- Page 1 and 2:

March 31, 2011 British Columbia Uti

- Page 3 and 4:

March 31, 2011 British Columbia Uti

- Page 5 and 6:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 7 and 8:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 9 and 10:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 11 and 12:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 13 and 14:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 15 and 16:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 17 and 18:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 19 and 20:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 21 and 22:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 23 and 24:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 25 and 26:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 27 and 28:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 29 and 30:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 31 and 32:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 33 and 34:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 35 and 36:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 37 and 38:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 39 and 40:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 41 and 42:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 43 and 44:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 45 and 46:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 47 and 48:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 49 and 50:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 51 and 52:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 53 and 54:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 55 and 56:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 57 and 58:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 59 and 60:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 61 and 62:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 63 and 64:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 65 and 66:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 67 and 68:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 69 and 70:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 71 and 72:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 73 and 74:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 75 and 76:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 77 and 78:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 79 and 80:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 81 and 82:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 83 and 84:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 85 and 86:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 87 and 88:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 89 and 90:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 91 and 92:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 93 and 94:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 95 and 96:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 97 and 98:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 99 and 100:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 101 and 102:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 103 and 104:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 105 and 106:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 107 and 108:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 109 and 110:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 111 and 112:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 113 and 114:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 115 and 116:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 117 and 118:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 119 and 120:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 121 and 122:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 123 and 124:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 125 and 126:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 127 and 128:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 129 and 130:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 131 and 132:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 133 and 134:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 135 and 136:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 137 and 138:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 139 and 140:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 141 and 142:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 143 and 144:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 145 and 146:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 147 and 148:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 149 and 150:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 151 and 152:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 153 and 154:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 155 and 156:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 157 and 158:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 159 and 160:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 161 and 162:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 163 and 164:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 165 and 166:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 167 and 168:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 169 and 170:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 171 and 172:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 173 and 174:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 175 and 176:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 177 and 178:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 179 and 180:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 181 and 182:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 183 and 184:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 185 and 186:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 187 and 188:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 189 and 190:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 191 and 192:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 193 and 194:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 195 and 196:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 197 and 198:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 199 and 200:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 201 and 202:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 203 and 204:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 205 and 206:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 207 and 208:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 209 and 210:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 211 and 212:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 213 and 214:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 215 and 216:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 217 and 218:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 219 and 220:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 221 and 222:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 223 and 224:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 225 and 226:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 227 and 228:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 229 and 230:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 231 and 232:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 233 and 234:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 235 and 236:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 237 and 238:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 239 and 240:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 241 and 242:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 243 and 244:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 245 and 246:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 247 and 248:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 249 and 250:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 251 and 252:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 253 and 254:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 255 and 256:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 257 and 258:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 259 and 260:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 261 and 262:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 263 and 264:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 265 and 266:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 267 and 268:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 269 and 270:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 271 and 272:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 273 and 274:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 275 and 276:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 277 and 278:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 279 and 280:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 281 and 282:

Appendix A GLOSSARY OF TERMS

- Page 283 and 284:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 285 and 286:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 287 and 288:

FORTISBC ENERGY INC. AND FORTISBC E

- Page 289 and 290:

2010 DSM Actuals SAVINGS (GJ) Impac

- Page 291 and 292:

FORTIS BC VANCOUVER ISLAND 2010 FEV

- Page 293 and 294:

FORTIS BC 2010 FEI Programs Actuals

- Page 295 and 296:

FORTIS BC 2010 Residential Programs

- Page 297 and 298:

FORTIS BC 2010 Commercial Programs

- Page 299 and 300:

FORTIS BC 2010 Joint Initiatives Pr

- Page 301 and 302:

FORTIS BC 2010 Conservation for Aff

- Page 303 and 304:

FORTIS BC 2010 High Carbon Fuel Swi

- Page 305 and 306:

FORTIS BC 2010 High Carbon Fuel Swi

- Page 307 and 308:

2011 DSM Planned SAVINGS (GJ) Impac

- Page 309 and 310:

FORTIS BC VANCOUVER ISLAND 2011 FEV

- Page 311 and 312:

