- Page 1 and 2:

Proceedings <stron

- Page 3 and 4:

Contents Paper Title Author(s) Page

- Page 5 and 6:

Paper Title Author(s) Page No. Hier

- Page 7 and 8:

Preface These proceedings represent

- Page 9 and 10:

educating through ‘hands on’ co

- Page 11 and 12:

Ibrahim Elbeltagi is a Senior lectu

- Page 13 and 14:

Theodora Ngosi has a PhD in Compute

- Page 15:

José Vale is an invited assistant

- Page 19 and 20:

Social Knowledge: Are you Ready? 1

- Page 21 and 22:

John Girard don’t know.” (Benne

- Page 23 and 24:

John Girard The real question becom

- Page 25 and 26:

John Girard our belief that many le

- Page 27 and 28:

John Girard organizations to gain k

- Page 29 and 30:

Intellectual Capital Accounting - H

- Page 31:

Academic Research Papers 15

- Page 34 and 35:

Khodayar Abili and Mahyar Abili The

- Page 36 and 37:

Khodayar Abili and Mahyar Abili Nah

- Page 38 and 39:

Khodayar Abili and Mahyar Abili Tim

- Page 40 and 41:

Knowledge Transfer in Romanian Univ

- Page 42 and 43:

Simona Agoston et al. Table 1: Know

- Page 44 and 45:

Simona Agoston et al. homoscedastic

- Page 46 and 47:

Simona Agoston et al. included in <

- Page 48 and 49:

A Modeling Approach to Intellectual

- Page 50 and 51:

Eckhard Ammann (referring to <stron

- Page 52 and 53:

Eckhard Ammann Figure 2: The IC spa

- Page 54 and 55:

Eckhard Ammann section 2. They are

- Page 56 and 57:

Eckhard Ammann From an overall pers

- Page 58 and 59:

Sorin Anagnoste and Gabriela Dumitr

- Page 60 and 61:

Sorin Anagnoste and Gabriela Dumitr

- Page 62 and 63:

Sorin Anagnoste and Gabriela Dumitr

- Page 64 and 65:

Sorin Anagnoste and Gabriela Dumitr

- Page 66 and 67:

Sorin Anagnoste and Gabriela Dumitr

- Page 68 and 69:

Sorin Anagnoste and Gabriela Dumitr

- Page 70 and 71:

Gabriela Atanasiu and Florin Leon T

- Page 72 and 73:

Gabriela Atanasiu and Florin Leon

- Page 74 and 75:

Gabriela Atanasiu and Florin Leon B

- Page 76 and 77:

Gabriela Atanasiu and Florin Leon a

- Page 78 and 79:

Developing and Implementing Strateg

- Page 80 and 81:

2. Technology, faculty, and staff B

- Page 82 and 83:

Learning programs Individual poten

- Page 84 and 85:

Bob Barrett facts with the<

- Page 86 and 87:

Intellectual Capital Dynamics withi

- Page 88 and 89:

Ruxandra Bejinaru and Stefan Iordac

- Page 90 and 91:

Ruxandra Bejinaru and Stefan Iordac

- Page 92 and 93:

Ruxandra Bejinaru and Stefan Iordac

- Page 94 and 95:

Education and Training Practice Str

- Page 96 and 97:

Andrea Bencsik et al. We wanted to

- Page 98 and 99:

Andrea Bencsik et al. In this sampl

- Page 100 and 101:

Table 4: Types of

- Page 102 and 103:

References Andrea Bencsik et al. An

- Page 104 and 105:

Ayşen Berberoğlu and Emine Ünar

- Page 106 and 107:

Ayşen Berberoğlu and Emine Ünar

- Page 108 and 109:

Table 7: Descriptive statistics Ay

- Page 110 and 111:

Knowledge Dynamics Modeling Using A

- Page 112 and 113:

Constantin Bratianu et al. will hav

- Page 114 and 115:

Constantin Bratianu et al. 5. a) Gi

- Page 116 and 117:

Constantin Bratianu et al. 5. Data

- Page 118 and 119:

Constantin Bratianu et al. Nissen,

- Page 120 and 121:

2. Technology and infrastructure Sh

- Page 122 and 123:

Sheryl Buckley and Apostolos Gianna

- Page 124 and 125:

Sheryl Buckley and Apostolos Gianna

- Page 126 and 127:

Sheryl Buckley and Apostolos Gianna

- Page 128 and 129:

Sheryl Buckley and Apostolos Gianna

- Page 130 and 131:

Donley Carrington and Mike Tayles t

- Page 132 and 133:

Donley Carrington and Mike Tayles f

- Page 134 and 135:

Donley Carrington and Mike Tayles l

- Page 136 and 137: Donley Carrington and Mike Tayles i

- Page 138 and 139: Donley Carrington and Mike Tayles G

- Page 140 and 141: John Dumay and Jim Rooney on a more

- Page 142 and 143: John Dumay and Jim Rooney Taking <s

- Page 144 and 145: John Dumay and Jim Rooney “For ex

- Page 146 and 147: John Dumay and Jim Rooney Mouritsen

- Page 148 and 149: Marziye Ehrami et al. 1. Creation

- Page 150 and 151: Marziye Ehrami et al. Note: In 2005

- Page 152 and 153: Earnings Quality and Othe</

- Page 154 and 155: Magdi El-Bannany resource-based per

- Page 156 and 157: Magdi El-Bannany Based on this argu

- Page 158 and 159: Magdi El-Bannany Table 2: Descripti

- Page 160 and 161: Magdi El-Bannany variable equal to

- Page 162 and 163: Magdi El-Bannany Edvinsson, L. & Ma

- Page 164 and 165: Ahmed Elsetouhi and Ibrahim Elbelta

- Page 166 and 167: Ahmed Elsetouhi and Ibrahim Elbelta

- Page 168 and 169: Ahmed Elsetouhi and Ibrahim Elbelta

- Page 170 and 171: Ahmed Elsetouhi and Ibrahim Elbelta

- Page 172 and 173: Ahmed Elsetouhi and Ibrahim Elbelta

- Page 174 and 175: Albrecht Fritzsche and Rebecca Geig

- Page 176 and 177: Albrecht Fritzsche and Rebecca Geig

- Page 178 and 179: Table 4: Applicability of</

- Page 180 and 181: Albrecht Fritzsche and Rebecca Geig

- Page 182 and 183: S&P 500 Market Cap ($ billions) 14,

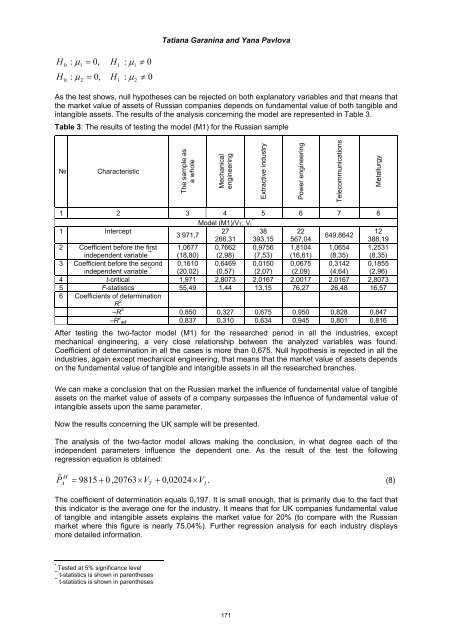

- Page 184 and 185: Tatiana Garanina and Yana Pavlova T

- Page 188 and 189: Tatiana Garanina and Yana Pavlova T

- Page 190 and 191: Tatiana Garanina and Yana Pavlova I

- Page 192 and 193: Impact of Investme

- Page 194 and 195: Lidia García-Zambrano et al. 2003;

- Page 196 and 197: Lidia García-Zambrano et al. 4.2 P

- Page 198 and 199: Table 7: Goodness of</stron

- Page 200 and 201: Lidia García-Zambrano et al. reaso

- Page 202 and 203: Lidia García-Zambrano et al. Rodri

- Page 204 and 205: Víctor Raúl López Ruiz et al. co

- Page 206 and 207: Víctor Raúl López Ruiz et al. NI

- Page 208 and 209: EI c k i 1 w PC i ic Víctor Raúl

- Page 210 and 211: Víctor Raúl López Ruiz et al. Ta

- Page 212 and 213: Víctor Raúl López Ruiz et al. Co

- Page 214 and 215: Víctor Raúl López Ruiz et al. At

- Page 216 and 217: Maria de Lourdes Machado and Odíli

- Page 218 and 219: Maria de Lourdes Machado and Odíli

- Page 220 and 221: Maria de Lourdes Machado and Odíli

- Page 222 and 223: Intellectual Capital and Corporate

- Page 224 and 225: Agnes Maciocha when objects in a da

- Page 226 and 227: Agnes Maciocha 4. Presentation <str

- Page 228 and 229: Agnes Maciocha while in the

- Page 230 and 231: Agnes Maciocha Choong K., “Intell

- Page 232 and 233: The Influence of H

- Page 234 and 235: Anca Mândruleanu From the<

- Page 236 and 237:

