ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

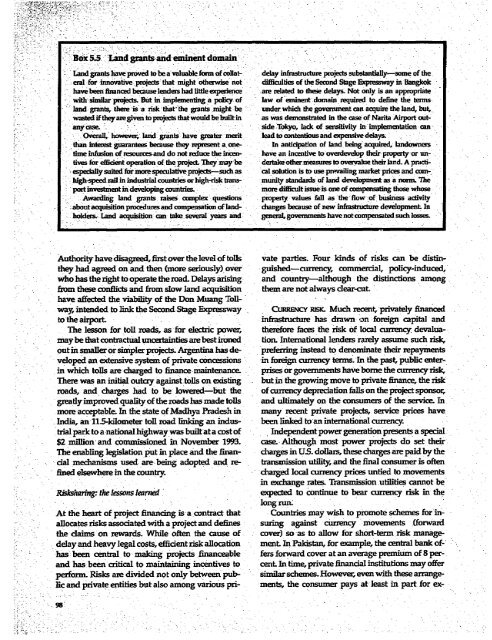

Box 5.5 'Land grnsand-eminent domain<br />

Land gants have proved to be a valuable form of collat- delay infrastructue projects substantially-some of the<br />

eml for innovative projects that might otherwise not difficuldes of the Second Stage Expesway in Bangkok<br />

have been financed because lenders had little experence are related to these delays- Not only is an apprpriate<br />

with similar pr-jects But in implementng a poicy of law of eminent:domain required to define the terms<br />

land grants, there is a rsk ithatihe grants might be under which the governmet can acquire the land, but,<br />

wasted if teyaregiven to projects that would be built in -as was demonstrated in the case of Narita Airport outany<br />

case-<br />

side Tokyo, lack of sensitivity in implementation can<br />

Overall,' howeve,land grants have greater merit lead to contentious and expesive delays.<br />

than interest guarantees because they represent a. one- In anticpation of land being acquired, landowners<br />

-time inhfsion of resources-and do not reduce the incn- have an incentive to overdevelop their property or unfives<br />

for efficient operation of the project. They may be dertakeothermeasures to overvalue their land. A prdCtiespeciallysuited<br />

frmorespecative projects-suCh as cal solution is to use prevailing market prices and comldgh-speed<br />

rail in industal couneries or high-risk trans- munity standards of land development as a norm. 'Me<br />

-portisnent in developing cotnmties, more difficult issue is one of compensating those whose<br />

Awarding land grants raises complex questions property values fai as the flow of business activity<br />

-aboutacquisition proceduresand compensation of land- changes because of new infrastructur development In<br />

holders Land acquisition can te. several years and: geeraL govenmnents have notcompensted such losses.<br />

Authori hAve dls frs ove Le lee of to--s<br />

Autorityhavedisag,Wfirsteoverelevelof tols vate parties. Four kinds of risks can be distinthey<br />

had agreed on and then (more seriously) over guished-crency, commercial, policy-induced,<br />

X -- who has the right to operate the road. Delays arising and country-although the distinctions namong<br />

from these conflicts and frm sIow land acquisiton them are not always dear-cut<br />

. have affected the viability of the Don Muang Tollway,<br />

intended to link the Second Stage Expressway. CURRENCY RiSK Much ecent, privately financed<br />

to the airport . ifrastructure has drawn an foreign capital and<br />

The lesson for toll roads, as for electric power, therefore faces the risk of local currency devaluamay<br />

be that contractual uncertainties arebestironed tion. Interational lenders rarly assume such risk,<br />

out in smaller or simpler projects. Argetina has de- prefering instead to denominate their repayments<br />

veloped an extensive system of private concessions in foreign currency terms. En the past, public enterin<br />

which tolls are charged to finance maintenance. pnses or goverxunents have borne the currency risk,<br />

There was an inial outcry against tolls on existing . but in the growing move to private finance, the risk<br />

roads, and charges had to be lowered-but the of curency depreciation falls on the project sponsor,<br />

greatly improved quality of the roads has made tolls and ultinately on the consumers of the service. In<br />

more acceptabIe. En the state of Madhya Pradesh in many recent private projects, service prices have<br />

India, an US-lkilometer tol road linkng an indus- been linked to an international currency<br />

trial park to a national highway was built at a cost of Independent power generation presents a special<br />

- $2 million and commissioned in November 1993. case Although most power projects do set their<br />

The enabling legislation put in place and the finan- charges in US. dollars, these charges are paid by the<br />

cial mechanisms used are being adopted and re- tran sion utility, and the final consumer is often<br />

fined elsewhere in the country.<br />

charged local cunrency prices untied to movements<br />

in exchange rates. Transmission utilities cannot be<br />

-* Riksharingr thelessowns lirned<br />

expected to continue to bear currency risk in the<br />

long run.i<br />

At the heart of project financing is a contract that Countries may wish to promote schemes for inallocates<br />

risks associated with a project and defines suring against cuny movements (forward<br />

the daims on rewards- While often the cause of cover) so as to allow for short-term risk manage<br />

delay and heavy legal costs, efficientrisk allocation menL In Pakistan, for example, the central bank ofhas<br />

been central to- making projects financeable fers forward cover at an average premium of 8 per-.<br />

and has been critical to maintamiing incentives to cent In time, private financial institutions may offer<br />

- ; . . perfomL Risks are divided not only between pub- similar schemes- However, even with these anange<br />

lic and private entities but also among various pri- ments, the consumer pays at least in part for ex-<br />

98