LACC Vision & Mission Statements As Approved By - Los Angeles ...

LACC Vision & Mission Statements As Approved By - Los Angeles ...

LACC Vision & Mission Statements As Approved By - Los Angeles ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

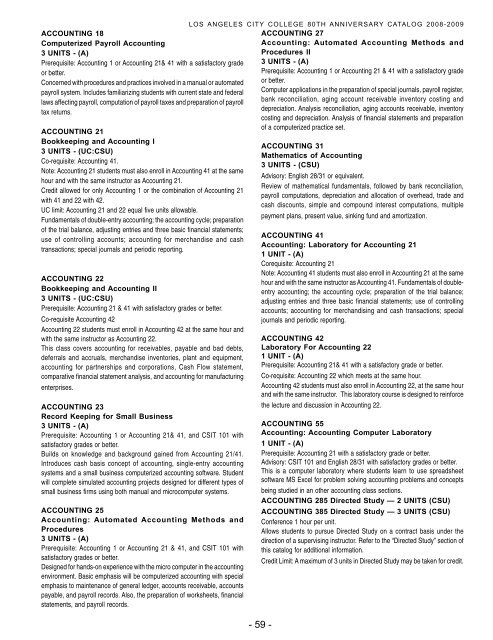

ACCOUNTING 18<br />

Computerized Payroll Accounting<br />

3 UNITS - (A)<br />

Prerequisite: Accounting 1 or Accounting 21& 41 with a satisfactory grade<br />

or better.<br />

Concerned with procedures and practices involved in a manual or automated<br />

payroll system. Includes familiarizing students with current state and federal<br />

laws affecting payroll, computation of payroll taxes and preparation of payroll<br />

tax returns.<br />

ACCOUNTING 21<br />

Bookkeeping and Accounting I<br />

3 UNITS - (UC:CSU)<br />

Co-requisite: Accounting 41.<br />

Note: Accounting 21 students must also enroll in Accounting 41 at the same<br />

hour and with the same instructor as Accounting 21.<br />

Credit allowed for only Accounting 1 or the combination of Accounting 21<br />

with 41 and 22 with 42.<br />

UC limit: Accounting 21 and 22 equal five units allowable.<br />

Fundamentals of double-entry accounting; the accounting cycle; preparation<br />

of the trial balance, adjusting entries and three basic financial statements;<br />

use of controlling accounts; accounting for merchandise and cash<br />

transactions; special journals and periodic reporting.<br />

ACCOUNTING 22<br />

Bookkeeping and Accounting II<br />

3 UNITS - (UC:CSU)<br />

Prerequisite: Accounting 21 & 41 with satisfactory grades or better.<br />

Co-requisite Accounting 42<br />

Accounting 22 students must enroll in Accounting 42 at the same hour and<br />

with the same instructor as Accounting 22.<br />

This class covers accounting for receivables, payable and bad debts,<br />

deferrals and accruals, merchandise inventories, plant and equipment,<br />

accounting for partnerships and corporations, Cash Flow statement,<br />

comparative financial statement analysis, and accounting for manufacturing<br />

enterprises.<br />

ACCOUNTING 23<br />

Record Keeping for Small Business<br />

3 UNITS - (A)<br />

Prerequisite: Accounting 1 or Accounting 21& 41, and CSIT 101 with<br />

satisfactory grades or better.<br />

Builds on knowledge and background gained from Accounting 21/41.<br />

Introduces cash basis concept of accounting, single-entry accounting<br />

systems and a small business computerized accounting software. Student<br />

will complete simulated accounting projects designed for different types of<br />

small business firms using both manual and microcomputer systems.<br />

ACCOUNTING 25<br />

Accounting: Automated Accounting Methods and<br />

Procedures<br />

3 UNITS - (A)<br />

Prerequisite: Accounting 1 or Accounting 21 & 41, and CSIT 101 with<br />

satisfactory grades or better.<br />

Designed for hands-on experience with the micro computer in the accounting<br />

environment. Basic emphasis will be computerized accounting with special<br />

emphasis to maintenance of general ledger, accounts receivable, accounts<br />

payable, and payroll records. Also, the preparation of worksheets, financial<br />

statements, and payroll records.<br />

LOS ANGELES CITY COLLEGE 80TH ANNIVERSARY CATALOG 2008-2009<br />

ACCOUNTING 27<br />

Accounting: Automated Accounting Methods and<br />

Procedures II<br />

3 UNITS - (A)<br />

Prerequisite: Accounting 1 or Accounting 21 & 41 with a satisfactory grade<br />

or better.<br />

Computer applications in the preparation of special journals, payroll register,<br />

bank reconciliation, aging account receivable inventory costing and<br />

depreciation. Analysis reconciliation, aging accounts receivable, inventory<br />

costing and depreciation. Analysis of financial statements and preparation<br />

of a computerized practice set.<br />

ACCOUNTING 31<br />

Mathematics of Accounting<br />

3 UNITS - (CSU)<br />

Advisory: English 28/31 or equivalent.<br />

Review of mathematical fundamentals, followed by bank reconciliation,<br />

payroll computations, depreciation and allocation of overhead, trade and<br />

cash discounts, simple and compound interest computations, multiple<br />

payment plans, present value, sinking fund and amortization.<br />

ACCOUNTING 41<br />

Accounting: Laboratory for Accounting 21<br />

1 UNIT - (A)<br />

Corequisite: Accounting 21<br />

Note: Accounting 41 students must also enroll in Accounting 21 at the same<br />

hour and with the same instructor as Accounting 41. Fundamentals of doubleentry<br />

accounting; the accounting cycle; preparation of the trial balance;<br />

adjusting entries and three basic financial statements; use of controlling<br />

accounts; accounting for merchandising and cash transactions; special<br />

journals and periodic reporting.<br />

ACCOUNTING 42<br />

Laboratory For Accounting 22<br />

1 UNIT - (A)<br />

Prerequisite: Accounting 21& 41 with a satisfactory grade or better.<br />

Co-requisite: Accounting 22 which meets at the same hour.<br />

Accounting 42 students must also enroll in Accounting 22, at the same hour<br />

and with the same instructor. This laboratory course is designed to reinforce<br />

the lecture and discussion in Accounting 22.<br />

ACCOUNTING 55<br />

Accounting: Accounting Computer Laboratory<br />

1 UNIT - (A)<br />

Prerequisite: Accounting 21 with a satisfactory grade or better.<br />

Advisory: CSIT 101 and English 28/31 with satisfactory grades or better.<br />

This is a computer laboratory where students learn to use spreadsheet<br />

software MS Excel for problem solving accounting problems and concepts<br />

being studied in an other accounting class sections.<br />

ACCOUNTING 285 Directed Study — 2 UNITS (CSU)<br />

ACCOUNTING 385 Directed Study — 3 UNITS (CSU)<br />

Conference 1 hour per unit.<br />

Allows students to pursue Directed Study on a contract basis under the<br />

direction of a supervising instructor. Refer to the “Directed Study” section of<br />

this catalog for additional information.<br />

Credit Limit: A maximum of 3 units in Directed Study may be taken for credit.<br />

- 59 -