ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

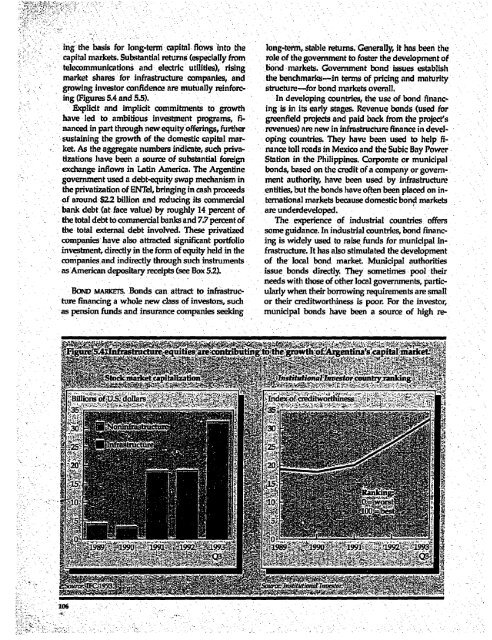

ing the basis for long-term capital flows intD the long-term, stable retums. Generally, it has.been the<br />

capital markets. Substantial returns (especially from role of the government to foster the development of<br />

telecommunications and electric utilities), rising bond markets. Government bond issues establishi<br />

market shares for infrastructure companies, and the benchmarks-in terms of pricing and maturity<br />

growing investor confidence are mutually reinforc- structure-for bond markets overall.<br />

ing (Figures 5.4.and 5-5).<br />

Explicit and implicit commitments to growth<br />

In developing countries, the use of bond financing<br />

is in its early stages. Revenue bonds (used for<br />

h ave led to. ambitious investment programs, fi- greenfield projects and paid back from the project's<br />

nanced in part thirough new equity offerings, furthier revenues) are new in infrastructure finance in develsustaining<br />

the growth of the domestic capital mar- oping countries. They have been used to help fiket.<br />

As the aggregate numbers indicate, such priva- niance toll roads in Mexico and the Subic Bay Power<br />

tizations hiave been a source of substantial foreign Station in the Philippines. Corporate or municipal:<br />

exchange inflows in Latin America. The Argentine bonds, based on the credit of a company or governgovernment<br />

used a debt-equity swap mechanism in ment authority, have been used by infrastructure<br />

the privatization of ENTel, bringing in cash proceeds entities, but the bonds have often been placed on inof<br />

around $2.2 billion and reducing its commercial ternational markets because domestic bond markets<br />

bank debt (at. face value) by roughly 14 percent of are underdeveloped..<br />

. the total debt to cominercial banks and 7.7 percent of The experience of industrial countries offers<br />

the total external debt involved. These privatized some guidance. In industrial countries, bond financcompanies<br />

have also attracted significant portfolio ing is widely used to raise funds for municipal ininvestnent,<br />

directly in the form of equity held in the frastructure. It has also stimulated the development<br />

companies and indirectly through sucl instruments of the local bond market. Municipal authorities<br />

as'American depositary receipts (see Box 5.2). issue bonds directly. They sometimes -pool their<br />

needs with those of other local governments, partic-<br />

BOND MARKErS. Bonds can attract to infrastruc- ularly when their borrowing requiruements are small<br />

tire financing a whole new class of investors, such or their creditworthiness is poor. For the investor,<br />

as pension fumds and insurance companies seeking municipal bonds have been a source of high ref--<br />

-- - :<br />

- - .~~~~~~4. -c4 -.-- : -~ - t' - t t." -- - . .k :<br />

-A El nfrwctnzcte4uiteiuia&ucodbuhntregro.oth:bt4SArgmtena U<br />

s taal marktk<br />

L~~~~~~~~~~~- - ,-<br />

j-AnimxsoUStolr%<br />

f:~~~~~~~~~~~ S:<br />

i1. ' : -- 910 kr,<br />

- . : . - , -, .:9:1: -* - 't. : ' :<br />