- Page 1 and 2: Kitsap County Washington

- Page 3 and 4: KITSAP COUNTY 2009 BUDGET Approved

- Page 5 and 6: The Government Finance Officers Ass

- Page 7 and 8: T A B L E O F C O N T E N T S Page

- Page 9: KITSAP COUNTY OFFICIALS ELECTED OFF

- Page 12 and 13: County Mission Kitsap County govern

- Page 14 and 15: This page intentionally left blank

- Page 16 and 17: This page intentionally left blank

- Page 18 and 19: General Information and Economic In

- Page 20 and 21: General Information and Economic In

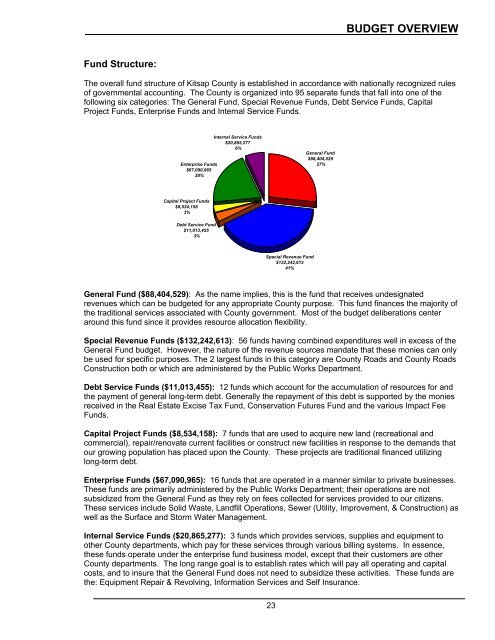

- Page 22 and 23: General Information and Economic In

- Page 24 and 25: General Information and Economic In

- Page 26 and 27: General Information and Economic In

- Page 28 and 29: General Information and Economic In

- Page 30: This page intentionally left blank

- Page 36 and 37: This page intentionally left blank

- Page 38 and 39: This page intentionally left blank

- Page 40: 2010 Annual Budget Calendar Revised

- Page 51 and 52: GENERAL FUND $88,404,529 Revenue Fi

- Page 53 and 54: ADMINISTRATIVE SERVICES II. Purpose

- Page 55 and 56: ADMINISTRATIVE SERVICES Performance

- Page 57 and 58: ADMINISTRATIVE SERVICES Expenditure

- Page 59 and 60: ADMINISTRATIVE SERVICES Program: De

- Page 61 and 62: ADMINISTRATIVE SERVICES Expenditure

- Page 63 and 64: ADMINISTRATIVE SERVICES Performance

- Page 65 and 66: ADMINISTRATIVE SERVICES Program: De

- Page 67 and 68: ADMINISTRATIVE SERVICES Agency Stru

- Page 69 and 70: ASSESSOR Historical Trends/Industry

- Page 71 and 72: ASSESSOR 2006 2007 2008 2009 Worklo

- Page 73 and 74: AUDITOR II. Purpose: The County Aud

- Page 75 and 76: AUDITOR IV. 2009 Goals and Objectiv

- Page 77 and 78: AUDITOR Expenses 2009 Budget Salari

- Page 79 and 80: AUDITOR Performance Measures: (Note

- Page 81 and 82: AUDITOR Program: Description: Initi

- Page 83 and 84: AUDITOR Agency Structure: 67

- Page 85 and 86:

CLERK Historical Court Service Leve

- Page 87 and 88:

CLERK • We will contribute to Inc

- Page 89 and 90:

CLERK Expenditures: 2006 Actual Off

- Page 91 and 92:

BOARD OF COMMISSIONERS II. Purpose:

- Page 93 and 94:

BOARD OF COMMISSIONERS Agency Struc

- Page 95 and 96:

CORONER Historical Trends/Industry

- Page 97 and 98:

CORONER Agency Structure: Coroner C

- Page 99 and 100:

DISTRICT COURT Trends 1,000 - 5,500

- Page 101 and 102:

DISTRICT COURT We will contribute t

- Page 103 and 104:

DISTRICT COURT STAFFING LEVEL Perfo

- Page 105 and 106:

GENERAL ADMINISTRATION & OPERATIONS

- Page 107 and 108:

JAIL o Kitchen maintenance and repa

- Page 109 and 110:

STAFFING LEVEL Full Time Equivalent

- Page 111 and 112:

Expenditures: Agency Structure: DEP

- Page 113 and 114:

JUVENILE SERVICES Historical Trends

- Page 115 and 116:

JUVENILE SERVICES Initiatives: 1. A

- Page 117 and 118:

JUVENILE SERVICES devoted to assess

- Page 119 and 120:

JUVENILE SERVICES Program Notes: A)

- Page 121 and 122:

JUVENILE SERVICES Agency Structure:

- Page 123 and 124:

PARKS AND RECREATION II. III. IV. P

- Page 125 and 126:

PARKS AND RECREATION PROGRAM BUDGET

- Page 127 and 128:

PARKS AND RECREATION PROGRAM BUDGET

- Page 129 and 130:

PERSONNEL AND HUMAN SERVICES I. Bud

- Page 131 and 132:

PERSONNEL AND HUMAN SERVICES IV. 20

- Page 133 and 134:

PERSONNEL AND HUMAN SERVICES 2007 A

- Page 135 and 136:

PERSONNEL AND HUMAN SERVICES Initia

- Page 137 and 138:

PERSONNEL AND HUMAN SERVICES Perfor

- Page 139 and 140:

PERSONNEL AND HUMAN SERVICES Effici

- Page 141 and 142:

PERSONNEL AND HUMAN SERVICES Agency

- Page 143 and 144:

PROSECUTING ATTORNEY • Collection

- Page 145 and 146:

PROSECUTING ATTORNEY STAFFING LEVEL

- Page 147 and 148:

PROSECUTING ATTORNEY STAFFING LEVEL

- Page 149 and 150:

SHERIFF CRIME STATS COMPARISONS 200

- Page 151 and 152:

SHERIFF o Upgraded to three new enf

- Page 153 and 154:

SHERIFF Program: Civil Division Des

- Page 155 and 156:

SHERIFF Program: Patrol Description

- Page 157 and 158:

SHERIFF Expenditures: 2009 Budget S

- Page 159 and 160:

SHERIFF Expenditures: 2009 Budget S

- Page 161 and 162:

SUPERIOR COURT I. Budget Overview E

- Page 163 and 164:

SUPERIOR COURT V. Program Overview

- Page 165 and 166:

SUPERIOR COURT Initiatives: 1. Oper

- Page 167 and 168:

SUPERIOR COURT Agency Structure: Ci

- Page 169 and 170:

TREASURER • Anticipated increase

- Page 171 and 172:

TREASURER Performance Measures: STA

- Page 173 and 174:

WSU EXTENSION SERVICES I. Budget Ov

- Page 175 and 176:

WSU EXTENSION SERVICES V. Program O

- Page 177 and 178:

SPECIAL REVENUE FUNDS $132,242,613

- Page 179 and 180:

ADMINISTRATIVE SERVICES Efficiency

- Page 181 and 182:

ADMINISTRATIVE SERVICES Program: De

- Page 183 and 184:

BLOCK GRANT ENTITLEMENT FUND Initia

- Page 185 and 186:

CENTRAL COMMUNICATIONS I. Budget Ov

- Page 187 and 188:

CENTRAL COMMUNICATIONS IV. 2009 Goa

- Page 189 and 190:

COMMUNITY DEVELOPMENT I. Budget Ove

- Page 191 and 192:

COMMUNITY DEVELOPMENT 3. Maintain o

- Page 193 and 194:

COMMUNITY DEVELOPMENT STAFFING LEVE

- Page 195 and 196:

COMMUNITY DEVELOPMENT Performance M

- Page 197 and 198:

COMMUNITY DEVELOPMENT Workload 2006

- Page 199 and 200:

COMMUNITY DEVELOPMENT Performance M

- Page 201 and 202:

COMMUNITY DEVELOPMENT STAFFING LEVE

- Page 203 and 204:

COMMUNITY DEVELOPMENT PROGRAM BUDGE

- Page 205 and 206:

COMMUNITY DEVELOPMENT Agency Struct

- Page 207 and 208:

EMERGENCY MANAGEMENT • Fully impl

- Page 209 and 210:

EMERGENCY MANAGEMENT KPREP (1061) i

- Page 211 and 212:

HUMAN SERVICES I. Budget Overview S

- Page 213 and 214:

HUMAN SERVICES II. 2009 Goals and O

- Page 215 and 216:

HUMAN SERVICES Performance Measures

- Page 217 and 218:

HUMAN SERVICES 2005 Actual 2006 Act

- Page 219 and 220:

HUMAN SERVICES Program Notes: Chang

- Page 221 and 222:

HUMAN SERVICES 2008 Accomplishment:

- Page 223 and 224:

HUMAN SERVICES PROGRAM BUDGET Reven

- Page 225 and 226:

HUMAN SERVICES PROGRAM BUDGET Reven

- Page 227 and 228:

HUMAN SERVICES PROGRAM BUDGET Reven

- Page 229 and 230:

HUMAN SERVICES Human Services Divis

- Page 231 and 232:

PUBLIC WORKS ROADS III. IV. 2008 AC

- Page 233 and 234:

PUBLIC WORKS ROADS 10. Inspect and

- Page 235 and 236:

PUBLIC WORKS ROADS Performance Meas

- Page 237 and 238:

PUBLIC WORKS ROADS STAFFING LEVEL A

- Page 239 and 240:

223 PUBLIC WORKS ROADS

- Page 241 and 242:

OTHER SPECIAL REVENUE FUNDS 00145 P

- Page 243 and 244:

ENTERPRISE FUNDS $67,090,965 SSWM P

- Page 245 and 246:

PUBLIC WORKS SOLID WASTE Garbage an

- Page 247 and 248:

STAFFING LEVEL Full Time Equivalent

- Page 249 and 250:

STAFFING LEVEL Full Time Equivalent

- Page 251 and 252:

PUBLIC WORKS SOLID WASTE Workload 2

- Page 253 and 254:

PUBLIC WORKS SOLID WASTE Program Ov

- Page 255 and 256:

Agency Structure: TRANSFER STATION

- Page 257 and 258:

PUBLIC WORKS SEWER UTILITY II. Purp

- Page 259 and 260:

PUBLIC WORKS SEWER UTILITY Program:

- Page 261 and 262:

PUBLIC WORKS SEWER UTILITY Program:

- Page 263 and 264:

PUBLIC WORKS SEWER UTILITY DEPARTME

- Page 265 and 266:

SURFACE & STORMWATER MANAGEMENT I.

- Page 267 and 268:

SURFACE & STORMWATER MANAGEMENT •

- Page 269 and 270:

SURFACE & STORMWATER MANAGEMENT Per

- Page 271 and 272:

SURFACE & STORMWATER MANAGEMENT Pro

- Page 273 and 274:

SURFACE & STORMWATER MANAGEMENT Per

- Page 275 and 276:

SURFACE & STORMWATER MANAGEMENT Far

- Page 277 and 278:

SURFACE & STORMWATER MANAGEMENT PRO

- Page 279 and 280:

OTHER ENTERPRISE FUNDS Fund Expense

- Page 281 and 282:

INTERNAL SERVICE FUNDS $20,865,277

- Page 283 and 284:

PUBLIC WORKS EQUIPMENT RENTAL & REV

- Page 285 and 286:

INFORMATION SERVICES I. Budget Over

- Page 287 and 288:

INFORMATION SERVICES o SECTOR paper

- Page 289 and 290:

INFORMATION SERVICES The major cate

- Page 291 and 292:

INFORMATION SERVICES 3. Project & M

- Page 293 and 294:

RISK MANAGEMENT II. Purpose: The Ri

- Page 295 and 296:

DEBT SERVICE FUNDS $11,013,455 LTGO

- Page 297 and 298:

DEBT SERVICE FUNDS Year Purpose 199

- Page 299 and 300:

DEBT SERVICE REQUIREMENTS FOR LTGO

- Page 301 and 302:

Public Works Debt Service Funds for

- Page 303 and 304:

CAPITAL PROJECT FUNDS $8,534,158 20

- Page 305 and 306:

CAPITAL PROJECT FUNDS Revenue: This

- Page 307 and 308:

Parks Capital Projects Gordon Field

- Page 309 and 310:

Appendices

- Page 311 and 312:

Appendix A Policies Budget Policy T

- Page 313 and 314:

Appendix A Policies Investment Poli

- Page 315 and 316:

Appendix A Policies Collateral is t

- Page 317 and 318:

Appendix A Policies Debt Policy Res

- Page 319 and 320:

Appendix A Policies The County will

- Page 321 and 322:

Appendix A Policies other tax law r

- Page 323 and 324:

Appendix B Glossary G L O S S A R Y

- Page 325 and 326:

Appendix B Glossary ESA - Endangere

- Page 327 and 328:

Appendix B Glossary RESOLUTION - A

- Page 329 and 330:

Appendix C Tax Levies 2008 KITSAP C

- Page 331 and 332:

Appendix C Tax Levies T.E.D. = Timb

- Page 333 and 334:

Appendix D Synopsis of Property Tax

- Page 335 and 336:

Appendix D Synopsis of Property Tax

- Page 337 and 338:

Appendix E General Administration &

- Page 339 and 340:

Appendix F Staffing Levels KITSAP C

- Page 341 and 342:

Appendix F Staffing Levels KITSAP C

- Page 343 and 344:

Appendix F Staffing Levels KITSAP C

- Page 345 and 346:

Appendix F Staffing Levels KITSAP C

- Page 347 and 348:

Appendix F Staffing Levels KITSAP C

- Page 349 and 350:

Appendix F Staffing Levels KITSAP C

- Page 351 and 352:

Appendix F Staffing Levels KITSAP C

- Page 353 and 354:

Appendix F Staffing Levels KITSAP C

- Page 355 and 356:

Appendix F Staffing Levels KITSAP C

- Page 357 and 358:

Appendix F Staffing Levels KITSAP C

- Page 359 and 360:

TAXES KITSAP COUNTY GENERAL FUND RE

- Page 361 and 362:

Appendix H Statement of Changes in

- Page 363 and 364:

Appendix I 6 Year Public Buildings

- Page 365 and 366:

Major Revenue Sources Appendix J Ge