Anca Mândruleanu In Table 2, <stro

- Page 238 and 239:

Eliciting Tacit Knowledge From a Do

- Page 240 and 241:

Peter Marshall and Damian Gordon MM

- Page 242 and 243:

Peter Marshall and Damian Gordon re

- Page 244 and 245:

Peter Marshall and Damian Gordon ar

- Page 246 and 247:

Peter Marshall and Damian Gordon Th

- Page 248 and 249:

Maurizio Massaro et al. crucial fac

- Page 250 and 251:

Maurizio Massaro et al. exclusive (

- Page 252 and 253:

Maurizio Massaro et al. autonomy <s

- Page 254 and 255:

Maurizio Massaro et al. Chennal (20

- Page 256 and 257:

Intellectual Capital Management: Ca

- Page 258 and 259:

Florinda Matos et al. These models

- Page 260 and 261:

Complaints System dos clients New

- Page 262 and 263:

Florinda Matos et al. Finally, <str

- Page 264 and 265:

Florinda Matos et al. The training

- Page 266 and 267:

Florinda Matos et al. 47. Opinion

- Page 268 and 269:

Florinda Matos et al. In th

- Page 270 and 271:

Florinda Matos et al. The Quadrant

- Page 272 and 273:

Florinda Matos et al. Integrated te

- Page 274 and 275:

Florinda Matos et al. The networks

- Page 276 and 277:

Knowledge Management for Knowledge

- Page 278 and 279:

3. Our research Ludmila Mládková

- Page 280 and 281:

Ludmila Mládková organizational s

- Page 282 and 283:

Ludmila Mládková mentioned only b

- Page 284 and 285:

Applying the VAIC

- Page 286 and 287:

Maria Molodchik and Anna Bykova pro

- Page 288 and 289:

Maria Molodchik and Anna Bykova 2.

- Page 290 and 291:

Maria Molodchik and Anna Bykova Let

- Page 292 and 293:

Maria Molodchik and Anna Bykova The

- Page 294 and 295:

Perspectives on the</strong

- Page 296 and 297:

Maria Cristina Morariu as we consid

- Page 298 and 299:

Maria Cristina Morariu Tobin’s q

- Page 300 and 301:

Maria Cristina Morariu for determin

- Page 302 and 303:

The Structural Model of</st

- Page 304 and 305:

Fattah Nazem Ackerley (2006) reveal

- Page 306 and 307:

Fattah Nazem The research instrumen

- Page 308 and 309:

Fattah Nazem intellectual capital m

- Page 310 and 311:

Fattah Nazem Johnson, M.J. (1986) T

- Page 312 and 313:

Andrei Stefan Nestian organization.

- Page 314 and 315:

Andrei Stefan Nestian Chaordic syst

- Page 316 and 317:

Andrei Stefan Nestian environment,

- Page 318 and 319:

Increasing Knowledge Management Mat

- Page 320 and 321:

Theodora Ngosi et al. 2.2 Dominatin

- Page 322 and 323:

Theodora Ngosi et al. Figure 1: Del

- Page 324 and 325:

Theodora Ngosi et al. IT systems, a

- Page 326 and 327:

5. Discussion and summary Theodora

- Page 328 and 329:

Theodora Ngosi et al. Weill, P., an

- Page 330 and 331:

Bongani Ngwenya late adopters respo

- Page 332 and 333:

Bongani Ngwenya This paper extends

- Page 334 and 335:

Bongani Ngwenya argument, t

- Page 336 and 337:

Bongani Ngwenya DiMaggio, P. J., an

- Page 338 and 339:

The Quality of Kno

- Page 340 and 341:

5.2 5 4.8 4.6 4.4 4.2 4 3.8 Compete

- Page 342 and 343:

Corina Pelau et al. In order to imp

- Page 344 and 345:

Hierarchy and Tacit Knowledge in <s

- Page 346 and 347:

Ulrica Pettersson and James Nyce in

- Page 348 and 349:

Ulrica Pettersson and James Nyce mi

- Page 350 and 351:

Katja Pook and Campbell Warden time

- Page 352 and 353:

Katja Pook and Campbell Warden futu

- Page 354 and 355:

5. Commonalities of</strong

- Page 356 and 357:

Katja Pook and Campbell Warden <str

- Page 358 and 359:

Katja Pook and Campbell Warden Lazl

- Page 360 and 361:

Nicolae Al. Pop et al. satisfaction

- Page 362 and 363:

Nicolae Al. Pop et al. the<

- Page 364 and 365:

Nicolae Al. Pop et al. satisfaction

- Page 366 and 367:

Knowledge Cities: A Portuguese Case

- Page 368 and 369:

Katia Rodrigues and Eduardo Tomé

- Page 370 and 371:

3. The empirical study 3.1 Methodol

- Page 372 and 373:

Table 3: Smart cities - application

- Page 374 and 375:

4.3 Suggestions to future work Kati

- Page 376 and 377:

Anna Romiti and Daria Sarti 2. Orga

- Page 378 and 379:

Anna Romiti and Daria Sarti based o

- Page 380 and 381:

Anna Romiti and Daria Sarti Governa

- Page 382 and 383:

Anna Romiti and Daria Sarti Therefo

- Page 384 and 385:

Anna Romiti and Daria Sarti Valkoka

- Page 386 and 387:

Kent Rondeau and Terry Wagar planne

- Page 388 and 389:

2.1 Study measures Kent Rondeau and

- Page 390 and 391:

Kent Rondeau and Terry Wagar contri

- Page 392 and 393:

Kent Rondeau and Terry Wagar Our re

- Page 394 and 395:

Intellectual Capital and a Firm’s

- Page 396 and 397:

Figure 1: Hypothes

- Page 398 and 399:

Helena Santos-Rodrigues et al. Norm

- Page 400 and 401:

Helena Santos-Rodrigues et al. To s

- Page 402 and 403:

Helena Santos-Rodrigues et al. Our

- Page 404 and 405:

Factors Influencing the</st

- Page 406 and 407:

Thanaletchumi Sathasivam et al. 2.3

- Page 408 and 409:

Thanaletchumi Sathasivam et al. The

- Page 410 and 411:

Thanaletchumi Sathasivam et al. gro

- Page 412 and 413:

Thanaletchumi Sathasivam et al. The

- Page 414 and 415:

Thanaletchumi Sathasivam et al. 11.

- Page 416 and 417:

Enhancing IC Formation by Evoking H

- Page 418 and 419:

Klaus Bruno Schebesch to portray <s

- Page 420 and 421:

Klaus Bruno Schebesch 4. Leaning an

- Page 422 and 423:

Klaus Bruno Schebesch We argue in f

- Page 424 and 425:

Klaus Bruno Schebesch come

- Page 426 and 427:

In Search of key F

- Page 428 and 429:

Karen Smits et al. contribution, wi

- Page 430 and 431:

Karen Smits et al. Table 1: Correla

- Page 432 and 433:

Karen Smits et al. staff feel that

- Page 434 and 435:

Marta-Christina Suciu et al. This p

- Page 436 and 437:

Marta-Christina Suciu et al. <stron

- Page 438 and 439:

Marta-Christina Suciu et al. The qu

- Page 440 and 441:

Marta-Christina Suciu et al. This t

- Page 442 and 443:

Information and Communication Techn

- Page 444 and 445:

Jukka Surakka et al. The participan

- Page 446 and 447:

Jukka Surakka et al. people. Commun

- Page 448 and 449:

Personal Knowledge Management (PKM)

- Page 450 and 451:

Marzena Świgoń provide th

- Page 452 and 453:

Marzena Świgoń (number and type <

- Page 454 and 455:

Marzena Świgoń measure self-perce

- Page 456 and 457:

Eduardo Tomé what we consider to b

- Page 458 and 459:

Eduardo Tomé IC. The intervention

- Page 460 and 461:

Eduardo Tomé In the</stro

- Page 462 and 463:

Eduardo Tomé to stress that <stron

- Page 464 and 465:

Eleni Magdalini Vasileiadou et al.

- Page 466 and 467:

Eleni Magdalini Vasileiadou et al.

- Page 468 and 469:

Eleni Magdalini Vasileiadou et al.

- Page 470 and 471:

Eleni Magdalini Vasileiadou et al.

- Page 472 and 473:

Eleni Magdalini Vasileiadou et al.

- Page 474 and 475:

Eleni Magdalini Vasileiadou et al.

- Page 476 and 477:

Eleni Magdalini Vasileiadou et al.

