Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

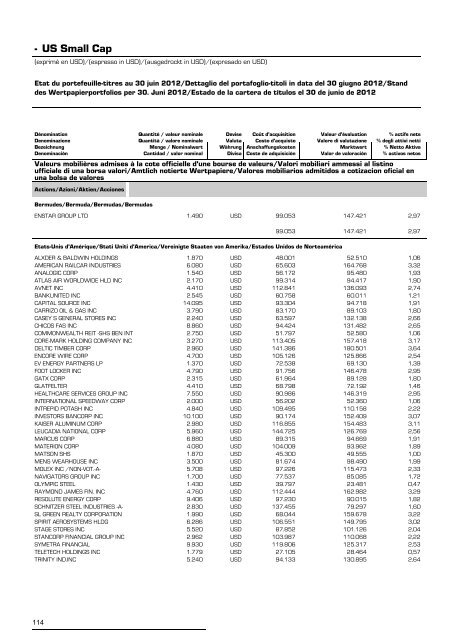

-<br />

US Small Cap<br />

(exprimé en USD)/(espresso in USD)/(ausgedrückt in USD)/(expresado en USD)<br />

Etat du portefeuille-titres au 30 juin 2012/Dettaglio del portafoglio-titoli in data del 30 giugno 2012/Stand<br />

des Wertpapierportfolios per 30. Juni 2012/Estado de la cartera de títulos el 30 de junio de 2012<br />

Dénomination<br />

Denominazione<br />

Bezeichnung<br />

Denominación<br />

Valeurs mobilières admises à la cote officielle d'une bourse de valeurs/Valori mobiliari ammessi al listino<br />

ufficiale di una borsa valori/Amtlich notierte Wertpapiere/Valores mobiliarios admitidos a cotizacion oficial en<br />

una bolsa de valores<br />

Actions/Azioni/Aktien/Acciones<br />

Bermudes/Bermuda/Bermudas/Bermudas<br />

Quantité / valeur nominale<br />

Quantità / valore nominale<br />

Menge / Nominalwert<br />

Cantidad / valor nominal<br />

Devise<br />

Valuta<br />

Währung<br />

Divisa<br />

Coût d'acquisition<br />

Costo d'acquisto<br />

Anschaffungskosten<br />

Coste de adquisición<br />

Valeur d'évaluation<br />

Valore di valutazione<br />

Marktwert<br />

Valor de valoración<br />

% actifs nets<br />

% degli attivi netti<br />

% Netto Aktiva<br />

% activos netos<br />

ENSTAR GROUP LTD 1.490 USD 99.053<br />

147.421 2,97<br />

99.053<br />

147.421 2,97<br />

Etats-Unis d'Amérique/Stati Uniti d'America/Vereinigte Staaten von Amerika/Estados Unidos de Norteamérica<br />

ALXDER & BALDWIN HOLDINGS 1.870 USD 48.001<br />

52.510 1,06<br />

AMERICAN RAILCAR INDUSTRIES 6.080 USD 65.603<br />

164.768 3,32<br />

ANALOGIC CORP 1.540 USD 56.172<br />

95.480 1,93<br />

ATLAS AIR WORLDWIDE HLD INC 2.170 USD 99.314<br />

94.417 1,90<br />

AVNET INC 4.410 USD 112.841<br />

136.093 2,74<br />

BANKUNITED INC 2.545 USD 60.758<br />

60.011 1,21<br />

CAPITAL SOURCE INC 14.095 USD 93.304<br />

94.718 1,91<br />

CARRIZO OIL & GAS INC 3.790 USD 83.170<br />

89.103 1,80<br />

CASEY S GENERAL STORES INC 2.240 USD 63.597<br />

132.138 2,66<br />

CHICOS FAS INC 8.860 USD 94.424<br />

131.482 2,65<br />

COMMONWEALTH REIT -SHS BEN INT 2.750 USD 51.797<br />

52.580 1,06<br />

CORE-MARK HOLDING COMPANY INC 3.270 USD 113.405<br />

157.418 3,17<br />

DELTIC TIMBER CORP 2.960 USD 141.386<br />

180.501 3,64<br />

ENCORE WIRE CORP 4.700 USD 105.126<br />

125.866 2,54<br />

EV ENERGY PARTNERS LP 1.370 USD 72.538<br />

69.130 1,39<br />

FOOT LOCKER INC 4.790 USD 91.756<br />

146.478 2,95<br />

GATX CORP 2.315 USD 61.964<br />

89.128 1,80<br />

GLATFELTER 4.410 USD 68.798<br />

72.192 1,46<br />

HEALTHCARE SERVICES GROUP INC 7.550 USD 90.986<br />

146.319 2,95<br />

INTERNATIONAL SPEEDWAY CORP 2.000 USD 56.202<br />

52.360 1,06<br />

INTREPID POTASH INC 4.840 USD 109.495<br />

110.158 2,22<br />

INVESTORS BANCORP INC 10.100 USD 90.174<br />

152.409 3,07<br />

KAISER ALUMINUM CORP 2.980 USD 116.855<br />

154.483 3,11<br />

LEUCADIA NATIONAL CORP 5.960 USD 144.725<br />

126.769 2,56<br />

MARCUS CORP 6.880 USD 89.315<br />

94.669 1,91<br />

MATERION CORP 4.080 USD 104.009<br />

93.962 1,89<br />

MATSON SHS 1.870 USD 45.300<br />

49.555 1,00<br />

MENS WEARHOUSE INC 3.500 USD 81.674<br />

98.490 1,99<br />

MOLEX INC /NON-VOT.-A- 5.708 USD 97.226<br />

115.473 2,33<br />

NAVIGATORS GROUP INC 1.700 USD 77.537<br />

85.085 1,72<br />

OLYMPIC STEEL 1.430 USD 39.797<br />

23.481 0,47<br />

RAYMOND JAMES FIN. INC 4.760 USD 112.444<br />

162.982 3,29<br />

RESOLUTE ENERGY CORP 9.406 USD 97.230<br />

90.015 1,82<br />

SCHNITZER STEEL INDUSTRIES -A- 2.830 USD 137.455<br />

79.297 1,60<br />

SL GREEN REALTY CORPORATION 1.990 USD 68.044<br />

159.678 3,22<br />

SPIRIT AEROSYSTEMS HLDG 6.286 USD 106.551<br />

149.795 3,02<br />

STAGE STORES INC 5.520 USD 87.852<br />

101.126 2,04<br />

STANCORP FINANCIAL GROUP INC 2.962 USD 103.987<br />

110.068 2,22<br />

SYMETRA FINANCIAL 9.930 USD 119.806<br />

125.317 2,53<br />

TELETECH HOLDINGS INC 1.779 USD 27.105<br />

28.464 0,57<br />

TRINITY IND.INC 5.240 USD 94.133<br />

130.895 2,64<br />

114