- Page 1 and 2:

Tulsa Comprehensive Plan Vision Con

- Page 3 and 4:

Introduction Our Vision for Tulsa i

- Page 5 and 6:

Executive Summary Matt Moff ett Exe

- Page 7 and 8:

Guiding Principles Capturing these

- Page 9 and 10:

The Vision of Tulsa’s Future PLAN

- Page 11 and 12:

The Vision of Tulsa’s Future Lind

- Page 13 and 14:

The Vision of Tulsa’s Future The

- Page 15 and 16:

The Vision of Tulsa’s Future KEy

- Page 17 and 18:

Plan Chapter: Land Use LAND USE bUi

- Page 19 and 20:

Plan Chapter: Land Use VISUALIzATIO

- Page 21 and 22:

Plan Chapter: Land Use ExAMPLES OF

- Page 23 and 24:

Plan Chapter: Land Use New resident

- Page 25 and 26:

Plan Chapter: Land Use U.S. green b

- Page 27 and 28:

Plan Chapter: Transportation Plan C

- Page 29 and 30:

Plan Chapter: Transportation NETWOr

- Page 31 and 32:

Plan Chapter: Transportation How We

- Page 33 and 34:

Plan Chapter: Economic Development

- Page 35 and 36:

Plan Chapter: Housing TULSA’S FUT

- Page 37 and 38:

Plan Chapter: Parks Plan Chapter Pa

- Page 39 and 40:

Achieving the Vision Matt Moff ett

- Page 41 and 42:

Achieving the Vision: Strategies Pr

- Page 43 and 44:

Achieving the Vision: Strategies MA

- Page 45 and 46:

Achieving the Vision: Strategies St

- Page 47 and 48:

Next Steps and Plan Structure SUCCE

- Page 49 and 50:

City of Tulsa Planning Department C

- Page 51 and 52:

Land Use Land Use Part I: Our Visio

- Page 53 and 54:

Land Use parT i: OUR VisiOn FOR TUL

- Page 55 and 56:

Land Use Land Use Part II: Tulsa’

- Page 57 and 58:

Land Use parT ii: TULsa’s PasT an

- Page 59 and 60:

Land Use parT ii: TULsa’s PasT an

- Page 61 and 62:

Land Use parT ii: TULsa’s PasT an

- Page 63 and 64:

Land Use chart 6: distribution by a

- Page 65 and 66:

Land Use parT iii: TULsa’s FUTURe

- Page 67 and 68:

Land Use parT iv: Land Use PLanninG

- Page 69 and 70:

Land Use parT iv: Land Use PLanninG

- Page 71 and 72:

Land Use parT iv: Land Use PLanninG

- Page 73 and 74:

Land Use parT iv: Land Use PLanninG

- Page 75 and 76:

Land Use Land Use part v: Building

- Page 77 and 78:

Land Use parT v: BUiLdinG THe PLan

- Page 79 and 80:

Land Use parT v: BUiLdinG THe PLan

- Page 81 and 82:

Land Use parT v: BUiLdinG THe PLan

- Page 83 and 84:

Land Use parT v: BUiLdinG THe PLan

- Page 85 and 86:

Land Use parT v: BUiLdinG THe PLan

- Page 87 and 88:

Land Use parT v: BUiLdinG THe PLan

- Page 89 and 90:

Land Use parT v: BUiLdinG THe PLan

- Page 91 and 92:

Land Use parT v: BUiLdinG THe PLan

- Page 93 and 94:

Land Use parT v: BUiLdinG THe PLan

- Page 95 and 96:

Land Use parT v: BUiLdinG THe PLan

- Page 97 and 98:

Land Use parT v: BUiLdinG THe PLan

- Page 99 and 100:

Land Use parT v: BUiLdinG THe PLan

- Page 101 and 102:

Land Use Land Use part vi: Managing

- Page 103 and 104:

Land Use parT vi: ManaGinG THe PLan

- Page 105 and 106:

Land Use parT vi: ManaGinG THe PLan

- Page 107 and 108:

