ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

poor financial discipline, and substantial arrears.<br />

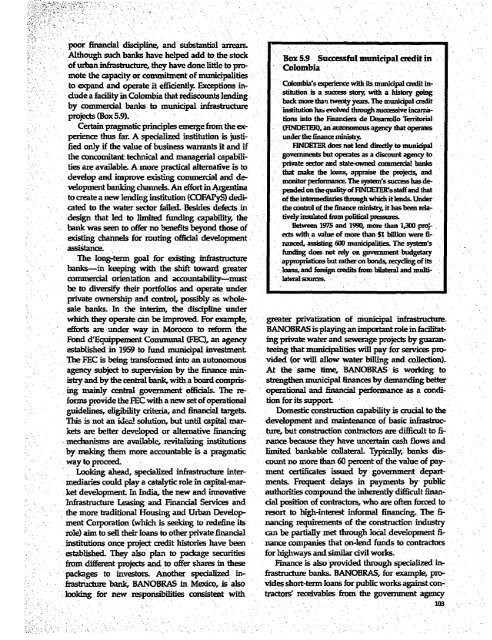

Although such banks have helped add to the stock Box 59 Successful micipal credi in<br />

of urban infrastructure, they have done little to pro- Colombia<br />

mote the capacity or commitment of municipalities<br />

to expand and operate it effiienty. Except in- Colombiassexperienceiwith itsmicipal indude<br />

a facility in Colombia that-rediscounts lending st n is a su sto with a history going<br />

back more than twenty yens. The municipal credit<br />

institution has evolved thugh succewssve incarnaprojects<br />

(Box 5.9). - - - - btions into the Fmandera de Desarrollo Ternitorial<br />

Certain pragmatic principles emerge from the ex- FNrDrER), an autonomos agency that opeate<br />

perience thus far. A spealized institution is justi- under the firnance minisry..<br />

fled orly if the value of business warrants it and if<br />

FINDETE does not lend dircty to municipal<br />

the concomitant. techical and manageral capabili- govemments but operates as a discount agency to<br />

ties are available. A more practical alternative is tovate sectr and stat-wned bank<br />

develop and improve existing commercial and de- that make the loans, appraise the projects, and<br />

e momtor perfrnmance. The system' success has development<br />

banldng channels. An effort in Argentina- pendet onthequalityofFlNDErEWsstaffand that<br />

to create a new lending institution (COFAPyS) dedi- of the intennediaries through which itlends. Under<br />

cated to the water sector filed. Besides defects in the control of the finance ministry, has it been reladesign<br />

that led to limited funding capability, the tively insuated from political pressures.<br />

bank was seen to offer no benefits beyond those of 9 a n d 1990, moe tha 1,300 pro.<br />

existing chnnels for routing official development . with a value of more than S1 bilio were f-<br />

nanceL assing 600 municipalities. The system's<br />

funding does not rely on government budgetay<br />

The long-term goal for existing infrastructure ao tions bat ratheronbonds,ngofits<br />

bank-in keeping with the shift toward greater loans, and heign aedits frm bilateral and muliconmercial<br />

orientation and accountability-must laenal sources.<br />

be to diversify their portfolios and operate under<br />

private ownership and control, possibly as wholesale<br />

banks. In the interim, the discipline under<br />

which they operate can be improved. For example, greater privatization of municipal fastrudcure<br />

efforts are under way m MorocCo to reform the BANOBRAS is playing an important role in facilitat-<br />

Fond d'Equippement Communal (FEC), an agency ing private watEr and sewerage projcts by guaranestablished<br />

in 1959 to fund municipal investment teeing that municpalities will pay for services pro-<br />

The FEC is being transformed into an autonomous vided (or will allow water billing and collection).<br />

agency subject to supervision by the finance -miin- At the same time, BANOBRAS is worldng to<br />

istry and by the central bank, with a board compris- strengthen municipal finances by demanding better<br />

ing mainly central government officiaIs. The re operational and financial performance as a condiforms<br />

provide the FEC with a new set of operational tion for its support<br />

guidelines, eligibility citeria, and financial targets Domestic construction capability is crucial to the<br />

This is not an ideal solution, but until capital mar- development and maintenance of basic infrastruckets<br />

are better developed or alternative financing ture, but construction contractors are difficult to fimechanism<br />

are available, revitalizing institutions nance because they have uncertain cash flows and<br />

by maldng them more accountable is a pragmatic limited bankable collateraL Typically, banks disway<br />

to proceed.<br />

count no more than 60 percent of the value of pay-<br />

Looking ahead, specialized infrastructure inter- ment certificates issued by government departmediaries<br />

could play a catalytic role in capital-mar- mentsa Frequent delays in payments by public<br />

ket development In India, the new and innovative authorities compound the inherently difficult finan-<br />

Infrastructure Leasing and Financial Services and cial position of contractors, who. are often forced to<br />

the more traditional Housing and Urban Develop- resort to high-interest informal financing. The fiment<br />

Corporation (which is seeking to redefine its nancing requirements of the construction industry<br />

role) aim to sell their loans to other private financial can be partially met through local development fiinstitutions<br />

once project credit histories have been nance compaxnes that on-lend funds to contractors<br />

established. They also plan to padcage securities for highways and similar civil works.<br />

from different projects and to offer shares in these Fnance is also provided through specialized inpackages<br />

to investors. Another specalized in- frastructure banks. BANOBRAS, for example, profrastructure<br />

bank, BANOBRAS in Mexico, is also vides short-term loans for public works against conlooking<br />

for new responsibilities consistent with tractors' receivables from the government agency<br />

103