FORTIS BC COSTS ($000) 2011 DSM Pla

- Page 313 and 314:

FORTIS BC 2011 Residential Planned

- Page 315 and 316:

FORTIS BC 2011 Commercial Programs

- Page 317 and 318:

FORTIS BC 2011 Joint Initiatives Pl

- Page 319 and 320:

FORTIS BC 2011 Conservation for Aff

- Page 321 and 322:

FORTIS BC 2011 Innovative Technolog

- Page 323 and 324:

FORTIS BC 2011 High Carbon Fuel Swi

- Page 325:

Appendix C DSM REGULATION AND BCUC

- Page 332 and 333:

PART 5 — ENERGY EFFICIENCY MEASUR

- Page 334 and 335:

HER MAJESTY, by and with the advice

- Page 336 and 337:

(c) equipment and facilities that a

- Page 338 and 339:

Integrated resource plans (l) to fo

- Page 340 and 341:

services necessary to facilitate th

- Page 342 and 343:

Status report (2) In an order under

- Page 344 and 345:

prescribed circumstances and on the

- Page 346 and 347:

8 (1) In setting rates under the Ut

- Page 348 and 349:

(a) undertake a prohibited project,

- Page 350 and 351:

(ii) generates energy by means of a

- Page 352 and 353:

(5) The authority may, by itself, o

- Page 354 and 355:

"power project" means an electricit

- Page 356 and 357:

Transfer of property "right", in re

- Page 358 and 359:

(ii) execute any record required to

- Page 360 and 361:

Definitions be continued, by or aga

- Page 362 and 363:

29 (1) The transfer of a transferre

- Page 364 and 365:

(2) Despite section 36 (1) of the H

- Page 366 and 367:

08, that, under the Utilities Commi

- Page 368 and 369:

(i) respecting the authority's obli

- Page 370 and 371:

Regulations 36 (1) In making a regu

- Page 372 and 373:

Transition (a) prescribing classes

- Page 374 and 375:

(a) in subsection (1) (f) by striki

- Page 376 and 377:

(1.1) The authority's purposes are

- Page 378 and 379:

(a) any other provision of this Act

- Page 380 and 381:

eceive or may receive service from

- Page 382 and 383:

(b) an applicable integrated resour

- Page 384 and 385:

9 Section 73 July 5, 2010 Schedule

- Page 386 and 387:

(f) McGregor Lower Canyon; (g) Homa

- Page 388 and 389:

TABLE OF CONTENTS Page No. 1.0 BACK

- Page 390 and 391:

1.0 BACKGROUND AND REGULATORY PROCE

- Page 392 and 393:

1.2 Legal and Regulatory 3 1.2.1 Th

- Page 394 and 395:

1.2.4 BC Government’s Energy Obje

- Page 396 and 397:

7 Terasen also submits that the ene

- Page 398 and 399:

2.1.1.1 New Construction For new co

- Page 400 and 401:

TGI and TGVI Commercial Programs Ne

- Page 402 and 403:

13 Terasen states that commercial s

- Page 404 and 405:

New Construction 15 Table 5 Residen

- Page 406 and 407:

17 BC Hydro filed the evidence of R

- Page 408 and 409:

• Stakeholder industry group acti

- Page 410 and 411: the CEO expenditures be redirected

- Page 412 and 413: public outreach. (Exhibit B‐1, p.

