ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

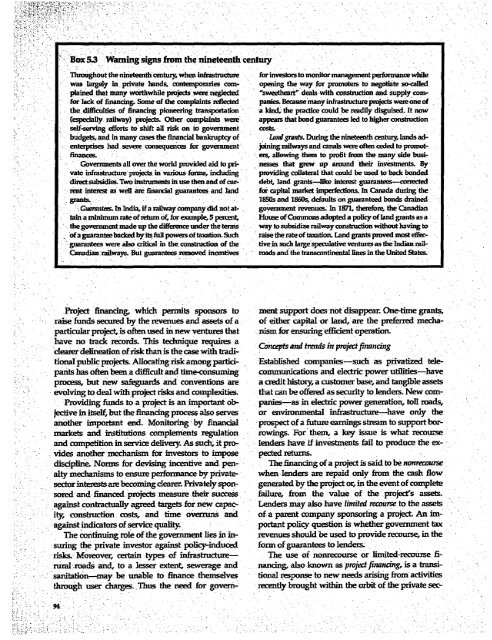

-.Bo'x5. Warning signs from the nineteentht century<br />

Throughout the nineteenth century, when infrastructure foDr investors to monitor management performance while<br />

was largely in , private hands, contemporaries corn- opening the way for promoter to negotiate so-called<br />

plained.that many wo,rthwhile psojects.were. neglected 'sweetheart' deals-with construction and suppl_y corn-<br />

* f~~~or lack of financing& Some of the complaints reflected panies. Because'many infrastructure projets were onte of<br />

mthe, difficulties of financing pioneerng transportation a kin&- the practice could be readily disguised. It now<br />

(especially railway) projets. Oter complaints were' appears that bond guarantees led to higher construction<br />

* ~~~~self-serving efforts to shift alt risk on to government costs.<br />

* ~~~~budgets, and in many cases the financial bankruptcy of Larnlggrants. During the nbineeeth cenhury, lands adenterprises<br />

hiad. severe consequences for government joining railways and canals were often ceded to promot-.<br />

financer.<br />

ers, ailowing them to profit from the many side busi-<br />

Governments all over the world provided aid to pri- nesses that grew up around their investments By<br />

vrate infrastructure pro*ets hin various forms, includinkg providing collateral that could be used to back bonded<br />

direct subsidies. Two isrmnsin use then and of cur- debt, land grants--like interest guarantees-corrected<br />

rent interest- as went are financial guarantees and. land for capital miarket imperfections. In Canada during the<br />

grants .. 1550s and 1860s, defaults on guaranteed bonds drained<br />

Guaamnfras In In dia, if a railway company did niot at-. government revenues. In 1871. therefore, the Canadiant<br />

tain a minimum rate of Meumn of, for example, 5 patcent, House of Commons adopted a policy, of land grants as a<br />

the government made up the difference under the terms way to subsidize railway construction without having to<br />

-of a guarantee badcked by its futI powers of taxation. Such raise the rate of taxtion. Land grants proved most effec-<br />

-guarantees were also critical in the, constructon of the tive in such large speculative ventures as the Indian rail-<br />

Canadian railways. But guarantees remnoved incentives moads and the transcontinentalines in the United States.<br />

Project financing, which permits- sponsors to ment support does-n'ot disappear One-time grants,<br />

raise hinds secured by the revenues and assets of a of either capital or land, are the preferred mediaparticular<br />

project, is often used in new ventures that niLsm for ensuring efficient opertion.<br />

* ~~have no track records. This technique requires a cnet n rnsh rjc iacn<br />

dearer defineation of risk than is the case with traditional<br />

public projets. Allocatin risk among partid- Established companies-such as privatized telepants<br />

has often been a difficult and lime-consumiing commnunications and electric power utilities-have<br />

* ~~process, but nwsafeguards and conventions are a credit history, a customer base, and tangibl asets<br />

evolving to deal with project risks and complexities.- that can be offered as security to lentders. New corn-<br />

Providing funds to a project is an important oh- panies-as in electric power generation, toll woads,<br />

Jective in itself, but the financing process also serves or envirounmenta infrastructure-have ontly the<br />

another important end. Monitoring -by financial poecofa future earnings stream to support bornmarkets<br />

-and institutions complements regulation rowings. For themn, a key issue is what recourse<br />

and competition in servce dehivery- As such;it pro- lenders have if investments fail to produce the exvides<br />

anotlher mechanism foDr investors to impose pected returns.<br />

discpline. Norms for devising incentive and pen-- The financing of a project is said to be non recourse<br />

alty mechanisms to ensure performance by private- when Ienders are repaid only from the cash flow<br />

sector interests axe becoming dlearer- Privately sport- generated by the project or, in the event of complete<br />

sored and financed projects, measure their success failure, from the value of the project's assets.<br />

against.contractually agreed targets. for new capac- Lenders myalso have limited recourse to the assets<br />

ity, construction costs, and time overruns and of a parent company sponsoring a project An imagainst<br />

indicators of servce qluality-<br />

portant policy question is whether government tax<br />

The continuing role of the government lies in in- revenues should be used to provide recourse, in te<br />

suiring the private investor against policy-induced form of guarantees to lenders.<br />

risks. M-oreover, certain types of infrastructure-. The use of nonrecourse or limited-recourse. firural<br />

roads and, to a lesser extent, sewerage and nancing, also known as project financing, is a transisanitation-may<br />

be unable to finance themselves tional response to new needs arising from'activities<br />

through user charges. Thus the nteed for govern- recently brought withiin the orbit of -the private sec-<br />

'94.