- Page 1 and 2:

3jQi'[~~~~~~~~~~~~~ ~~~~~~~ I -:A -

- Page 3 and 4:

... ..... Oxford University Prss :O

- Page 5 and 6:

-: .- : 7 - A- - .~ g ------ Vry. _

- Page 7 and 8:

. 6 Setting priorities and implemen

- Page 9 and 10:

3.1. Contractual anrangements for p

- Page 11 and 12:

Because of changes in GNP per capit

- Page 13 and 14:

- - Infrastruckure's roleand record

- Page 15 and 16:

L ~ ~ ~ ~ ~ ... ~ ~ ~ ~ ~ C- l' __

- Page 17 and 18:

Diagnosing the causes of poor perfo

- Page 19 and 20:

private sector have evolved. Port f

- Page 21 and 22:

tradability of infrastructure servi

- Page 23 and 24:

fits. The way ahead is one of 'cont

- Page 25 and 26:

Eior - 1 a iX for. - '1~t'*%~ E 6 -

- Page 27 and 28:

;~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~W.:-

- Page 29 and 30:

BoxL12 The importance of infrastruc

- Page 31 and 32:

and reliability, as well as on quan

- Page 33 and 34:

Expansion of transport infrastructu

- Page 35 and 36:

Roads are not private goods, althou

- Page 37 and 38:

Table 1.3 Expansion of infrastructu

- Page 39 and 40:

: ~ ~ 2 A :0::~~~~~~~~~~~~~~ 9 0 0

- Page 41 and 42:

pie of Latin American water utiltie

- Page 43 and 44:

straint to their mobility (Figure 1

- Page 45 and 46:

Box 1.7 Infastiucture activities ti

- Page 47 and 48:

* Option A: Public ownership and op

- Page 49 and 50:

Lessons of success and failure mana

- Page 51 and 52:

-~~~~o 22, -Svrac pa eae layoffs tt

- Page 53 and 54:

vices. These concerns are particula

- Page 55 and 56:

Management conitracting wHEN is Ir

- Page 57 and 58:

- :. : : . - I- ~~*r~ 4.~ accounts

- Page 59 and 60:

The best way of reducing the gap be

- Page 61 and 62:

the high rates of return for mainte

- Page 63 and 64:

l:: :: . - : 0~ ,aSn- ::~~~i /W-#H

- Page 65 and 66:

egional gas distributors, and an en

- Page 67 and 68:

5 : zFigre3C4mnbndbgl atvitie ices

- Page 69 and 70:

Helped in part by sectoral unbundli

- Page 71 and 72:

;t~~1F D ¢- l- e as is demnonstrat

- Page 73 and 74:

short-mn gain and skimp on routine

- Page 75 and 76:

Table 3.2 Value of infrastructure p

- Page 77 and 78:

Box 3.6 Telecom piivatizati6ci the

- Page 79 and 80:

Box 3.8 Regulation and privatizatio

- Page 81 and 82:

private management can become compl

- Page 83 and 84:

this chapter shows, where regulator

- Page 85 and 86:

transport ministries in Africa is o

- Page 87 and 88:

Unlodking local effort through- dec

- Page 89 and 90:

Box 4.3 Power in Purang and roads i

- Page 91 and 92:

->W>

- Page 93 and 94:

way of achieving distributional obj

- Page 95 and 96:

are bundled into low-cost loans to

- Page 97 and 98:

powerful minorities can capture the

- Page 99 and 100:

to this purpose without sacrificing

- Page 101 and 102:

found that although households were

- Page 103 and 104:

4 I~~~Z Box46 W canbenefitftbm ibut

- Page 105 and 106:

I Box. 4.9 Icroaigenviironmental. c

- Page 107 and 108:

. ............ --S - Financigneeded

- Page 109 and 110:

Box 5.1 Is there a free lunch?-limi

- Page 111 and 112:

Box 52 Tapping international capita

- Page 113 and 114:

1~~~~D Clt ,-,.Re -b cope an tie 0

- Page 115 and 116:

V Box 5A A successfl-firtt step in

- Page 117 and 118:

change risk through the passing on

- Page 119 and 120:

Box 5.8 Look before you leap: limit

- Page 121 and 122:

poor financial discipline, and subs

- Page 123 and 124:

'sv,t-za6oapioceeds (billions of VS

- Page 125 and 126:

-~ f4' * ; ylkj XtLSidolkits.(1. -~

- Page 127 and 128:

.*,mmr ''', '- ' f - .,__ -, 6.. -.

- Page 129 and 130:

Box 6.1 Ingedientr. of good peromne

- Page 131 and 132:

government and e strength of the co

- Page 133 and 134:

= -ableb 6.Te tspbrhivaof jrnte' sc

- Page 135 and 136:

elements of natural monopoly and mu

- Page 137 and 138:

solid waste disposal through metrop

- Page 139 and 140:

portant that uinstituitional activi

- Page 141 and 142:

V-~~~~~~ : ~~~~ :: . = .-s Bibliogr

- Page 143 and 144:

on. grwh once more sophisticated ec

- Page 145 and 146:

structure and explain the importanc

- Page 147 and 148:

1993, Drtze and Stern 1987, Goldste

- Page 149 and 150:

Ailken, J., G. Cromwell and C. Wish

- Page 151 and 152:

Easterly, William and Sergio ReWo.

- Page 153 and 154:

Paul, Samuel. 1991a. -Accomitabilit

- Page 155 and 156:

Shirley; Mary and John Nellia 1991.