- Page 414 and 415: 25 2.4.3 Innovative Technologies, N

- Page 416 and 417: 27 2.5 Conservation Potential Revie

- Page 418 and 419: 29 “The study findings confirm th

- Page 420 and 421: 31 3.0 ASSESSMENT CRITERIA AND ACCO

- Page 422 and 423: Total Resource Cost Test Terasen pr

- Page 424 and 425: 3.2 Free Riders Terasen seeks certa

- Page 426 and 427: Commission Determination 37 The Com

- Page 428 and 429: “[a]ttribution of savings from co

- Page 430 and 431: Tax was included in the participant

- Page 432 and 433: 43 4.0 CAPITALISATION OF INCREMENTA

- Page 434 and 435: 5.0 AMORTISATION OF EEC EXPENDITURE

- Page 436 and 437: SIXTH FLOOR, 900 HOWE STREET, BOX 2

- Page 438 and 439: 5. The proposal to exclude the free

- Page 440 and 441: Exhibit No. Description B‐2‐1 C

- Page 442 and 443: Exhibit No. Description C4‐3 Lett

- Page 444 and 445: Exhibit No. Description E‐13 CANA

- Page 446 and 447: 2 B RITISH COLUMBIA U TILITIES COMM

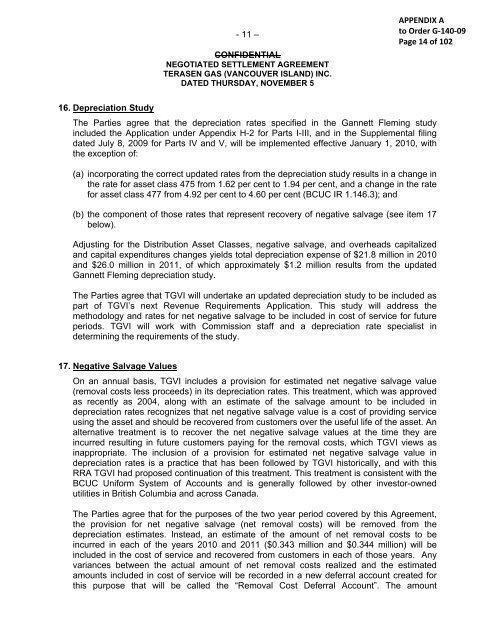

- Page 448 and 449: APPENDIX A to Order G-140-09 Page 1

- Page 450 and 451: November 13, 2009 British Columbia

- Page 452 and 453: - 2 - CONFIDENTIAL NEGOTIATED SETTL

- Page 454 and 455: - 4 - CONFIDENTIAL NEGOTIATED SETTL

- Page 456 and 457: - 6 - CONFIDENTIAL NEGOTIATED SETTL

- Page 458 and 459: - 8 - CONFIDENTIAL NEGOTIATED SETTL

- Page 462 and 463: - 12 - CONFIDENTIAL NEGOTIATED SETT

- Page 464 and 465: - 14 - CONFIDENTIAL NEGOTIATED SETT

- Page 466 and 467: - 16 - CONFIDENTIAL NEGOTIATED SETT

- Page 468 and 469: - 18 - CONFIDENTIAL NEGOTIATED SETT

- Page 470 and 471: Schedule # Summary Schedules Core M

- Page 472 and 473: CONFIDENTIAL AND WITHOUT PREJUDICE

- Page 474 and 475: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 476 and 477: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 478 and 479: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 480 and 481: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 482 and 483: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 484 and 485: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 486 and 487: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 488 and 489: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 490 and 491: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 492 and 493: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 494 and 495: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 496 and 497: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 498 and 499: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 500 and 501: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 502 and 503: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 504 and 505: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 506 and 507: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 508 and 509: TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 510 and 511:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 512 and 513:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 514 and 515:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 516 and 517:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 518 and 519:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 520 and 521:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 522 and 523:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 524 and 525:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 526 and 527:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 528 and 529:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 530 and 531:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 532 and 533:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 534 and 535:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 536 and 537:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 538 and 539:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 540 and 541:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 542 and 543:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 544 and 545:

TERASEN GAS (VANCOUVER ISLAND) INC.