Land Use parT vi: ManaGinG THe PLan

- Page 109 and 110:

Land Use parT vi: ManaGinG THe PLan

- Page 111 and 112:

Land Use parT vi: ManaGinG THe PLan

- Page 113 and 114:

Land Use parT vi: ManaGinG THe PLan

- Page 115 and 116:

Land Use parT vi: ManaGinG THe PLan

- Page 117 and 118:

Land Use parT vi: ManaGinG THe PLan

- Page 119 and 120:

Land Use parT vii: MOniTORinG THe P

- Page 121 and 122:

Land Use parT vii: MOniTORinG THe P

- Page 123 and 124:

Land Use parT viii: PRiORiTies, GOa

- Page 125 and 126:

Land Use parT viii: PRiORiTies, GOa

- Page 127 and 128:

Land Use parT viii: PRiORiTies, GOa

- Page 129 and 130:

Land Use parT viii: PRiORiTies, GOa

- Page 131 and 132:

Land Use parT viii: PRiORiTies, GOa

- Page 133 and 134:

Land Use parT viii: PRiORiTies, GOa

- Page 135 and 136:

Land Use parT viii: PRiORiTies, GOa

- Page 137 and 138:

Transportation transportation Part

- Page 139 and 140:

Transportation PArT I: Vision anD C

- Page 141 and 142:

Transportation PArT I: Vision anD C

- Page 143 and 144:

Transportation P ArT I: Vision anD

- Page 145 and 146:

Transportation transportation Part

- Page 147 and 148:

Transportation PArT II: thE roUtE F

- Page 149 and 150:

Transportation PArT II: thE roUtE F

- Page 151 and 152:

Transportation PArT II: thE roUtE F

- Page 153 and 154:

Transportation PArT II: thE roUtE F

- Page 155 and 156:

Transportation PArT II: thE roUtE F

- Page 157 and 158:

Transportation PArT III: tooLs For

- Page 159 and 160:

Transportation PArT III: tooLs For

- Page 161 and 162:

Transportation PArT III: tooLs For

- Page 163 and 164:

Transportation PArT III: tooLs For

- Page 165 and 166:

Transportation PArT III: tooLs For

- Page 167 and 168:

Transportation PArT III: tooLs For

- Page 169 and 170:

Transportation TR 34 SIx LIVABILITy

- Page 171 and 172:

Transportation PArT V: prioritiEs,

- Page 173 and 174:

Transportation PArT V: prioritiEs,

- Page 175 and 176:

Transportation PArT V: prioritiEs,

- Page 177 and 178:

Transportation PArT V: prioritiEs,

- Page 179 and 180:

Housing Housing part i: Tulsa’s H

- Page 181 and 182:

Housing parT i: TuLsA’s Housing T

- Page 183 and 184:

Housing parT ii: TuLsA’s FuTuRE H

- Page 185 and 186:

Housing parT ii: TuLsA’s FuTuRE H

- Page 187 and 188:

Housing Guiding principles for hous

- Page 189 and 190:

Housing parT iii: PRioRiTiEs, goALs

- Page 191 and 192:

Tulsa Economic Comprehensive develo

- Page 193 and 194:

Economic development parT i: AnAlyS

- Page 195 and 196:

Economic development parT i: AnAlyS

- Page 197 and 198:

Economic development parT i: AnAlyS

- Page 199 and 200:

Economic development economic devel

- Page 201 and 202:

Economic development parT ii: econo

- Page 203 and 204:

Economic development parT ii: econo

- Page 205 and 206:

Economic development parT ii: econo

- Page 207 and 208:

Economic development parT iii: pRio

- Page 209 and 210:

Economic development parT ii: econo

- Page 211 and 212:

Parks, Tulsa Trails Comprehensive a

- Page 213 and 214:

Parks, Trails and Open Space parT i

- Page 215 and 216:

Parks, Trails and Open Space Parks,

- Page 217 and 218:

Parks, Trails and Open Space parT i

- Page 219 and 220:

Parks, Trails and Open Space Parks,

- Page 221 and 222:

Parks, Trails and Open Space parT i

- Page 223 and 224:

Parks, Trails and Open Space parT i

- Page 225 and 226:

Parks, Trails and Open Space parT i

- Page 227 and 228:

Parks, Trails and Open Space parT i

- Page 229 and 230:

Parks, Trails and Open Space parT v

- Page 231 and 232:

Parks, Trails and Open Space Guidin

- Page 233 and 234:

Parks, Trails and Open Space parT v

- Page 235 and 236:

Parks, Trails and Open Space parT v

- Page 237 and 238:

Parks, Trails and Open Space parT v

- Page 239 and 240:

Parks, Trails and Open Space parT v

- Page 241 and 242: Tulsa Comprehensive Plan Appendix A

- Page 243 and 244: Appendix LAnD Use: SMAll AreA PlANN

- Page 245 and 246: Appendix LAnD Use: SMAll AreA PlANN

- Page 247 and 248: Appendix LAnD Use: SMAll AreA PlANN

- Page 249 and 250: Appendix LAnD Use: SMAll AreA PlANN

- Page 251 and 252: Appendix Appendix Transportation I

- Page 253 and 254: Appendix TrAnsporTATIon I: CONTexT-

- Page 255 and 256: Appendix TrAnsporTATIon I: CONTexT-

- Page 257 and 258: Appendix TrAnsporTATIon I: CONTexT-

- Page 259 and 260: Appendix TrAnsporTATIon I: CONTexT-

- Page 261 and 262: Appendix TrAnsporTATIon I: CONTexT-

- Page 263 and 264: Appendix TrAnsporTATIon I: CONTexT-

- Page 265 and 266: Appendix TrAnsporTATIon I: CONTexT-

- Page 267 and 268: Appendix TrAnsporTATIon I: CONTexT-

- Page 269 and 270: Appendix Appendix Transportation II

- Page 271 and 272: Appendix TrAnsporTATIon II: UrBAN C

- Page 273 and 274: Appendix TrAnsporTATIon II: UrBAN C

- Page 275 and 276: Appendix TrAnsporTATIon II: UrBAN C

- Page 277 and 278: Appendix TrAnsporTATIon II: UrBAN C

- Page 279 and 280: Appendix TrAnsporTATIon II: UrBAN C

- Page 281 and 282: Appendix TrAnsporTATIon II: UrBAN C

- Page 283 and 284: Appendix TrAnsporTATIon II: UrBAN C

- Page 285 and 286: Appendix TrAnsporTATIon II: UrBAN C

- Page 287 and 288: Appendix Appendix Transportation II

- Page 289 and 290: Appendix TrAnsporTATIon III: SUSTAI

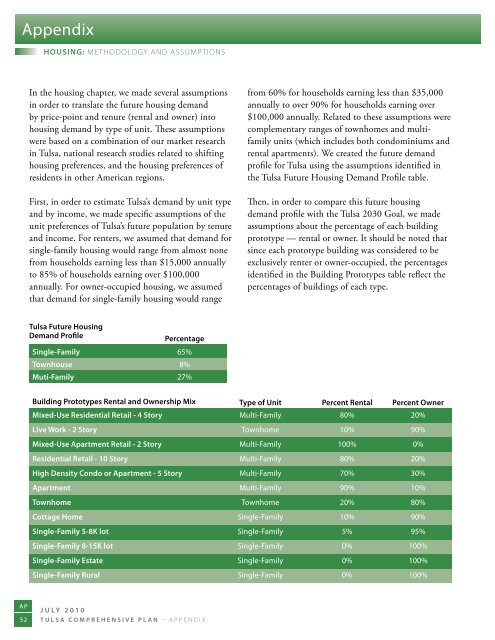

- Page 291: Appendix Appendix Housing Methodolo

- Page 295 and 296: Appendix GLossAry Business iMproveM

- Page 297 and 298: Appendix GLossAry growth scenArios:

- Page 299 and 300: Appendix GLossAry Mixed-use develop

- Page 301 and 302: Appendix GLossAry the linear space