Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 Streng<strong>the</strong>n<strong>in</strong>g <strong>the</strong> f<strong>in</strong>ancial viability <strong>of</strong> <strong>the</strong> registered<br />

clubs <strong>in</strong>dustry<br />

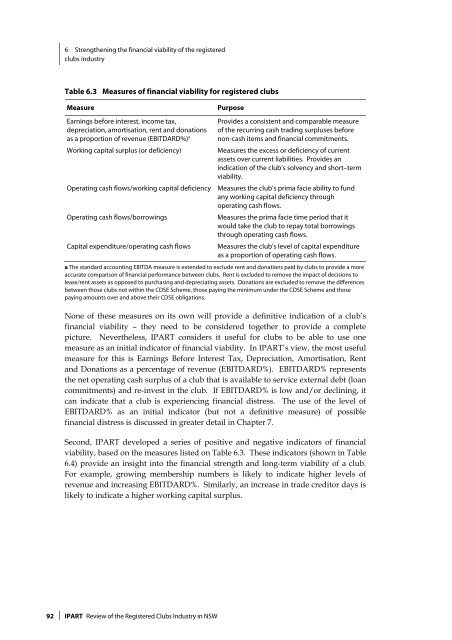

Table 6.3 Measures <strong>of</strong> f<strong>in</strong>ancial viability for registered clubs<br />

Measure<br />

Earn<strong>in</strong>gs before <strong>in</strong>terest, <strong>in</strong>come tax,<br />

depreciation, amortisation, rent and donations<br />

as a proportion <strong>of</strong> revenue (EBITDARD%) a<br />

Work<strong>in</strong>g capital surplus (or deficiency)<br />

Operat<strong>in</strong>g cash flows/work<strong>in</strong>g capital deficiency<br />

Operat<strong>in</strong>g cash flows/borrow<strong>in</strong>gs<br />

Capital expenditure/operat<strong>in</strong>g cash flows<br />

Purpose<br />

Provides a consistent and comparable measure<br />

<strong>of</strong> <strong>the</strong> recurr<strong>in</strong>g cash trad<strong>in</strong>g surpluses before<br />

non-cash items and f<strong>in</strong>ancial commitments.<br />

Measures <strong>the</strong> excess or deficiency <strong>of</strong> current<br />

assets over current liabilities. Provides an<br />

<strong>in</strong>dication <strong>of</strong> <strong>the</strong> club’s solvency and short–term<br />

viability.<br />

Measures <strong>the</strong> club’s prima facie ability to fund<br />

any work<strong>in</strong>g capital deficiency through<br />

operat<strong>in</strong>g cash flows.<br />

Measures <strong>the</strong> prima facie time period that it<br />

would take <strong>the</strong> club to repay total borrow<strong>in</strong>gs<br />

through operat<strong>in</strong>g cash flows.<br />

Measures <strong>the</strong> club’s level <strong>of</strong> capital expenditure<br />

as a proportion <strong>of</strong> operat<strong>in</strong>g cash flows.<br />

a The standard account<strong>in</strong>g EBITDA measure is extended to exclude rent and donations paid by clubs to provide a more<br />

accurate comparison <strong>of</strong> f<strong>in</strong>ancial performance between clubs. Rent is excluded to remove <strong>the</strong> impact <strong>of</strong> decisions to<br />

lease/rent assets as opposed to purchas<strong>in</strong>g and depreciat<strong>in</strong>g assets. Donations are excluded to remove <strong>the</strong> differences<br />

between those clubs not with<strong>in</strong> <strong>the</strong> CDSE Scheme, those pay<strong>in</strong>g <strong>the</strong> m<strong>in</strong>imum under <strong>the</strong> CDSE Scheme and those<br />

pay<strong>in</strong>g amounts over and above <strong>the</strong>ir CDSE obligations.<br />

None <strong>of</strong> <strong>the</strong>se measures on its own will provide a def<strong>in</strong>itive <strong>in</strong>dication <strong>of</strong> a club’s<br />

f<strong>in</strong>ancial viability – <strong>the</strong>y need to be considered toge<strong>the</strong>r to provide a complete<br />

picture. Never<strong>the</strong>less, IPART considers it useful for clubs to be able to use one<br />

measure as an <strong>in</strong>itial <strong>in</strong>dicator <strong>of</strong> f<strong>in</strong>ancial viability. In IPART’s view, <strong>the</strong> most useful<br />

measure for this is Earn<strong>in</strong>gs Before Interest Tax, Depreciation, Amortisation, Rent<br />

and Donations as a percentage <strong>of</strong> revenue (EBITDARD%). EBITDARD% represents<br />

<strong>the</strong> net operat<strong>in</strong>g cash surplus <strong>of</strong> a club that is available to service external debt (loan<br />

commitments) and re-<strong>in</strong>vest <strong>in</strong> <strong>the</strong> club. If EBITDARD% is low and/or decl<strong>in</strong><strong>in</strong>g, it<br />

can <strong>in</strong>dicate that a club is experienc<strong>in</strong>g f<strong>in</strong>ancial distress. The use <strong>of</strong> <strong>the</strong> level <strong>of</strong><br />

EBITDARD% as an <strong>in</strong>itial <strong>in</strong>dicator (but not a def<strong>in</strong>itive measure) <strong>of</strong> possible<br />

f<strong>in</strong>ancial distress is discussed <strong>in</strong> greater detail <strong>in</strong> Chapter 7.<br />

Second, IPART developed a series <strong>of</strong> positive and negative <strong>in</strong>dicators <strong>of</strong> f<strong>in</strong>ancial<br />

viability, based on <strong>the</strong> measures listed on Table 6.3. These <strong>in</strong>dicators (shown <strong>in</strong> Table<br />

6.4) provide an <strong>in</strong>sight <strong>in</strong>to <strong>the</strong> f<strong>in</strong>ancial strength and long-term viability <strong>of</strong> a club.<br />

For example, grow<strong>in</strong>g membership numbers is likely to <strong>in</strong>dicate higher levels <strong>of</strong><br />

revenue and <strong>in</strong>creas<strong>in</strong>g EBITDARD%. Similarly, an <strong>in</strong>crease <strong>in</strong> trade creditor days is<br />

likely to <strong>in</strong>dicate a higher work<strong>in</strong>g capital surplus.<br />

92 IPART <strong>Review</strong> <strong>of</strong> <strong>the</strong> <strong>Registered</strong> <strong>Clubs</strong> <strong>Industry</strong> <strong>in</strong> <strong>NSW</strong>