- Page 546 and 547:

APPENDIX A to Order G-140-09 Page 9

- Page 548 and 549:

APPENDIX A to Order G-140-09 Page 1

- Page 550 and 551:

SIXTH FLOOR, 900 HOWE STREET, BOX 2

- Page 552 and 553:

APPENDIX A to Order G-141-09 Page 1

- Page 554 and 555:

- 2 - CONFIDENTIAL NEGOTIATED SETTL

- Page 556 and 557:

- 4 - CONFIDENTIAL NEGOTIATED SETTL

- Page 558 and 559:

- 6 - CONFIDENTIAL NEGOTIATED SETTL

- Page 560 and 561:

- 8 - CONFIDENTIAL NEGOTIATED SETTL

- Page 562 and 563:

- 10 - CONFIDENTIAL NEGOTIATED SETT

- Page 564 and 565:

22. Depreciation Study - 12 - CONFI

- Page 566 and 567:

- 14 - CONFIDENTIAL NEGOTIATED SETT

- Page 568 and 569:

- 16 - CONFIDENTIAL NEGOTIATED SETT

- Page 570 and 571:

- 18 - CONFIDENTIAL NEGOTIATED SETT

- Page 572 and 573:

TERASEN GAS INC. 2010-2011 REVENUE

- Page 574 and 575:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 576 and 577:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 578 and 579:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 580 and 581:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 582 and 583:

APPENDIX A to Order G-141-09 TERASE

- Page 584 and 585:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 586 and 587:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 588 and 589:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 590 and 591:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 592 and 593:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 594 and 595:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 596 and 597:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 598 and 599:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 600 and 601:

TERASEN GAS INC Nov 5, 2009 NSP Agr

- Page 602 and 603:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 604 and 605:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 606 and 607:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 608 and 609:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 610 and 611:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 612 and 613:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 614 and 615:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 616 and 617:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 618 and 619:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 620 and 621:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 622 and 623:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 624 and 625:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 626 and 627:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 628 and 629:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 630 and 631:

APPENDIX A to Order G-141-09 TERASE

- Page 632 and 633:

APPENDIX A to Order G-141-09 TERASE

- Page 634 and 635:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 636 and 637:

APPENDIX A to Order G-141-09 Page 8

- Page 638 and 639:

TERASEN GAS INC. Nov 5, 2009 NSP Ag

- Page 640 and 641:

TERASEN GAS INC. June 1, 2009 A Sec

- Page 642 and 643:

APPENDIX A to Order G-141-09 Page 9

- Page 644 and 645:

TERASEN GAS INC. June 1, 2009 A Sec

- Page 646 and 647:

TERASEN GAS INC. June 1, 2009 A Sec

- Page 648 and 649:

TERASEN GAS INC. August 17, 2009 Re

- Page 650 and 651:

The British Columbia Public Interes

- Page 652 and 653:

APPENDIX A to Order G-141-09 Page 1

- Page 654 and 655:

From: Nakoneshny, Philip BCUC:EX Se

- Page 656 and 657:

PHILIP W. NAKONESHNY DIRECTOR, RATE

- Page 658:

3 for approval of Rate Schedule 6 C

- Page 663 and 664:

B.C. EnErgy EffiCiEnCy ACt StAndArd

- Page 665 and 666:

B.C. EnErgy EffiCiEnCy ACt StAndArd

- Page 667 and 668:

Appendix E CONSERVATION EDUCATION A

- Page 669 and 670:

Event Location Residential Commerci

- Page 671 and 672:

Event Location Residential Commerci

- Page 673 and 674:

Event Location Residential Commerci

- Page 675 and 676:

School Location Program Brooke Elem

- Page 677 and 678:

School Location Program Conservatio

- Page 679 and 680:

School Location Program Hudson Road

- Page 681 and 682:

School Location Program Montecito E

- Page 683 and 684:

School Location Program Shawnigan L

- Page 685 and 686:

School Location Program Wiltse Elem

- Page 687 and 688:

March 22, 2011 Mr. Mark Grist, Fort

- Page 689 and 690:

the fact review processes enabled b

- Page 693 and 694:

March 23, 2011 Mark Grist Manager,

- Page 695 and 696:

Appendix G CONTRACTOR STUDY QUALITA

- Page 697 and 698:

2 Table Of Contents Background And

- Page 699 and 700:

4 Methodology METHODOLOGY Study par

- Page 701 and 702:

6 Summary Of Findings (2) Customers

- Page 703 and 704:

8 Awareness Of EE Incentive Program

- Page 705 and 706:

10 Barriers To Contractor Participa

- Page 707 and 708:

12 Communications Of Energy gy Effi

- Page 709 and 710:

14 Desirable Support Materials The

- Page 711 and 712:

Perspectives On Training And Upgrad

- Page 713 and 714:

18 Certification Very few indicate

- Page 716 and 717:

Appendix H EEC STAKEHOLDER GROUP

- Page 718 and 719:

Westbrook Relations Nina Winham New

- Page 720 and 721:

Attendees Terasen Gas Energy Effici

- Page 722 and 723:

Ministry policy on storage tanks ha

- Page 724 and 725:

Burn blue. Save green. Alternative

- Page 726 and 727:

Terasen Approach

- Page 728 and 729:

Terasen Large Scale Alternative Ene

- Page 730 and 731:

Terasen Large Scale Alternative Ene

- Page 732 and 733:

Burn blue. Save green. Energy Effic

- Page 734 and 735:

Innovative Technologies Approved Fu

- Page 736 and 737:

Innovative Technologies Proposed Pr

- Page 738 and 739:

Innovative Technologies Natural gas

- Page 740 and 741:

Proposal for Innovative Technologie

- Page 742 and 743:

Proposed Innovative Technologies TG

- Page 744 and 745:

Proposed Innovative Technologies Po

- Page 746 and 747:

Burn blue. Save green. Structure &

- Page 748 and 749:

2009 EEC Report Structure • Intro

- Page 750 and 751:

2009 Program Results* - Highlights

- Page 752 and 753:

Research & Evaluation Activities

- Page 754 and 755:

Processes and Controls Overview •

- Page 756 and 757:

Presentation Agenda • Achievement

- Page 758 and 759:

Switch ‘N’ Shrink Oil and Propa

- Page 760 and 761:

Domestic Hot Water ENERGYSTAR ® Ta

- Page 762 and 763:

Whole Home Partnerships • Utility

- Page 764 and 765:

Burn blue. Save green. Commercial P

- Page 766 and 767:

2010 Programs Summary Hot Water Cus

- Page 768 and 769:

Custom Design Program Internal Appr

- Page 770 and 771:

Commercial Cooking Program Initial

- Page 772 and 773:

Timeline for 2010 Project Q 1 Q 2 Q

- Page 774 and 775:

Conservation for Affordable Housing

- Page 776 and 777:

2010 Programs Summary • REnEW •

- Page 778 and 779:

2010 Programs & Partnerships Energy

- Page 780 and 781:

2010 Timeline REnEW Energy Saving K

- Page 782 and 783:

Supply Chain Manufacturers Supplier

- Page 784 and 785:

Efficiency Partners 2009 Program Ac

- Page 786 and 787:

2010 Timeline Efficiency Partners P

- Page 788 and 789:

2009 Results Program Name Total (No

- Page 790 and 791:

2010 Timeline Project Q 1 Q 2 Q 3 Q

- Page 792 and 793:

Innovative Technologies g Backgroun

- Page 794 and 795:

Innovative Technologies g Terms of

- Page 796 and 797:

Innovative Technologies g Proposed

- Page 798 and 799:

California Standard Protocol Tests

- Page 800 and 801:

Example with Solar Thermal-City of

- Page 802 and 803:

Proposed p Innovative Technologies

- Page 804 and 805:

Innovative Technologies g -Summaryy

- Page 806 and 807:

Slide 15 d5 Arvind could you add so

- Page 808 and 809:

Innovative Technologies g -TGI Brea

- Page 810 and 811:

Proposed p Innovative Technologies

- Page 812 and 813:

Terasen Gas EEC Stakeholder Meeting

- Page 814 and 815:

Organization Goals Members Prioriti

- Page 816 and 817:

Organization Goals Members represen

- Page 818 and 819:

Organization Goals Members represen

- Page 820 and 821:

Terasen Gas EEC Stakeholder Meeting

- Page 822 and 823:

Sarah Smith, EEC Looking Ahead Ques

- Page 824 and 825:

Affordable Housing Discussion point

- Page 826 and 827:

Innovative Technologies and Industr

- Page 828 and 829:

Corporate Overview EEC Stakeholder

- Page 830 and 831:

Fortis in BC: Terasen Gas and Forti

- Page 832 and 833:

Natural Gas Vehicle Program for BC

- Page 834 and 835:

Overview • Market Context • NGV

- Page 836 and 837:

BC’s Motor Fuels Market Motor fue

- Page 838 and 839:

Historical Diesel Pricing vs. NG (D

- Page 840 and 841:

NGV Strategy • Focus on Heavy Dut

- Page 842 and 843:

GHG Implications • 17% of diesel

- Page 844 and 845:

NGVs Delivering Solutions Today Lig

- Page 846 and 847:

Terasen Gas Key Projects Applicatio

- Page 848 and 849:

Questions?

- Page 850 and 851:

2010 YTD Results • Portfolio TRC

- Page 852 and 853:

Funding approval request - 2012 and

- Page 854 and 855:

Terasen dealer (contractor) program

- Page 856 and 857:

FortisBC EEC Stakeholder Meeting Mi

- Page 858 and 859:

EEC Stakeholder Meeting March 15, 2

- Page 860 and 861:

2010 EEC Portfolio Highlights March

- Page 862 and 863:

Utility 2010 EEC Combined Conventio

- Page 864 and 865:

Utility 2011 EEC Combined Conventio

- Page 866 and 867:

2011 Commercial Programs Timeline (

- Page 868 and 869:

2011 Residential Customer Programs

- Page 870 and 871:

2011 Conservation for Affordable Ho

- Page 872 and 873:

2011 Innovative Technologies Timeli

- Page 874 and 875:

Utility (Year) FEI 2010 Actual FEI

- Page 876 and 877:

A Speed Bump re the NGV Program…

- Page 878 and 879:

EEC Accountability Mechanism (G-36-

- Page 880 and 881:

EEC Stakeholder Sessions (2010) •

- Page 882 and 883:

EEC Incentives for NGV: Summary 1 2

- Page 884 and 885:

2010 and 2011 Industrial Programs O

- Page 886 and 887:

Enabling Activity: Efficiency Partn

- Page 888 and 889:

2010 Conservation Education and Out

- Page 890 and 891:

FortisBC Conservation Potential Rev

- Page 892 and 893:

Background & Objectives • FortisB

- Page 894 and 895:

• GHG Reduction Targets • BC -

- Page 896 and 897:

Current Practice • Total Resource

- Page 898 and 899:

#1 - Avoided / Marginal Costs • T

- Page 900 and 901:

#1 - Avoided / Marginal Costs • I

- Page 902 and 903:

#1 - Discount Rate Impacts NPV Meas

- Page 904 and 905:

#1 - Discount Rate Impacts • Impa

- Page 906 and 907:

#1 - Free Riders / Spillover • Op

- Page 908 and 909:

#1 - Treatment of Non-energy • Th

- Page 910 and 911:

• The Issue #1 - Measure Life - S

- Page 912 and 913:

#1 - Program and Measure Life • I

- Page 914 and 915:

Option #2: Change B/C Test • Opti

- Page 916 and 917:

#2 - Use Societal Cost Test • Pro

- Page 918 and 919:

#2 - Use Societal Cost Test • Imp

- Page 920 and 921:

• Pros - More like new supply ana

- Page 922 and 923:

Summary - Screening Tests • Summa

- Page 924 and 925:

#3: GHG Based Approach • Options

- Page 926 and 927:

Carbon Reduction Supply Curve (Conc

- Page 928 and 929:

Thank you

- Page 930 and 931:

Strategy • 2012 - 2013 Revenue Re

- Page 932 and 933:

Additional Items • Split 75% FEI,

- Page 934 and 935:

Organization Goals of Organization

- Page 936 and 937:

Organization Goals of Organization

- Page 938 and 939:

Organization Goals of Organization

- Page 940 and 941:

Appendix I EFFICIENT BOILER PROGRAM

- Page 942 and 943:

Table of contents Section Page The

- Page 944 and 945:

3.0 Program process All market part

- Page 946:

5.0 Incentives All market participa