ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- -. *1t a-N -.<br />

X m.-0 -<br />

:9t<br />

'4:-~~~~~~~~~~~~~~~~~~'<br />

*~~~~~~M n z ce-. it& P -- SffLfXf00: |f.<br />

4- t - ~A .<br />

liars~~~~~~~~~<br />

~has4Jcreased2,butpiihI<br />

uaate<br />

,-h,_., W _ t d<br />

-bf17 6lirs<br />

*;i needed in0 ( q y<br />

* 'StS<br />

th<br />

ff"'; f-S X "W C, f:~~~~~<br />

Pi: - U Mi. - .<br />

5 -I<br />

n o<br />

: . - - nt direcll generatethe forein exchangMearning<br />

:5 frte -_ coiintd<br />

fiang, re.<br />

ios uedn geaf,eate pr mr,pon<br />

4, .c- .~~~~~~~~cosrit, n 9asoue o iac oclepn<br />

. -f<br />

iuWlstructure andervices- edaotbe fpinaced land soxp<br />

: - men inxretment s rard less han 30 t andt dir-ecd gfor t he ton for;eqigmnt ehande ernaings<br />

sometimes as much as 70 pecent (Chapter 1). hi ad- .nnce when public sector sau ngs i are imited. The<br />

dition, maitenance and operatng expenchtures Dominied nRepubliciis onesof severalycounihies with<br />

:t. comrnand a high share of current exSpenditures..--avr heavy reifance on foreign funding, which fi-<br />

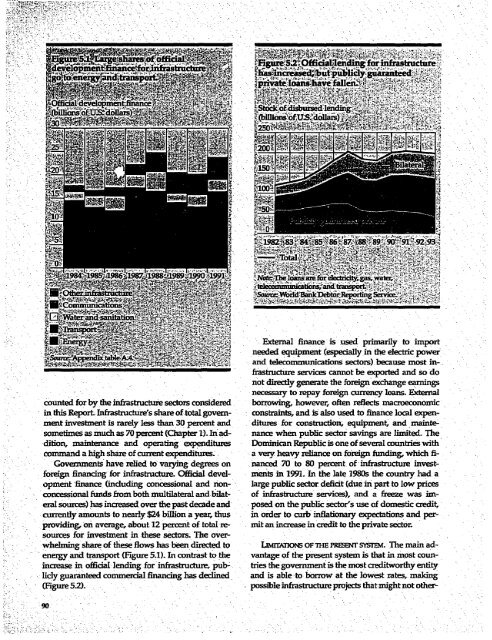

- Governments have relied to va.ying degrees on nanced tee to 8m percent of inftastructure invest-<br />

-foreign finaig for infastructure- Official devel- ments in 1991. In the late 1980s the c aunty had a<br />

: - opmenlt finance (including concessional and non- -nlarge pubcsc sector deficgt (due in part to low pnces<br />

councessionar funds fromboth multrateral andsbidat- of winastruchme services), and a freeze was iceial<br />

sources) has increaset over the past decade and- posed on the pubic sectors use of domestic credit,xpn<br />

currently amounts to nearly $24 bihion a3 yearc thus a order to crb infsationa,y eqpectations and per--<br />

sprovmidine on averages about7 2 percent of totaI re- nianc wein puaseic credittothe pinvate sector. T<br />

sources for investment in these rne sectors. over- D R i o o s<br />

whelmig share of these flows has been direced to IAv NSe OFrTHE oRE SYSfuM gNT The mawi adenergy<br />

and n sort (Fhgure 5.1) In contrast to the vantage of 8e present system is thatin most counfcrease<br />

in offici ng for infras tructur e, devel- puO mtients inent islthe most creditworuntry hada<br />

Iicly guaranteed commercial financing has delined and is able to bordw at the lowest rates, maliceg<br />

c(oeiogure whelming :- shr fun) :: d<br />

enrg an trnpr<br />

:these r flw t has bee e -diece ad b - to<br />

(Fgr 5 .1). In cotrs to th<br />

. oble L--TTIN infrastructure OP :.E -REE: provects -wr that might Th not mai owaersuc<br />

ad: :-<br />

vanag of th prsn syte is tha in mos coun-<br />

fo i t in ths s . The<br />

over-