Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Review of the Registered Clubs Industry in NSW - Clubs NSW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

11 Mak<strong>in</strong>g it easier for clubs to amalgamate<br />

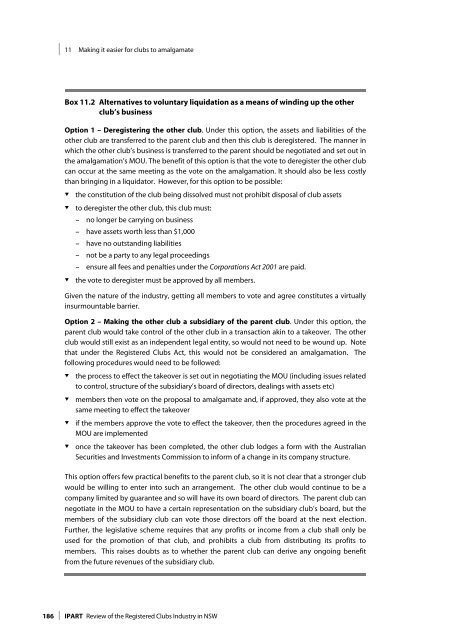

Box 11.2 Alternatives to voluntary liquidation as a means <strong>of</strong> w<strong>in</strong>d<strong>in</strong>g up <strong>the</strong> o<strong>the</strong>r<br />

club’s bus<strong>in</strong>ess<br />

Option 1 – Deregister<strong>in</strong>g <strong>the</strong> o<strong>the</strong>r club. Under this option, <strong>the</strong> assets and liabilities <strong>of</strong> <strong>the</strong><br />

o<strong>the</strong>r club are transferred to <strong>the</strong> parent club and <strong>the</strong>n this club is deregistered. The manner <strong>in</strong><br />

which <strong>the</strong> o<strong>the</strong>r club’s bus<strong>in</strong>ess is transferred to <strong>the</strong> parent should be negotiated and set out <strong>in</strong><br />

<strong>the</strong> amalgamation’s MOU. The benefit <strong>of</strong> this option is that <strong>the</strong> vote to deregister <strong>the</strong> o<strong>the</strong>r club<br />

can occur at <strong>the</strong> same meet<strong>in</strong>g as <strong>the</strong> vote on <strong>the</strong> amalgamation. It should also be less costly<br />

than br<strong>in</strong>g<strong>in</strong>g <strong>in</strong> a liquidator. However, for this option to be possible:<br />

<br />

<br />

<br />

<strong>the</strong> constitution <strong>of</strong> <strong>the</strong> club be<strong>in</strong>g dissolved must not prohibit disposal <strong>of</strong> club assets<br />

to deregister <strong>the</strong> o<strong>the</strong>r club, this club must:<br />

– no longer be carry<strong>in</strong>g on bus<strong>in</strong>ess<br />

– have assets worth less than $1,000<br />

– have no outstand<strong>in</strong>g liabilities<br />

– not be a party to any legal proceed<strong>in</strong>gs<br />

– ensure all fees and penalties under <strong>the</strong> Corporations Act 2001 are paid.<br />

<strong>the</strong> vote to deregister must be approved by all members.<br />

Given <strong>the</strong> nature <strong>of</strong> <strong>the</strong> <strong>in</strong>dustry, gett<strong>in</strong>g all members to vote and agree constitutes a virtually<br />

<strong>in</strong>surmountable barrier.<br />

Option 2 – Mak<strong>in</strong>g <strong>the</strong> o<strong>the</strong>r club a subsidiary <strong>of</strong> <strong>the</strong> parent club. Under this option, <strong>the</strong><br />

parent club would take control <strong>of</strong> <strong>the</strong> o<strong>the</strong>r club <strong>in</strong> a transaction ak<strong>in</strong> to a takeover. The o<strong>the</strong>r<br />

club would still exist as an <strong>in</strong>dependent legal entity, so would not need to be wound up. Note<br />

that under <strong>the</strong> <strong>Registered</strong> <strong>Clubs</strong> Act, this would not be considered an amalgamation. The<br />

follow<strong>in</strong>g procedures would need to be followed:<br />

<br />

<br />

<br />

<br />

<strong>the</strong> process to effect <strong>the</strong> takeover is set out <strong>in</strong> negotiat<strong>in</strong>g <strong>the</strong> MOU (<strong>in</strong>clud<strong>in</strong>g issues related<br />

to control, structure <strong>of</strong> <strong>the</strong> subsidiary’s board <strong>of</strong> directors, deal<strong>in</strong>gs with assets etc)<br />

members <strong>the</strong>n vote on <strong>the</strong> proposal to amalgamate and, if approved, <strong>the</strong>y also vote at <strong>the</strong><br />

same meet<strong>in</strong>g to effect <strong>the</strong> takeover<br />

if <strong>the</strong> members approve <strong>the</strong> vote to effect <strong>the</strong> takeover, <strong>the</strong>n <strong>the</strong> procedures agreed <strong>in</strong> <strong>the</strong><br />

MOU are implemented<br />

once <strong>the</strong> takeover has been completed, <strong>the</strong> o<strong>the</strong>r club lodges a form with <strong>the</strong> Australian<br />

Securities and Investments Commission to <strong>in</strong>form <strong>of</strong> a change <strong>in</strong> its company structure.<br />

This option <strong>of</strong>fers few practical benefits to <strong>the</strong> parent club, so it is not clear that a stronger club<br />

would be will<strong>in</strong>g to enter <strong>in</strong>to such an arrangement. The o<strong>the</strong>r club would cont<strong>in</strong>ue to be a<br />

company limited by guarantee and so will have its own board <strong>of</strong> directors. The parent club can<br />

negotiate <strong>in</strong> <strong>the</strong> MOU to have a certa<strong>in</strong> representation on <strong>the</strong> subsidiary club’s board, but <strong>the</strong><br />

members <strong>of</strong> <strong>the</strong> subsidiary club can vote those directors <strong>of</strong>f <strong>the</strong> board at <strong>the</strong> next election.<br />

Fur<strong>the</strong>r, <strong>the</strong> legislative scheme requires that any pr<strong>of</strong>its or <strong>in</strong>come from a club shall only be<br />

used for <strong>the</strong> promotion <strong>of</strong> that club, and prohibits a club from distribut<strong>in</strong>g its pr<strong>of</strong>its to<br />

members. This raises doubts as to whe<strong>the</strong>r <strong>the</strong> parent club can derive any ongo<strong>in</strong>g benefit<br />

from <strong>the</strong> future revenues <strong>of</strong> <strong>the</strong> subsidiary club.<br />

186 IPART <strong>Review</strong> <strong>of</strong> <strong>the</strong> <strong>Registered</strong> <strong>Clubs</strong> <strong>Industry</strong> <strong>in</strong> <strong>NSW</strong>