- Page 478 and 479:

José María Viedma Marti products

- Page 480 and 481:

Sustainable competitive advantage T

- Page 482 and 483:

José María Viedma Marti knowledge

- Page 484 and 485:

José María Viedma Marti pr<strong

- Page 486 and 487:

José María Viedma Marti All <stro

- Page 488 and 489:

ICBS I CBS José María Viedma Mart

- Page 490 and 491:

José María Viedma Marti Sullivan,

- Page 492 and 493:

2. Balanced scorecard framework Ang

- Page 494 and 495:

Angelos Vouldis and Angelica Kokkin

- Page 496 and 497:

Unclear benefits of</strong

- Page 498 and 499:

Angelos Vouldis and Angelica Kokkin

- Page 500 and 501:

9. Discussion and conclusions Angel

- Page 502 and 503:

The Global Position of</str

- Page 504 and 505:

Piotr Wisniewski safeguarding IC vi

- Page 506 and 507:

Piotr Wisniewski Figure 2: Ten larg

- Page 508 and 509:

Piotr Wisniewski suspected

- Page 510 and 511:

Piotr Wisniewski 2) Slow growth in

- Page 512 and 513:

Piotr Wisniewski US 3.8 3.8 3.9 4.3

- Page 514 and 515:

498

- Page 516 and 517:

500

- Page 518 and 519:

2. Hypothesis deve

- Page 520 and 521:

3.2 Control variables Deborah Brans

- Page 522 and 523:

Deborah Branswijck and Patricia Eve

- Page 524 and 525:

Deborah Branswijck and Patricia Eve

- Page 526 and 527:

Korosh Gholami et al. Durkheim beli

- Page 528 and 529:

Korosh Gholami et al. The effect <s

- Page 530 and 531:

Measure the Unmeas

- Page 532 and 533:

Knowledge Capital 5. Efforts for de

- Page 534 and 535:

Exclusive use of L

- Page 536 and 537:

Emmanouil Gkinoglou from th

- Page 538 and 539:

Project Assets Need for synergies Q

- Page 540 and 541:

Table 5: Sustainability checklist E

- Page 542 and 543:

Emmanouil Gkinoglou The next challe

- Page 544 and 545:

Kai Mertins and Ronald Orth generat

- Page 546 and 547:

Kai Mertins and Ronald Orth Never<s

- Page 548 and 549:

Kai Mertins and Ronald Orth <strong

- Page 550 and 551:

Ad 2 Structure of

- Page 552 and 553:

Kai Mertins and Ronald Orth Hauff,

- Page 554 and 555:

Maria Simonova “Concept o

- Page 556 and 557:

Maria Simonova The concept regardin

- Page 558 and 559:

Maria Simonova Becker, G. S. (1983)

- Page 560 and 561:

2. The aim of appl

- Page 562 and 563:

Nellija Titova W+I+DP+D+T+M+R (equa

- Page 564 and 565:

Nellija Titova performing better. I

- Page 566 and 567:

5. Conclusions and furthe</

- Page 568 and 569:

Nellija Titova Annex 2: Summary on

- Page 570 and 571:

Meaning in the tab

- Page 572 and 573:

Krishanthi Ganga Vithana et al. for

- Page 574 and 575:

Krishanthi Ganga Vithana et al. sti

- Page 576 and 577:

5. Conclusion Krishanthi Ganga Vith

- Page 578 and 579:

562

- Page 580 and 581:

564

- Page 582 and 583:

The Tobing Knowledge Management Arc

- Page 584 and 585:

Paul Lumbantobing et al. user, know

- Page 586 and 587:

Paul Lumbantobing et al. people con

- Page 588 and 589:

Paul Lumbantobing et al. influence

- Page 590 and 591:

Develop KM Strategy Description Dev

- Page 592 and 593:

Paul Lumbantobing et al. In <strong

- Page 594 and 595:

Yuli Purwanti et al. Figure 1: Imag

- Page 596 and 597:

Yuli Purwanti et al. Table below is

- Page 598 and 599:

582

- Page 600 and 601:

584

- Page 602 and 603:

Nargiza Abdullaeva and Campbell War

- Page 604 and 605:

Nargiza Abdullaeva and Campbell War

- Page 606 and 607:

Nargiza Abdullaeva and Campbell War

- Page 608 and 609:

Andreea Feraru and Nicoleta Ciucesc

- Page 610 and 611:

Andreea Feraru and Nicoleta Ciucesc

- Page 612 and 613:

Andreea Feraru and Nicoleta Ciucesc

- Page 614 and 615:

Roxana Mironescu This could be <str

- Page 616 and 617:

Roxana Mironescu Daft, R.L. (2002)

- Page 618 and 619:

Paloma Sánchez and Oihana Basilio

- Page 620 and 621:

Evaluating Intellectual Capital Usi

- Page 622 and 623:

Table 1. CRS input efficiency score

- Page 624 and 625:

Stelian Stancu and Anca Domnica Lup

- Page 626 and 627:

José Vale et al. However, it is im

- Page 628:

José Vale et al. Pöyhönen, A. an