ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2.4). The second incn!five element that can be built WHAT . IAVE PERFORMANCE AGREEMENTS ACCOMinto<br />

these agreemenits relates to the duration of the PLUSHED? Performance agreements have often been<br />

agreement Shorter agreements (one year, as in successful in East Asia, thanks to explicit efforts to<br />

Korea or Mexico) are more effective because they build incentives for.managers and workers into the<br />

allow for more frequent a-essments, although they contracts and to monitor these incentives. When<br />

also involve time-consuming renegotiations.<br />

performance agreements were used, the rate of re-<br />

The third common -incentive is the weight at- turn on the assets of the Korean Electric Corporation<br />

tached to various performance indicators after care-. tripled over a period of seven years (Box 2.4). These<br />

ful negotiation between the managers involved and agrments are also. proving useful in the reform of<br />

the government In Mexico the agreement signed in Ilighway departments, as seen from the supplier's<br />

1989 by the Federal Electriity Commidssion and the experience. .Performance agreemnents have not<br />

government distributed weights according to its achieved such impressive results in Africa. Alpriorities<br />

as follows: 44 percent for improvements in. though they have often improved noncommercial<br />

productivity, 23 percent for better operational effi- goals, such as increases in rural coverage, they have<br />

ciency, 18 percent for reaching administrative and fi- often failed to achieve financial targets. In Senegal<br />

nancial targets, and 15 percent for improvements in cost recovery efforts improved initially, but within<br />

service quality. Thtese weights were only partly suc- three years costs were back to the level they had<br />

cessful in giving managers and employees a better been before the introduction of performance agreesense<br />

of priorities and an incentive to focus on what ments. In this case, the agreements failed to address<br />

matters rather than on what might be easier to the lack of performance incentives for managers and<br />

achieve. By 1991 the ranldng of performance from workers. The difficulties that many agreements have.<br />

best to worst was as follows: efficiency, service qual- had in differentiating the rewards for performance<br />

ity, productivity, and administrative and financial in the civil service explains why most experts hold<br />

performances-not quite a match with the priorities little hope for such agreements in Africa and suggest<br />

and weights.<br />

relying more on other alternatives discussed below.<br />

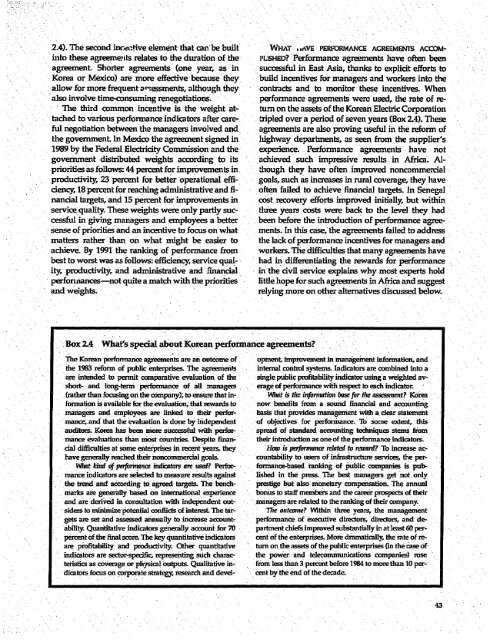

Box 2.4 What's special about Korean perormane agreements?<br />

The Korean performance agreements are an outcome of opment, improvement in management information, and<br />

the 1983 reform of public enterprises The agreemenils internal control systems Indicators are combined into a<br />

are intended to pmdt comparative evaluation of the single public profitabilityindicator using a weighted avshort-<br />

and long-term performance of all managers erage of performance Witfirespect to each indicator.<br />

(rather than focusing on the company), to ensure that in- Whrit is tire infonnation base for the assessment? Korea<br />

formation is available for the evaluation, that rewards to now benefits from a sound financial and accounting<br />

managers and emplyees are linked to their perfor- basis that provIdes management with a. clear statement<br />

mance,-and that the evaluation is done by independent of objectives for performance. To some extent, this<br />

auditors. Korea has been imore successful with perfor- - spread of standard accounting techniques stems from<br />

Iiance evaluations than most countries Despite finan- their introduction as one of the performance indicators<br />

cial difficulties at some enterprises in recent years, they HOW is permance relatcd to nrward? To increase achave<br />

generally reached their noncommercial goals. countability to users of infrastructure services, the per-<br />

What ind of perfonmnce indicators arm tsed? Perfor- formance-based ranking of publlc companies is pubmance<br />

indicators are selected to measure results against lished in the press. The best managers get not only<br />

the trend and according to agieed targets. The bench- prestige but also monetary compensation. The annual<br />

marks are generAly based on international experience bonus to staff members and the career prospects of their<br />

and are derived in consultation with independent out- -managers are related to the ranking of their company.<br />

siders to miniiize potential conflicts of interesL The tar- 7The outcne? Within three years, the management<br />

gets are set and assessed annually to increase account- performance of executive directors, directors, and deability.<br />

Quantitative indicators- generally aCCOuntlfor 70 partmnentchiefs improved substantiallyinatleastd60 perpercent<br />

of the final sore. The key quantitative indicators cent of the enterprises. More dramatically, the mte of reare<br />

profitability and productivity. Other quantitative turn on the assets of the public enterprises (in the case of<br />

indicators are sector-specific, representing such charac- the power and telecommunications companies) rose<br />

teristics as coverage or physical outputs. Qiialitative in- from less than 3 pecent before 1984 to more than 10 perdicators<br />

focus on corporate strategy, research and devel- cent by the end of the decade. -<br />

43