ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

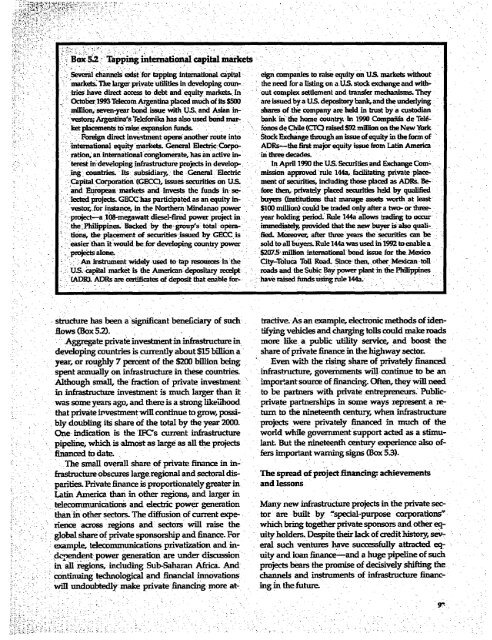

Box 52 Tapping international capital markets<br />

Several channels exist for tapping international capital eign compaiies to raise equity on US. markets without<br />

markets The larger private utilities in developing coun- the need for a listing on a.US. stock exchange and with-<br />

--tries have direct access to debt and equity markets.. In -out comnplex settlement and transfer mechanisms. They<br />

October 1993 Telecom Argentina placed much of its 5500 al issued by-a:US. depository bank, and the underlying<br />

million, seven-year bond issue with U.S.. and Asian in- shares of the company are held in trust by a custodian<br />

vestors; Argentina's Telefonika has also used bond mar- bank in the home country. In 1990 Compafifa de TelS<br />

ket placements to raise . n- fonos de Chile (CTO raised $92 million on the New York<br />

.:.'Foreign direct investment opens another route into Stock Exchange through an issue of equity in the form of<br />

.international equity markets. General Electric Corpo- ADRs-the first major equity issue from Latin America<br />

ration, an international conglomerate, has an active in- in three decades.<br />

terest in developing infrastructure projects in develop-. In April 1990 the US. Securities and Exchange Com-<br />

.ming countries. Its subsidiary, the General Electric mission approved rule 144a, facilitating private place-<br />

DCapital Corporation (GECCQ, issues seurities on U.S. ment of securities, including those placed as ADRs. Be--<br />

and European markets and invests the funds in se- fore then, privately placed securities held by qualified<br />

lected projects. GECC has participated as an equity in- . buyers (Istitutions that manage assets worth at leastvestor,.for<br />

instance, in the Northern Mindanao power $100 million) could be traded only after a two- or threeprojvect-a<br />

108-megawatt diesel-fired power project in year holding period- Rule 144a allows trading to occrthe<br />

Philippines. Backed by the* group's total opera- immediately, provided that the new buyer is also quali-.<br />

tions, the placenient of securities-issued .by GECC is fied. Moreover after three years the secunities can be<br />

- easier than it would-be for developing country power sold to all buyer Rule 144a was used in 1992 to enable a.<br />

- projects alone- : t r $2075 million international bond issue for the Mexico<br />

An instrument widely used to tap resources inCthe ity-Toluca Toll Road. Since then, offier MExican toll<br />

US. capital market is the American depositary eceipt roads and the Subic Bay power plant in the Phiippines<br />

(ADR). ADRs are certificates of deposit that enable for- haveraisedfindsusingrule][44a.<br />

structure has been a significant beneficary of such tractive. As an example, electronic methods of idenflows<br />

(Box 5.2). tifyg velchiles and chargng tolls could make roads<br />

Aggregate private investmentin inifrstructure in more like a public utility service, and boost the<br />

developing countries is currently about $15 billion a share of private finance in the highway sector.<br />

year, or roughly 7 percent of the $200 billion being Even with the rising share of privately financed<br />

spent annully on infrastructure in these countries, infrastructure, governments will continue to be an<br />

-Although small, the fraction of private investment importantsource of financing. Often, they will need<br />

in infhrstructure investment is much larger than it to be partners with private -entrepreneurs. Publicwas<br />

some years ago, and there is a strong likelihood private partnerships in some ways represent a rethat<br />

private investmentwillconinue to grow, possi- turn to the nineteenth century, when infrastructure<br />

: -- .bly doubling its share of the total by the year 2000. projects were privately financed in much of the<br />

One indication is the IFC's current infrastructure world while government support acted as a stimupipeline,<br />

which is almost as large as all the projects lanL But the nineteenth century experince also offinanced<br />

to date. . fers important waning signs (Box 53).<br />

The smaIl overall share of private finance in infrstructure<br />

obscures large. regional and sectoral dis- The spread of project finandng: achievements<br />

parities. Private finance is proportionately greater in and lessons<br />

Latin America than in other regions, and larger in<br />

telecommunications and electric power generation Many new infrastructure projects in the private secthan<br />

in other sectors. The diffusion of current expe- tor are built by "special-purpose corporations"<br />

rnence across regions and sectors will raise the which bring together private sponsors and other eq-<br />

- -- - global share of private sponsorship and finance. For uity holders. Despite their lack of credit histojr, sevexample,<br />

telecommunications privatization and in- . eral such ventures have successfully attracted eqdcpendent<br />

power generation are under discussion uity and loan finance-and a huge pipeline of such<br />

in all regions, including Sub-Saharan Africa. And projects bears the promise of decisively shifdng the<br />

continuing technological and financial innovations channels and instrumets of inastructure financwill<br />

undoubtedly make private financng more at- ing in the-futurc<br />

- : . 0 ............. W~~~~