Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 Measur<strong>in</strong>g and report<strong>in</strong>g on club contributions<br />

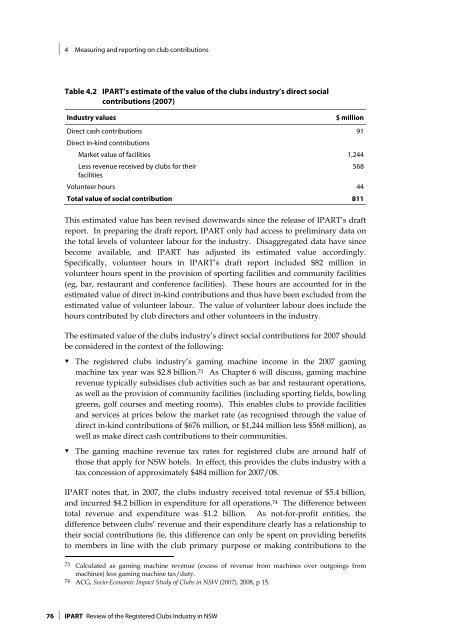

Table 4.2 IPART’s estimate <strong>of</strong> <strong>the</strong> value <strong>of</strong> <strong>the</strong> clubs <strong>in</strong>dustry’s direct social<br />

contributions (2007)<br />

<strong>Industry</strong> values<br />

$ million<br />

Direct cash contributions 91<br />

Direct <strong>in</strong>-k<strong>in</strong>d contributions<br />

Market value <strong>of</strong> facilities 1,244<br />

Less revenue received by clubs for <strong>the</strong>ir<br />

568<br />

facilities<br />

Volunteer hours 44<br />

Total value <strong>of</strong> social contribution 811<br />

This estimated value has been revised downwards s<strong>in</strong>ce <strong>the</strong> release <strong>of</strong> IPART’s draft<br />

report. In prepar<strong>in</strong>g <strong>the</strong> draft report, IPART only had access to prelim<strong>in</strong>ary data on<br />

<strong>the</strong> total levels <strong>of</strong> volunteer labour for <strong>the</strong> <strong>in</strong>dustry. Disaggregated data have s<strong>in</strong>ce<br />

become available, and IPART has adjusted its estimated value accord<strong>in</strong>gly.<br />

Specifically, volunteer hours <strong>in</strong> IPART’s draft report <strong>in</strong>cluded $82 million <strong>in</strong><br />

volunteer hours spent <strong>in</strong> <strong>the</strong> provision <strong>of</strong> sport<strong>in</strong>g facilities and community facilities<br />

(eg, bar, restaurant and conference facilities). These hours are accounted for <strong>in</strong> <strong>the</strong><br />

estimated value <strong>of</strong> direct <strong>in</strong>-k<strong>in</strong>d contributions and thus have been excluded from <strong>the</strong><br />

estimated value <strong>of</strong> volunteer labour. The value <strong>of</strong> volunteer labour does <strong>in</strong>clude <strong>the</strong><br />

hours contributed by club directors and o<strong>the</strong>r volunteers <strong>in</strong> <strong>the</strong> <strong>in</strong>dustry.<br />

The estimated value <strong>of</strong> <strong>the</strong> clubs <strong>in</strong>dustry’s direct social contributions for 2007 should<br />

be considered <strong>in</strong> <strong>the</strong> context <strong>of</strong> <strong>the</strong> follow<strong>in</strong>g:<br />

<br />

<br />

The registered clubs <strong>in</strong>dustry’s gam<strong>in</strong>g mach<strong>in</strong>e <strong>in</strong>come <strong>in</strong> <strong>the</strong> 2007 gam<strong>in</strong>g<br />

mach<strong>in</strong>e tax year was $2.8 billion. 73 As Chapter 6 will discuss, gam<strong>in</strong>g mach<strong>in</strong>e<br />

revenue typically subsidises club activities such as bar and restaurant operations,<br />

as well as <strong>the</strong> provision <strong>of</strong> community facilities (<strong>in</strong>clud<strong>in</strong>g sport<strong>in</strong>g fields, bowl<strong>in</strong>g<br />

greens, golf courses and meet<strong>in</strong>g rooms). This enables clubs to provide facilities<br />

and services at prices below <strong>the</strong> market rate (as recognised through <strong>the</strong> value <strong>of</strong><br />

direct <strong>in</strong>-k<strong>in</strong>d contributions <strong>of</strong> $676 million, or $1,244 million less $568 million), as<br />

well as make direct cash contributions to <strong>the</strong>ir communities.<br />

The gam<strong>in</strong>g mach<strong>in</strong>e revenue tax rates for registered clubs are around half <strong>of</strong><br />

those that apply for <strong>NSW</strong> hotels. In effect, this provides <strong>the</strong> clubs <strong>in</strong>dustry with a<br />

tax concession <strong>of</strong> approximately $484 million for 2007/08.<br />

IPART notes that, <strong>in</strong> 2007, <strong>the</strong> clubs <strong>in</strong>dustry received total revenue <strong>of</strong> $5.4 billion,<br />

and <strong>in</strong>curred $4.2 billion <strong>in</strong> expenditure for all operations. 74 The difference between<br />

total revenue and expenditure was $1.2 billion. As not-for-pr<strong>of</strong>it entities, <strong>the</strong><br />

difference between clubs’ revenue and <strong>the</strong>ir expenditure clearly has a relationship to<br />

<strong>the</strong>ir social contributions (ie, this difference can only be spent on provid<strong>in</strong>g benefits<br />

to members <strong>in</strong> l<strong>in</strong>e with <strong>the</strong> club primary purpose or mak<strong>in</strong>g contributions to <strong>the</strong><br />

73 Calculated as gam<strong>in</strong>g mach<strong>in</strong>e revenue (excess <strong>of</strong> revenue from mach<strong>in</strong>es over outgo<strong>in</strong>gs from<br />

mach<strong>in</strong>es) less gam<strong>in</strong>g mach<strong>in</strong>e tax/duty.<br />

74 ACG, Socio-Economic Impact Study <strong>of</strong> <strong>Clubs</strong> <strong>in</strong> <strong>NSW</strong> (2007), 2008, p 15.<br />

76 IPART <strong>Review</strong> <strong>of</strong> <strong>the</strong> <strong>Registered</strong> <strong>Clubs</strong> <strong>Industry</strong> <strong>in</strong> <strong>NSW</strong>