ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1~~~~D Clt ,-,.Re -b cope an tie 0 reous 0.<br />

'tor. Financingin.this form.can be oplx and time- r e projiects. Relative to its size, Malaysia, too,<br />

consuming, as the interests of various parties have. has been a significant user of project finance.<br />

to, be secured through contractual agreements. The Trans,portation projects, maindy toll roads, doniequity<br />

stake of private sponsors is typically about 30 nated the numbers and the value of projects in highpercent<br />

of project costs and usually fonns the limit income and developing countries Crable 53). The<br />

of their liability Private lenders (especially commer- more than two-thirds share of transport projects in<br />

cial banks) influence project success by demanding middle-income countries reflected the extensive<br />

performance guarantees from project sponsors. toll-road programs in Argentina, Malaysia, and<br />

Where performance depends on govemment poiqc, Mexico. The survey estimated that twelve pow-er<br />

such guarantees are sought from governments. The projects had been funded in middle-income counexpectation<br />

is that projects financed on a imited- tries (a 16 percent share of all projects). This estimate<br />

recourse basis will, over time, develop a track record is already outdated, however, with the number for<br />

that will provide comfort for future investments. the Philippnes alone now beng eighL The sectoral<br />

composition of -the project pipeline is constantly<br />

ADVANCES mN rROJEcr RNNaNc.'A survey pub- changing For middle- and (especially) low-income<br />

lished in October 1993 provided details of nearly countries, independent power projects are likely to<br />

150 private infrastructre projects that l[ad been be an important focus for future prject financing.<br />

funded worldwide since the early 1980s on limited- Water and environmental infrastructure is another<br />

- -.-- recourse terms, at a total cost of more than $60 bil- growth area-projects are being undertaken in midlion<br />

(fable 5.2). Both the number of projects and the dle-income countries (especially for wastewater<br />

funding involved had doubled compared with an treatment), and their diffusion to low-income counearlier<br />

sample (in September 1992). This illustrates tries is imminent A public-private partnership has<br />

the stmng momentum in private projects, which made possible the construction of a chemical waste<br />

firve years ago were largdy curosities.<br />

treatment and disposal facility south of Jakarta in<br />

About half the projects surveyed (by number and Indonesia.<br />

value) were in developing countries, with a heavy The pipeline of projects under serious considera-.<br />

concentration in middle-income countries. The only tion is substantiaL Public Works Financing estinates<br />

low-income country with more than one funded that 250 projects are being considered in developing<br />

projectcwas China (although many more projects are countries-seventy-two- of them in low-income<br />

in the pipeline there). Argetina, Malaysia, Mexico, countries. The countries of East Asia and the Pacific<br />

and the Philippines had the most projects. Along Rim are exected to be the biggest users of standwith<br />

China, they represented 80 percent of the proj- alone, limited-recourse projects in the next decade.<br />

ects for which funding had been comrmitted. Mexico This region has 150 projects in the pipeline, with an<br />

stood out, with the largest number of limited- estimated total cost of $114 bilion China alone is es-<br />

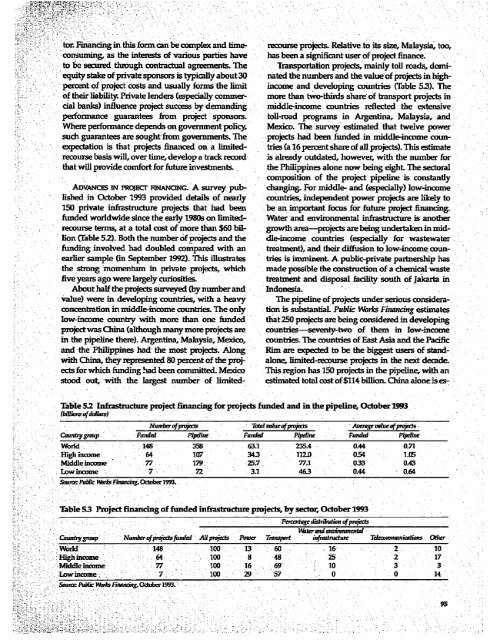

Table 52 Infrastructure project financing for projects fmded and in the pipeline, October1993<br />

-: f - ~ (bitllwnsofdul&n5/- --<br />

Number ofprocsts<br />

Toal valucef prouts<br />

A. veWviaeofpsec1s<br />

Co-ntygaup Funded PWitecin Funddf Pipelne Funded Pr,liur<br />

Woldd 148 358 63.1 235.4 0.44 0.71<br />

High income 64 107 34.3 1121- 054 .1.05<br />

ihddleincome -77 179. -25.7. 77.1 033 0.43<br />

Lowincome 7 77- 3.1 46.3 0.44 - 0.64<br />

So: P.Sblu P Wns ufic Fimd.ObeffI93.<br />

. -.- Table 5.3 Project financing of funded infrastmcture projects, by sector, October1993<br />

- ; - - . - - : - :Perentaedistrirut ion of pn#ects<br />

-.Wleramd ewmnmmtalft<br />

Co--. -;trySup Nhuberoqf pmfeElsfunded AWpmt Power Tqrnt mfrnsttur Tdecmmnotns Othr<br />

:<br />

World 148 - 100 13 60 16 2 10<br />

-. lghiname 64 1.00 8 48 .25 2 17<br />

-Middleiicome 77 100 16 69 - 10 .3 3<br />

Lowincame 7: .00 29 57 0 0 14<br />

SW= Pub-ic Fi:-dFtrbFc g,Odober1993. -<br />

95