000 Morgan Stanley FRN 24/01/2014 1.598.872 0,22USD 1.700.000 NBC Universal Media 144A 5.15%1.800.887 0,2530/04/2020USD 2.774.738 NCUA Guaranteed Notes 2010-A1 A2.782.452 0,38FRN 07/12/2020USD 428.390 NCUA Guaranteed Notes 2010-R1 1AFRN 07/10/2020429.195 0,06Le note da pagina 17 a pagina 62 costituiscono parte integrante del presente bilancio.