- Page 157 and 158:

*:: Appendix: Infrastr cture data T

- Page 159 and 160:

Piual aolai Ekd rkrilytarnyftig' nz

- Page 161 and 162:

*TLqdqmrc Main (rsRaiilwad tracks I

- Page 163 and 164:

*Teplephmein lines Railnnd tmcts rs

- Page 165 and 166:

Acress to safe drIPAIng zmfer Acem

- Page 167 and 168:

Table AS3 IBRD and IDA commitments

- Page 169 and 170:

* ;;\ * i Contents Key 154 Introduc

- Page 171 and 172:

mairking Popzdaliou: hrf htt Total

- Page 173 and 174:

.~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~~~~~I .- In

- Page 175 and 176:

into the following broad areas: pro

- Page 177 and 178:

: - .~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- Page 179 and 180:

Pqm&uem Airs GN'perafii -AY an!A Uj

- Page 181 and 182:

GDP AgmIrflun"y Alatmqjrmd Senrrk.

- Page 183 and 184:

Disurihhhiuuefgrmd dmndprSarrf 11 G

- Page 185 and 186:

Frnltioirruapm Food pnafaai fndia $

- Page 187 and 188:

E-wapro&d-rrm &-VWrvaimdVf Penwifr

- Page 189 and 190:

Drnbmdnlnfmafaaummtwdwhirdalf%J 197

- Page 191 and 192:

73 Ukraine.. ... 74 Algeria ~~~~~-.

- Page 193 and 194:

Gewmt~ ~ Awgsaagsns 1 1970-80 *fl3)

- Page 195 and 196:

Aimor GOUANWnk Gniadonmk piomm cama

- Page 197 and 198:

D!~~me. MasSe limit ~~mar.w-fftw sf

- Page 199 and 200:

Perauagrq JwL node riseiiv swim na

- Page 201 and 202:

19M410 1.931-9 Sm 193 199 I93-92 PM

- Page 203 and 204:

hfar~uNzr,,~r(udWrnSIAwwunqem-fgmi.

- Page 205 and 206:

0hsrpflra Maudhmer& Dinf B21) 1992

- Page 207 and 208:

P---rAgetrefurerd.ds&rcpans FiEs. n

- Page 209 and 210:

73 Ukruin 339 10.3 33.0 3.2 IDA) 43

- Page 211 and 212:

MD3 599 197f 19 197) 199 ami 1992 i

- Page 213 and 214:

OECD Net bilatral flows to 1ew4ineo

- Page 215 and 216:

~~~~~~~Fcquaa MSraefMIm Par iS&f WV

- Page 217 and 218:

TowdrreTaRr -- Inc~~t mz2 ]m im mm

- Page 219 and 220: Dbimnsuzm pulEIMS) RqrsYWwsefpdnr4u

- Page 221 and 222: * ~~~~~~~~~~~~~ToAd njinuc Net FDI

- Page 223 and 224: Wpram agwofamdamrsdddirm S of~~~S.f

- Page 225 and 226: Caiwhssu ~~~An iwqr6atwe A-ragromaB

- Page 227 and 228: Tot 1.iS. 1lj9muksud Awiugnwf-guw*

- Page 229 and 230: Cnd&bin CswkdtmuhArifuve rno fjrIUA

- Page 231 and 232: 1970 199 1971 POO0 199 1970 1992 1O

- Page 233 and 234: _ _ __ _ _ _ _ _ _ * A~~~~~~~~ifm a

- Page 235 and 236: Luje'ecam=rurabt @vs A&J a(nionrper

- Page 237 and 238: PPPEJrImE4fGNp Tar Is seon N i Fe I

- Page 239 and 240: M%qainl in. Elm arrarein 1992.. 5 %

- Page 241 and 242: ParTr TdecImUmfaIUkdIS Pawr,! at Wa

- Page 243 and 244: Taunt iFemifirnms Fwstr,srsuahmrd.

- Page 245 and 246: E000 *t Technical notes' The main c

- Page 247 and 248: practical and conceptual difficulti

- Page 249 and 250: ties, and any statistical discrepan

- Page 251 and 252: ily workers, they exdude homeworker

- Page 253 and 254: and bxes not allocable to other cat

- Page 255 and 256: derived from shorter-term stays are

- Page 257 and 258: table, goods and services include w

- Page 259 and 260: aise the isk of infant mortaliyand

- Page 261 and 262: Columns 2 thrugh 7 give the shares

- Page 263 and 264: the ICP Phase IV report, World Comp

- Page 265 and 266: mation explicitly excludes decade-l

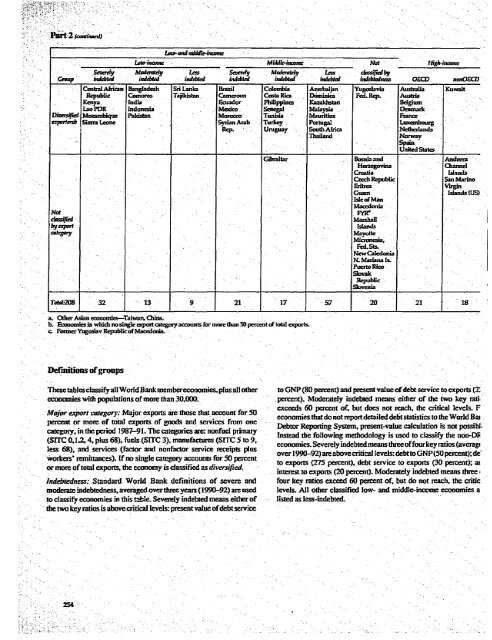

- Page 267 and 268: t 1 Classfiction orec"onomuies by i

- Page 269: Part 2 Clssfcation of economies by